Big Oil Holds Firm On Production Ahead Of Crucial OPEC+ Talks

Table of Contents

OPEC+’s Production Strategy and its Impact

Current Oil Production Levels and Quotas

OPEC+ member countries currently adhere to a production quota system, aiming to balance supply and demand in the global oil market. However, adherence to these quotas has varied. Let's examine the current production levels of some key players:

- Saudi Arabia: [Insert current Saudi Arabia production figures and any recent changes]. Their production decisions significantly influence global oil prices.

- Russia: [Insert current Russia production figures and any recent changes, considering sanctions and geopolitical factors]. The ongoing conflict in Ukraine has introduced significant uncertainty into their production capabilities.

- Other OPEC+ Members: [Briefly mention production figures for other major players like the UAE, Iraq, etc., highlighting any significant deviations from quotas].

Any deviations from the agreed-upon production targets have ripple effects throughout the energy market. For example, [mention a specific instance of underproduction or overproduction and its impact].

Market Response to Current Oil Production

The market’s response to the current production levels has been marked by volatility. Crude oil prices have [describe price trends – increased, decreased, remained stable – since the last OPEC+ meeting].

[Insert chart or graph illustrating crude oil price trends].

The price fluctuations have significant consequences:

- Inflation: Higher oil prices contribute to inflation, impacting consumer spending and overall economic growth.

- Economic Growth: Uncertainty in oil prices can deter investment and negatively impact economic forecasts.

- Investor Sentiment: Oil price volatility affects investor confidence, leading to fluctuations in stock markets.

Geopolitical Factors Influencing Production Decisions

Geopolitical events profoundly impact oil production decisions. The war in Ukraine, for instance, has disrupted supply chains, leading to production constraints and price increases. Additionally, sanctions imposed on Russia have further complicated the global oil supply landscape.

- Supply Chain Disruptions: The conflict has created significant disruptions in the global oil supply chain, leading to shortages and price spikes.

- Production Capabilities: Sanctions and geopolitical tensions impact the production capabilities of various oil-producing nations.

- Potential for Further Disruptions: The ongoing geopolitical instability increases the risk of further disruptions to global oil production.

Big Oil's Stance and Justification

Statements from Major Oil Companies

Major oil companies have issued statements justifying their decision to hold firm on production. [Quote key executives from major oil companies – e.g., ExxonMobil, Chevron, Shell – and summarize their reasoning]. Their justifications often cite factors like:

- Shareholder Returns: Maximizing shareholder returns is a primary focus for many publicly traded oil companies.

- Market Conditions: Companies may argue that current market conditions don’t warrant increased production.

- Investment in Renewables: Some companies emphasize investments in renewable energy sources as a part of a broader energy transition strategy.

Investment in Renewable Energy and its Impact on Production

The increasing investment in renewable energy by major oil companies presents a complex picture. While many are transitioning towards renewables, they are simultaneously maintaining their focus on fossil fuel production in the short term.

- Short-Term Profits vs. Long-Term Investments: There's inherent tension between maximizing short-term profits from fossil fuels and investing in the long-term development of renewable energy infrastructure.

- Investor Perspectives: Investors are increasingly scrutinizing the environmental and social impacts of fossil fuel investments, impacting the financial viability of solely focusing on oil production.

Analysis of Profitability and Production Costs

The decision to maintain production levels also involves careful consideration of economic factors.

- Rising Production Costs: Increasing operational costs, including labor and equipment expenses, can impact profitability.

- Market Equilibrium: Concerns about overproduction and the potential for price crashes may influence the decision to maintain current output levels.

Predictions and Implications for the OPEC+ Meeting

Potential Outcomes of the OPEC+ Meeting

The upcoming OPEC+ meeting could result in several scenarios:

- Increased Production: This would likely lead to lower oil prices but might not fully address global supply concerns.

- Decreased Production: This would further exacerbate existing supply constraints and likely drive prices upward.

- Maintaining Current Levels: This will likely maintain the current level of market volatility.

Each outcome has significant geopolitical and economic implications.

Long-Term Implications for the Energy Market

The current situation has profound long-term implications for the global energy market.

- Energy Transition Strategies: The world's dependence on fossil fuels highlights the urgency of transitioning to cleaner, more sustainable energy sources.

- Future of Fossil Fuels: The long-term viability of fossil fuels is under increasing scrutiny as concerns about climate change escalate.

Market Volatility and Price Forecasting

Predicting future oil prices is inherently challenging due to the interplay of numerous factors. However, based on current trends and expert analysis, [provide a cautious forecast for future oil prices, acknowledging limitations and uncertainties].

Conclusion: Big Oil's Firm Stance and the Future of OPEC+ Talks

Big Oil's decision to hold firm on production, driven by a complex interplay of economic, geopolitical, and strategic factors, sets the stage for a crucial OPEC+ meeting. The outcome of these talks will significantly impact global oil prices and energy security. The ongoing tension between short-term profits from fossil fuels and the transition to renewable energy sources continues to shape the energy landscape. To stay informed about the developments following this critical OPEC+ meeting and the evolving dynamics surrounding "Big Oil Holds Firm on Production," subscribe to our newsletter or follow reputable financial news sources for updates.

Featured Posts

-

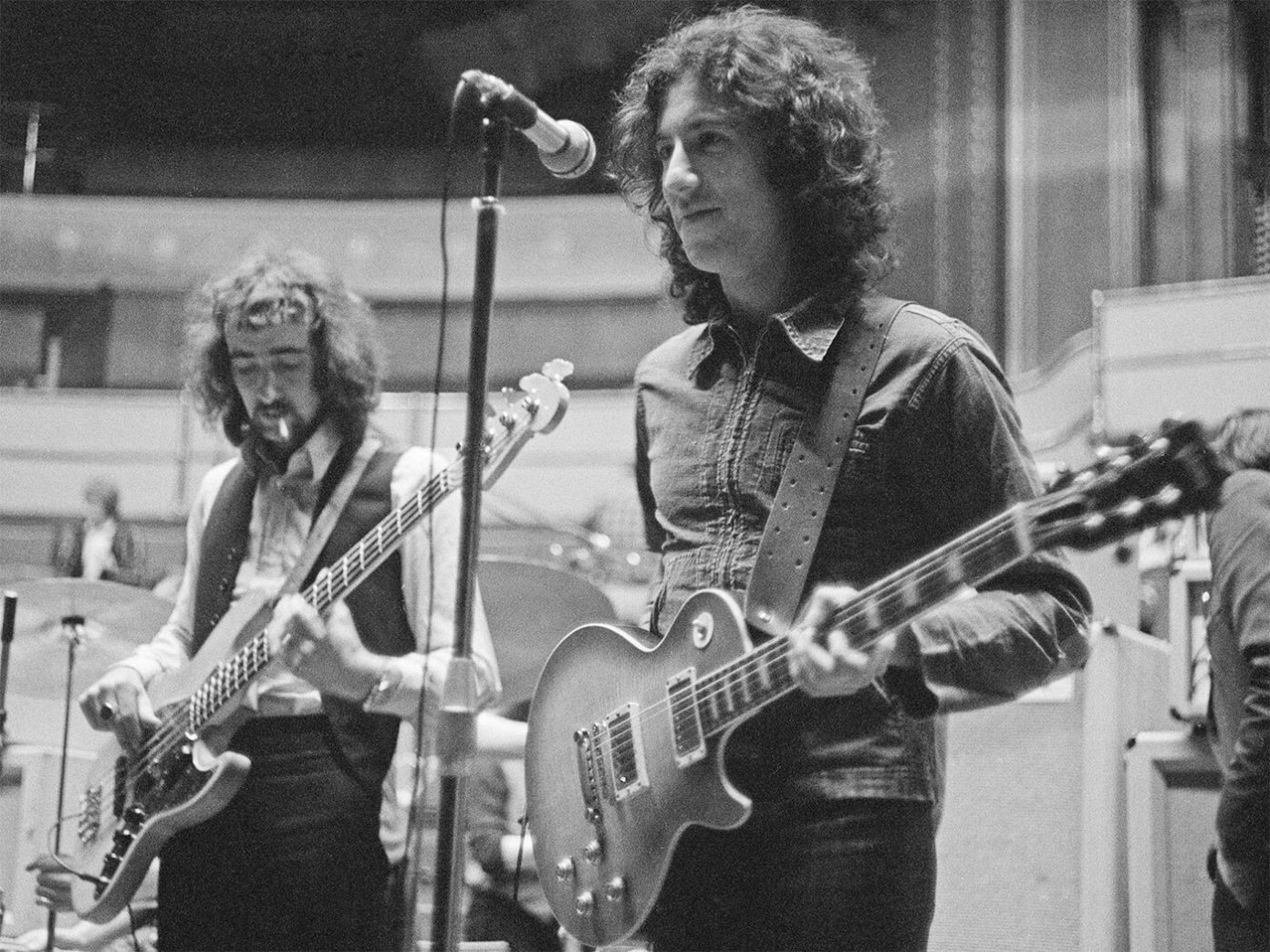

The Day Peter Green Created Fleetwood Mac The Genesis Of 96 1 The Rocket

May 05, 2025

The Day Peter Green Created Fleetwood Mac The Genesis Of 96 1 The Rocket

May 05, 2025 -

Jail Time For Cult Members Gambling With Childrens Lives

May 05, 2025

Jail Time For Cult Members Gambling With Childrens Lives

May 05, 2025 -

Bradley Cooper And Will Arnett Behind The Scenes Photos From Is This Thing On Nyc Filming

May 05, 2025

Bradley Cooper And Will Arnett Behind The Scenes Photos From Is This Thing On Nyc Filming

May 05, 2025 -

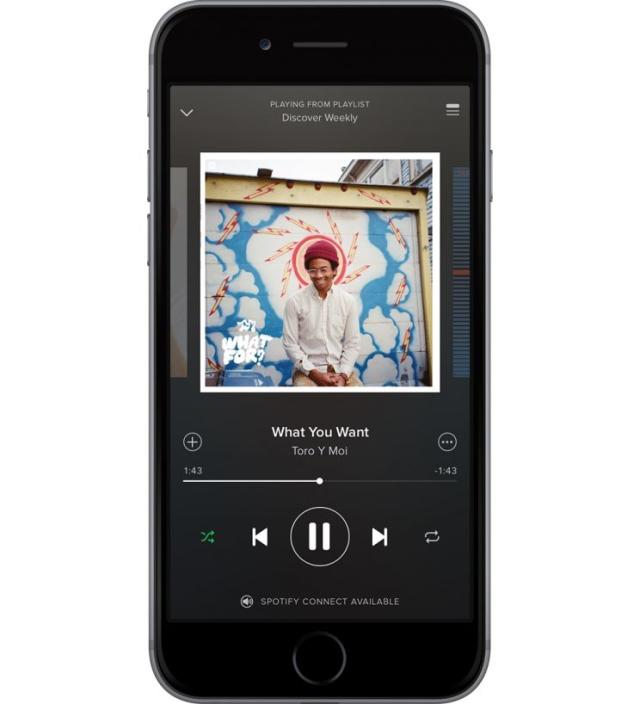

Spotify I Phone App Enhanced Payment System Explained

May 05, 2025

Spotify I Phone App Enhanced Payment System Explained

May 05, 2025 -

Americas Ev Challenge Responding To Chinas Growing Dominance

May 05, 2025

Americas Ev Challenge Responding To Chinas Growing Dominance

May 05, 2025

Latest Posts

-

Kanye Wests Wife Bianca Censoris Latest Public Appearance In Italy

May 05, 2025

Kanye Wests Wife Bianca Censoris Latest Public Appearance In Italy

May 05, 2025 -

Meet Angelina Censori More Than Just Bianca Censoris Sister

May 05, 2025

Meet Angelina Censori More Than Just Bianca Censoris Sister

May 05, 2025 -

Public Scrutiny Of Kanye Wests Relationship With Bianca Censori Power Imbalance Concerns

May 05, 2025

Public Scrutiny Of Kanye Wests Relationship With Bianca Censori Power Imbalance Concerns

May 05, 2025 -

Kanye Wests Controversial Image Of Bianca Censori Promotes New Film

May 05, 2025

Kanye Wests Controversial Image Of Bianca Censori Promotes New Film

May 05, 2025 -

Bianca Censori Spotted Rollerblading In Italy Without Kanye West

May 05, 2025

Bianca Censori Spotted Rollerblading In Italy Without Kanye West

May 05, 2025