BigBear.ai (BBAI) Stock: Buy Rating Holds Despite Defense Sector Uncertainty

Table of Contents

Understanding BigBear.ai (BBAI) and its Business Model

BigBear.ai is a leading provider of artificial intelligence (AI) solutions, primarily serving the defense and intelligence communities, but also expanding into commercial sectors. Their core offerings revolve around advanced data analytics, AI-powered decision support tools, and sophisticated modeling capabilities. BBAI leverages its cutting-edge technology to help clients analyze massive datasets, predict future trends, and make more informed decisions.

-

Competitive Advantages: BBAI boasts a strong intellectual property portfolio, a highly skilled workforce, and a proven track record of successful deployments. Their proprietary algorithms and advanced analytics set them apart from competitors.

-

Revenue Streams & Market Positioning: BigBear.ai generates revenue through government contracts, commercial partnerships, and software licensing agreements. They are well-positioned to capitalize on the increasing demand for AI-driven solutions across various sectors.

-

Target Market: While the government (primarily defense and intelligence) remains a significant segment for BBAI, their expanding commercial partnerships demonstrate a successful diversification strategy.

The Current State of the Defense Sector and its Impact on BBAI

The current geopolitical climate is marked by significant uncertainty. Defense spending, while substantial, is subject to fluctuations based on shifting geopolitical priorities and budgetary constraints. This volatility creates inherent risk for companies like BigBear.ai, whose revenue is significantly tied to government contracts.

-

Challenges Impacting the Defense Sector: Budgetary pressures, shifting priorities toward different defense capabilities, and increased scrutiny of government spending all pose challenges to the defense sector.

-

Potential Government Policy Changes Affecting BBAI: Changes in government procurement processes or a shift away from AI-focused initiatives could impact BBAI's revenue stream.

-

Market Trends Impacting BBAI's Growth: Competition within the AI and defense technology sectors is intense, potentially limiting BBAI's market share growth.

Why Analysts Maintain a "Buy" Rating for BBAI Stock Despite Uncertainty

Despite the inherent risks associated with the defense sector, analysts maintain a "buy" rating for BBAI stock, largely due to several key factors.

-

Rationale for the "Buy" Rating: Analysts point to BBAI's strong long-term growth potential fueled by increasing demand for AI solutions. Their diversification efforts into commercial markets also lessen dependence on the volatile defense sector.

-

Financial Performance & Future Projections: While short-term fluctuations are expected, BBAI's long-term financial projections showcase robust growth, bolstering the "buy" recommendation.

-

Partnerships & Acquisitions: Recent strategic partnerships and acquisitions have expanded BBAI's capabilities and market reach, further reinforcing its positive outlook.

Potential Risks and Rewards of Investing in BBAI Stock

Investing in BBAI stock presents both significant opportunities and potential risks.

-

Risks Involved: Market volatility, dependence on government contracts, competition from larger established players, and potential delays in contract awards are all inherent risks.

-

Potential Returns: The potential for high growth, fueled by the increasing adoption of AI and BBAI's innovative technology, presents significant upside potential.

-

Comparison to Similar Companies: Compared to other companies in the AI and defense sectors, BBAI offers a compelling combination of growth potential and innovative technology.

Conclusion

The "buy" rating for BigBear.ai (BBAI) stock remains noteworthy despite the inherent uncertainties within the defense sector. While BBAI’s revenue is significantly tied to government contracts, its diversification strategy and strong long-term growth potential mitigate some of these risks. However, it's crucial to acknowledge that investing in BBAI stock carries substantial risk. Before making any investment decisions regarding BigBear.ai (BBAI) stock, thorough due diligence is essential. Further research into BBAI's financial statements and a comprehensive analysis of the defense sector landscape are recommended. The BigBear.ai investment opportunity presents both significant potential rewards and considerable risks, demanding careful consideration and a thorough BigBear.ai stock analysis before investing.

Featured Posts

-

Formula 1 Star Charles Leclerc Teams Up With Chivas Regal

May 20, 2025

Formula 1 Star Charles Leclerc Teams Up With Chivas Regal

May 20, 2025 -

Former Us Attorney Zachary Cunhas New Role In Private Practice

May 20, 2025

Former Us Attorney Zachary Cunhas New Role In Private Practice

May 20, 2025 -

Unlocking The Marvel Avengers Clue Your Guide To Todays Nyt Mini Crossword

May 20, 2025

Unlocking The Marvel Avengers Clue Your Guide To Todays Nyt Mini Crossword

May 20, 2025 -

Resmi Aciklama Fenerbahce Oyuncusu Ajax A Transfer Oluyor

May 20, 2025

Resmi Aciklama Fenerbahce Oyuncusu Ajax A Transfer Oluyor

May 20, 2025 -

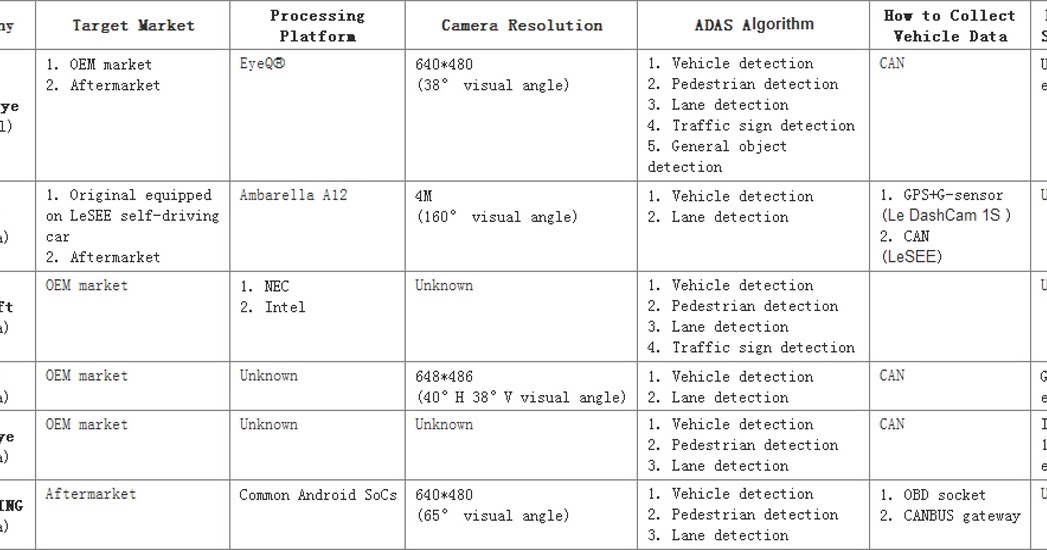

Adas

May 20, 2025

Adas

May 20, 2025

Latest Posts

-

Complete Tv Schedule For Sandylands U

May 20, 2025

Complete Tv Schedule For Sandylands U

May 20, 2025 -

Gangsta Granny Themes Characters And Literary Devices Explored

May 20, 2025

Gangsta Granny Themes Characters And Literary Devices Explored

May 20, 2025 -

Find Sandylands U On Tv Your Guide To Airtimes

May 20, 2025

Find Sandylands U On Tv Your Guide To Airtimes

May 20, 2025 -

Is Gangsta Granny Suitable For Young Readers A Parents Guide

May 20, 2025

Is Gangsta Granny Suitable For Young Readers A Parents Guide

May 20, 2025 -

Sandylands U Tv Listings And Showtimes

May 20, 2025

Sandylands U Tv Listings And Showtimes

May 20, 2025