Betting On Uber's Driverless Future: ETFs That Could Pay Off

Table of Contents

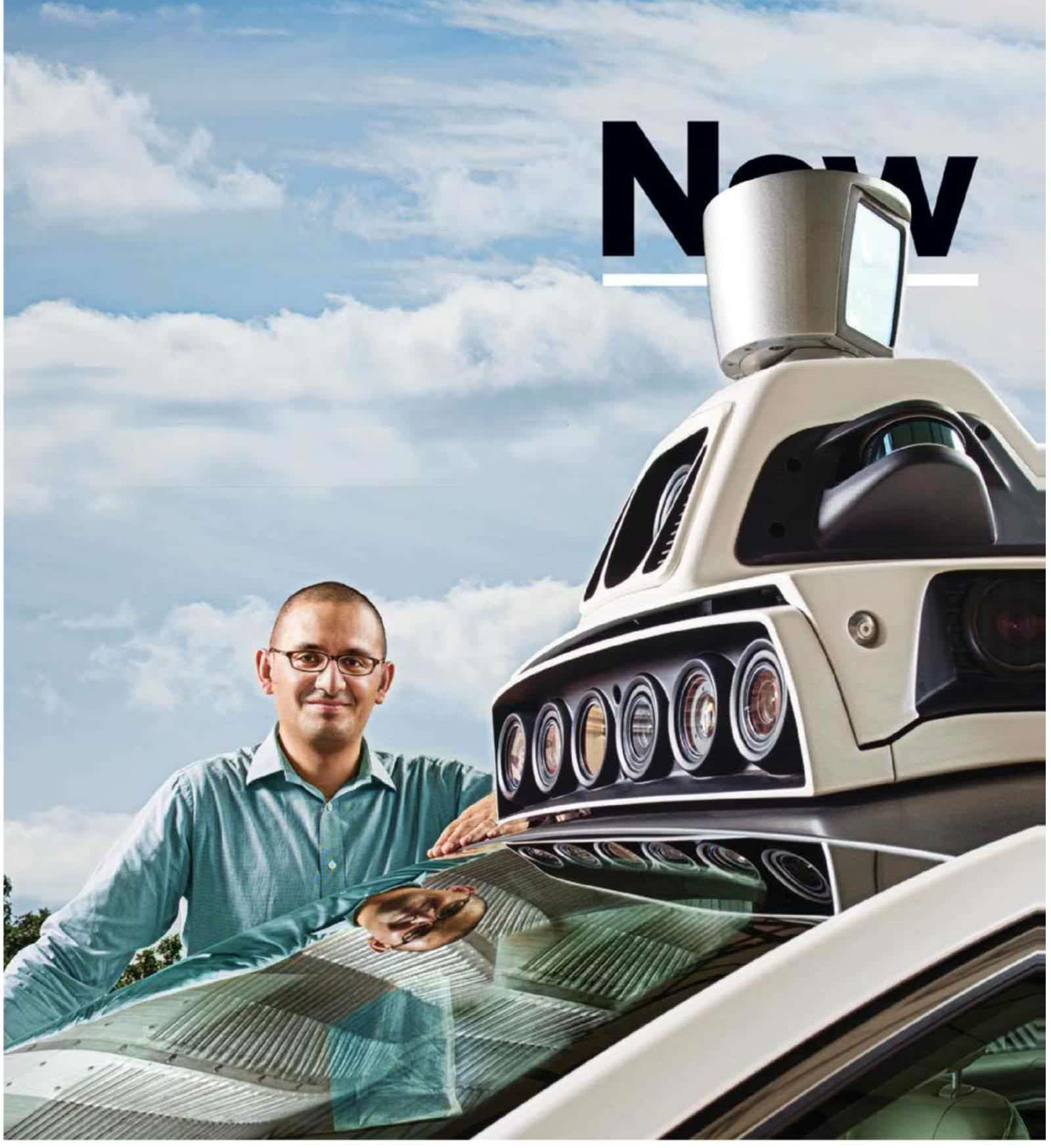

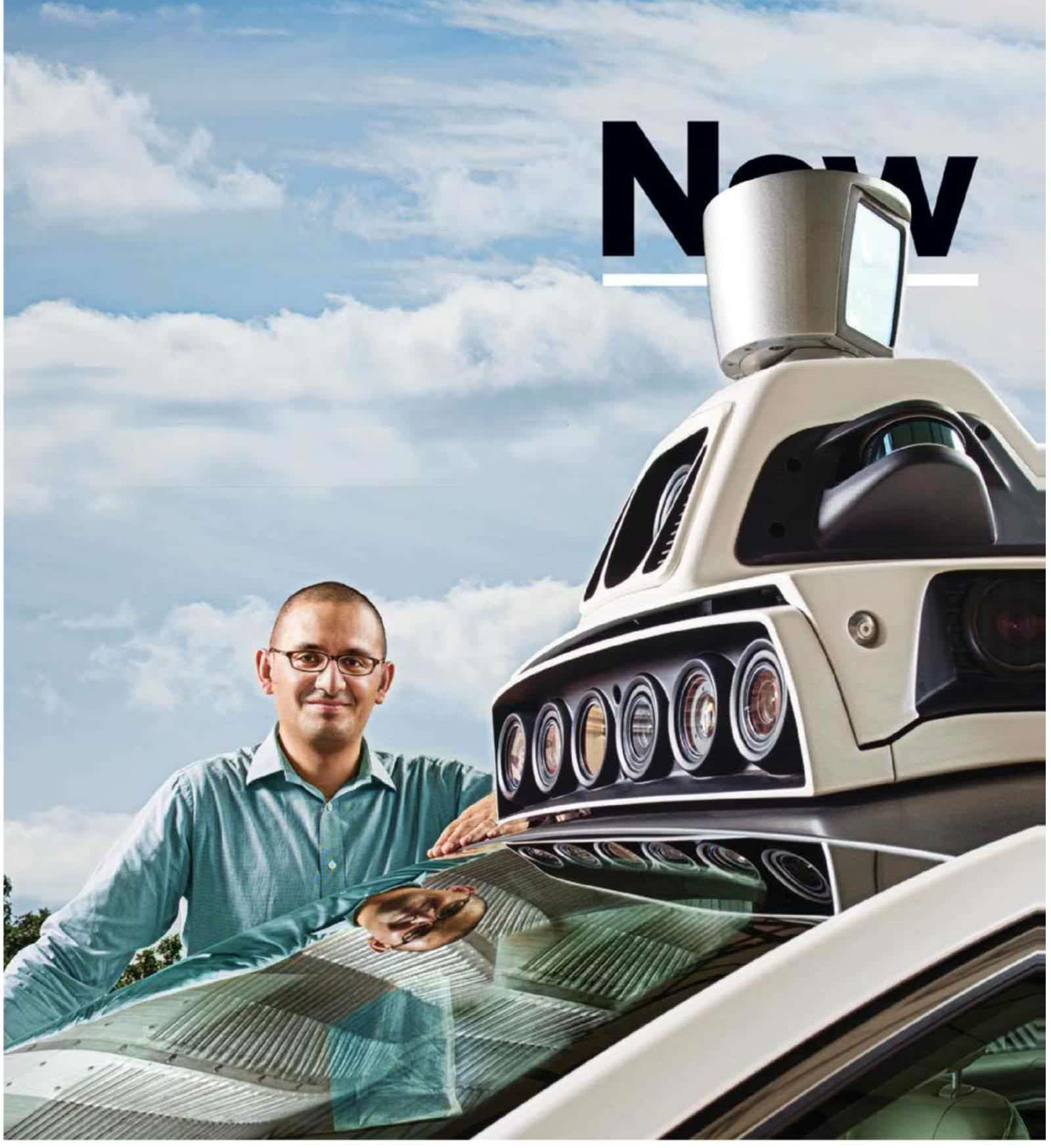

Understanding the Autonomous Vehicle Market & its Potential

The autonomous vehicle (AV) market is poised for explosive growth. Analysts project a massive expansion in the coming decade, transforming not only ride-sharing but also logistics, delivery services, and even public transportation. While Uber is a major player in the ride-sharing sector with its ambitious robotaxi program, it's crucial to remember that the autonomous vehicle landscape is far more expansive. Key players like Waymo (Google's self-driving car project), Tesla, and Cruise (General Motors' autonomous driving subsidiary) are also heavily invested in this technology, pushing the boundaries of innovation. Beyond ride-sharing, autonomous vehicles are expected to revolutionize last-mile delivery, trucking, and potentially even public transportation systems.

- Market size projections: Some analysts predict the global market for autonomous vehicles will reach hundreds of billions of dollars within the next 5-10 years.

- Government regulations: Government regulations concerning safety, liability, and data privacy will significantly influence market growth. The regulatory landscape varies across countries, creating both opportunities and challenges.

- Potential challenges and risks: Safety concerns, ethical dilemmas surrounding accidents involving autonomous vehicles, and the high initial investment costs are significant hurdles. Technological setbacks and unexpected delays are also inherent risks.

Identifying ETFs with Exposure to Autonomous Vehicle Technology

Investing in the autonomous vehicle revolution doesn't require picking individual stocks. Exchange-Traded Funds (ETFs) offer diversified exposure to this exciting sector. There are two main ETF strategies for accessing this market: sector-specific ETFs focusing on technology or transportation, and thematic ETFs explicitly targeting autonomous vehicle technology.

Several ETFs hold significant positions in companies deeply involved in the development and deployment of autonomous vehicles. While specific holdings change, researching ETFs with strong representation in the following technology areas can provide significant exposure:

Sensor Technology (Lidar, Radar, Cameras)

Autonomous vehicles rely heavily on sophisticated sensor technology to perceive their surroundings. Companies like Luminar Technologies (LAZR) and Velodyne Lidar (VLDR) are key players in the Lidar market, providing crucial distance-measuring sensors. Mobileye (MBLY), acquired by Intel, is another significant contributor, providing advanced driver-assistance systems (ADAS) and camera-based perception technology.

- Luminar Technologies (LAZR): Develops high-performance lidar sensors for autonomous vehicles.

- Velodyne Lidar (VLDR): A pioneer in lidar technology, offering various sensor solutions for autonomous driving.

- Mobileye (MBLY): Provides advanced driver-assistance systems and computer vision technology.

AI and Machine Learning

Artificial intelligence and machine learning are the brains behind autonomous driving. Companies like NVIDIA (NVDA), known for its powerful GPUs, and Alphabet (GOOGL), through its Waymo project, are heavily involved in developing the complex algorithms required for self-driving capabilities.

- NVIDIA (NVDA): Provides high-performance computing platforms crucial for training and deploying AI algorithms in autonomous vehicles.

- Alphabet (GOOGL): Waymo's development of autonomous driving technology relies heavily on advanced AI and machine learning.

Mapping and Localization

Precise mapping and localization are fundamental for self-driving cars to navigate safely. Companies specializing in high-definition mapping and location services are essential.

- Mapbox: Provides location data and mapping solutions for various applications, including autonomous vehicles.

- TomTom: Offers high-precision maps and location technologies.

Infrastructure Development

The successful deployment of autonomous vehicles also necessitates infrastructure development. Companies working on smart city initiatives and connected car technologies are indirectly benefiting from the growth of the AV sector.

Assessing Risk and Diversification with Autonomous Vehicle ETFs

Investing in emerging technologies like autonomous vehicles carries inherent risks. Technological setbacks, regulatory hurdles, and intense competition can significantly impact the performance of companies in this sector. Therefore, diversification is paramount. Don't put all your eggs in one basket. Investing in multiple ETFs with different strategies and holdings can help mitigate risk.

- Potential downsides: Technological failures, regulatory delays or changes, unexpected competition, and slower-than-expected market adoption are all potential downsides.

- Risk minimization strategies: Dollar-cost averaging (investing a fixed amount at regular intervals) and diversifying across multiple ETFs can help reduce risk.

- Due diligence: Thorough research is crucial before investing in any ETF. Consult financial news websites, review ETF prospectuses, and consider seeking advice from a financial advisor.

Conclusion

Investing in the autonomous vehicle market through strategically selected ETFs presents a compelling opportunity to capitalize on the transformative potential of self-driving technology, including Uber's driverless future. Companies developing sensor technology, AI algorithms, mapping solutions, and supportive infrastructure will all play a crucial role. However, remember that investing in this emerging sector involves risk. Diversification and thorough due diligence are key to mitigating potential losses. Start researching ETFs focused on autonomous vehicle technology and consider adding "Uber driverless future ETFs" to your investment strategy today! Remember to conduct thorough research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

The Warner Bros Pictures Presentation Cinema Con 2025 Recap

May 17, 2025

The Warner Bros Pictures Presentation Cinema Con 2025 Recap

May 17, 2025 -

Sbry Abwshealt Aljzayr Tukhld Msyrt Mkhrj Lyby Barz

May 17, 2025

Sbry Abwshealt Aljzayr Tukhld Msyrt Mkhrj Lyby Barz

May 17, 2025 -

Lawrence O Donnell The Moment Trump Was Humiliated On Live Tv

May 17, 2025

Lawrence O Donnell The Moment Trump Was Humiliated On Live Tv

May 17, 2025 -

Investigacion Sobre El Esquema Ponzi De Koriun Inversiones

May 17, 2025

Investigacion Sobre El Esquema Ponzi De Koriun Inversiones

May 17, 2025 -

Pentingnya Laporan Keuangan Untuk Pertumbuhan Bisnis

May 17, 2025

Pentingnya Laporan Keuangan Untuk Pertumbuhan Bisnis

May 17, 2025

Latest Posts

-

Report Doctor Who Christmas Special Cancelled For 2024

May 17, 2025

Report Doctor Who Christmas Special Cancelled For 2024

May 17, 2025 -

Doctor Who Christmas Special Production Halt And Future Uncertain

May 17, 2025

Doctor Who Christmas Special Production Halt And Future Uncertain

May 17, 2025 -

Spanish Townhouse Renovation By Alan Carr And Amanda Holden E245 000

May 17, 2025

Spanish Townhouse Renovation By Alan Carr And Amanda Holden E245 000

May 17, 2025 -

No Doctor Who Christmas Special This Year Fans React To Rumours

May 17, 2025

No Doctor Who Christmas Special This Year Fans React To Rumours

May 17, 2025 -

Alan Carr And Amanda Holdens Renovated Spanish Townhouse On Sale For E245 K

May 17, 2025

Alan Carr And Amanda Holdens Renovated Spanish Townhouse On Sale For E245 K

May 17, 2025