BigBear.ai (BBAI): A Deep Dive Into The Recent Stock Market Decline

Table of Contents

Macroeconomic Factors Contributing to the BigBear.ai Stock Decline

The current macroeconomic climate has significantly impacted growth stocks, including BigBear.ai. Several factors are at play.

Interest Rate Hikes and Inflation

Rising interest rates implemented by central banks to combat persistent inflation have created a challenging environment for high-growth technology companies like BBAI.

- Impact on Valuations: Higher interest rates increase the discount rate used in valuing future cash flows, reducing the present value of BBAI's projected growth, thus impacting its valuation.

- Reduced Investor Appetite for Risk: Investors are becoming more risk-averse in a high-interest-rate environment, shifting their investments towards safer, more stable assets. This reduced risk appetite negatively impacts high-growth, often less profitable, companies like BBAI.

- Increased Borrowing Costs: Higher interest rates make it more expensive for BBAI to borrow money for expansion, research and development, or other operational needs, potentially hindering its growth trajectory.

Overall Market Sentiment and Tech Sector Downturn

The broader market downturn, particularly within the technology sector, has significantly impacted BBAI's performance.

- Correlation between BBAI Performance and the Nasdaq Composite: BBAI's stock price often mirrors the overall performance of the Nasdaq Composite, a key index for technology stocks. A decline in the Nasdaq generally correlates with a decline in BBAI's stock price.

- General Investor Fear: Widespread market uncertainty and fear have led to a sell-off in many technology stocks, including BBAI, as investors seek to protect their capital.

- Potential for Further Corrections: The possibility of further market corrections remains a significant risk factor, potentially leading to additional declines in BBAI's stock price.

Company-Specific Factors Affecting BigBear.ai (BBAI) Stock Price

Beyond macroeconomic factors, several company-specific issues have contributed to the BigBear.ai stock decline.

Earnings Reports and Financial Performance

Recent BBAI earnings reports have provided mixed signals to investors. A careful analysis is needed to assess the company's financial health.

- Specific Financial Figures: Examination of revenue growth, net income, and operating margins compared to previous quarters is crucial in evaluating BBAI's performance. Any significant deviations from expectations can impact investor sentiment.

- Comparisons to Previous Quarters: Year-over-year and quarter-over-quarter comparisons of key financial metrics provide valuable insights into BBAI's operational efficiency and growth trajectory.

- Analysts' Reactions: Post-earnings reports, analysts often adjust their price targets and ratings, influencing investor perception and subsequent trading activity.

Competition and Market Share

BBAI operates in a highly competitive market, facing pressure from established players and emerging competitors.

- Key Competitors: Identifying BBAI's main competitors, analyzing their strengths and weaknesses, and assessing the competitive dynamics within the AI and data analytics industry is essential.

- Market Share Analysis: Evaluating BBAI's market share, its growth trajectory compared to competitors, and its ability to gain or maintain market share reveals its competitive standing.

- Competitive Advantages (or Disadvantages): Determining whether BBAI possesses significant competitive advantages, such as proprietary technology or strong customer relationships, can influence investor confidence.

Strategic Initiatives and Execution

BBAI's recent strategic decisions, partnerships, and acquisitions have also influenced investor sentiment.

- Examples of Specific Strategic Moves: Analyzing recent mergers, acquisitions, or new product launches helps understand BBAI's growth strategy and its execution effectiveness.

- Successes and Failures: Evaluating the success or failure of past strategic initiatives reveals BBAI's ability to implement its plans and achieve its objectives.

- Influence on Stock Price: The market's reaction to BBAI's strategic moves directly reflects investor confidence in the company's long-term prospects.

Investor Sentiment and Market Speculation

Investor sentiment and market speculation significantly impact BBAI's stock price.

Analyst Ratings and Price Targets

Changes in analyst ratings and price targets for BBAI stock influence investor decisions.

- Summary of Analyst Opinions: Consolidating analyst opinions from various financial institutions helps to understand the overall market sentiment towards BBAI.

- Range of Price Targets: Analyzing the range of price targets set by different analysts provides a spectrum of potential future price movements.

- Overall Impact on Investor Sentiment: The consensus view among analysts significantly impacts investor confidence and trading activity.

Short Selling and Institutional Investor Activity

Short selling and institutional investor activity can exert considerable pressure on BBAI's stock price.

- Percentage of Shares Shorted: High short interest can indicate negative sentiment and potential for further price declines as short sellers profit from downward movements.

- Changes in Institutional Ownership: Tracking changes in institutional ownership reveals the level of confidence among major investors in BBAI.

- Potential Influence: Both short selling and institutional investor activity can amplify price movements in either direction, impacting BBAI's volatility.

News and Media Coverage

News and media coverage significantly impact public perception and investor sentiment towards BBAI.

- Examples of Significant News Stories: Analyzing news reports covering BBAI's performance, strategic initiatives, or any controversies that may arise offers crucial insights.

- Influence on Investor Sentiment: Positive news generally boosts investor confidence, while negative news can trigger sell-offs.

- Overall Media Narrative: The overall tone and coverage of BBAI in the media contribute to the prevailing narrative around the stock and influence investor perception.

Conclusion

The recent BigBear.ai (BBAI) stock market decline is a result of a complex interplay of macroeconomic factors, such as rising interest rates and inflation, and company-specific challenges, including earnings reports and competitive pressures. While BBAI operates in a promising sector with significant long-term potential, the current market environment presents significant headwinds. The future performance of BBAI remains uncertain and subject to further market corrections and company-specific developments.

Investors should conduct thorough due diligence, carefully weigh the potential risks and rewards, and consider consulting with a financial advisor before making any investment decisions related to BigBear.ai (BBAI) stock. Stay updated on news and developments related to the BigBear.ai stock decline to make informed decisions in this dynamic market.

Featured Posts

-

Superalimentos Por Que Este Supera Al Arandano En Beneficios Para La Salud

May 21, 2025

Superalimentos Por Que Este Supera Al Arandano En Beneficios Para La Salud

May 21, 2025 -

Concert Novelistes Espace Julien Pre Hellfest

May 21, 2025

Concert Novelistes Espace Julien Pre Hellfest

May 21, 2025 -

Tikkie Gebruiken Een Handleiding Voor Nederlandse Bankieren

May 21, 2025

Tikkie Gebruiken Een Handleiding Voor Nederlandse Bankieren

May 21, 2025 -

Anazitontas Lyseis Gia Ta Xronia Provlimata Ton Sidirodromon

May 21, 2025

Anazitontas Lyseis Gia Ta Xronia Provlimata Ton Sidirodromon

May 21, 2025 -

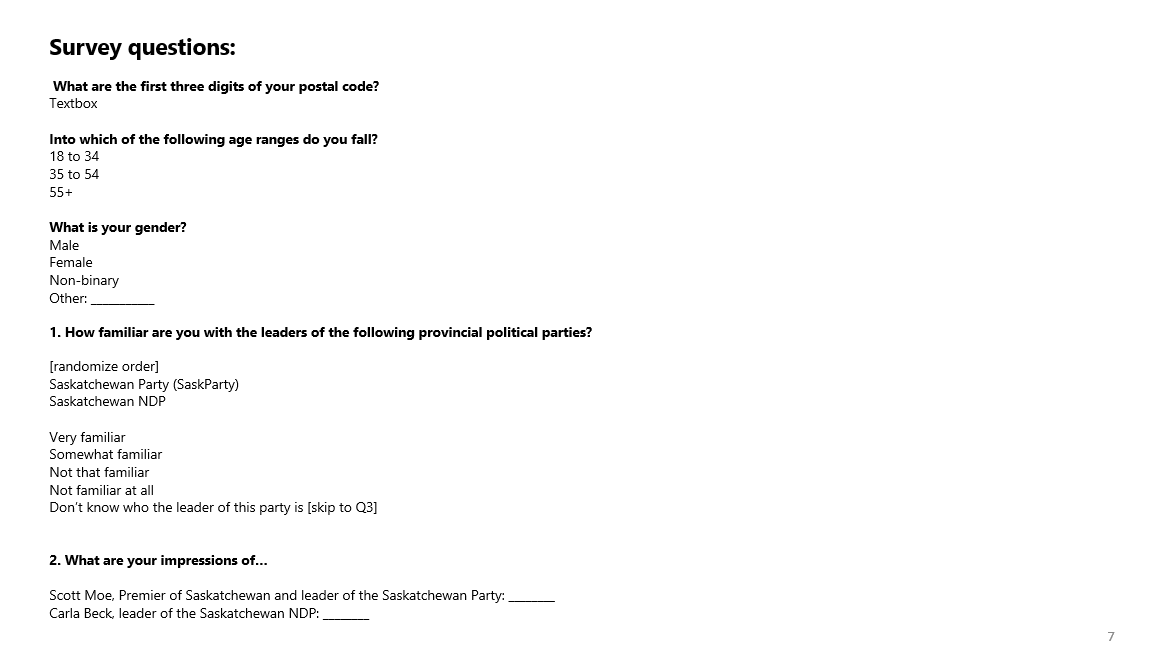

Federal Election Fallout Analyzing Its Impact On Saskatchewan Politics

May 21, 2025

Federal Election Fallout Analyzing Its Impact On Saskatchewan Politics

May 21, 2025

Latest Posts

-

The Goldbergs Exploring The Family Dynamics And Lasting Appeal

May 22, 2025

The Goldbergs Exploring The Family Dynamics And Lasting Appeal

May 22, 2025 -

The Future Of Saskatchewan Examining The Potential For Western Canadian Separation

May 22, 2025

The Future Of Saskatchewan Examining The Potential For Western Canadian Separation

May 22, 2025 -

Saskatchewans Political Landscape And The Debate Over Western Separation

May 22, 2025

Saskatchewans Political Landscape And The Debate Over Western Separation

May 22, 2025 -

Federal Leaders Saskatchewan Visit Analysis Of Controversial Remarks

May 22, 2025

Federal Leaders Saskatchewan Visit Analysis Of Controversial Remarks

May 22, 2025 -

Saskatchewan Political Panel Exploring Western Separation

May 22, 2025

Saskatchewan Political Panel Exploring Western Separation

May 22, 2025