Bitcoin Investment: A 1,500% Return In Five Years – Possible?

Table of Contents

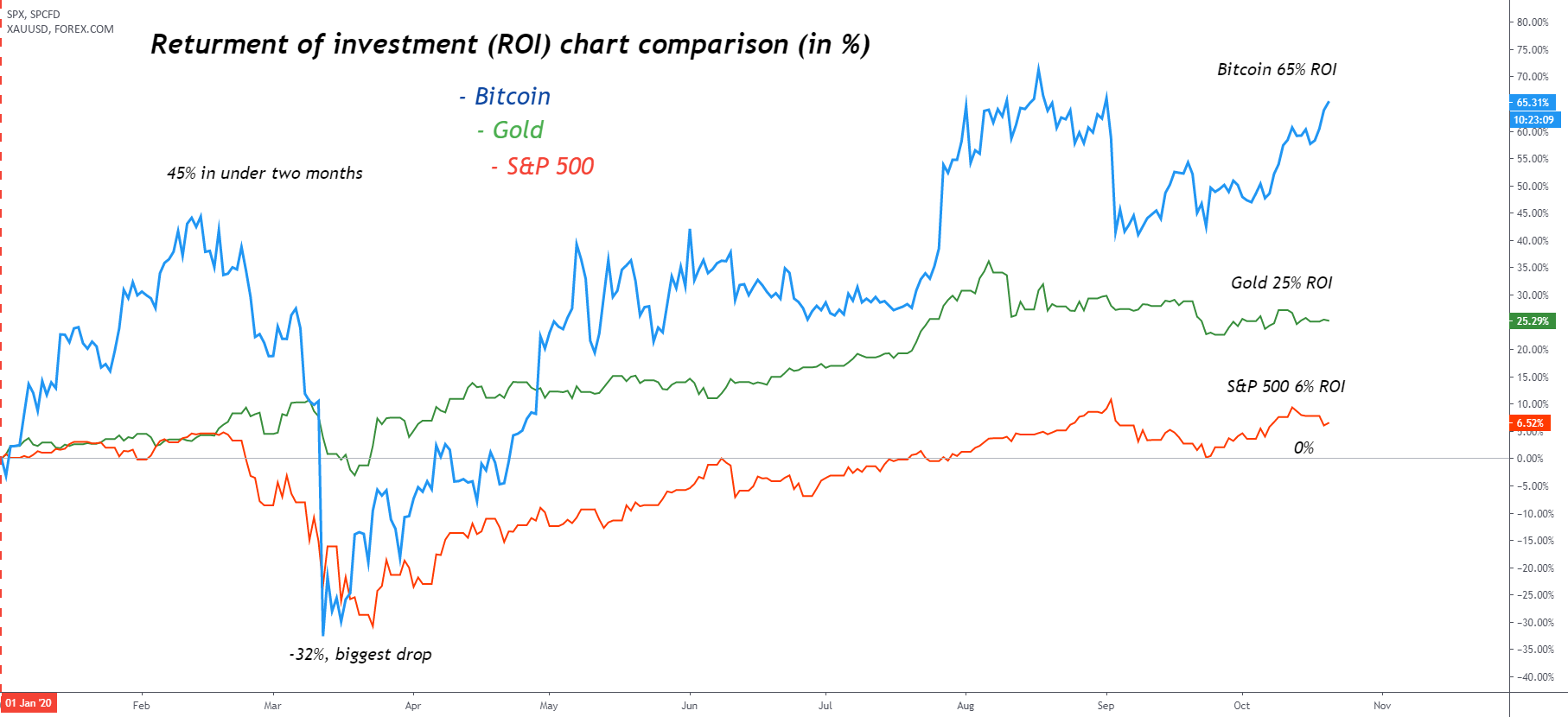

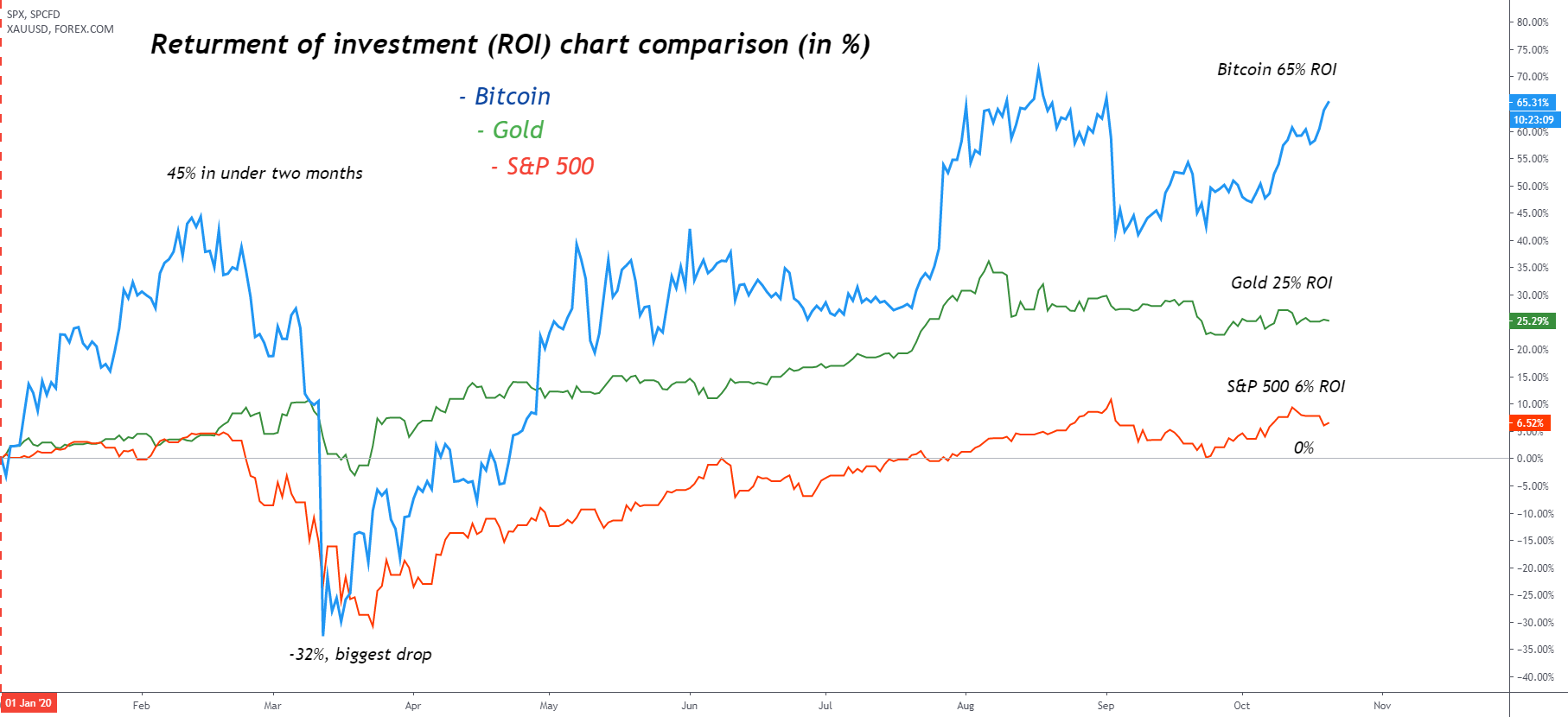

Bitcoin's Historical Volatility and Growth Potential

Past Performance is Not Indicative of Future Results

Bitcoin's price history is a rollercoaster. While past performance can be informative, it's crucial to remember that it's not a predictor of future results. Investing in Bitcoin carries significant risk. The cryptocurrency market is inherently volatile, and dramatic price swings are common.

- 2017: Bitcoin soared to nearly $20,000 before a significant correction.

- 2018-2019: A prolonged bear market saw prices plummet to below $4,000.

- 2020-2021: A resurgence propelled Bitcoin to record highs above $60,000.

- 2022-Present: Another significant downturn has shown the volatility of Bitcoin's price.

Regulatory uncertainty further contributes to this volatility. Changes in government regulations globally can dramatically impact Bitcoin's price and overall market sentiment.

Understanding Bitcoin's Underlying Technology and Market Forces

Bitcoin's value is underpinned by its underlying technology, the blockchain. This decentralized, secure ledger system underpins Bitcoin's scarcity and perceived value. However, market forces significantly influence its price.

- Supply and Demand: Bitcoin's limited supply (21 million coins) creates scarcity, potentially driving up demand and price.

- Institutional Adoption: Increasing adoption by large financial institutions and corporations lends credibility and drives demand.

- Technological Advancements: Improvements in blockchain technology and related infrastructure can boost Bitcoin's appeal and value.

- Macroeconomic Conditions: Global economic events and trends, such as inflation and geopolitical instability, can significantly influence investor sentiment towards Bitcoin and other cryptocurrencies.

Calculating the Probability of a 1500% Bitcoin Return in Five Years

The Power of Compounding and Exponential Growth

While a 1500% return in five years seems improbable, the power of compounding should not be underestimated. Small, consistent annual gains can accumulate significantly over time. Conversely, consistent negative returns can lead to substantial losses.

- Example 1 (High Growth): A consistent annual return of 47.58% would yield roughly a 1500% increase over five years. This is an extremely optimistic scenario.

- Example 2 (Moderate Growth): A more realistic scenario of a 20% annual return would only lead to a total return of approximately 248%.

- Example 3 (Negative Growth): A 20% annual loss over five years would result in a significantly reduced investment value.

Calculating the compound annual growth rate (CAGR) can help you model various growth scenarios, but remember that past performance is not indicative of future results.

Assessing Risk Factors and Potential Downsides

Investing in Bitcoin, or any cryptocurrency, involves substantial risk. Unexpected events can dramatically impact its price.

- Market Crashes: Significant price drops can wipe out a substantial portion of your investment.

- Hacks and Security Breaches: Exchanges and wallets are vulnerable to hacking, leading to potential losses.

- Scams and Fraud: The cryptocurrency market is susceptible to scams and fraudulent activities.

- Regulatory Changes: Changes in government regulations can negatively affect Bitcoin's price and trading.

- Volatility: The inherent volatility of Bitcoin prices poses a significant risk for investors.

Diversification is essential to manage this risk. Don't invest more than you can afford to lose.

Strategies for Mitigating Risk and Maximizing Potential Returns

Diversification and Risk Management

Don't put all your eggs in one basket. Diversify your investment portfolio across various asset classes, including traditional investments and other cryptocurrencies (with caution).

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price fluctuations, can help mitigate risk.

- Stop-Loss Orders: Setting stop-loss orders to automatically sell your Bitcoin if the price falls below a certain threshold can limit potential losses.

Conducting Thorough Research and Due Diligence

Before investing in Bitcoin, educate yourself. Understanding the technology, market dynamics, and associated risks is crucial.

- Reputable Sources: Consult reputable news outlets, financial analysts, and educational resources.

- Avoid Misinformation: Be wary of misleading information and get-rich-quick schemes.

- Seek Professional Advice: Consider consulting a qualified financial advisor before making any investment decisions.

Alternative Investment Strategies in the Cryptocurrency Market

Exploring other cryptocurrencies with high growth potential

While Bitcoin is the largest and most established cryptocurrency, alternative cryptocurrencies (altcoins) may offer higher growth potential – but with even higher risk.

- Examples: Ethereum, Solana, Cardano, etc. (Note: Investing in altcoins is extremely risky due to their high volatility and often lack of regulation.)

Considering Bitcoin ETFs and other regulated investment products

Bitcoin exchange-traded funds (ETFs) and other regulated investment products offer a less risky way to gain Bitcoin exposure.

- Pros: Regulation, diversification, ease of access.

- Cons: Potentially lower returns compared to direct Bitcoin ownership, higher fees.

Conclusion

While a 1,500% Bitcoin ROI in five years is theoretically possible, it's highly improbable. The potential for significant returns exists, but so does the substantial risk. Before making any Bitcoin investment, conduct thorough research, understand the inherent volatility and various risks involved, and consider diversifying your portfolio. Remember that responsible Bitcoin investment involves careful planning and effective risk management. Learn more about responsible Bitcoin investment strategies today!

Featured Posts

-

Ethereums Bullish Run Analyzing The Price Increase And Market Outlook

May 08, 2025

Ethereums Bullish Run Analyzing The Price Increase And Market Outlook

May 08, 2025 -

La Angels Win Against Dodgers Both Teams Face Shortstop Shortages

May 08, 2025

La Angels Win Against Dodgers Both Teams Face Shortstop Shortages

May 08, 2025 -

Xrp Etfs Potential For 800 Million In Week 1 Inflows Upon Approval

May 08, 2025

Xrp Etfs Potential For 800 Million In Week 1 Inflows Upon Approval

May 08, 2025 -

The Long Walk Movie Adaptation Release Date Announced At Cinema Con

May 08, 2025

The Long Walk Movie Adaptation Release Date Announced At Cinema Con

May 08, 2025 -

Lotto Draw Results Saturday April 12th Jackpot Numbers

May 08, 2025

Lotto Draw Results Saturday April 12th Jackpot Numbers

May 08, 2025