BigBear.ai (BBAI) Stock: Analyst Downgrade Fuels Growth Uncertainty

Table of Contents

The Analyst Downgrade and its Rationale

On [Date], [Analyst Firm Name] downgraded BigBear.ai (BBAI) stock from [Previous Rating] to [New Rating]. The rationale behind this decision cited several key concerns about the company's future performance. Their report, available [link to analyst report if available], highlighted the following critical issues:

-

Revenue projections and their shortfall: The analyst firm expressed concern that BigBear.ai's revenue projections for [Year] are overly optimistic and likely to fall short of expectations, impacting overall financial performance and investor confidence. This shortfall is attributed to [Specific reasons for revenue shortfall, e.g., slower-than-anticipated contract signings, delays in project implementation].

-

Competitive landscape and market saturation: The increasing competition in the AI solutions market, particularly within the government and commercial sectors, poses a significant challenge to BigBear.ai's growth. The report suggests that market saturation could limit BBAI's ability to secure new contracts and maintain its market share.

-

Profitability concerns and operating expenses: The analyst firm noted concerns about BigBear.ai's profitability, citing high operating expenses and low profit margins. The report suggests that the company needs to improve its operational efficiency and cost management strategies to achieve sustainable profitability.

-

Debt levels and financial stability: High levels of debt could pose a significant risk to BigBear.ai's long-term financial stability. The analyst firm's concerns regarding debt repayment ability warrant careful consideration for investors.

BigBear.ai's (BBAI) Business Model and Recent Performance

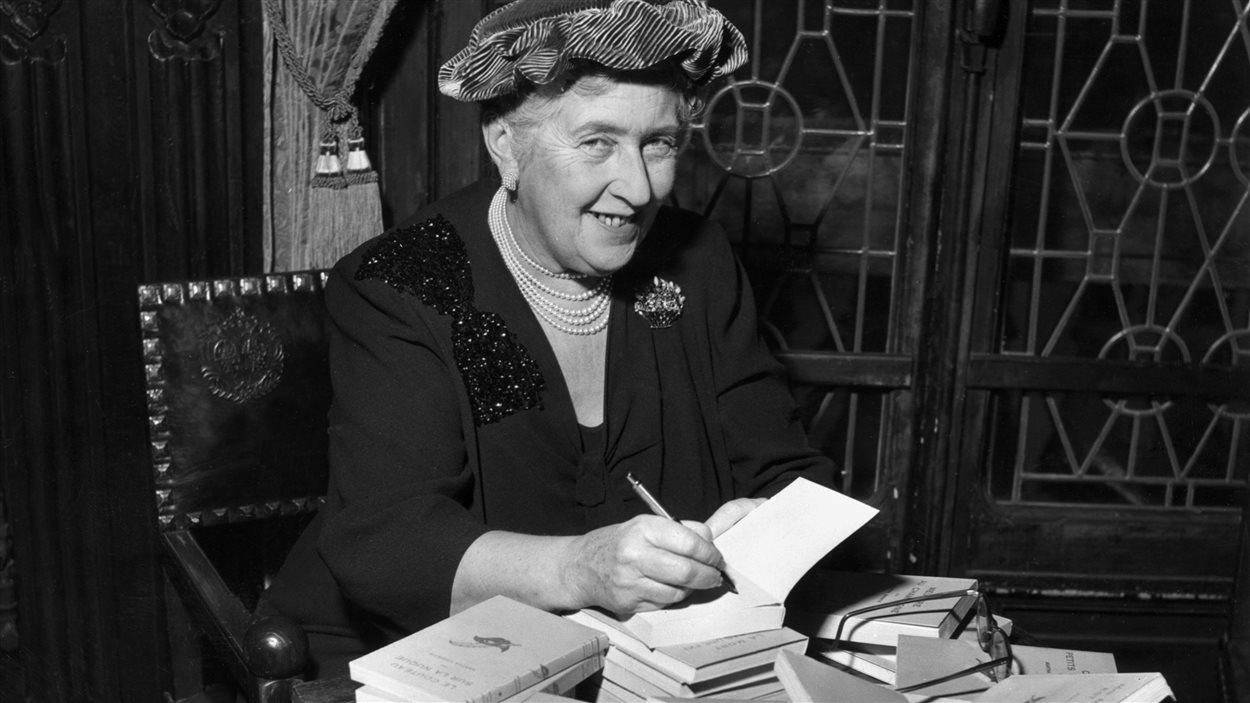

BigBear.ai provides advanced AI-powered solutions to government and commercial clients, focusing on [mention specific areas like data analytics, cybersecurity, etc.]. The company's recent financial performance has shown [mention overall trend - positive or negative growth]. Key performance indicators (KPIs) paint a mixed picture:

- Year-over-year revenue growth: [Insert percentage and context, e.g., "showed a 10% increase year-over-year, but this growth rate is slowing down."]

- Contract wins and backlog: [Summarize the recent contract wins and the size of the backlog. Positive news here could offset the negative impact of the downgrade.]

- Customer acquisition costs: [Discuss the cost of acquiring new customers. High customer acquisition costs can impact profitability.]

- Profit margins: [Report on profit margins and explain any trends or fluctuations.]

[Insert chart or graph visualizing key financial metrics if available]

BigBear.ai has recently secured contracts with [mention key clients or partnerships if any]. These partnerships could potentially contribute to future revenue growth and offset some of the concerns raised in the analyst downgrade.

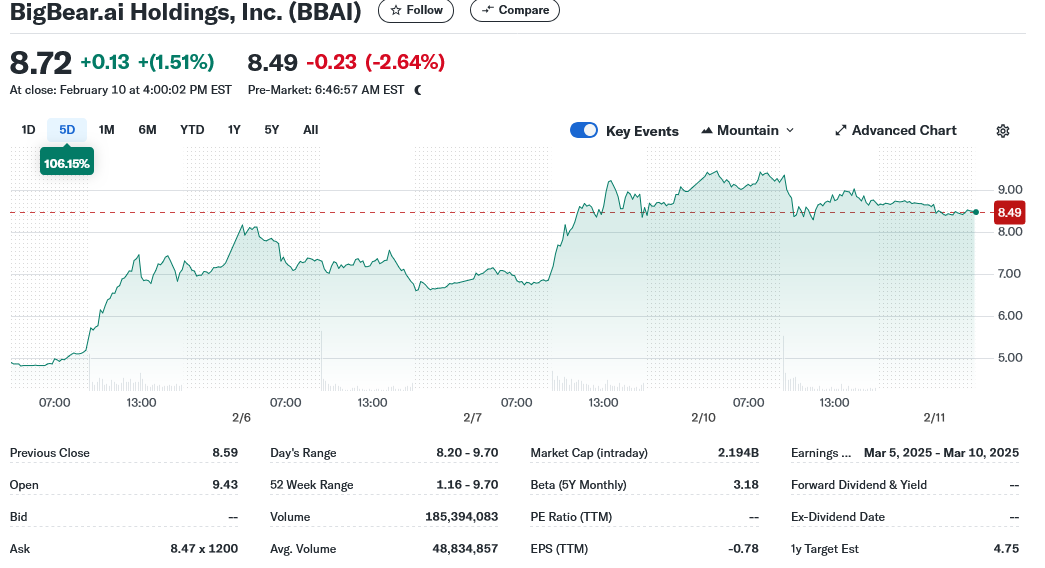

Impact on BBAI Stock Price and Investor Sentiment

The analyst downgrade had an immediate and significant impact on BBAI's stock price, causing a [percentage]% drop on [date]. Trading volume [increased/decreased] significantly following the announcement, indicating [high/low] investor activity. Social media sentiment reflects a mix of [mention prevailing sentiment – e.g., concern, uncertainty, opportunity], with some investors expressing concerns about the company's future prospects, while others see the price drop as a potential buying opportunity.

- Percentage change in stock price after downgrade: [Insert percentage]

- Trading volume fluctuations: [Describe the changes in trading volume]

- Changes in analyst ratings: [Mention any other changes in analyst ratings besides the initial downgrade]

- Investor comments and social media sentiment: [Summarize the overall sentiment expressed by investors and on social media platforms]

Future Outlook and Potential Risks for BigBear.ai (BBAI) Stock

The long-term implications of the analyst downgrade remain uncertain. While the concerns raised are valid, BigBear.ai still possesses potential for growth, particularly in the expanding AI market. However, several key risks remain:

- Potential for future growth: BigBear.ai's potential for future growth hinges on its ability to secure new contracts, improve its operational efficiency, and manage its debt effectively.

- Key risk factors: Competition, high operating expenses, debt levels, and failure to meet revenue projections are significant risks.

- Possible catalysts for price appreciation: New contract wins, successful product launches, and strategic partnerships could drive price appreciation.

- Long-term investment potential: The long-term investment potential of BBAI stock depends largely on the company's ability to address the concerns highlighted in the analyst downgrade and capitalize on the growth opportunities in the AI market.

Conclusion

The recent analyst downgrade of BigBear.ai (BBAI) stock has created significant uncertainty for investors. While concerns about revenue projections, competition, profitability, and debt levels are valid, the company's potential in the growing AI market cannot be ignored. Careful consideration of these factors, alongside the company's ability to overcome these challenges, is crucial. While the recent downgrade of BigBear.ai (BBAI) stock presents challenges, further research and consideration of the long-term prospects are crucial before making any investment decisions regarding BBAI. Conduct thorough due diligence and consult with a financial advisor before investing in BigBear.ai (BBAI) stock.

Featured Posts

-

Assessing The Transparency Of Trump Era Aerospace Agreements

May 20, 2025

Assessing The Transparency Of Trump Era Aerospace Agreements

May 20, 2025 -

Efimeries Giatron Stin Patra 12 And 13 Aprilioy

May 20, 2025

Efimeries Giatron Stin Patra 12 And 13 Aprilioy

May 20, 2025 -

Snls 50th Season Finale Record Breaking Ratings And Highlights

May 20, 2025

Snls 50th Season Finale Record Breaking Ratings And Highlights

May 20, 2025 -

Plongez Dans L Integrale D Agatha Christie Vie Et Uvre

May 20, 2025

Plongez Dans L Integrale D Agatha Christie Vie Et Uvre

May 20, 2025 -

Australia Us Missile Test Sparks Tensions With China

May 20, 2025

Australia Us Missile Test Sparks Tensions With China

May 20, 2025

Latest Posts

-

The Challenges Faced By Billionaire Boys Pressure Expectations And Privacy

May 20, 2025

The Challenges Faced By Billionaire Boys Pressure Expectations And Privacy

May 20, 2025 -

How Billionaire Boys Spend Their Money Investments Philanthropy And Excess

May 20, 2025

How Billionaire Boys Spend Their Money Investments Philanthropy And Excess

May 20, 2025 -

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025

Understanding The Billionaire Boy Phenomenon Family Fortune And Future

May 20, 2025 -

The Making Of A Billionaire Boy Inheritance Innovation Or Both

May 20, 2025

The Making Of A Billionaire Boy Inheritance Innovation Or Both

May 20, 2025 -

Billionaire Boy A Look Into The Life Of Extreme Wealth

May 20, 2025

Billionaire Boy A Look Into The Life Of Extreme Wealth

May 20, 2025