BigBear.ai Stock: A Detailed Investment Analysis

Table of Contents

BigBear.ai's Business Model and Revenue Streams

BigBear.ai's core offerings center around providing AI-powered solutions across diverse sectors. Their expertise lies in data analytics, cybersecurity, and particularly in national security applications. This specialization provides a strong foundation for their revenue streams.

BigBear.ai boasts a diverse client base, encompassing both government agencies and private sector companies. This diversification mitigates risk associated with relying solely on one market segment. Revenue is generated primarily through contracts, subscriptions, and other service agreements.

-

Key Government Contracts: BigBear.ai has secured several substantial contracts with government agencies, contributing significantly to its overall revenue. These contracts often involve long-term partnerships, providing a degree of revenue stability. The impact of these contracts on the BigBear.ai share price is considerable, making them a key aspect of any BigBear.ai analysis.

-

Private Sector Diversification: The company is actively pursuing growth opportunities within the private sector, expanding its client base beyond government contracts. This diversification strategy aims to reduce reliance on government funding and enhance long-term sustainability.

-

Recurring Revenue Model: A growing portion of BigBear.ai's revenue comes from recurring subscription-based services. This model offers improved predictability and contributes to more stable financial performance, influencing the BigBear.ai stock forecast positively.

Financial Performance and Key Metrics

Analyzing BigBear.ai's recent financial statements reveals valuable insights into its performance. While specific numbers fluctuate, examining revenue growth, earnings, and debt levels is crucial. Key financial ratios, such as the price-to-earnings (P/E) ratio and debt-to-equity ratio, offer further insights into the company's financial health and valuation.

-

Revenue Growth and Profitability: Charts illustrating revenue growth and profitability over time are essential for understanding BigBear.ai's trajectory. A consistent upward trend suggests strong growth potential, positively impacting the BigBear.ai share price.

-

Changes in Financial Performance: Any significant changes in financial performance should be analyzed thoroughly. Understanding the reasons behind these shifts (e.g., new contracts, increased operating expenses) is key to a robust BigBear.ai analysis.

-

Competitor Comparison: Comparing BigBear.ai's financials to those of its competitors within the AI sector provides valuable context. This comparative analysis helps to gauge its relative strength and potential for future growth.

Competitive Landscape and Market Position

BigBear.ai operates in a competitive AI market. Identifying its main competitors and assessing its competitive advantages is vital for any BigBear.ai investment strategy.

-

Technological Expertise: BigBear.ai's technological capabilities, particularly its expertise in data analytics and AI-driven solutions for national security, provide a strong competitive edge.

-

Client Relationships: Strong relationships with government agencies and private sector clients contribute significantly to its market position.

-

Market Share and Growth Potential: Analyzing the overall market size and potential for future growth of AI-powered solutions is crucial. Understanding BigBear.ai's market share within this context helps assess its potential for future expansion. This ties directly into a BigBear.ai stock forecast.

-

Threats and Advancements: Potential threats from new entrants and rapid technological advancements must be considered. A BigBear.ai analysis should account for these factors and assess the company's ability to adapt and innovate.

Risk Factors and Potential Challenges

Investing in BigBear.ai stock carries inherent risks. A thorough assessment of these risks is essential for informed decision-making.

-

Government Contract Dependence: BigBear.ai's reliance on government contracts presents a risk. Changes in government policy or budget cuts could significantly impact revenue.

-

Geopolitical and Economic Risks: Geopolitical events and economic downturns can negatively affect the company's performance and the BigBear.ai share price.

-

Scaling Challenges and Profitability: Scaling the business while maintaining profitability poses a challenge. The company's ability to manage growth effectively is crucial.

-

Debt and Regulatory Challenges: High debt levels and potential legal or regulatory challenges represent additional risks. A BigBear.ai analysis should carefully consider these factors.

BigBear.ai Stock Valuation and Future Outlook

Valuing BigBear.ai stock requires employing various methods. Discounted cash flow analysis and comparable company analysis are common approaches.

-

Stock Price Scenarios: Based on different assumptions about future performance, a range of potential stock price scenarios can be developed. These scenarios form a crucial element of any BigBear.ai stock forecast.

-

Growth Catalysts: Identifying potential catalysts that could drive future stock price growth is important. These could include securing new contracts, successful product launches, or advancements in AI technology.

-

Disclaimer: It is crucial to reiterate that this analysis is not financial advice. Investors should conduct their own thorough due diligence before making any investment decisions.

Conclusion

This BigBear.ai investment analysis provides a comprehensive overview of the company, its business model, financial performance, competitive landscape, and associated risks. While the AI sector offers significant growth potential, investing in BigBear.ai stock involves inherent risks. Careful consideration of these risks is paramount.

Call to Action: Before making any investment decisions regarding BigBear.ai stock or other AI stocks, thorough research and due diligence are vital. Consulting a qualified financial advisor is recommended. Conduct your own comprehensive BigBear.ai investment analysis to make informed decisions about your portfolio.

Featured Posts

-

Four Bribery Charges Against Retired 4 Star Admiral Result In Guilty Verdict

May 20, 2025

Four Bribery Charges Against Retired 4 Star Admiral Result In Guilty Verdict

May 20, 2025 -

Conference De Presse 15eme Salon International Du Livre D Abidjan

May 20, 2025

Conference De Presse 15eme Salon International Du Livre D Abidjan

May 20, 2025 -

Enhanced Wireless Headphones A Comprehensive Guide

May 20, 2025

Enhanced Wireless Headphones A Comprehensive Guide

May 20, 2025 -

Gaza Food Crisis Israel Announces First Food Shipments In Months

May 20, 2025

Gaza Food Crisis Israel Announces First Food Shipments In Months

May 20, 2025 -

Uk Taxpayers Locked Out Hmrc Website Outage Causes Chaos

May 20, 2025

Uk Taxpayers Locked Out Hmrc Website Outage Causes Chaos

May 20, 2025

Latest Posts

-

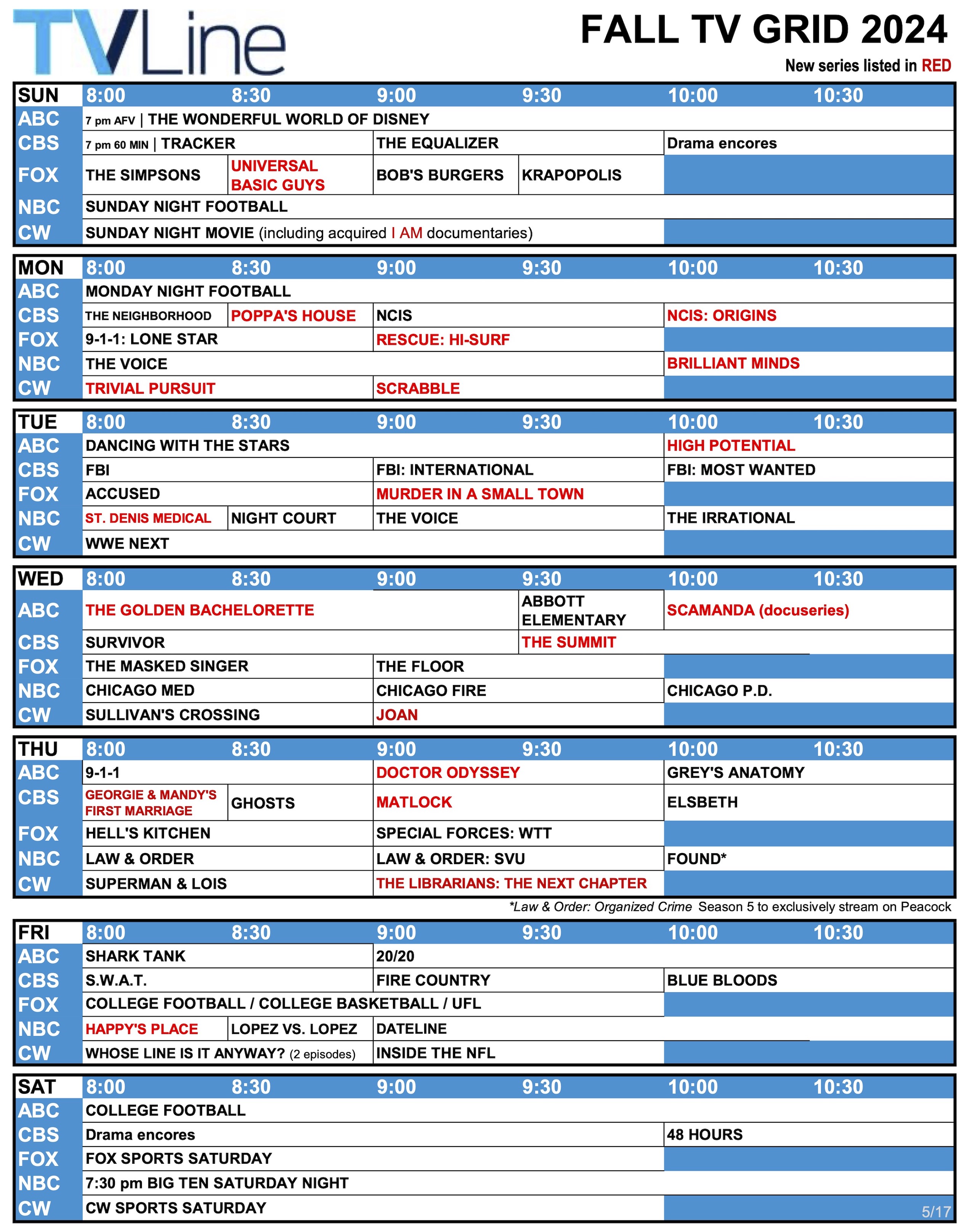

Sandylands U Tv Show Schedule And Viewing Information

May 20, 2025

Sandylands U Tv Show Schedule And Viewing Information

May 20, 2025 -

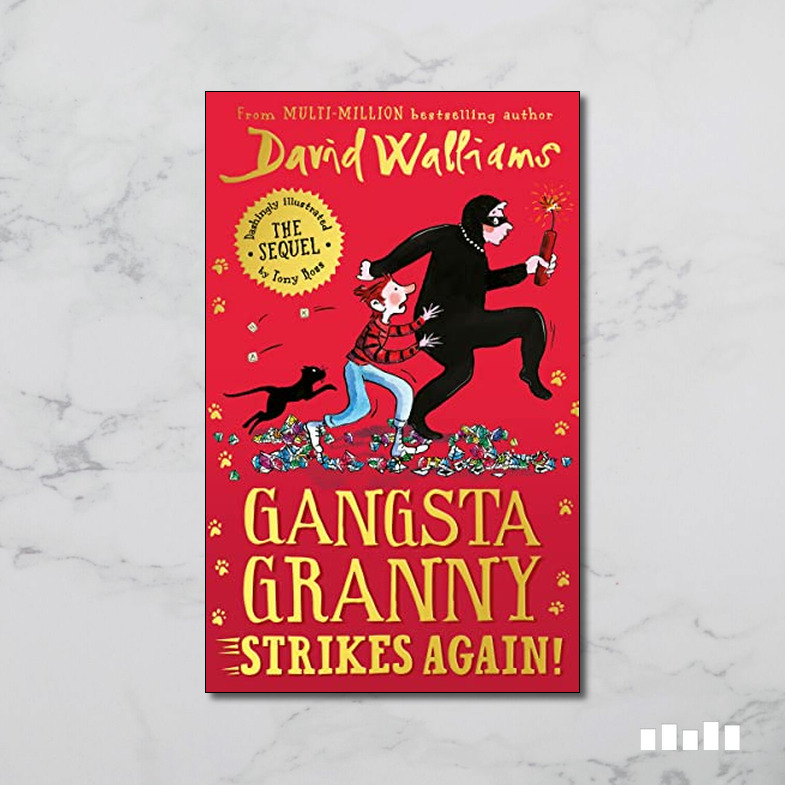

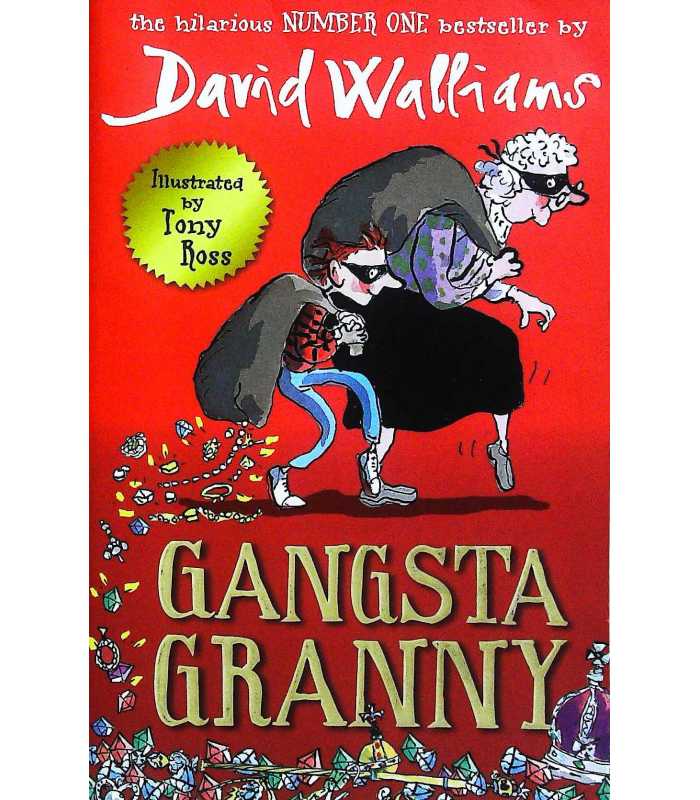

The Enduring Appeal Of Gangsta Granny

May 20, 2025

The Enduring Appeal Of Gangsta Granny

May 20, 2025 -

Your Guide To Sandylands U Tv Show Listings

May 20, 2025

Your Guide To Sandylands U Tv Show Listings

May 20, 2025 -

Gangsta Granny A Comparative Analysis Of Walliams Works

May 20, 2025

Gangsta Granny A Comparative Analysis Of Walliams Works

May 20, 2025 -

Gangsta Granny Activities And Resources For Kids

May 20, 2025

Gangsta Granny Activities And Resources For Kids

May 20, 2025