BigBear.ai Holdings, Inc. (BBAI): A Top AI Penny Stock Pick?

Table of Contents

BBAI's Business Model and AI Capabilities

BigBear.ai offers a range of AI-powered solutions primarily targeting the defense, intelligence, and commercial sectors. The company leverages advanced technologies like machine learning, deep learning, and sophisticated data analytics to deliver solutions for complex problems. Their core offerings include predictive analytics, data visualization, and AI-driven decision support systems. This positioning within the AI stock market makes it a potentially lucrative investment, but requires careful analysis.

- Successful AI Deployments: BigBear.ai boasts successful deployments of its AI solutions within government agencies, assisting in crucial tasks such as threat detection and resource optimization. Specific details often remain confidential due to the sensitive nature of the work.

- Key Partnerships: Strategic partnerships with major technology companies and government organizations provide BBAI with access to resources, expertise, and potentially lucrative contracts, solidifying their position in the AI industry.

- Proprietary AI Algorithms: The company invests heavily in developing proprietary AI algorithms and platforms, giving them a potential competitive edge within the crowded AI marketplace and differentiating them from other AI penny stocks.

Financial Performance and Stock Valuation

Analyzing BBAI's financial performance requires careful consideration of recent financial reports. While revenue growth might show promise, profitability and overall financial health need thorough evaluation. Investors should examine factors like revenue streams, earnings per share, debt levels, and cash flow. The Price-to-Earnings (P/E) ratio provides valuable insight into the stock's valuation relative to its earnings. However, remember that P/E ratios for penny stocks can be highly volatile and may not accurately reflect the company's long-term prospects.

- Key Financial Trends: Tracking key financial figures such as revenue, net income, and earnings per share over time is crucial to understand BBAI’s financial trajectory. A consistent upward trend suggests growth potential, while a decline warrants caution.

- Competitor Comparison: Comparing BBAI's financial performance to that of competitor AI companies provides context and helps gauge its relative strength within the market.

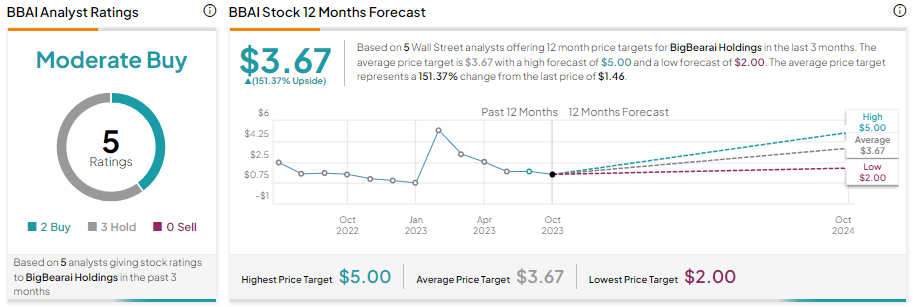

- Analyst Ratings: Consider analyst ratings and price targets for BBAI. Remember that these are opinions, not guarantees, and should be considered alongside your own research.

Risks and Challenges Facing BBAI

Investing in penny stocks, including BBAI stock, carries substantial risks. The inherent volatility of the stock market, especially for small-cap companies, means significant price fluctuations are common. Furthermore, the AI industry is highly competitive, with established giants and numerous startups vying for market share.

- Market Risks: The AI market is dynamic and subject to rapid technological advancements. BBAI’s reliance on government contracts introduces dependence on government budgets and regulatory changes, impacting its revenue streams.

- Financial Risks: High debt levels or inconsistent cash flow can severely impact BBAI's financial stability and stock price. Analyzing the company's balance sheet is critical.

- Operational Risks: Challenges in technology development, implementation, or scaling operations can hinder BBAI's progress and affect its stock valuation.

Alternative AI Investments

A balanced investment strategy requires considering alternatives to BBAI. Exploring other AI penny stocks or established, large-cap AI companies provides diversification and reduces risk. Comparing various options based on factors like market capitalization, P/E ratio, growth potential, and financial stability is essential.

- Comparable Companies: Several other companies operate in the AI sector, each with its own strengths and weaknesses. Researching these alternatives can reveal more suitable investment opportunities based on your risk tolerance and investment goals.

- Comparative Metrics: A table summarizing key metrics – like market cap, P/E ratio, and revenue growth – allows for easy comparison between different AI investments, aiding your decision-making process.

Conclusion: Is BigBear.ai (BBAI) Right for Your Portfolio?

Investing in BBAI stock presents a high-risk, high-reward scenario. While the company's focus on AI and its potential within the defense and intelligence sectors are attractive, significant financial and market risks are involved. This analysis highlights the need for thorough due diligence before investing in BBAI or any other AI penny stock. The information provided is for educational purposes only and should not be considered financial advice. Before making any investment decisions regarding BBAI stock or other artificial intelligence-related penny stock investments, conduct thorough independent research, explore reputable financial resources, and consult a qualified financial advisor. Remember, responsible investing starts with knowledge and careful consideration of your risk tolerance.

Featured Posts

-

Cunhas Move From Public Service To Private Law Practice

May 20, 2025

Cunhas Move From Public Service To Private Law Practice

May 20, 2025 -

Snl Celebrates 50 Years With A Historic Season Finale

May 20, 2025

Snl Celebrates 50 Years With A Historic Season Finale

May 20, 2025 -

L Affaire Jaminet Un Accord Financier Trouve Avec Le Stade Toulousain

May 20, 2025

L Affaire Jaminet Un Accord Financier Trouve Avec Le Stade Toulousain

May 20, 2025 -

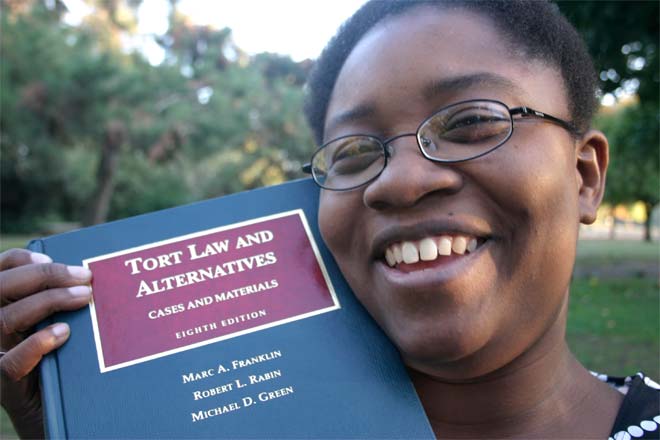

College Enrollment Decline A Case Study Of Battered Local Economies

May 20, 2025

College Enrollment Decline A Case Study Of Battered Local Economies

May 20, 2025 -

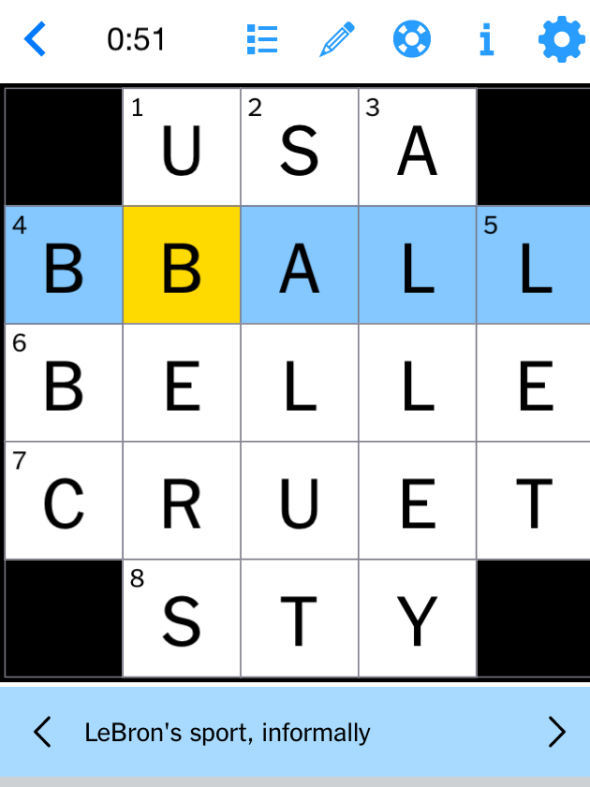

Solve The Nyt Mini Crossword March 20 2025 Answers And Hints

May 20, 2025

Solve The Nyt Mini Crossword March 20 2025 Answers And Hints

May 20, 2025

Latest Posts

-

David Walliams Scathing Simon Cowell Takedown A Britains Got Talent Feud

May 20, 2025

David Walliams Scathing Simon Cowell Takedown A Britains Got Talent Feud

May 20, 2025 -

The David Walliams Bgt Controversy Explained

May 20, 2025

The David Walliams Bgt Controversy Explained

May 20, 2025 -

New Family Film Featuring Mia Wasikowska And Taika Waititi

May 20, 2025

New Family Film Featuring Mia Wasikowska And Taika Waititi

May 20, 2025 -

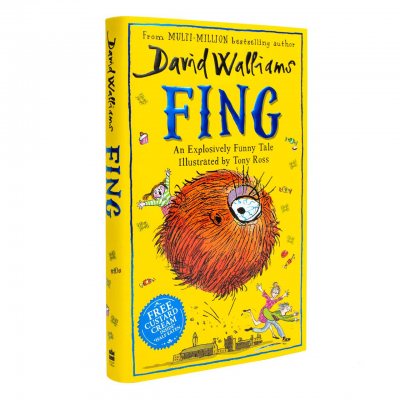

David Walliams Fing Production Details Following Stans Approval

May 20, 2025

David Walliams Fing Production Details Following Stans Approval

May 20, 2025 -

Taika Waititis Family Film Adds Mia Wasikowska To The Cast

May 20, 2025

Taika Waititis Family Film Adds Mia Wasikowska To The Cast

May 20, 2025