Beijing's Trade War Strategy: Obfuscating Economic Realities From America

Table of Contents

State-Controlled Data & Transparency

China's control over information significantly impacts the transparency of its economic data, creating challenges for international observers trying to understand its true economic power. This lack of transparency is a cornerstone of Beijing's trade war strategy.

Manipulating Economic Indicators

China's control over data collection and reporting allows for selective releases and potentially misleading statistics on GDP growth, inflation, and unemployment. This manipulation is a key component of Beijing's trade war strategy.

- Inconsistent methodology compared to international standards: China's methodology often differs from internationally accepted standards, making direct comparisons difficult and potentially obscuring the true economic picture. This lack of standardization hinders accurate assessments of Chinese economic performance.

- Lack of independent auditing of official data: The absence of independent audits of official data raises concerns about the reliability and accuracy of the figures presented. This lack of accountability allows for potential manipulation without external verification.

- Potential underreporting of debt levels and non-performing loans: Experts suspect underreporting of debt levels and non-performing loans, potentially masking significant financial vulnerabilities within the Chinese economy. This hidden debt could impact the country's long-term economic stability and influence trade negotiations.

- Strategic manipulation of data releases to influence market sentiment: The timing and content of data releases are often strategically chosen to influence market sentiment, both domestically and internationally. This manipulation is a powerful tool in China's trade war strategy.

Opaque State-Owned Enterprises (SOEs)

The lack of transparency in SOE financials obscures their true contribution to the Chinese economy and their role in trade negotiations. This opacity is another critical element of Beijing's trade war strategy.

- Limited public disclosure of SOE financial data: Many SOEs provide limited public disclosure of their financial data, making it challenging to assess their profitability, debt levels, and overall contribution to the economy. This lack of information hinders accurate analysis of the Chinese economy.

- Difficulty in assessing the true extent of SOE subsidies and government support: The extent of government subsidies and support provided to SOEs is often unclear, making it difficult to determine the true cost of their products and services in the global marketplace. This hidden support gives SOEs an unfair competitive advantage.

- SOEs' dominance in key sectors hides the competitive landscape: The dominance of SOEs in many key sectors masks the true competitive landscape and makes it difficult to assess the health and dynamism of the private sector. This dominance allows China to control key industries and leverage them in trade negotiations.

- Use of SOEs to exert influence in international trade negotiations: SOEs are often used as instruments of national policy, exerting significant influence in international trade negotiations and potentially leveraging their market power to achieve political objectives.

Subsidies and Hidden Government Support

China's extensive network of subsidies and industrial policies distorts market competition and makes it difficult to determine the true cost of Chinese goods. This is a crucial part of Beijing's trade war strategy.

Subsidy Programs and Industrial Policy

China's targeted subsidies and industrial policies give specific industries an unfair advantage in global markets.

- Targeted subsidies for specific industries give unfair advantages in global markets: Subsidies directed at particular industries create an uneven playing field, giving Chinese companies an unfair competitive advantage over their foreign rivals. This undermines fair competition.

- Hidden forms of support, such as tax breaks and preferential loans, are hard to quantify: The full extent of government support is often obscured by hidden forms of assistance, such as tax breaks and preferential loan terms, making it difficult to measure their true impact. This hidden support distorts the market and is difficult to counter.

- Difficulty in isolating the effect of subsidies on specific trade flows: It's challenging to isolate the precise impact of subsidies on particular trade flows, complicating efforts to determine the extent to which Chinese exports benefit from unfair state support. This makes determining fair trade practices extremely difficult.

- Impact on US companies and industries due to unfair competition: These subsidies and policies negatively impact US companies and industries facing unfair competition from subsidized Chinese producers. This leads to job losses and decreased competitiveness for US businesses.

Technological Advancement and Intellectual Property

China's pursuit of technological advancement, frequently involving questionable intellectual property practices, adds another layer of complexity to the economic picture.

- Forced technology transfer demands from foreign companies: China's demand for forced technology transfer from foreign companies undermines innovation and intellectual property rights. This is a clear violation of international norms and a core element of their trade strategy.

- Intellectual property theft and counterfeiting undermining American innovation: Widespread intellectual property theft and counterfeiting significantly harm American innovation and competitiveness. This theft directly impacts the profitability of US companies and discourages further investment in research and development.

- Difficulty in assessing the true cost of Chinese technological advances: The true cost of China's technological advancements is often obscured by the obscured cost of intellectual property theft and government support. This makes it difficult to gauge the true competitiveness of Chinese technology.

- Implications for US long-term economic competitiveness: These practices pose significant threats to US long-term economic competitiveness by undermining innovation and intellectual property rights. The loss of innovation could have lasting negative economic consequences for the US.

Capital Controls and Currency Manipulation

China's control over the Renminbi exchange rate and capital flows further complicates the economic landscape and is a significant aspect of Beijing's trade war strategy.

Managing the Renminbi

China's management of the Renminbi exchange rate allows for strategic manipulation, impacting trade balances and the effectiveness of US tariffs.

- Artificial suppression of the Renminbi to gain export competitiveness: The artificial suppression of the Renminbi gives Chinese exports an unfair price advantage in global markets. This is a key tool for leveraging trade advantages.

- Challenges in accurately assessing the true value of the Renminbi: The difficulty in determining the Renminbi's true value makes it challenging to assess the real impact of trade policies and tariffs. This makes it difficult to set effective tariffs.

- Impact on US trade deficit and competitiveness: Currency manipulation negatively impacts the US trade deficit and competitiveness by making Chinese goods cheaper and US goods more expensive. This leads to a negative trade balance for the US.

- The role of capital controls in obscuring capital flows: Capital controls limit transparency regarding capital flows into and out of China, making it challenging to obtain a comprehensive view of China's economic activity and financial health.

Restrictions on Foreign Investment

Restrictions on foreign investment limit transparency and make it difficult to assess the true extent of foreign involvement in the Chinese economy.

- Restrictions on access to information for foreign investors: Restrictions on access to information create barriers for foreign investors, hindering their ability to make informed decisions and to fully understand the economic landscape.

- Limited ability to independently verify economic data: Foreign investors have limited abilities to independently verify the accuracy and reliability of Chinese economic data.

- Influence on the accurate assessment of foreign direct investment in China: The opaque nature of the Chinese economy influences the accurate assessment of foreign direct investment in China.

- Implications for understanding the true scale of China's economic activity: These restrictions make it very challenging to fully grasp the true scale of China's economic activity.

Conclusion

Beijing's trade war strategy effectively uses opaque economic practices to obscure its true economic power and vulnerabilities from the US. By manipulating data, employing hidden subsidies, and controlling capital flows, China creates a challenging environment for accurate assessment and effective negotiation. Understanding these obfuscation tactics is crucial for the US to formulate a more effective trade policy and to accurately gauge the complexities of the global economic landscape. Further research and investigation into China's economic realities are essential to navigating future trade negotiations and mitigating the risks associated with this opaque economic strategy. A deeper understanding of Beijing's trade war strategy, including its reliance on data manipulation and hidden subsidies, is paramount for informed decision-making.

Featured Posts

-

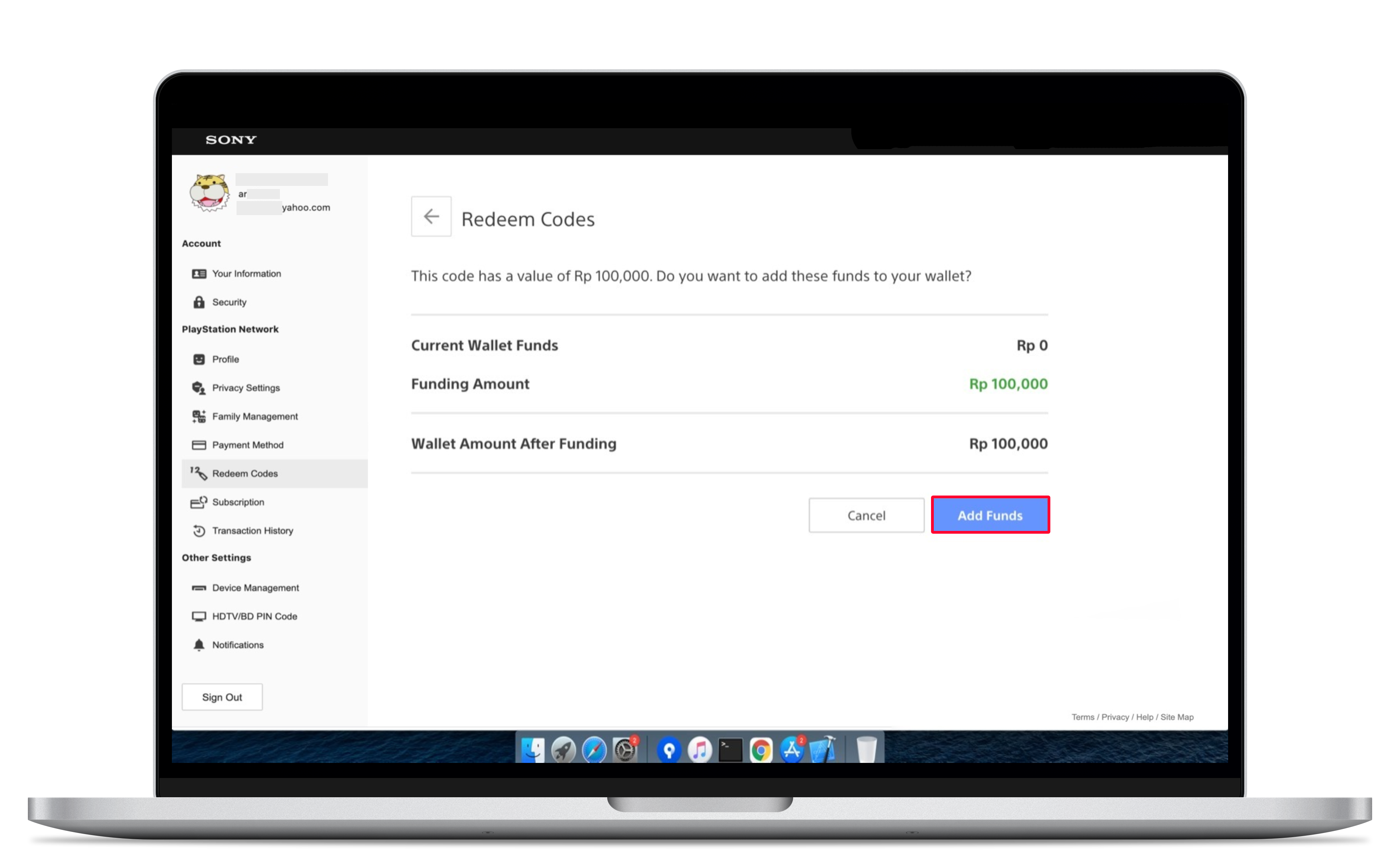

Play Station Users Receive Free Credit From Sony After Christmas Voucher Issue

May 02, 2025

Play Station Users Receive Free Credit From Sony After Christmas Voucher Issue

May 02, 2025 -

Road To Ofc U 19 Womens Championship 2025 Tongas Qualifying Triumph

May 02, 2025

Road To Ofc U 19 Womens Championship 2025 Tongas Qualifying Triumph

May 02, 2025 -

Analysis Hans Resignation And Its Implications For The South Korean Presidency

May 02, 2025

Analysis Hans Resignation And Its Implications For The South Korean Presidency

May 02, 2025 -

Bbcs 1bn Income Drop Unprecedented Challenges Ahead

May 02, 2025

Bbcs 1bn Income Drop Unprecedented Challenges Ahead

May 02, 2025 -

The End Of A Desegregation Order Examining The Justice Departments Actions And Their Ramifications

May 02, 2025

The End Of A Desegregation Order Examining The Justice Departments Actions And Their Ramifications

May 02, 2025