BigBear.ai Holdings, Inc. (BBAI): Analyst Downgrade And Growth Concerns

Table of Contents

The Analyst Downgrade: Reasons and Implications

Several prominent analyst firms have recently downgraded their ratings for BBAI. While the specific rationale may vary slightly between firms, several key factors consistently emerge. These include concerns about slower-than-anticipated revenue growth, intensified competition within the rapidly evolving AI market, and persistent challenges in achieving sustained profitability.

- Specific concerns raised by analysts: Analysts cite concerns about BBAI's ability to successfully compete with larger, more established players in the AI sector, particularly in securing and retaining lucrative government contracts. Questions have also been raised regarding the scalability of BBAI's current business model and its long-term financial sustainability.

- Impact on BBAI's stock price: The downgrades have understandably resulted in a significant decline in BBAI's stock price, reflecting investor apprehension about the company's future performance.

- Short-term and long-term implications of the downgrade: In the short term, the downgrade creates uncertainty and could lead to further price volatility. Long-term implications depend heavily on BBAI's ability to address the concerns raised by analysts and demonstrate a clear path to sustainable growth and profitability. Failure to do so could severely impact investor confidence and the company's overall market valuation.

BigBear.ai's Growth Challenges: Analyzing Key Factors

BigBear.ai operates in a highly competitive landscape, facing pressure from both established tech giants and emerging AI startups. Its focus on AI-driven solutions for national security and other critical sectors presents both opportunities and significant hurdles.

- Competition from established players in the AI industry: BigBear.ai competes with larger companies possessing greater resources and established market presence. This intense competition makes it challenging to secure and retain major contracts.

- Challenges in scaling operations and achieving profitability: Scaling operations while maintaining profitability is a major challenge for BBAI. The company needs to balance aggressive growth with efficient resource allocation to avoid excessive expenditure.

- Potential risks associated with BBAI's business model: BBAI's reliance on government contracts and its exposure to the volatility of the defense sector introduce inherent risks. Changes in government spending priorities could significantly impact the company's revenue streams.

Evaluating BBAI's Future Prospects: Opportunities and Risks

Despite the challenges, BigBear.ai possesses potential avenues for future growth and success. Its expertise in AI and its focus on critical sectors like national security offer significant opportunities.

- Opportunities for BBAI to expand into new markets: Exploring new market segments beyond its current focus could diversify revenue streams and reduce reliance on government contracts.

- Potential for strategic partnerships and acquisitions: Strategic alliances with complementary companies could bolster BBAI's technological capabilities and market reach. Acquisitions could help accelerate growth and expand its service offerings.

- Long-term growth potential in the AI industry: The long-term growth potential of the AI industry remains significant. BBAI's ability to adapt to evolving market dynamics and innovate its offerings will be crucial to capitalizing on this potential.

Investor Sentiment and Market Reaction to the Downgrade

The market's reaction to the analyst downgrades has been largely negative, reflecting growing concerns among investors. This is evidenced by the decline in BBAI's stock price and increased trading volume.

- Stock price fluctuations following the downgrade: The stock price has experienced significant volatility since the downgrades were announced, indicating investor uncertainty.

- Trading volume changes: Trading volume has likely increased, reflecting heightened investor activity and a potential shift in market sentiment.

- Impact on investor confidence: Investor confidence in BBAI has undoubtedly been shaken by the negative analyst reports and subsequent stock price decline. Rebuilding this confidence requires a clear demonstration of strategic progress and improved financial performance.

Conclusion: BigBear.ai Holdings, Inc. (BBAI): A Cautious Outlook

The analyst downgrade of BigBear.ai Holdings, Inc. (BBAI) highlights significant concerns regarding its revenue growth, competition, and profitability. While the company possesses potential for future growth in the expanding AI sector, several challenges need to be addressed. Investors should carefully weigh the risks and opportunities before making any investment decisions. Conduct thorough due diligence and stay updated on further developments regarding BigBear.ai Holdings, Inc. (BBAI) and its growth trajectory. Subscribe to our newsletter for further updates and insights on BBAI and other market trends!

Featured Posts

-

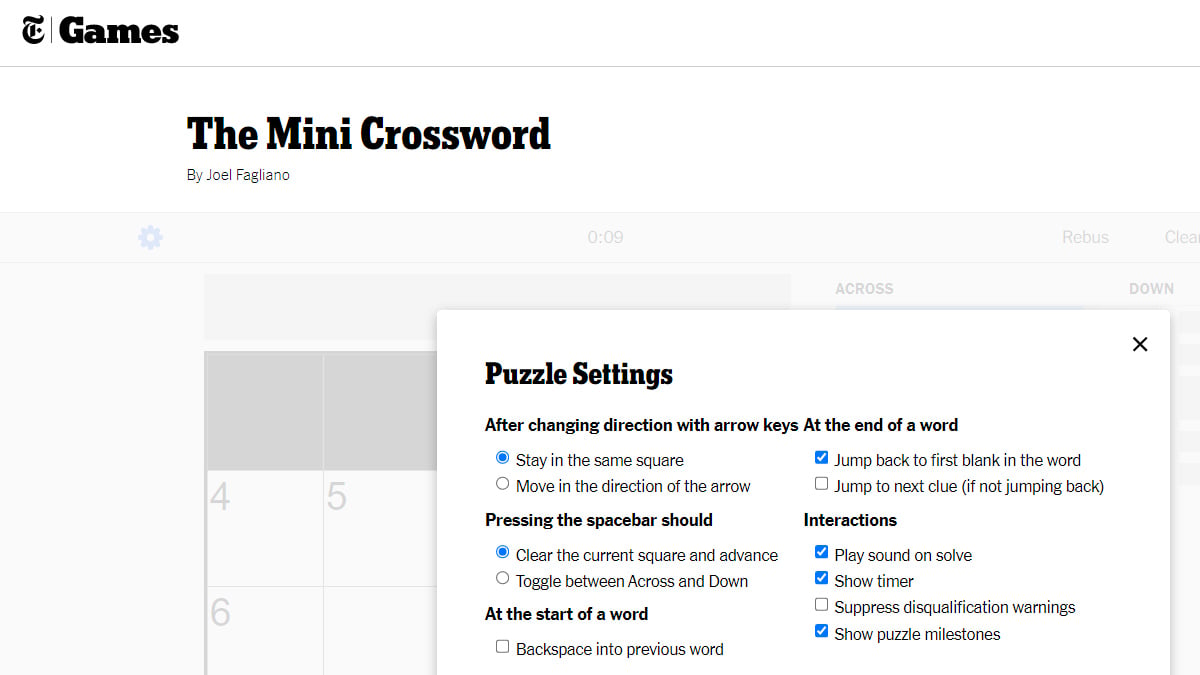

Nyt Mini Crossword Solutions For March 18 2025

May 21, 2025

Nyt Mini Crossword Solutions For March 18 2025

May 21, 2025 -

10 Minute Unpiloted Lufthansa Flight Investigation Into Co Pilot Medical Emergency

May 21, 2025

10 Minute Unpiloted Lufthansa Flight Investigation Into Co Pilot Medical Emergency

May 21, 2025 -

Showbiz Split David Walliams And Simon Cowell Reportedly End Friendship

May 21, 2025

Showbiz Split David Walliams And Simon Cowell Reportedly End Friendship

May 21, 2025 -

Man Breaks Australian Foot Race Speed Record

May 21, 2025

Man Breaks Australian Foot Race Speed Record

May 21, 2025 -

Oneireyontai Oi Amerikanoi Tin Epistrofi Toy Giakoymaki Sto Mls

May 21, 2025

Oneireyontai Oi Amerikanoi Tin Epistrofi Toy Giakoymaki Sto Mls

May 21, 2025

Latest Posts

-

19 Indian Table Tennis Players Participate In Wtt Star Contender Chennai

May 22, 2025

19 Indian Table Tennis Players Participate In Wtt Star Contender Chennai

May 22, 2025 -

Wtt Chennai Arunas Unexpected Early Defeat

May 22, 2025

Wtt Chennai Arunas Unexpected Early Defeat

May 22, 2025 -

Arunas Wtt Chennai Campaign Cut Short

May 22, 2025

Arunas Wtt Chennai Campaign Cut Short

May 22, 2025 -

Musique Metal Le Hellfest Debarque A Mulhouse

May 22, 2025

Musique Metal Le Hellfest Debarque A Mulhouse

May 22, 2025 -

Inside Aimscaps Strategy For The World Trading Tournament Wtt

May 22, 2025

Inside Aimscaps Strategy For The World Trading Tournament Wtt

May 22, 2025