Bitcoin Price Analysis: Rally Potential Identified (May 6 Chart)

Table of Contents

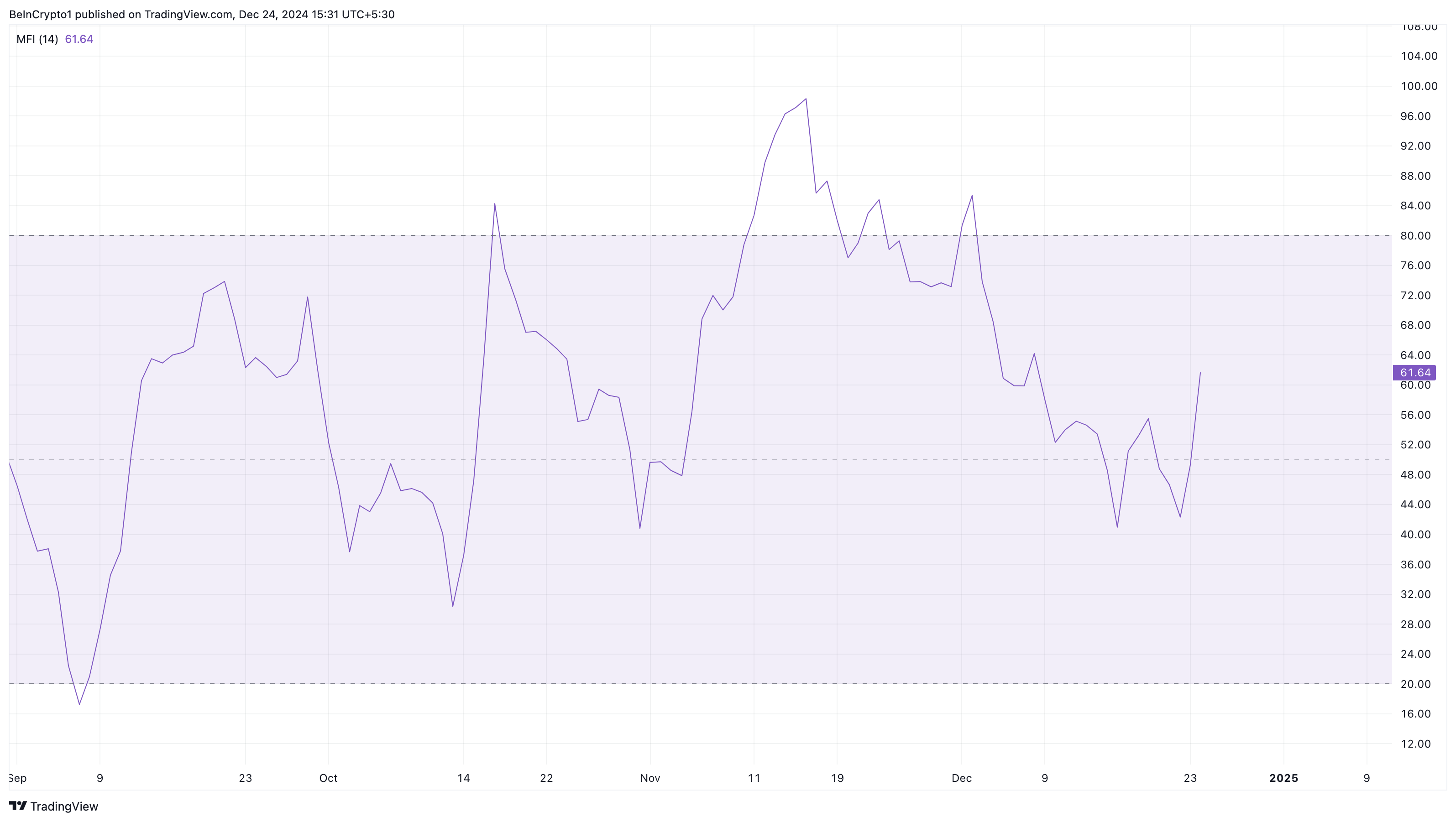

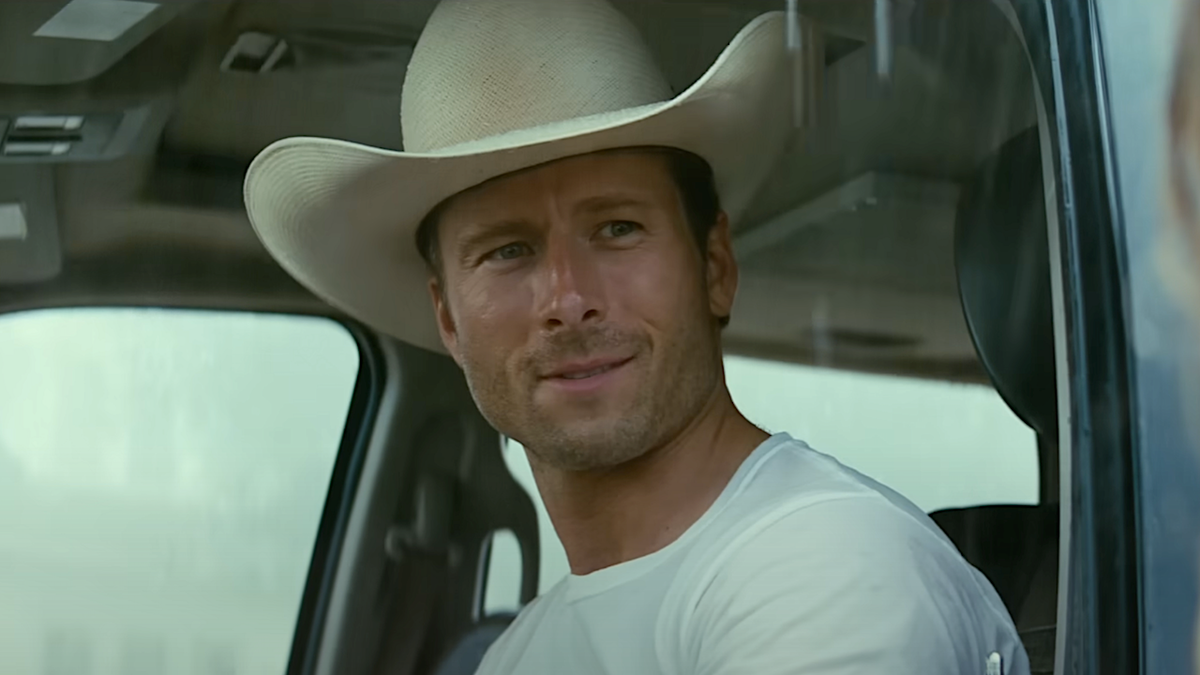

Technical Analysis of the May 6th Bitcoin Chart

The May 6th Bitcoin chart offers valuable insights into the potential for a rally. By examining key technical indicators and chart patterns, we can identify potential support and resistance levels, analyze trading volume, and assess the likelihood of a trendline breakout.

Identifying Key Support and Resistance Levels

The May 6th chart reveals several significant support and resistance levels crucial for Bitcoin price prediction.

-

Support Levels: A strong support level was observed around $27,000, coinciding with a previous price floor. A break below this level could signal further downward pressure. Another notable support level was at approximately $26,000. The strength of these support levels is further validated by the volume traded at these price points (see Volume Analysis below). Keywords: Bitcoin support levels, Bitcoin price floor

-

Resistance Levels: The immediate resistance level on May 6th was around $29,000. A decisive break above this level could trigger a significant rally. Subsequent resistance levels could be found around $30,000 and $32,000, representing psychological barriers and previous price highs. Keywords: Bitcoin resistance levels, Bitcoin price ceiling

-

Technical Indicators: The Relative Strength Index (RSI) showed a slight bullish divergence, suggesting a potential price reversal. The Moving Average Convergence Divergence (MACD) was approaching a bullish crossover, further supporting the possibility of a price increase. Keywords: technical indicators, Bitcoin chart analysis, RSI, MACD

(Insert chart/graph illustrating support and resistance levels here)

Volume Analysis and its Implications

Analyzing Bitcoin trading volume on the May 6th chart provides crucial context for the price movements observed. High volume accompanying price increases confirms the strength of the rally.

-

Price-Volume Correlation: High volume during upward price movements on May 6th indicated strong buying pressure, suggesting a sustained rally could be underway. Conversely, low volume during upward moves might suggest a weak rally, prone to reversals. Keywords: Bitcoin trading volume, volume analysis, price-volume correlation

-

Volume Confirmation: The increased volume around the $27,000 support level suggests strong buyer conviction at this price point. This reinforces the significance of this support level for Bitcoin price prediction. Keywords: Bitcoin trading volume, volume confirmation

Trendline Analysis and Breakout Potential

Identifying trendlines helps predict future price movements. A breakout from a significant trendline can signal a significant price change.

-

Ascending Trendline: The May 6th chart shows the potential for a breakout above an ascending trendline, suggesting a bullish trend. Keywords: Bitcoin trendlines, trendline breakout

-

Price Targets: A successful breakout above the ascending trendline could push Bitcoin's price towards the previously mentioned resistance levels, potentially reaching $30,000 or even higher, depending on the strength of the breakout and overall market sentiment. Keywords: Bitcoin price targets, Bitcoin price prediction

Fundamental Factors Influencing Bitcoin's Price

Beyond technical analysis, fundamental factors significantly impact Bitcoin's price. Understanding these factors is crucial for a comprehensive Bitcoin price prediction.

Macroeconomic Factors

Global economic conditions strongly influence Bitcoin's price.

-

Inflation and Interest Rates: High inflation and rising interest rates often drive investors towards alternative assets like Bitcoin, potentially fueling a rally. Keywords: Bitcoin and inflation, Bitcoin and interest rates

-

Geopolitical Events: Geopolitical uncertainty can increase the demand for Bitcoin as a safe haven asset, leading to price appreciation. Keywords: Bitcoin and geopolitical risk

Adoption and Regulatory Developments

Increasing adoption and clearer regulations influence Bitcoin's price.

-

Institutional Investment: Growing institutional adoption of Bitcoin strengthens its position as a legitimate asset class, potentially driving demand. Keywords: Bitcoin adoption, institutional Bitcoin investment

-

Regulatory Clarity: Favorable regulatory developments can reduce uncertainty and attract more investors, boosting Bitcoin's price. Keywords: Bitcoin regulation

Bitcoin Network Activity and Development

On-chain metrics and network developments also contribute to Bitcoin's price.

-

On-Chain Metrics: High transaction volume and increasing mining difficulty can be positive indicators for Bitcoin's price. Keywords: Bitcoin on-chain analysis, Bitcoin mining

-

Network Upgrades: Successful network upgrades enhance Bitcoin's scalability and security, fostering confidence and potentially attracting more investors. Keywords: Bitcoin network upgrades

Conclusion: Bitcoin Price Analysis: Concluding Thoughts and Future Outlook

Our Bitcoin price analysis of the May 6th chart suggests a potential rally, driven by both technical and fundamental factors. Key support levels, positive technical indicators, and increasing volume around significant support points paint a bullish picture. Furthermore, favorable macroeconomic conditions, growing institutional adoption, and ongoing Bitcoin network development could further fuel price increases. However, it's crucial to remember that the cryptocurrency market is inherently volatile. This analysis doesn't guarantee future price movements.

Disclaimer: Investing in cryptocurrencies like Bitcoin involves significant risk. The information provided here is for educational purposes only and shouldn't be considered financial advice. Always conduct thorough research and consult with a financial advisor before making any investment decisions.

Call to action: Stay informed about the latest Bitcoin price analysis and continue to monitor the market for further insights into the potential for a Bitcoin rally. Conduct thorough research before making any investment decisions. Understand the risks involved in Bitcoin investment and make informed decisions.

Featured Posts

-

Jayson Tatum Faces Renewed Criticism From Colin Cowherd

May 08, 2025

Jayson Tatum Faces Renewed Criticism From Colin Cowherd

May 08, 2025 -

Daily Lotto Winning Numbers For Wednesday 16th April 2025

May 08, 2025

Daily Lotto Winning Numbers For Wednesday 16th April 2025

May 08, 2025 -

Stephen Kings The Long Walk From Book To Big Screen

May 08, 2025

Stephen Kings The Long Walk From Book To Big Screen

May 08, 2025 -

Kyle Kuzma Responds To Jayson Tatums Trending Instagram Post

May 08, 2025

Kyle Kuzma Responds To Jayson Tatums Trending Instagram Post

May 08, 2025 -

Glen Powells Intense Training For The Running Man A Three Word Code To Success

May 08, 2025

Glen Powells Intense Training For The Running Man A Three Word Code To Success

May 08, 2025