BigBear.ai Holdings, Inc. Sued: Implications For Investors

Table of Contents

Understanding the Lawsuit Against BigBear.ai

The lawsuit against BigBear.ai Holdings, Inc. presents a significant challenge for the company and its stakeholders. Understanding the nature of the allegations is crucial for assessing its potential impact.

Nature of the Allegations

While the specifics may vary depending on the lawsuit, common allegations in such cases against technology companies often include securities fraud, breach of contract, or misrepresentation. These allegations often involve claims of misleading investors about the company's financial performance, technological capabilities, or future prospects. For example, a lawsuit might allege that BigBear.ai overstated the capabilities of its AI technology or misrepresented its financial position to attract investors.

Parties Involved

Identifying the plaintiff(s) and defendant(s) is crucial. The plaintiff(s) are the party or parties bringing the lawsuit, often investors who claim to have suffered financial losses due to BigBear.ai's actions or omissions. The defendant is BigBear.ai Holdings, Inc. itself. The relationship between the plaintiff(s) and BigBear.ai will determine the context and strength of the allegations.

- Key Allegations: (Specific allegations will need to be filled in based on the actual lawsuit. For example: "Allegations include misleading statements regarding contract wins," or "The lawsuit claims the company misrepresented its technological capabilities").

- Potential Financial Damages: (Insert details about the amount of damages sought by the plaintiff(s). For example: "Plaintiffs are seeking [Dollar Amount] in damages.")

- Court Documents/News Articles: (Include links to relevant legal documents or reputable news sources covering the lawsuit.)

Immediate Impact on BigBear.ai Stock Price

The lawsuit's announcement immediately impacted BigBear.ai's stock price, illustrating the market's sensitivity to legal and regulatory risks.

Stock Price Volatility

Following the news of the lawsuit, BigBear.ai's stock price likely experienced significant volatility. The degree of volatility will depend on the severity of the allegations and the market's overall sentiment towards the company. A sharp drop in stock price is a common immediate reaction.

Investor Reaction

Investors' initial reactions ranged from selling their shares to adopting a "wait-and-see" approach. Some investors might have viewed the lawsuit as a buying opportunity, anticipating a potential recovery if the allegations are proven unfounded.

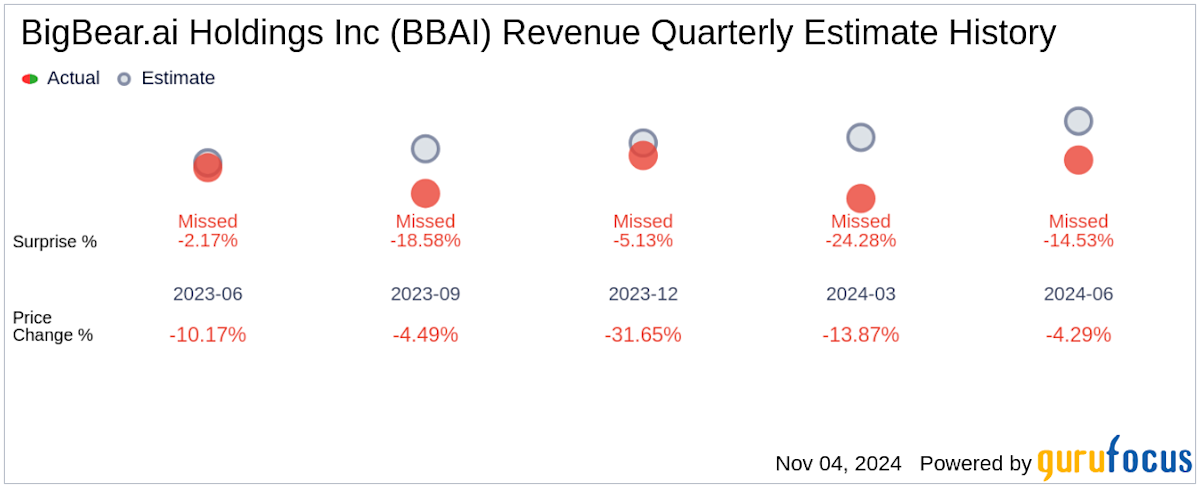

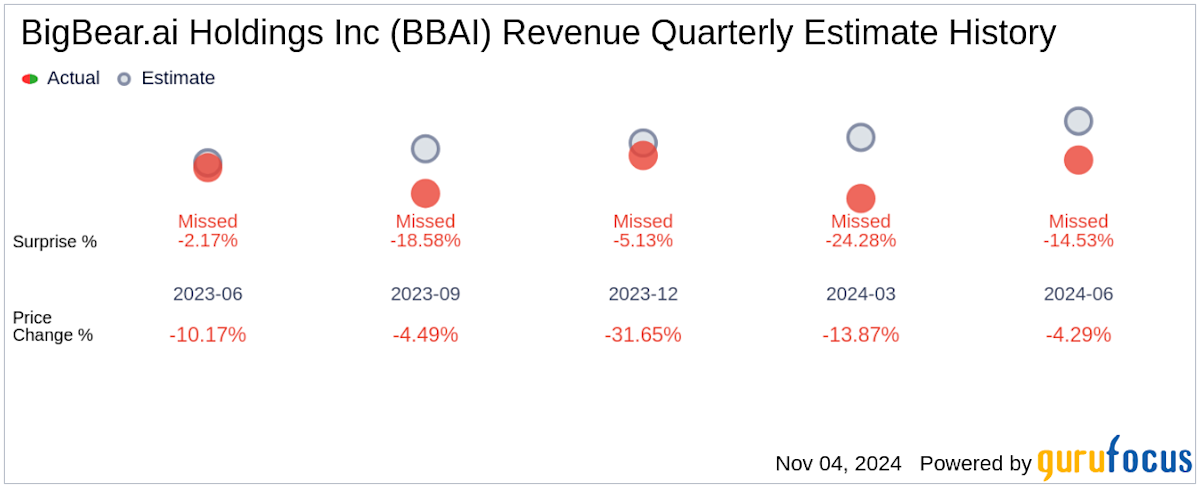

- Stock Price Fluctuations: (Include charts or graphs, if available, showing the stock price movements before and after the lawsuit announcement.)

- News Sources: (Cite news articles reporting on the market's reaction to the lawsuit.)

- Analyst Commentary: (Mention any analyst ratings changes or commentaries following the lawsuit announcement.)

Long-Term Implications for BigBear.ai and its Investors

The long-term implications of this lawsuit extend beyond the immediate stock price reaction. The legal ramifications, investor confidence, and potential regulatory scrutiny all hold significant consequences.

Legal Ramifications

The outcome of the lawsuit – whether a settlement or a trial – will have significant financial implications for BigBear.ai. Settlement costs, legal fees, and potential damages could strain the company's financial resources, impacting its future operations and growth.

Investor Confidence and Future Investments

The lawsuit casts a shadow of doubt over BigBear.ai's reputation and could significantly impact investor confidence. This could deter future investments, making it more difficult for the company to raise capital or secure new partnerships.

Potential Regulatory Scrutiny

The lawsuit could attract increased scrutiny from regulatory bodies. Further investigations might reveal additional issues, potentially leading to further legal action or penalties.

- Potential Settlement Costs: (Estimate the potential cost of a settlement or legal fees, if possible.)

- Impact on Future Contracts: (Discuss how the lawsuit might impact BigBear.ai's ability to secure new contracts or maintain existing partnerships.)

- Risks for Investors: (Highlight the potential risks for investors, including further stock price declines and potential loss of investment.)

Strategies for Investors in Light of the Lawsuit

Investors facing this situation need to adopt a proactive approach to protect their investments.

Risk Assessment and Diversification

Investors should reassess their risk tolerance and consider diversifying their investment portfolios to mitigate the impact of the lawsuit. Holding a large percentage of your investment in a single stock, especially one facing legal challenges, carries significant risk.

Monitoring the Legal Proceedings

Staying informed about the progress of the lawsuit is crucial. Follow reputable news sources and legal updates to understand the evolving situation and its potential implications.

Seeking Professional Advice

Investors should consult with financial advisors or legal professionals before making any investment decisions. Professional guidance can help them navigate the complexities of the situation and make informed choices aligned with their risk tolerance and investment goals.

- Risk Tolerance: (Emphasize the importance of understanding your individual risk tolerance and adjusting your investment strategy accordingly.)

- Reputable Sources: (Suggest reputable sources for tracking the legal developments.)

- Professional Guidance: (Emphasize the value of consulting with financial and legal professionals.)

Conclusion: Navigating the BigBear.ai Lawsuit: Guidance for Investors

The lawsuit against BigBear.ai Holdings, Inc. carries significant implications for investors. Understanding the nature of the allegations, the potential legal ramifications, and the impact on investor confidence is crucial for making informed decisions. The potential for stock price volatility, decreased investor confidence, and increased regulatory scrutiny underscores the need for careful assessment and proactive risk management. Stay informed about developments related to the BigBear.ai Holdings, Inc. lawsuit, conduct thorough due diligence, and seek professional advice before making any investment decisions concerning BigBear.ai stock or related securities. Remember that this information is for educational purposes only and is not financial advice.

Featured Posts

-

Agatha Christies Poirot A Comprehensive Guide To The Master Detective

May 20, 2025

Agatha Christies Poirot A Comprehensive Guide To The Master Detective

May 20, 2025 -

Delving Into The World Of Agatha Christies Poirot

May 20, 2025

Delving Into The World Of Agatha Christies Poirot

May 20, 2025 -

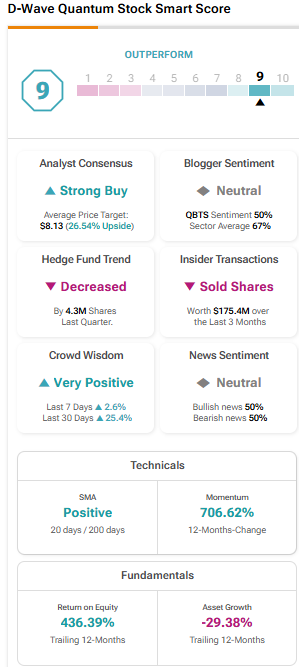

Analyzing The Friday Increase In D Wave Quantum Qbts Stock Price

May 20, 2025

Analyzing The Friday Increase In D Wave Quantum Qbts Stock Price

May 20, 2025 -

Nagelsmann Names Goretzka For Germanys Nations League Squad

May 20, 2025

Nagelsmann Names Goretzka For Germanys Nations League Squad

May 20, 2025 -

Fenerbahce Den Tadic Ayriliyor Transfer Anlasmasi Tamamlandi

May 20, 2025

Fenerbahce Den Tadic Ayriliyor Transfer Anlasmasi Tamamlandi

May 20, 2025

Latest Posts

-

Matt Lucas On Little Britain Revival A Future Update

May 20, 2025

Matt Lucas On Little Britain Revival A Future Update

May 20, 2025 -

Little Britains Enduring Appeal A Gen Z Perspective

May 20, 2025

Little Britains Enduring Appeal A Gen Z Perspective

May 20, 2025 -

Is This The End David Walliams And Simon Cowells Britains Got Talent Fallout

May 20, 2025

Is This The End David Walliams And Simon Cowells Britains Got Talent Fallout

May 20, 2025 -

The David Walliams Simon Cowell Rift A Britains Got Talent Crisis

May 20, 2025

The David Walliams Simon Cowell Rift A Britains Got Talent Crisis

May 20, 2025 -

Britains Got Talent Walliams And Cowells Feud Intensifies

May 20, 2025

Britains Got Talent Walliams And Cowells Feud Intensifies

May 20, 2025