Bitcoin Buying Volume Surges On Binance: First Time In Six Months

Table of Contents

The Surge in Bitcoin Buying Volume on Binance: Data and Analysis

The recent surge in Bitcoin buying volume on Binance is undeniable. Data shows a significant percentage increase in trading volume compared to the previous six months, marking the highest level seen in that timeframe. While precise figures fluctuate and depend on the chosen timeframe and reporting source, preliminary analysis from various reputable sources indicates an increase of at least [Insert Percentage]% compared to the monthly average for the preceding six months. This is based on aggregated data from [mention specific data sources, e.g., CoinMarketCap, CoinGecko, or Binance's own reports]. The surge primarily impacted the BTC/USDT and BTC/BUSD trading pairs, indicating high demand amongst traders using Tether and Binance USD stablecoins.

- Specific Numbers: For example, the daily average trading volume in BTC/USDT might have increased from [previous average] to [new average] within a specific period (e.g., from October 26th to November 2nd).

- Comparison with Previous Months: Illustrative charts comparing monthly Bitcoin buying volume on Binance for the past year would significantly enhance the article's readability and impact.

- Trading Pairs: The focus on BTC/USDT and BTC/BUSD suggests a preference for stablecoin pairings, possibly due to the perceived stability and ease of entry/exit for traders.

Potential Factors Driving the Increased Bitcoin Buying Volume

Several factors could contribute to this significant jump in Bitcoin buying volume on Binance. Understanding these factors requires a multifaceted approach, incorporating macroeconomic analysis, market sentiment evaluation, and technical analysis.

Macroeconomic Factors:

- Inflation and Recession Fears: Growing concerns about global inflation and the potential for a global recession might be driving investors towards Bitcoin as a hedge against traditional financial assets. Bitcoin's decentralized nature and limited supply are considered attractive during times of economic uncertainty.

- Regulatory Changes: Recent regulatory developments concerning cryptocurrencies, either positive or negative, can impact market sentiment and investment decisions. Any significant news regarding regulatory clarity in key jurisdictions could spur increased trading activity.

Market Sentiment:

- Positive News: Positive news related to Bitcoin adoption by large corporations or institutions might influence investor confidence, leading to increased buying pressure.

- Influencer Impact: Statements or actions by prominent figures in the crypto space can impact market sentiment, potentially causing short-term fluctuations in Bitcoin buying volume.

Technical Analysis:

- Chart Patterns: Certain technical chart patterns, like the breaking of a significant resistance level, might trigger buying activity from both short-term and long-term investors.

- Price Movements: A notable price drop followed by a sudden rebound could attract bargain hunters, thereby increasing buying volume.

Specific Events: Any specific announcements or initiatives by Binance itself, such as new trading features or promotional campaigns, could also contribute to the increase.

Implications of the Increased Bitcoin Buying Volume on the Market

This sharp increase in Bitcoin buying volume carries significant short-term and long-term implications for the market.

Short-Term Effects:

- Price Volatility: A sudden surge in buying volume can lead to increased price volatility in the short term.

- Price Increases: The increased demand is likely to exert upward pressure on Bitcoin’s price.

Long-Term Effects:

- Increased Adoption: Sustained high Bitcoin buying volume could signal increased institutional and retail adoption.

- Market Capitalization: An upward trend in Bitcoin buying volume would likely contribute to an increase in Bitcoin's overall market capitalization.

Risks:

- Market Correction: The sharp increase could be followed by a market correction, potentially leading to price declines.

- Manipulation: There’s always a possibility of market manipulation influencing the surge in buying volume.

Alternative Viewpoints: Some analysts might argue that the increase is temporary and driven by short-term speculative trading rather than underlying fundamental changes.

Conclusion: Understanding the Recent Bitcoin Buying Volume Surge on Binance

The recent surge in Bitcoin buying volume on Binance, the first significant increase in six months, is a noteworthy event with multifaceted causes. Several factors, including macroeconomic anxieties, positive market sentiment, and perhaps technical indicators, likely contributed to this increase. While the short-term effects might include increased price volatility and price movements, the long-term implications could significantly influence Bitcoin's adoption and market dominance. It’s crucial, however, to remain aware of the risks involved, including the possibility of market corrections. To stay informed about future trends, consistently monitoring Bitcoin buying volume on major exchanges like Binance is paramount. Stay updated on market developments and continue to research the dynamic world of Bitcoin and cryptocurrencies. [Link to Binance or relevant resource]. The cryptocurrency market remains dynamic and unpredictable, requiring continuous monitoring and careful analysis.

Featured Posts

-

Thunder Pacers Injury Report Key Players Status For March 29th Game

May 08, 2025

Thunder Pacers Injury Report Key Players Status For March 29th Game

May 08, 2025 -

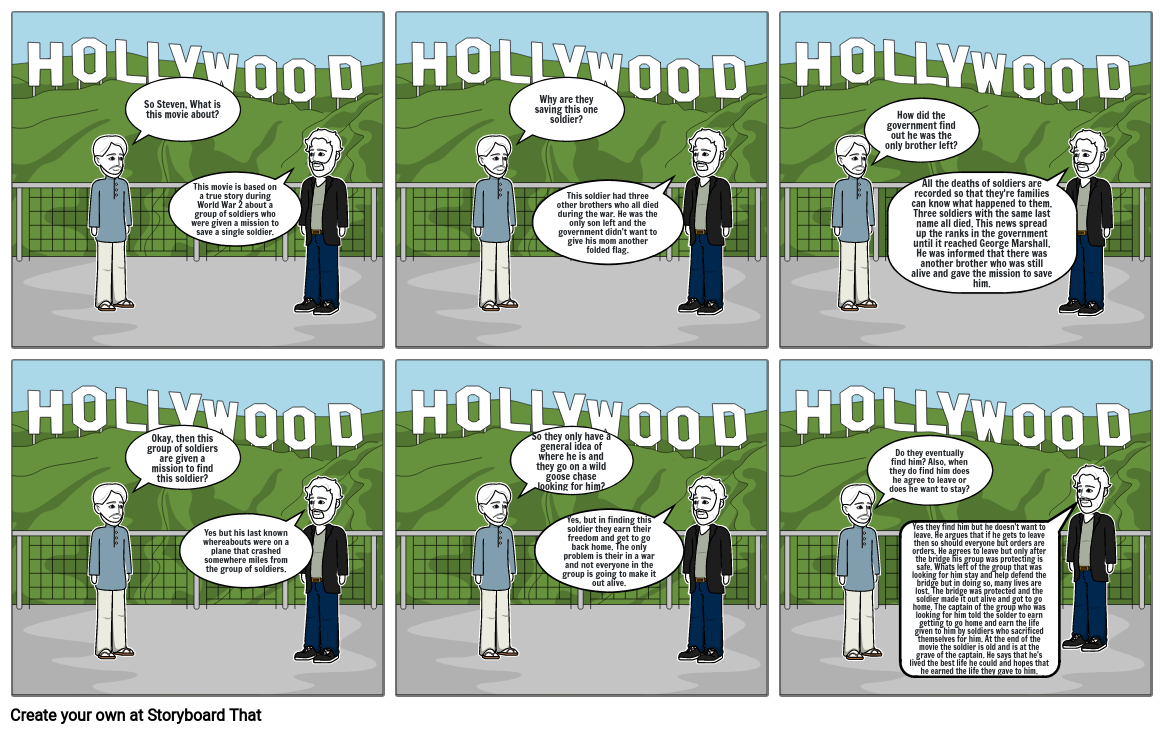

The Impact Of Unscripted Moments On Saving Private Ryans Legacy

May 08, 2025

The Impact Of Unscripted Moments On Saving Private Ryans Legacy

May 08, 2025 -

The Buzz Kuzmas Response To Tatums Viral Instagram Picture

May 08, 2025

The Buzz Kuzmas Response To Tatums Viral Instagram Picture

May 08, 2025 -

How Saturday Night Live Launched Counting Crows To Success

May 08, 2025

How Saturday Night Live Launched Counting Crows To Success

May 08, 2025 -

Is The Recent Bitcoin Price Rebound Sustainable Examining The Factors

May 08, 2025

Is The Recent Bitcoin Price Rebound Sustainable Examining The Factors

May 08, 2025