BigBear.ai (BBAI) Stock Plummets: Missed Revenue And Leadership Shakeup

Table of Contents

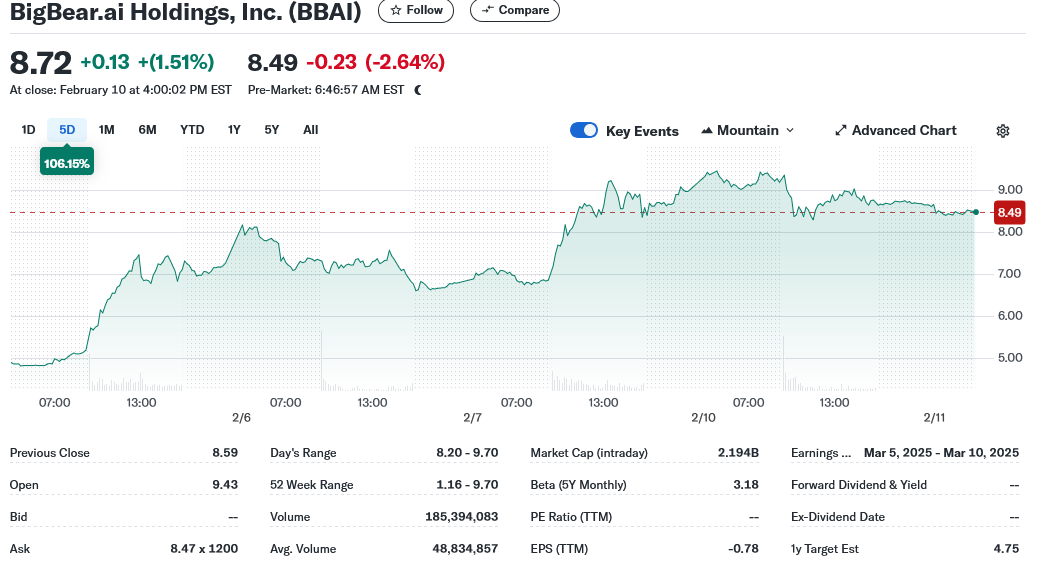

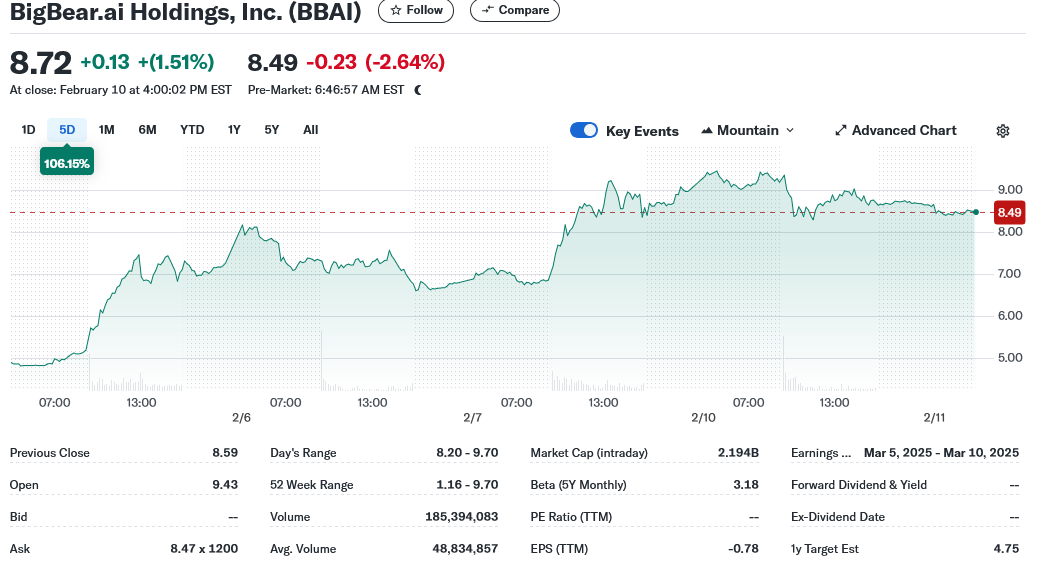

BigBear.ai Misses Revenue Expectations – Impact on BBAI Stock Price

The disappointing financial results released by BigBear.ai directly triggered the BBAI stock plummet. Let's break down the details.

Detailed Analysis of the Missed Revenue

BigBear.ai reported significantly lower-than-expected revenue for [Specify Quarter, e.g., Q2 2024]. While the company projected [State projected revenue figure], the actual results came in at [State actual revenue figure], representing a shortfall of [Percentage or numerical shortfall]. This substantial miss raises serious concerns.

Several factors contributed to this revenue shortfall:

- Contract Delays: Several key government contracts experienced unforeseen delays, pushing expected revenue into future quarters.

- Lower-than-Expected Demand: Market demand for certain BigBear.ai products and services proved weaker than anticipated, impacting overall sales.

- Increased Competition: Intensified competition within the AI and big data solutions market might have also played a role.

This significant discrepancy between projected and actual revenue severely eroded investor confidence, directly impacting the BBAI stock price. The missed revenue projections cast doubt on the company's short-term financial stability and growth trajectory.

Investor Reaction and Market Sentiment

The market reacted swiftly and negatively to the news of BigBear.ai's missed revenue projections. BBAI stock experienced a sharp decline in price, with trading volume significantly increasing as investors scrambled to react. Analyst ratings were downgraded by several prominent firms, further contributing to the negative market sentiment. The overall investor sentiment shifted from cautious optimism to significant concern, highlighting the gravity of the situation for BBAI stock.

Leadership Shakeup at BigBear.ai: Implications for BBAI Stock

Adding to the pressure on BBAI stock was a concurrent leadership shakeup within BigBear.ai.

Details of the Executive Changes

[Name of Executive] stepped down from their position as [Position] at BigBear.ai, while [Name of Executive] also departed from their role as [Position]. [If applicable, add details on new appointments and their backgrounds]. The reasons behind these departures were [State the reasons if publicly known, otherwise state that they remain unclear or are attributed to unspecified reasons]. This lack of transparency further fueled uncertainty among investors.

Impact on Company Strategy and Future Outlook

The leadership changes raise concerns about the company's short-term and long-term strategies. A change in leadership often leads to shifts in strategic direction and operational priorities. Investors are now questioning whether the new leadership team will successfully navigate the challenges facing the company and effectively execute a recovery strategy for BBAI stock. Concerns about operational efficiency and the potential for further disruptions are also prevalent.

Analyzing the Long-Term Prospects of BigBear.ai (BBAI)

Despite the recent setbacks, it's crucial to analyze the long-term prospects of BigBear.ai.

Potential for Recovery and Growth

BigBear.ai still possesses several key strengths:

- Strong Government Contracts: Despite recent delays, the company holds significant contracts within the government sector.

- Innovative AI and Big Data Solutions: BigBear.ai's technology remains competitive within the AI and big data space.

- Potential for Market Expansion: The AI and big data market is experiencing significant growth, offering potential opportunities for future expansion.

The management team’s ability to address the current challenges and capitalize on these opportunities will be crucial in determining BBAI stock's future trajectory.

Risks and Challenges Ahead

However, significant risks and challenges remain:

- Financial Stability: The missed revenue targets raise concerns regarding the company's financial health and stability.

- Increased Competition: The competitive landscape in the AI and big data sector is highly dynamic, demanding continuous innovation and adaptation.

- Execution Risk: Successfully implementing new strategies and overcoming operational challenges is crucial for recovery.

These factors must be carefully considered when evaluating the potential of BBAI stock.

Conclusion: Navigating the Volatility of BBAI Stock – What's Next?

The recent plummet in BigBear.ai (BBAI) stock price is a direct consequence of missed revenue targets and a significant leadership shakeup. While the company possesses strengths and potential for future growth within the AI and big data market, significant risks and challenges remain. Investors must carefully assess these factors before making any investment decisions.

To navigate the volatility of BBAI stock, it is essential to conduct thorough due diligence, monitor the company’s performance closely through financial reports and news releases, and stay informed about industry trends. Remember that investing in the stock market carries inherent risk. This article provides an analysis but is not financial advice. Always conduct your own research before investing in BBAI stock or any other security.

Featured Posts

-

Solve The Nyt Mini Crossword Answers For March 18 2025

May 20, 2025

Solve The Nyt Mini Crossword Answers For March 18 2025

May 20, 2025 -

Chinas Space Supercomputer Technological Advancements And Future Applications

May 20, 2025

Chinas Space Supercomputer Technological Advancements And Future Applications

May 20, 2025 -

Ferrari And Leclerc Imola Gp Statement Explained

May 20, 2025

Ferrari And Leclerc Imola Gp Statement Explained

May 20, 2025 -

Cunha Transfer Arsenal And Man United In Competition

May 20, 2025

Cunha Transfer Arsenal And Man United In Competition

May 20, 2025 -

Suki Waterhouses Met Gala 2025 Appearance Tuxedo Dress And Sideboob

May 20, 2025

Suki Waterhouses Met Gala 2025 Appearance Tuxedo Dress And Sideboob

May 20, 2025

Latest Posts

-

Matt Lucas On Little Britain Revival A Future Update

May 20, 2025

Matt Lucas On Little Britain Revival A Future Update

May 20, 2025 -

Little Britains Enduring Appeal A Gen Z Perspective

May 20, 2025

Little Britains Enduring Appeal A Gen Z Perspective

May 20, 2025 -

Is This The End David Walliams And Simon Cowells Britains Got Talent Fallout

May 20, 2025

Is This The End David Walliams And Simon Cowells Britains Got Talent Fallout

May 20, 2025 -

The David Walliams Simon Cowell Rift A Britains Got Talent Crisis

May 20, 2025

The David Walliams Simon Cowell Rift A Britains Got Talent Crisis

May 20, 2025 -

Britains Got Talent Walliams And Cowells Feud Intensifies

May 20, 2025

Britains Got Talent Walliams And Cowells Feud Intensifies

May 20, 2025