Bitcoin Chart Analysis: May 6 Signals Suggest Imminent Rally

Table of Contents

Price Action Suggests a Potential Reversal

Recent price lows and the formation of potential support levels are crucial elements in our Bitcoin chart analysis. The price action suggests a possible bullish trend reversal.

-

Specific Price Points and Support Levels: The $28,000 level acted as strong support, preventing a further significant drop. A bounce off this level, coupled with increasing volume, is a positive sign. The ability of Bitcoin to hold above this key psychological level is a significant factor in our analysis.

-

Candlestick Patterns: The formation of a bullish engulfing candle on the daily chart, followed by a hammer candle, suggests a potential reversal in the short-term downtrend. These candlestick patterns are powerful visual signals in Bitcoin price prediction.

-

Relative Strength Index (RSI): The RSI is currently showing signs of moving out of oversold territory, another indicator that a bullish reversal may be underway. An RSI below 30 often signals oversold conditions, increasing the probability of a price rebound.

These factors, when considered together, suggest a bullish trend reversal is possible. However, further confirmation is needed before declaring a strong bullish trend. (Insert chart showing price action and candlestick patterns here)

Increasing Trading Volume Confirms Buyer Interest

The importance of volume in confirming price movements cannot be overstated in our Bitcoin chart analysis. Increasing trading volume during price increases signifies strong buyer interest and confirms the potential for a sustained rally.

-

Volume Comparison: Recent trading volume, particularly around the $28,000 support level, shows a significant increase compared to previous periods of bearish activity. This suggests increased buyer conviction.

-

Volume and Price Relationship: The significant increases in volume accompanying price increases are a bullish sign. High volume during upward price movement validates the potential significance of the price action. This suggests that the price increase is not merely driven by a small number of buyers but is rather sustained by broader market interest.

-

Potential Price Surge: The combination of rising prices and increasing volume strongly suggests the potential for a substantial price surge in the coming days or weeks. This is a crucial aspect of our Bitcoin chart analysis today.

High volume during upward price movement lends credence to the potential for a continued rally. (Insert chart showing volume alongside price action here)

Key Technical Indicators Point Towards a Bullish Outlook

Several technical indicators support the prediction of an imminent rally in our Bitcoin chart analysis.

-

Moving Averages (MA): A potential bullish crossover of the short-term 50-day moving average (MA) and the long-term 200-day MA is imminent. This crossover is often interpreted as a strong bullish signal.

-

Bollinger Bands: The price is currently approaching the lower Bollinger Band, suggesting potential for a bounce back towards the mean. A break above the upper band would be a very strong bullish signal.

-

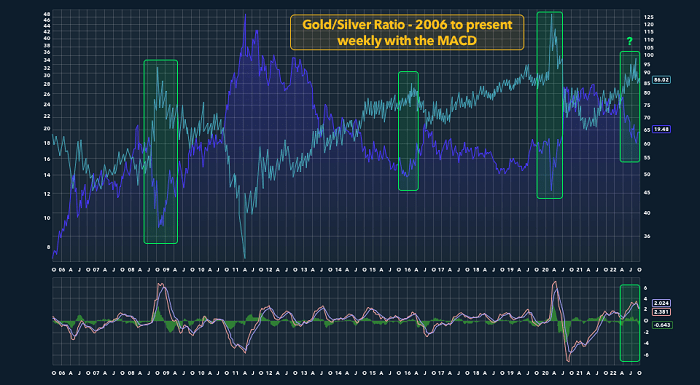

MACD (Moving Average Convergence Divergence): The MACD histogram is showing signs of a potential bullish crossover, indicating increasing bullish momentum. This confirms the potential for upward price movement.

These indicators, in conjunction with the positive price action and increasing volume, significantly strengthen the case for an impending Bitcoin rally. (Insert chart showing moving averages, Bollinger Bands, and MACD here)

Addressing Potential Counterarguments and Risks

While our Bitcoin chart analysis suggests a bullish outlook, it's crucial to acknowledge potential bearish scenarios.

-

Resistance Levels: The $30,000 and $35,000 levels represent significant resistance levels that could hinder a sustained rally. A failure to break through these levels could signal a continuation of the downtrend.

-

Broader Market Factors: Regulatory changes, macroeconomic conditions, and overall market sentiment can significantly impact the Bitcoin price. Unexpected negative news could trigger a price drop.

-

Risk Management: Remember that cryptocurrency investments are inherently risky. Always practice proper risk management and diversify your portfolio. Don't invest more than you can afford to lose.

Conclusion

Our Bitcoin chart analysis, based on May 6th data, reveals a confluence of positive signals: positive price action, increasing trading volume, and supportive technical indicators all point towards a potential imminent rally. However, it's essential to remember that cryptocurrency markets are highly volatile.

Call to Action: While this analysis suggests a potential Bitcoin rally, conduct your own thorough Bitcoin chart analysis before making any investment decisions. Consider these factors and consult additional resources for a comprehensive understanding. Stay informed and continue monitoring the Bitcoin chart for further developments. Remember, responsible Bitcoin chart analysis is key to informed decision-making.

Featured Posts

-

Technology Adoption Ahsans Plan To Strengthen Made In Pakistan Exports

May 08, 2025

Technology Adoption Ahsans Plan To Strengthen Made In Pakistan Exports

May 08, 2025 -

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results Here

May 08, 2025

Find The Latest Lotto Lotto Plus 1 And Lotto Plus 2 Results Here

May 08, 2025 -

Taca Guanabara El Impresionante Golazo De Arrascaeta En La Victoria De Flamengo

May 08, 2025

Taca Guanabara El Impresionante Golazo De Arrascaeta En La Victoria De Flamengo

May 08, 2025 -

Rogues Leadership A Necessary Evolution For The X Men

May 08, 2025

Rogues Leadership A Necessary Evolution For The X Men

May 08, 2025 -

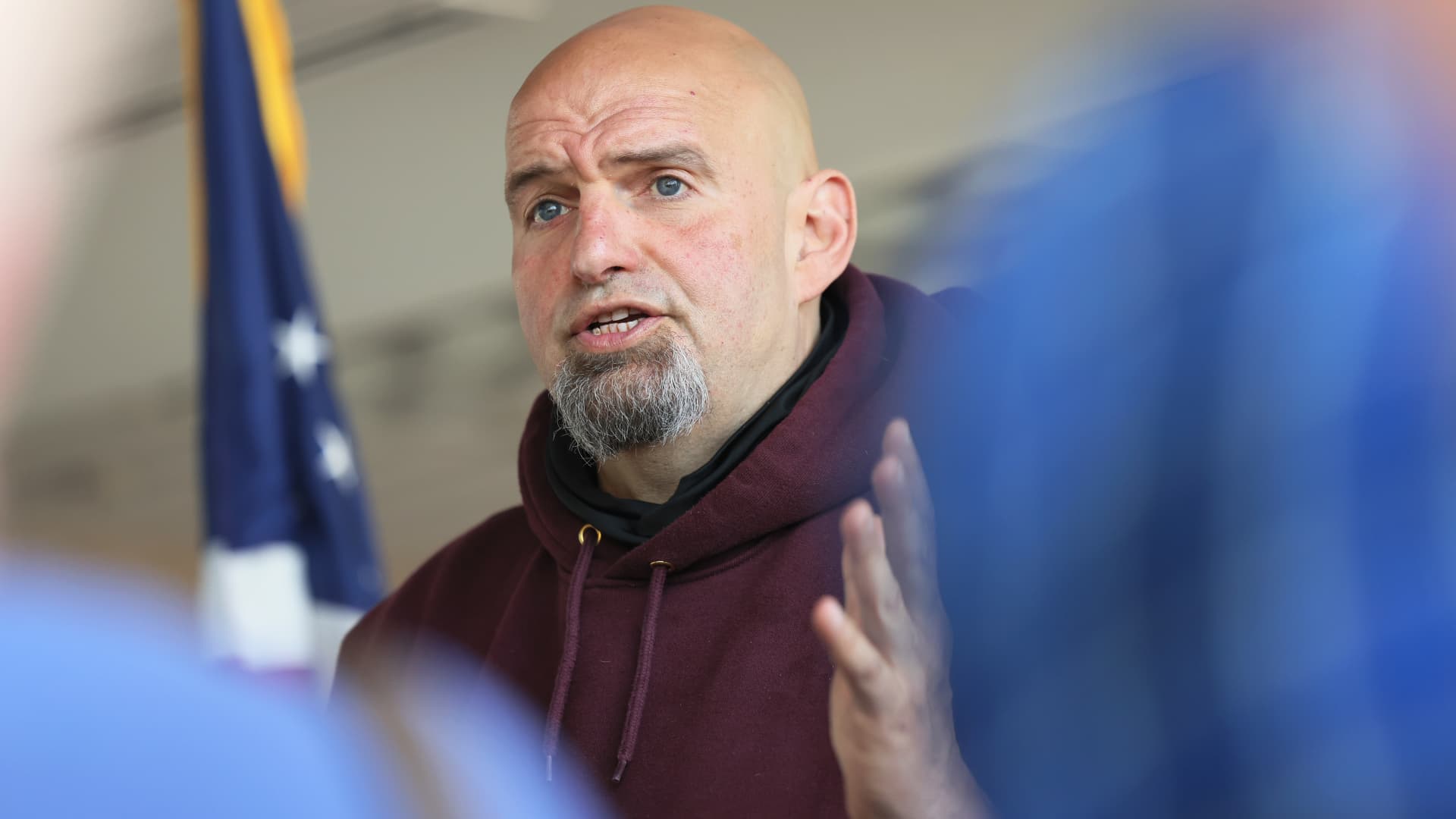

Fetterman Defends Fitness For Senate Rejects Calls To Step Down

May 08, 2025

Fetterman Defends Fitness For Senate Rejects Calls To Step Down

May 08, 2025