BigBear.ai (BBAI) Investors: Explore Your Legal Options

Table of Contents

Understanding Potential Legal Claims Against BigBear.ai (BBAI)

Investors who have suffered losses due to alleged misconduct by BigBear.ai (BBAI) may have several legal avenues available. These claims often hinge on demonstrating that the company or its leadership engaged in actions that violated securities laws or breached their fiduciary duty to investors.

Securities Fraud

Securities fraud claims center on material misstatements or omissions of fact by a company that misled investors. To succeed in such a claim, investors must prove:

- A material misrepresentation or omission: This means the false or missing information was significant enough to influence a reasonable investor's decision to buy or sell the security.

- Scienter: This means the company acted with intent to defraud or with reckless disregard for the truth.

- Reliance: Investors must show they relied on the misleading information when making their investment decisions.

- Damages: Investors must demonstrate they suffered financial losses as a direct result of the fraudulent conduct.

Relevant case laws, such as Basic Inc. v. Levinson, provide precedents for establishing these elements.

Examples of potential misstatements or omissions that could form the basis of a claim against BigBear.ai (BBAI) might include:

- Overly optimistic financial projections.

- Concealment of material risks or liabilities.

- False statements about the company's technology or market position.

- Failure to disclose conflicts of interest among company officers or directors.

Breach of Fiduciary Duty

Corporate officers and directors have a fiduciary duty to act in the best interests of the company and its shareholders. A breach of this duty occurs when these individuals prioritize their personal interests or act negligently, harming investors.

Potential scenarios where this claim could apply to BBAI include:

- Self-dealing transactions.

- Misappropriation of corporate assets.

- Gross negligence in managing the company's affairs.

Examples of actions that could constitute a breach of fiduciary duty include:

- Engaging in insider trading.

- Failing to disclose material information to the board of directors.

- Approving transactions that benefit the officers or directors at the expense of shareholders.

Negligence

A negligence claim requires demonstrating that BigBear.ai (BBAI) or its executives owed investors a duty of care, breached that duty, and that this breach directly caused the investors' losses. This requires proving:

- A duty of care existed.

- This duty was breached.

- The breach caused the investor's damages.

Examples of negligent actions that could lead to a claim include:

- Failure to adequately supervise employees.

- Failure to implement proper internal controls.

- Failure to disclose known risks to investors.

Investigating Your Potential Claim

Before filing a lawsuit, thorough investigation is crucial. This involves gathering and preserving evidence and securing competent legal counsel.

Gathering Evidence

Collecting relevant documents is vital. This includes:

- Investment statements showing purchase and sale dates and amounts.

- All communication with BigBear.ai (BBAI), brokers, or financial advisors.

- Company filings (SEC reports, press releases, etc.).

- Financial analysis reports and expert opinions.

The precise timelines of events and communication records are extremely important. Consulting with financial advisors or forensic accountants can significantly strengthen your case.

Types of evidence crucial to a successful claim include:

- Emails and letters.

- Financial records.

- Expert witness testimony.

- Internal company documents.

Finding Qualified Legal Representation

Securing experienced securities litigation attorneys is paramount. To find and vet potential counsel:

- Search online for firms specializing in securities litigation.

- Check attorney ratings and reviews.

- Consult with several firms to compare their experience and approach.

- Understand their fee structures (contingency fees are common).

Questions to ask potential legal counsel:

- What is your experience with similar cases?

- What is your fee structure?

- What is your strategy for this type of case?

- What is your track record of success?

The Process of Filing a Legal Claim

Filing a lawsuit is a complex process.

Understanding the Legal Process

A lawsuit typically involves these stages:

- Filing a complaint.

- Discovery (exchanging information with the opposing party).

- Motion practice (filing motions to dismiss or for summary judgment).

- Trial (if the case isn't settled beforehand).

Alternative dispute resolution (ADR), such as mediation or arbitration, may be considered.

Key stages and timelines involved in the process:

- Filing deadlines vary by jurisdiction.

- Discovery can take months or even years.

- Trial dates are usually set well in advance.

Class Action Lawsuits

Class action lawsuits allow multiple investors with similar claims to sue together. This can streamline the legal process and share costs. Joining an existing class action or forming a new one requires careful consideration of the involved attorneys and the terms of participation.

Conclusion: Next Steps for BigBear.ai (BBAI) Investors

BigBear.ai (BBAI) investors who believe they have suffered losses due to misconduct may have legal recourse through claims such as securities fraud, breach of fiduciary duty, or negligence. Gathering evidence and seeking qualified legal counsel are critical first steps. Don't delay – contact an experienced securities attorney today to discuss your specific situation and explore your legal options related to BigBear.ai (BBAI) investments. Use the keywords "BigBear.ai (BBAI) legal options" in your search for legal assistance to find the right advocate for your case.

Featured Posts

-

The Key To The Bruins Future Espns Offseason Breakdown

May 21, 2025

The Key To The Bruins Future Espns Offseason Breakdown

May 21, 2025 -

Mild Temperatures And Dry Conditions Predicted

May 21, 2025

Mild Temperatures And Dry Conditions Predicted

May 21, 2025 -

Huizenprijzen Nederland Analyse Van De Bewering Van Abn Amro Door Geen Stijl

May 21, 2025

Huizenprijzen Nederland Analyse Van De Bewering Van Abn Amro Door Geen Stijl

May 21, 2025 -

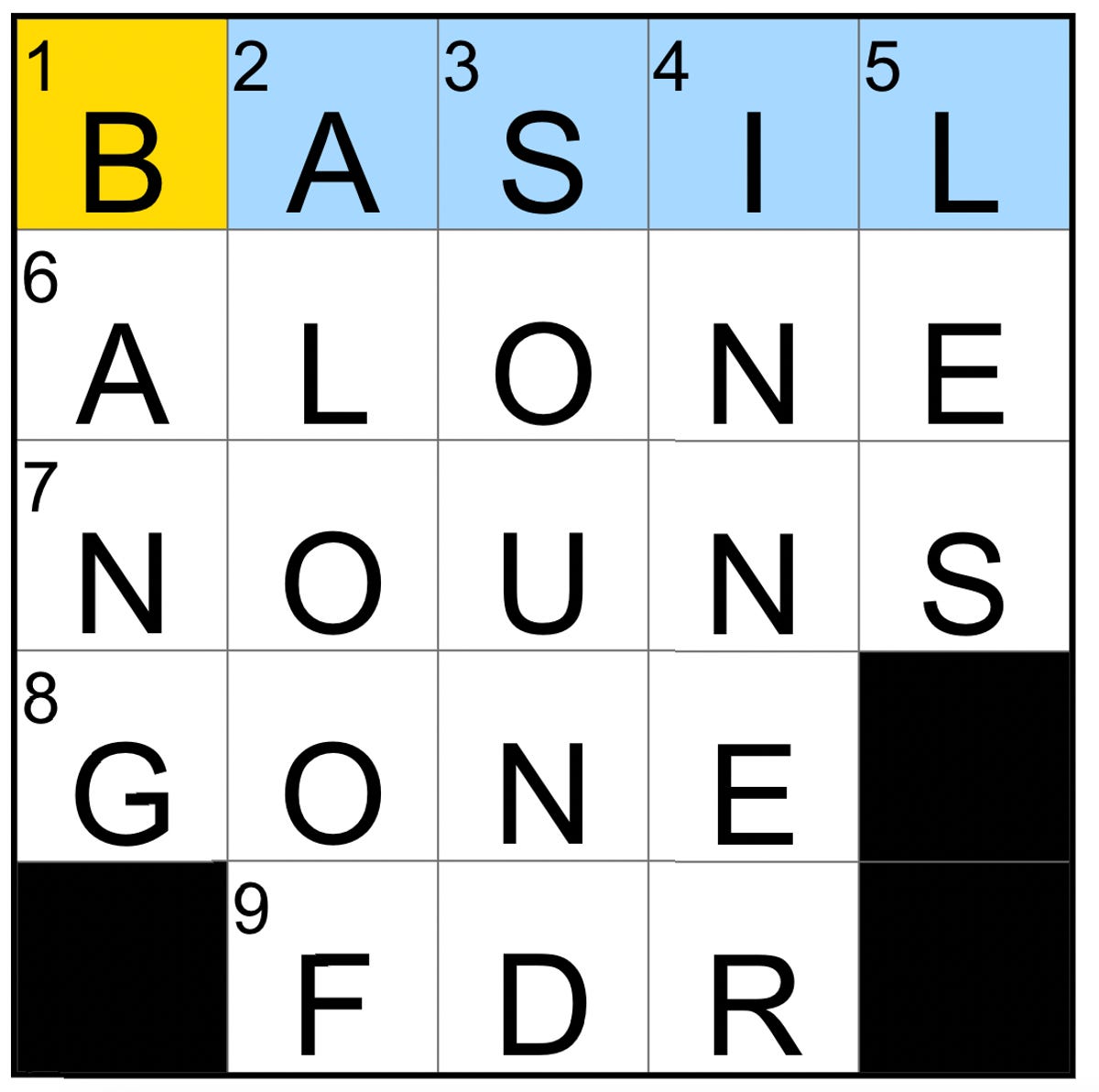

Nyt Mini Crossword Answers For March 16 2025

May 21, 2025

Nyt Mini Crossword Answers For March 16 2025

May 21, 2025 -

Gangsta Granny Comparing The Book And The Stage Adaptation

May 21, 2025

Gangsta Granny Comparing The Book And The Stage Adaptation

May 21, 2025

Latest Posts

-

Peppa Pigs Mums Stylish London Gender Reveal Party

May 22, 2025

Peppa Pigs Mums Stylish London Gender Reveal Party

May 22, 2025 -

Planning Your Trip To The New Peppa Pig Theme Park In Texas

May 22, 2025

Planning Your Trip To The New Peppa Pig Theme Park In Texas

May 22, 2025 -

Revealed The Sweet Meaning Of Peppa Pigs New Baby Sisters Name

May 22, 2025

Revealed The Sweet Meaning Of Peppa Pigs New Baby Sisters Name

May 22, 2025 -

Peppa Pig A Baby Girl Arrives

May 22, 2025

Peppa Pig A Baby Girl Arrives

May 22, 2025 -

Peppa Pig A New Baby Joins The Family Gender Reveal

May 22, 2025

Peppa Pig A New Baby Joins The Family Gender Reveal

May 22, 2025