BigBear.ai (BBAI) Stock: Analyst Downgrade Sparks Investor Uncertainty

Table of Contents

The Analyst Downgrade: A Detailed Look

The downgrade of BBAI stock originated from [Analyst Firm Name], a reputable investment firm known for its coverage of the technology sector. Their reasoning, detailed in their recent analyst report, cited several key concerns that led them to revise their BBAI rating. Keywords: BBAI rating, analyst report, price target, sell rating, investment recommendation

-

Revised Price Target: [Analyst Firm Name] lowered their price target for BBAI stock from $[Previous Price Target] to $[New Price Target], representing a significant decrease of [Percentage Change]%. This drastic revision reflects a considerably more pessimistic outlook on the company's future performance compared to their previous predictions.

-

Reasons for Downgrade: The analyst report highlighted concerns about [Specific Concern 1, e.g., slower-than-expected revenue growth], [Specific Concern 2, e.g., increased competition in the AI market], and [Specific Concern 3, e.g., challenges in securing new government contracts]. These issues collectively contributed to the firm's decision to issue a sell rating for BBAI stock.

-

Implications of the Downgrade: The downgrade has significantly impacted investor confidence in BBAI. The sell rating encourages investors to divest from the stock, potentially leading to further price declines and increased market volatility for BBAI. The negative sentiment expressed in the report could also deter potential new investors.

Market Reaction to the BBAI Downgrade

The market reacted swiftly to the BBAI downgrade. Keywords: BBAI stock price, trading volume, market volatility, investor sentiment, stock market reaction

-

Immediate Price Impact: Following the announcement, BBAI's stock price experienced a sharp [Percentage Change]% drop, closing at $[Closing Price]. This immediate reaction underscores the significant influence of analyst ratings on investor behavior and short-term stock price movements.

-

Trading Volume Surge: Trading volume for BBAI stock increased significantly in the days following the downgrade, indicating heightened investor activity as many reacted to the news. This high trading volume suggests that many investors are actively reassessing their positions in BBAI, either selling off their shares or looking for potential buying opportunities.

-

Broader Market Impact: While the primary impact was felt by BBAI, the overall market reaction reflected a degree of caution regarding other AI stocks. Some saw minor dips, reflecting the interconnectedness and sensitivity of the AI sector to negative news impacting any one significant player. This contagious negativity highlights the risk involved in concentrating investments in a single sector.

BigBear.ai's Business and Future Outlook

BigBear.ai operates in the highly competitive artificial intelligence market, focusing primarily on providing AI-powered solutions to government and commercial clients. Keywords: BigBear.ai business model, AI technology, government contracts, revenue growth, competitive landscape

-

Core Business and Market Position: BBAI's business model relies heavily on securing large government contracts for its AI-driven analytics and decision support systems. Its success is therefore intricately linked to the ongoing demand for these solutions within the public sector.

-

Recent Developments: Recent news regarding BBAI includes [mention any recent news, e.g., new contract wins, product launches, partnerships]. These factors can significantly impact the company's future performance and investor sentiment.

-

Financial Performance: BBAI's financial performance [insert details regarding revenue, profitability, debt levels etc. from recent financial reports]. Analyzing this data is crucial to assessing the company's health and potential for future growth.

-

Competitive Landscape: BBAI faces stiff competition from established players in the AI market, including [mention key competitors]. Its ability to differentiate its offerings and maintain a competitive edge will be critical for its long-term success.

-

Long-Term Growth Potential: The long-term outlook for BBAI hinges on its ability to secure new contracts, develop innovative AI solutions, and successfully navigate the challenges of a fiercely competitive market. The potential for growth in the AI sector remains significant, but BBAI's success is far from guaranteed.

Opportunities and Risks for BBAI Investors

The analyst downgrade presents both risks and opportunities for BBAI investors. Keywords: BBAI investment, risk assessment, long-term investment, potential returns, market risk

-

Risks: Investing in BBAI after the downgrade carries significant risk. The stock price could continue to decline, and there's no guarantee of a turnaround. Market volatility and the inherent risks associated with the AI sector add further complexity.

-

Opportunities: Some investors may view the current lower price as a potential buying opportunity, anticipating a future rebound based on the long-term growth prospects of the AI sector. However, this is highly speculative and requires thorough due diligence.

-

Long-Term Prospects: The long-term success of BBAI, and thus the potential returns for investors, depends heavily on the company's ability to overcome the challenges identified in the analyst report and capitalize on future growth opportunities within the AI industry.

Conclusion

The analyst downgrade of BigBear.ai (BBAI) stock has created significant investor uncertainty. The market's immediate reaction, coupled with the concerns raised in the analyst report, highlights the considerable risks involved in investing in BBAI at this time. While the long-term prospects of the AI sector remain promising, careful consideration of BBAI's specific challenges is crucial before making any investment decisions.

Call to Action: Before investing in BigBear.ai (BBAI) stock, conduct thorough due diligence and consider seeking professional financial advice. Understanding the risks associated with BBAI and the broader AI stock market is essential for making informed investment decisions. Stay updated on the latest news and analysis surrounding BBAI stock to better assess its future performance. Remember to diversify your portfolio to mitigate risks.

Featured Posts

-

Gangsta Granny Comparing The Book And The Stage Adaptation

May 21, 2025

Gangsta Granny Comparing The Book And The Stage Adaptation

May 21, 2025 -

Benjamin Kaellman Maalitykki Huuhkajien Riveihin

May 21, 2025

Benjamin Kaellman Maalitykki Huuhkajien Riveihin

May 21, 2025 -

David Walliams And Simon Cowell A Bitter Rivalry On Britains Got Talent

May 21, 2025

David Walliams And Simon Cowell A Bitter Rivalry On Britains Got Talent

May 21, 2025 -

Nyt Mini Crossword Puzzle Solutions March 26 2025

May 21, 2025

Nyt Mini Crossword Puzzle Solutions March 26 2025

May 21, 2025 -

Abn Amro Duurzame Tewerkstelling In De Voedingsindustrie En De Rol Van Arbeidsmigranten

May 21, 2025

Abn Amro Duurzame Tewerkstelling In De Voedingsindustrie En De Rol Van Arbeidsmigranten

May 21, 2025

Latest Posts

-

Vybz Kartels Exclusive Interview Life In Prison Hope For Freedom And Music

May 22, 2025

Vybz Kartels Exclusive Interview Life In Prison Hope For Freedom And Music

May 22, 2025 -

Experience Vybz Kartel Live Historic New York Show

May 22, 2025

Experience Vybz Kartel Live Historic New York Show

May 22, 2025 -

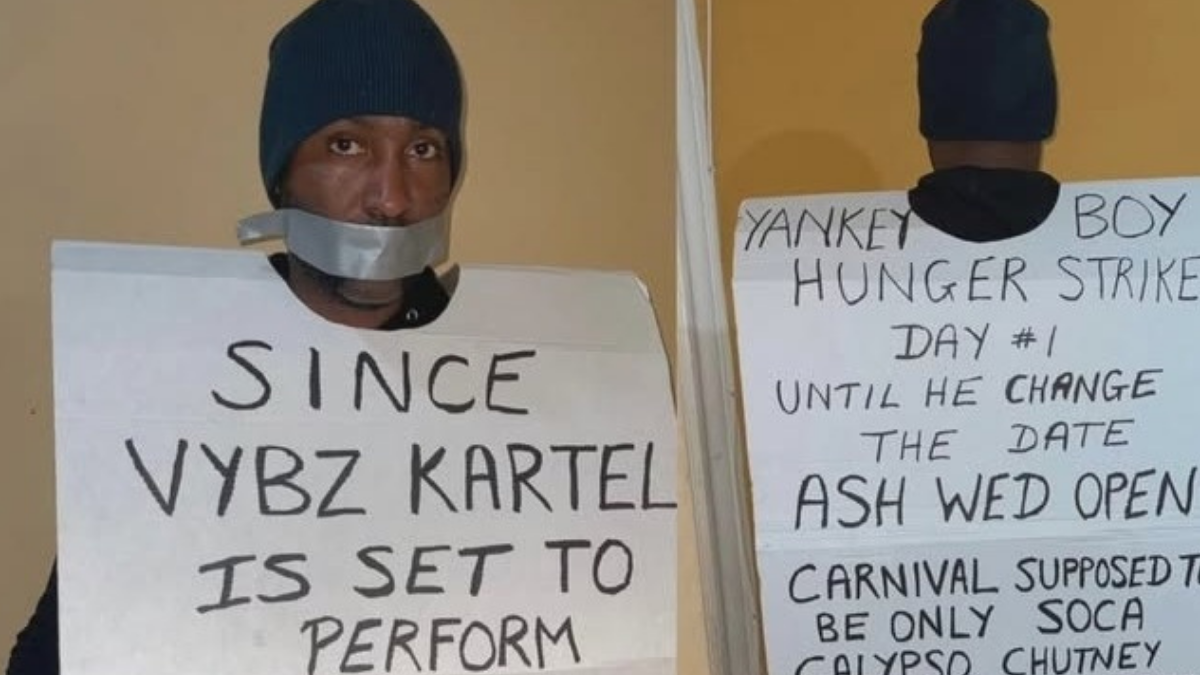

Trinidad Concert Defence Minister Debates Age Limits And Song Censorship For Kartel

May 22, 2025

Trinidad Concert Defence Minister Debates Age Limits And Song Censorship For Kartel

May 22, 2025 -

Historic Vybz Kartel Concert In New York Details Revealed

May 22, 2025

Historic Vybz Kartel Concert In New York Details Revealed

May 22, 2025 -

Potential Ban And Age Restrictions For Kartels Trinidad Performance

May 22, 2025

Potential Ban And Age Restrictions For Kartels Trinidad Performance

May 22, 2025