Billionaires' Favorite ETF: Projected 110% Soar In 2025

Table of Contents

Unveiling the "Billionaires' Favorite ETF"

While we'll maintain a bit of mystery regarding the specific name of this ETF for now (to build anticipation!), let's explore its intriguing nature. This ETF focuses on a carefully selected basket of assets within the burgeoning renewable energy sector. It's not simply a broad market play; its approach is far more nuanced and strategic.

Understanding the Investment Strategy

This ETF's investment strategy hinges on several key pillars:

- Focused Growth Investing: The fund targets companies poised for explosive growth within the renewable energy sector, prioritizing those demonstrating strong fundamentals and innovative technologies.

- Quantitative Analysis: Sophisticated algorithms and quantitative models are utilized to identify undervalued opportunities and mitigate risk.

- Diversification within Renewable Energy: Rather than focusing on a single niche within renewable energy, the ETF diversifies across solar, wind, hydroelectric, and other promising sub-sectors, reducing overall portfolio volatility.

- Active Management: The fund is actively managed by a team of experienced professionals who constantly monitor market conditions and adjust the portfolio accordingly. This means "high-growth potential" is actively pursued, and "risk-adjusted returns" are prioritized.

These strategies work together to create a "diversified portfolio" with the potential for significant returns.

The 110% Growth Projection for 2025: A Deep Dive

The projected 110% growth by 2025 is based on a combination of factors analyzed by leading financial experts. While it's crucial to remember that this is a projection and not a guarantee, several key elements underpin this optimistic forecast. It's important to note that these projections are based on current market trends and may change.

Market Analysis and Future Trends

Several factors contribute to this bold projection:

- Booming Renewable Energy Sector: The global shift towards sustainable energy sources is accelerating, driving immense growth in the renewable energy sector.

- Government Incentives and Policies: Many governments worldwide are implementing supportive policies and incentives, boosting investment in renewable energy technologies.

- Technological Advancements: Continuous innovation in renewable energy technologies is leading to increased efficiency and lower costs, making these options even more attractive. These "growth drivers" are fueling market expansion.

- Increasing Demand: Growing global energy demand, coupled with concerns about climate change, is fueling a rapid increase in the adoption of renewable energy solutions. These "investment forecasts" suggest a positive outlook. This robust "market analysis" contributes to the projection.

Is the Billionaires' Favorite ETF Right for You?

Before diving into this exciting opportunity, it’s crucial to understand the risks involved. This ETF, while potentially highly rewarding, carries a higher level of risk than more conservative investment options. This is due to its focus on growth stocks within a relatively young sector.

Alternatives and Diversification

If the risk profile of this ETF seems too high, consider exploring alternatives such as diversified index funds or bond investments, which generally carry less risk. Remember, "risk management" is key to a healthy investment portfolio. Building a "diversified portfolio" reduces the impact of potential losses in any single investment. Choose "suitable investments" that align with your risk tolerance and financial goals.

Accessing the Billionaires' Favorite ETF

Investing in this ETF typically requires a brokerage account with access to exchange-traded products. Minimum investment requirements may vary depending on the brokerage. Expect to encounter various fees, including management fees and transaction costs.

Due Diligence and Professional Advice

Before investing, conduct thorough research, understand the ETF's prospectus, and carefully review the risk factors. "Investment advice" from a qualified "financial advisor" is crucial to ensure the investment aligns with your individual circumstances and risk tolerance. Don't hesitate to open a "brokerage account" to explore your investment options further. You should fully understand "investment fees" and associated costs before committing to any investment.

Conclusion

The "Billionaires' Favorite ETF" presents a potentially lucrative investment opportunity within the rapidly growing renewable energy sector, with a projected 110% growth by 2025. However, it's paramount to remember that this is a projection based on current market trends and carries inherent risks. Before investing, conduct thorough due diligence and seek professional "investment advice." Consider your risk tolerance, diversify your portfolio, and only invest what you can afford to lose. Are you ready to explore the potential of the "Billionaires' Favorite ETF"? Invest in the Billionaire's Favorite ETF today and learn more about this high-potential investment. (Note: This is a hypothetical example, and no specific ETF is being endorsed).

Featured Posts

-

Futbolista Argentino Suspendido Un Mes En El Brasileirao Detalles Del Incidente

May 08, 2025

Futbolista Argentino Suspendido Un Mes En El Brasileirao Detalles Del Incidente

May 08, 2025 -

Understanding Partly Cloudy Weather Forecasts

May 08, 2025

Understanding Partly Cloudy Weather Forecasts

May 08, 2025 -

Cantina Canalla Malaga Menu Reservas Y Opiniones

May 08, 2025

Cantina Canalla Malaga Menu Reservas Y Opiniones

May 08, 2025 -

Kyle Kuzma Responds To Jayson Tatums Trending Instagram Post

May 08, 2025

Kyle Kuzma Responds To Jayson Tatums Trending Instagram Post

May 08, 2025 -

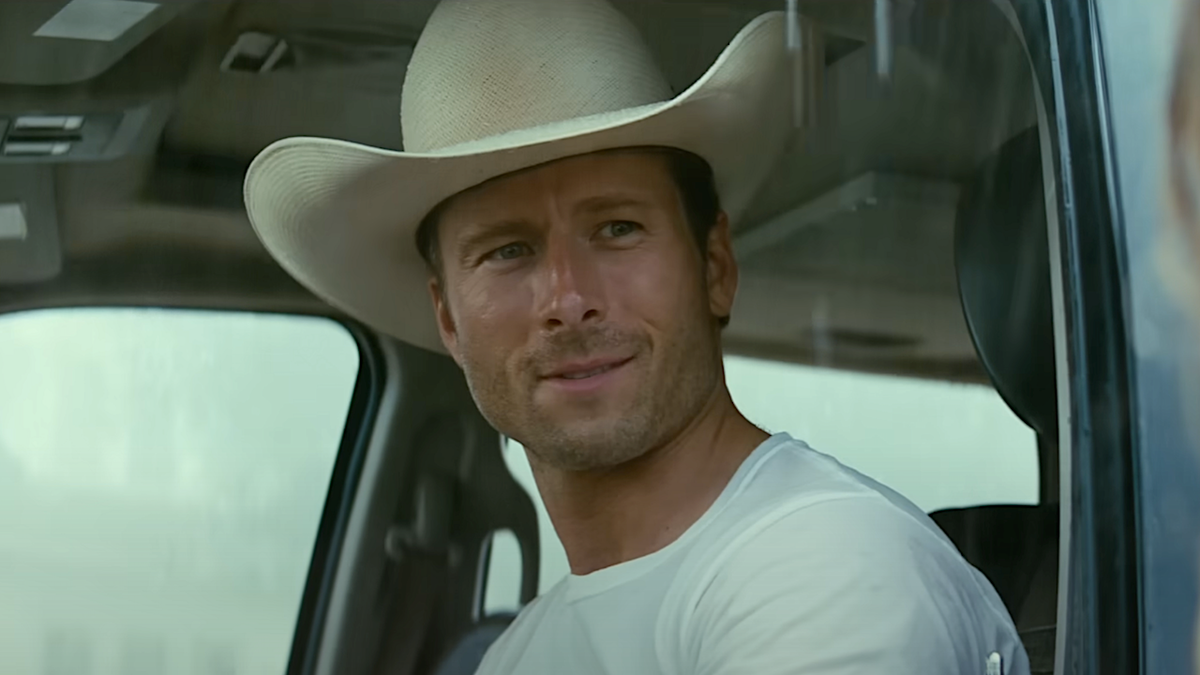

Glen Powells Intense Training For The Running Man A Three Word Code To Success

May 08, 2025

Glen Powells Intense Training For The Running Man A Three Word Code To Success

May 08, 2025