Billionaires' Favorite ETF: Predicted 110% Soar In 2025

Table of Contents

Unveiling the Billionaire's ETF:

The ETF generating significant buzz is the Global X Robotics & Artificial Intelligence ETF (BOTZ). BOTZ invests in companies involved in the robotics and artificial intelligence industries, a sector experiencing rapid expansion and technological advancements. This ETF has shown consistent growth since its inception, outperforming many of its competitors in the technology sector. Its current market position reflects strong investor confidence.

- High-Net-Worth Individuals and Institutional Investors: While specific billionaire holdings aren't publicly disclosed for all ETFs, the strong performance and growth potential of the robotics and AI sector have attracted significant investments from high-net-worth individuals and large institutional investors, suggesting confidence in BOTZ's future performance.

- Unique Features and Strategies: BOTZ employs a focused strategy, concentrating on companies directly involved in robotics and AI development and implementation. This targeted approach allows for significant exposure to this high-growth sector. The fund managers actively manage the portfolio, adapting to evolving market dynamics and technological breakthroughs.

- Expense Ratio: BOTZ boasts a competitive expense ratio, making it an attractive option compared to similar ETFs in the technology sector. A lower expense ratio means more of your investment returns are reinvested into the fund, leading to potentially higher growth.

The 110% Prediction: A Realistic Outlook?

The 110% growth prediction for BOTZ by 2025 is based on several factors analyzed by independent market research firms. While not a guaranteed outcome, the projection considers the anticipated explosive growth of the robotics and AI sector. This growth is fueled by several key drivers:

- Technological Advancements: Continuous breakthroughs in AI and robotics are driving innovation across numerous industries, creating enormous market opportunities for companies in the sector.

- Changing Market Trends: Automation, increased efficiency, and the demand for advanced technological solutions are pushing the adoption of robotics and AI across various sectors, boosting the demand for related products and services.

- Regulatory Support: Governments worldwide are increasingly investing in and supporting the development of AI and robotics through research grants, tax incentives, and regulatory frameworks that encourage innovation.

However, it's crucial to acknowledge potential risks:

- Market Volatility: The stock market is inherently volatile, and unforeseen events can negatively impact the performance of any investment, including ETFs.

- Economic Downturn: A global economic recession could significantly dampen investment in growth sectors like robotics and AI, impacting the performance of BOTZ.

- Competition: Increased competition within the robotics and AI sector could impact the profitability and growth of individual companies within the BOTZ portfolio.

Is This ETF Right for Your Investment Portfolio?

The suitability of BOTZ for your portfolio depends heavily on your individual circumstances:

- Risk Tolerance: BOTZ, as an investment in a high-growth sector, carries a higher degree of risk compared to more conservative investments. Investors with a higher risk tolerance and longer time horizons are better suited to this type of investment.

- Investment Goals: If your investment goals align with long-term growth in technology and innovation, BOTZ might be a suitable addition to your portfolio. However, it’s not suitable for short-term gains.

- Time Horizon: This investment is better suited for investors with a long-term investment horizon (5-10 years or more) to allow for potential market fluctuations and to potentially realize the predicted growth.

Comparing BOTZ to Similar ETFs: BOTZ offers a focused approach to robotics and AI, unlike broader technology ETFs. Its targeted strategy offers higher growth potential but also involves higher risk. Investors should compare it to similar ETFs, analyzing their holdings, expense ratios, and historical performance to make an informed decision.

- Diversification: Remember the importance of diversification within your investment portfolio. Don't put all your eggs in one basket. Diversifying across different asset classes reduces overall risk.

- Alternative Investments: For investors seeking less risk, consider diversifying into other asset classes like bonds or real estate.

- Professional Advice: Always seek the guidance of a qualified financial advisor before making any investment decisions.

Understanding ETF Investment Basics:

An ETF (Exchange Traded Fund) is a type of investment fund that trades on stock exchanges like individual stocks. They offer diversification, typically track an index or sector, and are generally less expensive than mutual funds.

- Low Cost: ETFs generally have lower expense ratios than mutual funds.

- Easy Trading: They are easily bought and sold throughout the trading day on stock exchanges.

- Diversification: Investing in an ETF provides instant diversification across a range of companies within a specific sector or market.

Conclusion:

The Global X Robotics & Artificial Intelligence ETF (BOTZ), a favorite among some high-net-worth individuals, presents a compelling investment opportunity with a predicted 110% soar by 2025. However, this prediction involves inherent risks associated with market volatility and the inherent uncertainty of future market performance. While the robotics and AI sector holds immense potential, thorough research and professional financial advice are crucial before investing. Don't miss out on this potentially lucrative opportunity – learn more about the BOTZ ETF and its investment prospects today! Consider carefully whether this ETF fits your personal investment strategy and risk tolerance.

Featured Posts

-

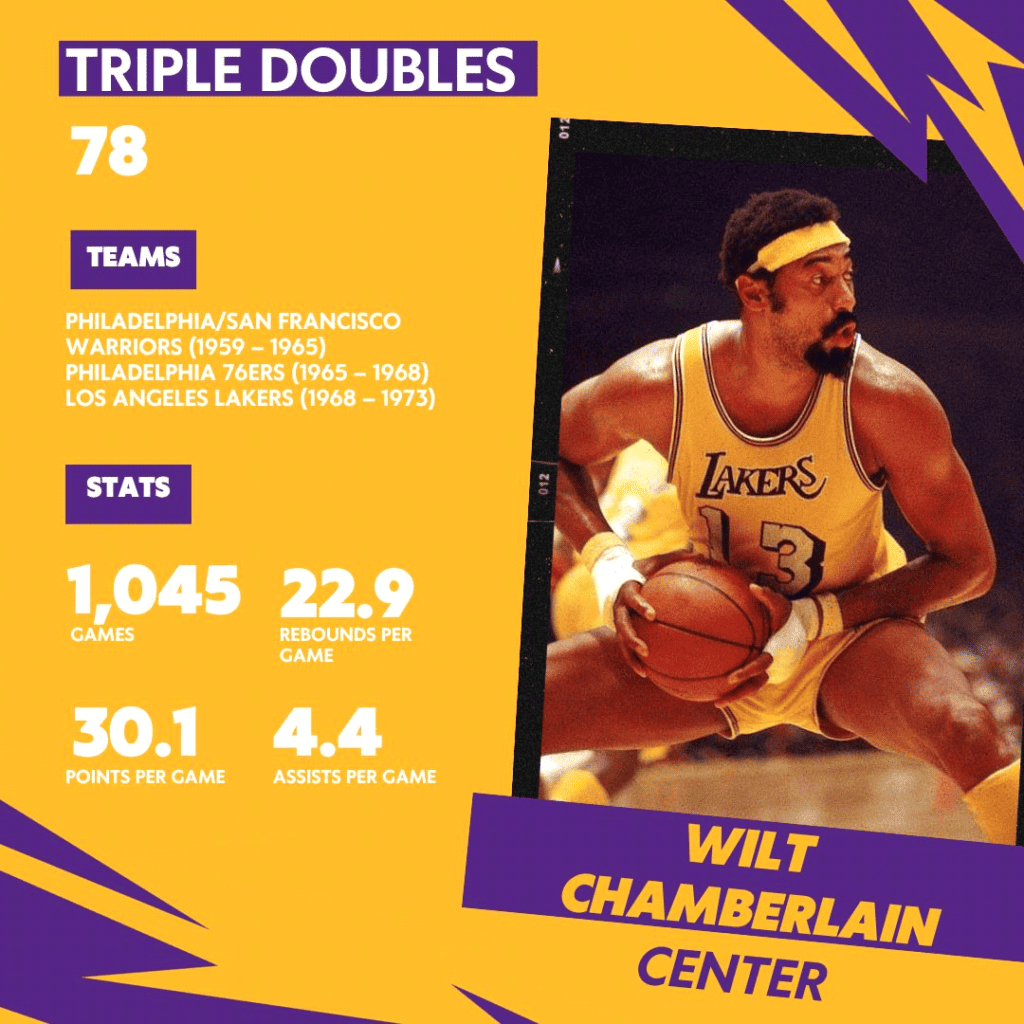

The Nba Playoffs Triple Doubles Quiz Are You A True Fan

May 08, 2025

The Nba Playoffs Triple Doubles Quiz Are You A True Fan

May 08, 2025 -

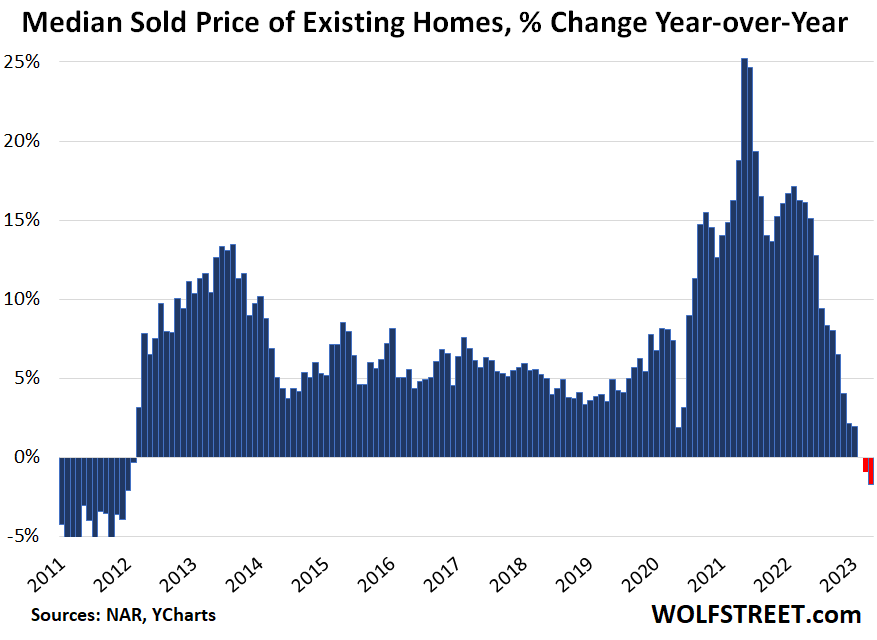

Toronto Home Sales Plunge 23 Drop Year Over Year Prices Down 4

May 08, 2025

Toronto Home Sales Plunge 23 Drop Year Over Year Prices Down 4

May 08, 2025 -

How Well Do You Know Nba Playoffs Triple Doubles Leaders

May 08, 2025

How Well Do You Know Nba Playoffs Triple Doubles Leaders

May 08, 2025 -

Ethereum Forecast High Eth Accumulation Signals Potential Price Increase

May 08, 2025

Ethereum Forecast High Eth Accumulation Signals Potential Price Increase

May 08, 2025 -

Micro Strategy Or Bitcoin Better Investment Prospects In 2025

May 08, 2025

Micro Strategy Or Bitcoin Better Investment Prospects In 2025

May 08, 2025