BigBear.ai (BBAI): Q1 Financial Report Triggers Stock Decline

Table of Contents

BigBear.ai (BBAI) Q1 Earnings Miss Expectations

Revenue Shortfall

BigBear.ai's Q1 2024 revenue significantly missed analysts' projections. While expectations were set at [Insert Projected Revenue Figure], the company reported actual revenue of only [Insert Actual Revenue Figure], representing a shortfall of [Insert Percentage]% and indicating a substantial gap between projected and actual performance.

- Contract delays: Several key contracts experienced unforeseen delays, pushing expected revenue into later quarters.

- Lower-than-anticipated demand: Market demand for certain BigBear.ai products and services fell short of internal forecasts.

- Competitive pressures: Increased competition within the industry may have contributed to reduced market share and lower-than-expected sales.

This revenue shortfall directly impacted the overall financial health of the company and contributed significantly to the negative market reaction.

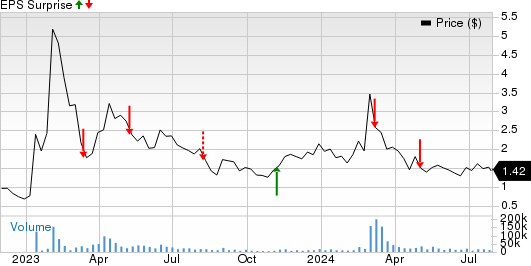

Earnings Per Share (EPS) Below Forecasts

The reported Earnings Per Share (EPS) for BigBear.ai also fell dramatically short of analyst predictions. Analysts predicted an EPS of [Insert Projected EPS Figure], but the actual EPS came in at [Insert Actual EPS Figure], a [Insert Percentage]% difference. This considerable miss further fueled investor concerns.

- Increased operating expenses: Higher-than-anticipated operating costs negatively impacted profitability.

- One-time charges: The Q1 report may have included unexpected one-time charges that reduced overall earnings.

- Investment in growth initiatives: Investments in new technologies and expansion strategies may have temporarily impacted profitability.

The significant EPS miss, coupled with the revenue shortfall, painted a concerning picture for investors, triggering a sharp decline in the BigBear.ai (BBAI) stock price.

Market Reaction and Investor Sentiment

Immediate Stock Price Drop

The release of the Q1 financial report immediately impacted BBAI's stock price. The stock experienced a sharp [Insert Percentage]% drop on [Insert Date], with trading volume significantly exceeding the average daily volume. This dramatic decrease reflects a strong negative market reaction.

- Investor panic selling: Many investors responded to the disappointing results by selling off their BBAI shares, exacerbating the price decline.

- Negative market sentiment: The overall market sentiment surrounding BigBear.ai shifted dramatically to negative, impacting investor confidence and willingness to hold the stock.

- Loss of confidence: The failure to meet expectations eroded investor confidence in the company's short-term and long-term prospects.

[Insert chart or graph visually representing the stock price decline].

Analyst Downgrades and Price Target Reductions

Following the release of the Q1 report, several analysts downgraded their ratings for BBAI stock and reduced their price targets. For example, [Analyst Name] at [Financial Institution] downgraded BBAI from [Previous Rating] to [New Rating], citing concerns about the revenue shortfall and weakened outlook. Similarly, [Another Analyst Name] reduced their price target from [Previous Price Target] to [New Price Target].

- Concerns over future performance: Analysts expressed concerns about the company's ability to meet future financial projections given the Q1 performance.

- Increased risk assessment: The disappointing results increased the perceived risk associated with investing in BigBear.ai (BBAI).

- Re-evaluation of company valuation: The lower-than-expected earnings led analysts to re-evaluate the intrinsic value of BBAI stock.

These analyst actions further fueled the negative market sentiment and contributed to the continued decline in BBAI's stock price.

BigBear.ai's Response and Future Outlook

Management Commentary

In response to the disappointing Q1 results, BigBear.ai management issued a statement [Insert Link to Statement] addressing the challenges and outlining plans to address them. Key takeaways from the management commentary include [Summarize Management's Key Points].

- [Bullet Point 1 summarizing management's response]

- [Bullet Point 2 summarizing management's response]

- [Bullet Point 3 summarizing management's response]

Strategic Initiatives and Growth Plans

BigBear.ai outlined several strategic initiatives aimed at improving future performance and achieving growth. These include [List Strategic Initiatives].

- [Bullet Point 1 detailing a strategic initiative]

- [Bullet Point 2 detailing a strategic initiative]

- [Bullet Point 3 detailing a strategic initiative]

The success of these initiatives will be crucial in determining the future trajectory of BigBear.ai (BBAI) and regaining investor confidence. For more information, refer to the company's investor relations page: [Insert Link to Investor Relations Page].

Conclusion: Analyzing the Future of BigBear.ai (BBAI) Stock

The Q1 2024 financial report revealed significant shortcomings for BigBear.ai (BBAI), resulting in a substantial stock decline. The key factors contributing to this decline include a substantial revenue miss, an equally disappointing EPS miss, and a consequent wave of negative investor sentiment. While the company's management has outlined strategies to address these challenges and achieve future growth, the success of these initiatives remains uncertain. Investors should carefully monitor the company's performance in the coming quarters to assess its ability to overcome these setbacks.

The future of BigBear.ai (BBAI) stock remains uncertain. While the company's plans for growth are promising, the market reaction to the Q1 report indicates a need for cautious optimism. To stay informed about BigBear.ai stock, its future performance, and opportunities related to BBAI investment, continue to follow reputable financial news sources and the company's official website. Keep a close eye on future BigBear.ai financial reports and announcements to gain a clearer picture of the company's prospects.

Featured Posts

-

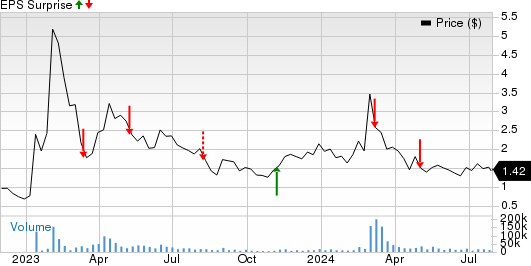

Navy Admiral Faces 30 Years For 500 000 Bribery Scheme

May 21, 2025

Navy Admiral Faces 30 Years For 500 000 Bribery Scheme

May 21, 2025 -

Echo Valley Images A Glimpse Of Sydney Sweeney And Julianne Moores Thriller

May 21, 2025

Echo Valley Images A Glimpse Of Sydney Sweeney And Julianne Moores Thriller

May 21, 2025 -

Is A Dexter Resurrection Trailer Coming Soon Release Date Rumors

May 21, 2025

Is A Dexter Resurrection Trailer Coming Soon Release Date Rumors

May 21, 2025 -

Assessing The Impact Of Trumps Policies On American Factory Jobs

May 21, 2025

Assessing The Impact Of Trumps Policies On American Factory Jobs

May 21, 2025 -

Western Separation Movement A Focus On Saskatchewans Role

May 21, 2025

Western Separation Movement A Focus On Saskatchewans Role

May 21, 2025

Latest Posts

-

Assessing Liverpools Win Arne Slot And Luis Enriques Perspectives

May 22, 2025

Assessing Liverpools Win Arne Slot And Luis Enriques Perspectives

May 22, 2025 -

Young Louth Entrepreneurs Recipe For Success Helping Others Thrive In The Food Industry

May 22, 2025

Young Louth Entrepreneurs Recipe For Success Helping Others Thrive In The Food Industry

May 22, 2025 -

Arne Slot And Luis Enrique Assess Liverpools Performance And Alisson Becker

May 22, 2025

Arne Slot And Luis Enrique Assess Liverpools Performance And Alisson Becker

May 22, 2025 -

Sharing Success A Louth Food Heros Guide To Business Growth

May 22, 2025

Sharing Success A Louth Food Heros Guide To Business Growth

May 22, 2025 -

Post Match Reaction Slot And Enrique Discuss Liverpools Luck And Alisson

May 22, 2025

Post Match Reaction Slot And Enrique Discuss Liverpools Luck And Alisson

May 22, 2025