Bitcoin Or MicroStrategy Stock: A Smart Investment Strategy For 2025

Table of Contents

Understanding Bitcoin's Potential in 2025

Bitcoin's Price Volatility and Long-Term Growth Potential

Bitcoin's price has historically been incredibly volatile. However, its proponents point to its long-term growth potential, driven by several factors:

- Increased Adoption Rate: As more individuals and institutions adopt Bitcoin as a store of value or a medium of exchange, demand could increase, pushing the price higher.

- Regulatory Clarity (or Lack Thereof): While regulatory uncertainty remains a risk, increased clarity in certain jurisdictions could boost confidence and investment.

- Technological Advancements: The ongoing development of the Bitcoin network, including the Lightning Network for faster transactions, could enhance its utility and appeal.

- Bitcoin Halving Events: The Bitcoin halving, which reduces the rate of new Bitcoin creation, has historically been followed by periods of price appreciation. The next halving is expected to further influence the Bitcoin price prediction for 2025.

These factors contribute to the ongoing debate surrounding long-term Bitcoin investment, and its potential as a hedge against inflation. However, understanding the associated risks is crucial.

Risks Associated with Direct Bitcoin Investment

Investing directly in Bitcoin carries significant risks:

- Regulatory Uncertainty: Governments worldwide are still grappling with how to regulate cryptocurrencies. Changes in regulation could negatively impact Bitcoin's price.

- Security Risks: The security of cryptocurrency exchanges and the potential for private key loss pose considerable risks. Exchange hacks and scams remain a threat.

- Market Manipulation: The relatively small market capitalization of Bitcoin compared to traditional assets makes it potentially susceptible to market manipulation.

- Volatility: The inherent volatility of Bitcoin means significant price swings are possible, leading to substantial potential losses. This cryptocurrency volatility can be difficult to predict.

Analyzing MicroStrategy's Bitcoin Strategy and Stock Performance

MicroStrategy's Business Model and Bitcoin Holdings

MicroStrategy, a leading provider of business intelligence software, has made a significant strategic decision to accumulate a substantial amount of Bitcoin. Their rationale is often cited as a hedge against inflation and a long-term investment. Understanding MicroStrategy's business model – and its financial health – is crucial before considering investment in its stock.

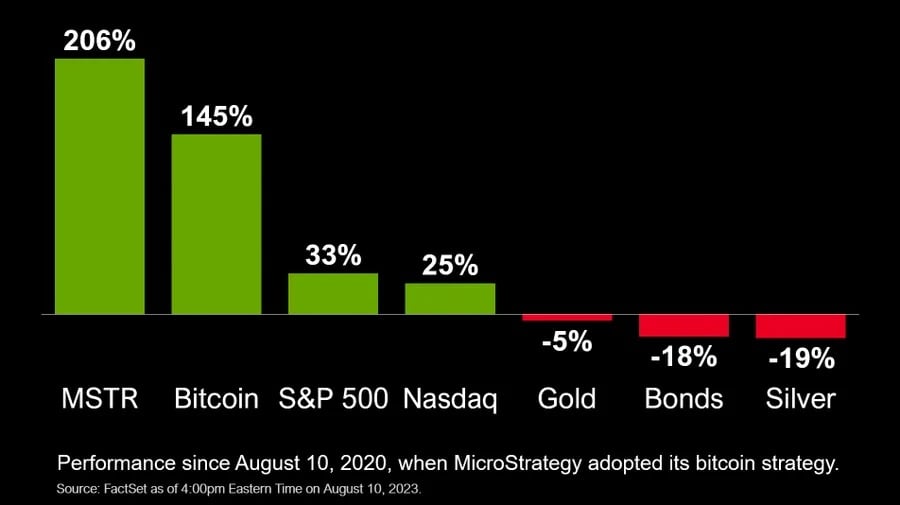

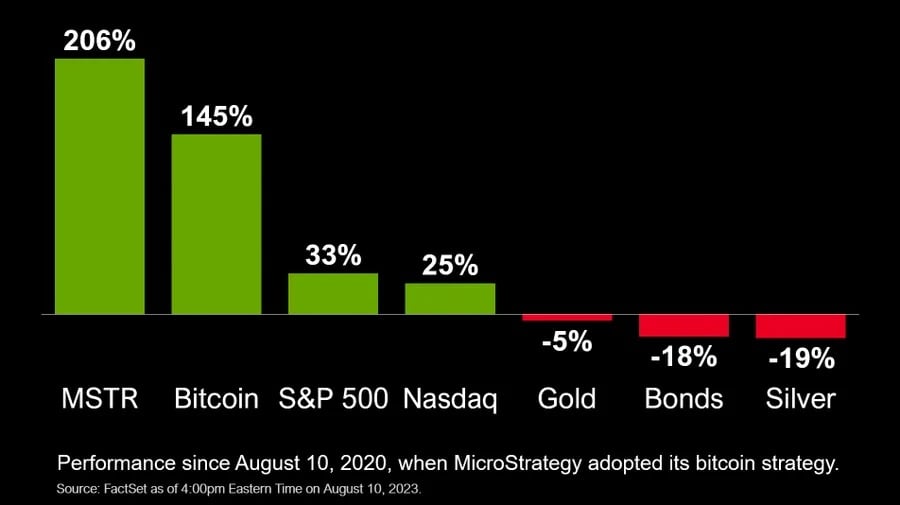

- Significant Bitcoin Holdings: MicroStrategy's massive Bitcoin holdings represent a significant portion of its assets, making its stock price highly correlated with Bitcoin's price.

- Business Intelligence Software: MicroStrategy's core business is providing analytics and business intelligence software, offering a degree of diversification.

- Financial Health: Investors should carefully review MicroStrategy's financial reports and assess its overall financial stability and profitability.

Assessing the Risks and Rewards of Investing in MicroStrategy Stock

Investing in MicroStrategy stock offers exposure to Bitcoin without the complexities of direct cryptocurrency ownership, but it also carries risks:

- Dependence on Bitcoin Price: A significant drop in Bitcoin's price could severely impact MicroStrategy's stock valuation.

- Competition in the Business Intelligence Market: MicroStrategy faces competition from other established players in the business intelligence software market.

- Potential Rewards: The potential for growth in both MicroStrategy's core business and its Bitcoin holdings could offer significant returns to investors. However, this is linked to both the Bitcoin price prediction and MicroStrategy’s business performance.

Comparing Bitcoin and MicroStrategy Stock: A Comparative Analysis for 2025

Risk Tolerance and Investment Goals

The choice between direct Bitcoin investment and MicroStrategy stock depends heavily on your risk tolerance and investment goals:

- High-Risk, High-Reward: Direct Bitcoin investment offers potentially higher returns but involves substantially higher risk.

- Moderate Risk, Moderate Reward: MicroStrategy stock offers a less volatile, but still risky, pathway to Bitcoin exposure. This approach may be better suited for investors with moderate risk tolerance.

- Investment Time Horizon: Long-term investors might be better positioned to weather the volatility of direct Bitcoin investment.

Diversification and Portfolio Management

Both Bitcoin and MicroStrategy stock should be considered within the context of a well-diversified investment portfolio.

- Diversification: Neither should represent a significant portion of your total investments.

- Asset Allocation: Careful asset allocation is key to managing risk and optimizing returns. This requires a detailed review of your investment portfolio.

- Risk Management: Thorough risk assessment should be a cornerstone of any investment strategy.

Conclusion: Making a Smart Investment Decision in 2025

Choosing between Bitcoin or MicroStrategy stock for 2025 requires a careful evaluation of your risk tolerance, investment goals, and understanding of both the cryptocurrency market and MicroStrategy's business model. Direct Bitcoin investment offers the potential for higher rewards but carries significant risks, while MicroStrategy stock provides a less volatile path to Bitcoin exposure but still depends on Bitcoin's performance. Remember to conduct thorough research and consider seeking advice from a qualified financial advisor before making any investment decisions. Further reading on Bitcoin investment strategies and MicroStrategy's financial reports is highly recommended before considering investments in Bitcoin or MicroStrategy stock for 2025.

Featured Posts

-

1 Mdb Exclusive Details On Malaysias Pursuit Of Former Goldman Sachs Partner

May 08, 2025

1 Mdb Exclusive Details On Malaysias Pursuit Of Former Goldman Sachs Partner

May 08, 2025 -

Update On Jayson Tatums Wrist Boston Celtics Coaching Staff Report

May 08, 2025

Update On Jayson Tatums Wrist Boston Celtics Coaching Staff Report

May 08, 2025 -

Bitcoin Conference Seoul 2025 A Global Industry Gathering

May 08, 2025

Bitcoin Conference Seoul 2025 A Global Industry Gathering

May 08, 2025 -

Canadian Dollars Strength A Call For Urgent Economic Strategy

May 08, 2025

Canadian Dollars Strength A Call For Urgent Economic Strategy

May 08, 2025 -

High Stock Market Valuations Bof As Rationale For Investor Calm

May 08, 2025

High Stock Market Valuations Bof As Rationale For Investor Calm

May 08, 2025