Berkshire Hathaway And Apple: Will Buffett's Departure Impact Apple Stock?

Table of Contents

Berkshire Hathaway's Investment in Apple: A Deep Dive

Berkshire Hathaway's Apple holdings represent a cornerstone of their investment portfolio, a testament to Warren Buffett's faith in the tech giant. Understanding the size and significance of this investment is crucial to assessing the potential impact of his departure. The sheer scale of Berkshire's Apple investment speaks volumes.

- Percentage of Berkshire's portfolio held in Apple: For a considerable period, Apple represented a significant percentage of Berkshire's overall portfolio, making it a hugely influential component of their investment strategy. While the exact percentage fluctuates with market conditions, its weight has been consistently substantial.

- Historical performance of the Apple investment: Berkshire Hathaway's investment in Apple has, historically, yielded substantial returns. This successful investment track record further underlines the confidence Buffett placed in Apple's long-term growth prospects.

- Buffett's public statements regarding Apple: Buffett's public pronouncements on Apple have been widely followed, offering valuable insights into his investment philosophy and confidence in the company's future. His consistent praise of Apple's business model and management team has bolstered investor sentiment.

The Succession Plan at Berkshire Hathaway and its Potential Impact

Berkshire Hathaway's succession plan is a complex matter, and its details are closely scrutinized by investors worldwide. The transition of leadership, while carefully planned, inevitably brings uncertainty regarding future investment strategies. This uncertainty directly impacts the potential future of Berkshire Hathaway Apple stock.

- Potential successors and their investment philosophies: The individuals poised to take over the reins at Berkshire Hathaway have their own investment styles and philosophies. While maintaining a long-term, value-oriented approach is likely, subtle shifts in investment allocation could occur.

- History of Berkshire Hathaway's investment decisions post-major leadership changes: Examining Berkshire Hathaway's historical investment decisions following previous leadership transitions provides valuable insights into potential future trends. Past responses to market fluctuations offer a glimpse into how the organization might react under new leadership.

- Analysis of potential shifts in allocation away from Apple: The possibility of a shift away from Apple, even a partial one, is a key concern for investors. This possibility introduces a significant variable in predicting the future trajectory of Berkshire Hathaway Apple stock.

Apple's Fundamental Strength and Independent Growth Trajectory

Analyzing Apple's independent growth trajectory is crucial to understanding the impact of Buffett's potential departure. Apple's fundamental strength lies in its diversified product ecosystem, strong brand recognition, and innovative capabilities. These factors are largely independent of Berkshire Hathaway's involvement.

- Key Apple product lines and their market position: From iPhones and Macs to wearables and services, Apple holds a commanding market position across multiple key product categories. This strong market presence ensures continued revenue generation.

- Innovation and future product roadmap: Apple's consistent investment in research and development ensures a steady stream of new products and services, fueling continuous growth and mitigating any potential risks.

- Apple's overall financial performance and growth projections: Apple's financial performance has been remarkably consistent, exhibiting strong revenue growth and profitability, suggesting a continued robust performance irrespective of Berkshire Hathaway's involvement.

Market Sentiment and Investor Reaction to Buffett's Potential Departure

Market sentiment plays a significant role in shaping investor reactions to any changes in Berkshire Hathaway's Apple holdings. A shift in investment strategy by Berkshire Hathaway could trigger short-term volatility, although the long-term impact might be less dramatic given Apple's intrinsic strength.

- Historical market reactions to similar events (e.g., other large divestments): Studying historical market reactions to large divestments by other major investors offers valuable insights into potential scenarios. Understanding such historical data allows for better predictions of investor behavior.

- Potential impact on investor confidence: Investor confidence in Apple could be temporarily impacted by news of significant changes in Berkshire Hathaway's holdings. However, Apple's strong fundamentals might mitigate any lasting negative effects.

- Analysis of how different investor groups might react: Different investor groups (long-term vs. short-term, institutional vs. individual) may react differently to changes in Berkshire Hathaway's Apple holdings.

Conclusion

This article examined the significant investment of Berkshire Hathaway in Apple stock and explored the potential impacts of Warren Buffett's eventual departure. While there's uncertainty surrounding any changes in investment strategy, Apple's strong fundamentals suggest a relatively resilient position. The influence of Berkshire Hathaway on Apple stock is undeniable, yet Apple’s independent strength provides a buffer against potential market fluctuations.

Call to Action: Stay informed about the latest developments concerning Berkshire Hathaway and Apple. Continue to monitor news and analysis regarding Berkshire Hathaway Apple stock to make informed investment decisions. Further research into Buffett's Apple investment and the impact on Apple share price will be crucial in navigating the future.

Featured Posts

-

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025

Shareholders Approve All Resolutions At Imcd N V Annual General Meeting

May 24, 2025 -

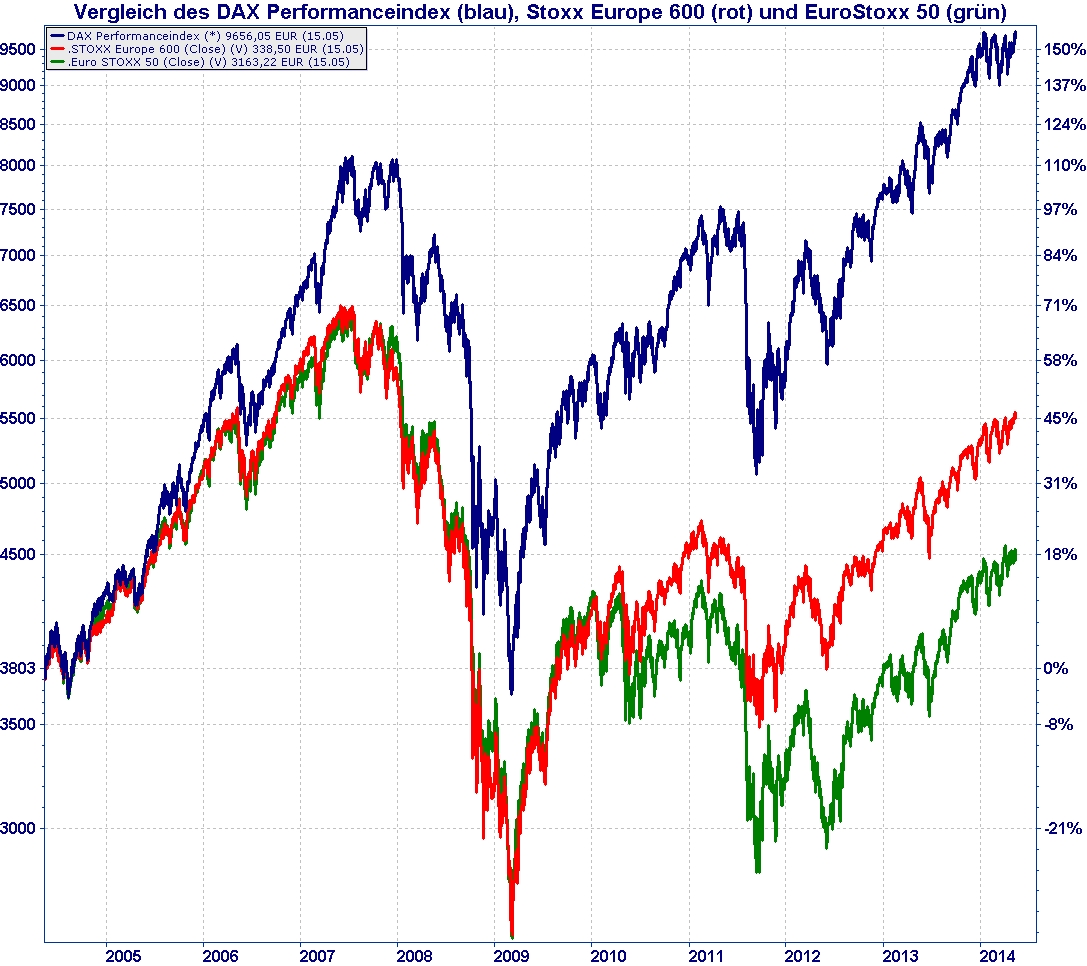

16 Nisan 2025 Avrupa Piyasa Raporu Stoxx 600 Ve Dax 40 In Duesuesue

May 24, 2025

16 Nisan 2025 Avrupa Piyasa Raporu Stoxx 600 Ve Dax 40 In Duesuesue

May 24, 2025 -

Scrutiny Of Thames Water Executive Bonuses Were They Justified

May 24, 2025

Scrutiny Of Thames Water Executive Bonuses Were They Justified

May 24, 2025 -

Apresentacao Oficial Ferrari 296 Speciale E Seu Motor Hibrido De 880 Cv

May 24, 2025

Apresentacao Oficial Ferrari 296 Speciale E Seu Motor Hibrido De 880 Cv

May 24, 2025 -

Svadby V Krasivuyu Datu Na Kharkovschine 89 Novykh Semey

May 24, 2025

Svadby V Krasivuyu Datu Na Kharkovschine 89 Novykh Semey

May 24, 2025

Latest Posts

-

Mz 12

May 24, 2025

Mz 12

May 24, 2025 -

Nisan Ayinda Maddi Bollugu Yasayacak Burclar

May 24, 2025

Nisan Ayinda Maddi Bollugu Yasayacak Burclar

May 24, 2025 -

Dahilik Geni Zekanin Burclarla Iliskisi

May 24, 2025

Dahilik Geni Zekanin Burclarla Iliskisi

May 24, 2025 -

Cekim Guecue Yueksek Burclar Seytan Tueyue Olanlar

May 24, 2025

Cekim Guecue Yueksek Burclar Seytan Tueyue Olanlar

May 24, 2025 -

Horoscope Predictions For March 20 2025 5 Powerful Zodiac Signs

May 24, 2025

Horoscope Predictions For March 20 2025 5 Powerful Zodiac Signs

May 24, 2025