Bitcoin Price Forecast: Rally Zone Entry Confirmed (May 6 Chart Data)

Table of Contents

Analyzing the May 6th Bitcoin Chart Data

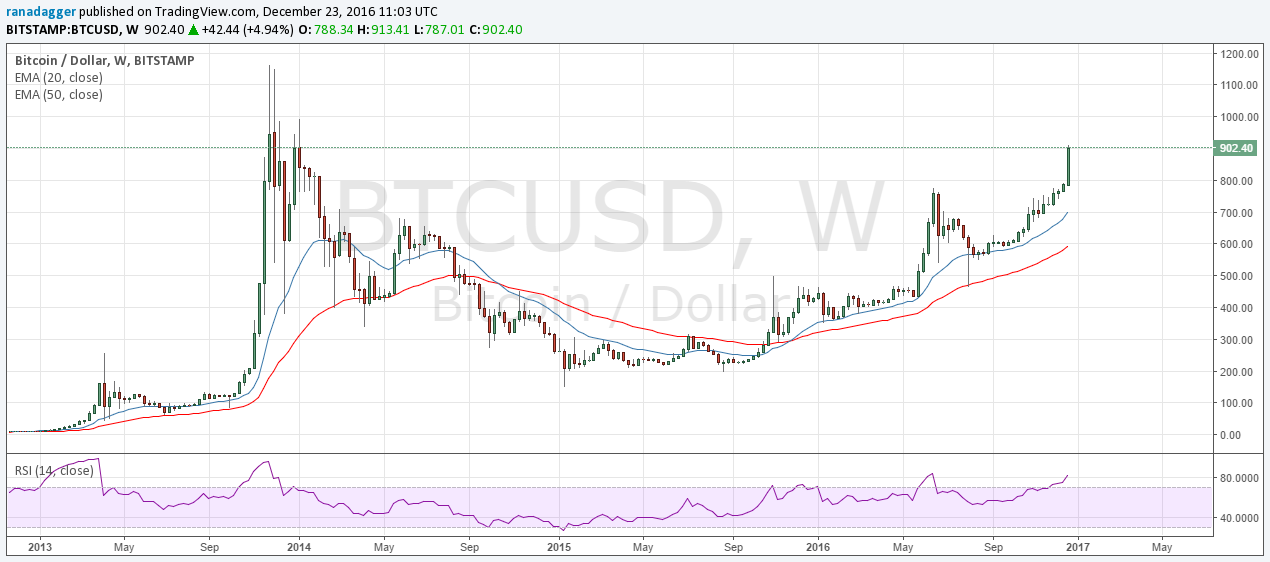

To understand the potential for a Bitcoin rally, we meticulously examined the May 6th chart data. Several key technical indicators, support and resistance levels, and volume analysis all point towards a possible bullish trend.

Key Technical Indicators

The May 6th Bitcoin chart revealed several positive signals from key technical indicators. Let's delve into the details:

- Relative Strength Index (RSI): The RSI showed a reading above 50, suggesting bullish momentum. A reading above 70 usually indicates overbought conditions, but in this instance, it was comfortably within the bullish territory.

- Moving Average Convergence Divergence (MACD): The MACD histogram showed a clear bullish crossover, further supporting the potential for a price increase. This crossover is a significant indicator often used in Bitcoin price prediction models.

- Moving Averages (MAs): The 50-day and 200-day moving averages were converging, a sign frequently associated with a potential upward trend reversal. The price broke above the 50-day MA, strengthening the bullish signal.

[Insert May 6th Bitcoin chart here, clearly labeled with RSI, MACD, and MAs indicated.]

Support and Resistance Levels

Identifying support and resistance levels is paramount in any Bitcoin price forecast. On May 6th:

- Support: A strong support level was observed around [Insert price level]. The price bounced off this level, demonstrating its significance.

- Resistance: The resistance level at [Insert price level] presented a challenge, but a decisive break above this level would confirm the rally zone entry. The price action showed strong buying pressure near this resistance, suggesting potential for a breakthrough.

The price action around these key levels is crucial evidence supporting the potential entry into a rally zone.

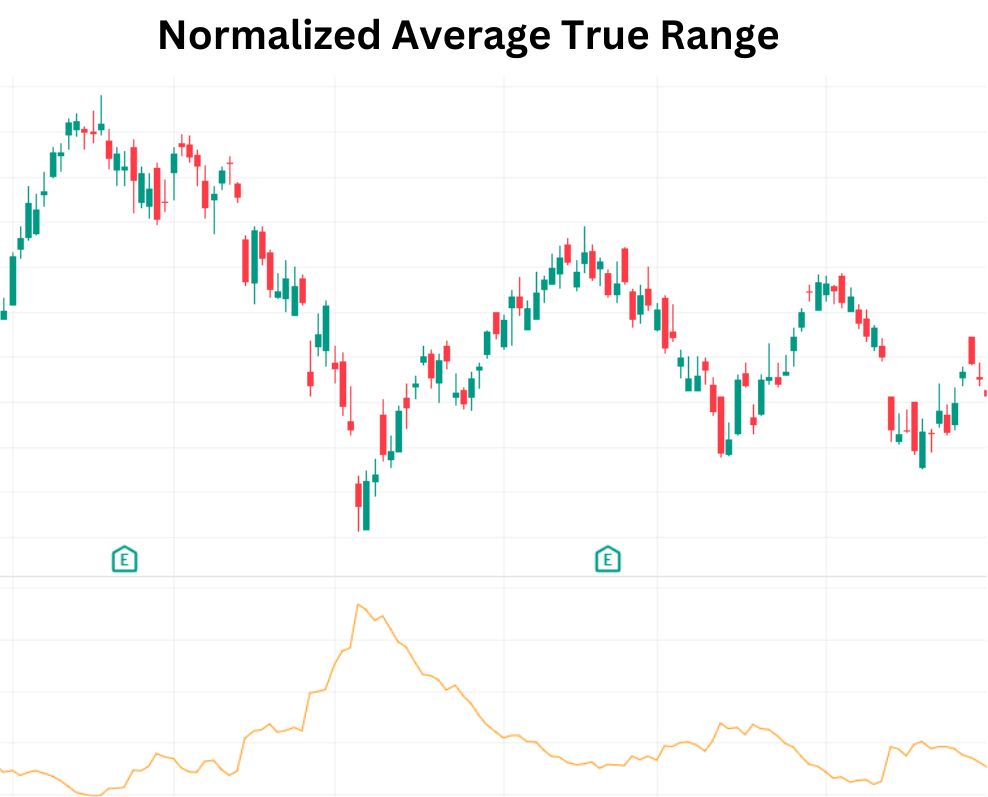

Volume Analysis

High trading volume is a key indicator confirming the strength of price movements. May 6th showed:

- Increased Volume: A noticeable increase in trading volume accompanied the price rise, signifying strong buying interest and confirming the legitimacy of the bullish move. This high volume surge around the resistance level is particularly bullish.

- Absence of Significant Drops: The lack of significant volume spikes during price corrections suggests a strong underlying buying pressure and reduced selling pressure.

This volume analysis reinforces the bullish outlook suggested by technical indicators and support/resistance levels.

Factors Influencing the Bitcoin Price Forecast

While technical analysis is crucial, external factors significantly influence the Bitcoin price forecast.

Macroeconomic Factors

Global macroeconomic conditions play a substantial role in cryptocurrency markets.

- Inflation and Interest Rates: High inflation and rising interest rates can impact investor sentiment towards riskier assets like Bitcoin, potentially impacting short-term price fluctuations.

- Geopolitical Events: Major geopolitical events can create market uncertainty, affecting Bitcoin's price, either positively or negatively.

Staying informed about global economic trends and geopolitical developments is crucial for a comprehensive Bitcoin price forecast.

Regulatory Developments

Government regulations heavily influence the cryptocurrency landscape.

- Regulatory Clarity: Increased regulatory clarity in major markets can boost investor confidence and lead to price increases.

- Regulatory Uncertainty: Conversely, uncertainty or unfavorable regulations can negatively impact Bitcoin’s price.

Staying updated on regulatory developments is essential for making informed investment decisions.

Market Sentiment and Adoption

Market sentiment and adoption rates are also significant drivers of Bitcoin price.

- Positive Investor Sentiment: Positive news and increasing institutional adoption drive up demand and push prices higher.

- Mainstream Adoption: The growing mainstream adoption of Bitcoin as a payment method and store of value contributes to price appreciation.

Potential Bitcoin Price Targets and Risk Assessment

Based on the May 6th analysis, we can speculate on potential price targets and risks.

Short-Term Price Targets

Based on the technical analysis and the current market conditions, we see a short-term price target of [Insert price level] as potentially achievable within [Timeframe]. This is based on the expected break above the May 6th resistance level. However, remember that short-term price movements are volatile.

Long-Term Price Outlook

The long-term outlook for Bitcoin remains positive, but it’s crucial to acknowledge inherent uncertainties. Factors like widespread adoption, regulatory changes, and macroeconomic conditions will heavily influence the long-term price trajectory.

Risk Management Strategies

Responsible investing requires diligent risk management:

- Stop-Loss Orders: Employing stop-loss orders helps limit potential losses should the price unexpectedly reverse.

- Diversification: Diversifying your investment portfolio across multiple assets reduces risk.

Conclusion: Bitcoin Price Forecast: Actionable Insights and Next Steps

Our analysis of May 6th Bitcoin chart data strongly suggests the potential entry into a rally zone. However, a comprehensive Bitcoin price forecast necessitates considering macroeconomic factors, regulatory developments, and market sentiment, along with a thorough risk assessment. Remember that no prediction is foolproof. Conduct your own in-depth research and utilize appropriate risk management strategies. This article provides valuable insights, but it's not financial advice. For further reading on Bitcoin price prediction and trading strategies, explore resources like [Link to relevant resources]. Make informed decisions based on your own research and risk tolerance. Remember to always conduct thorough due diligence before investing in any cryptocurrency.

Featured Posts

-

Get Your Psl 10 Tickets Sale Starts Today

May 08, 2025

Get Your Psl 10 Tickets Sale Starts Today

May 08, 2025 -

Dogecoin Shiba Inu And Sui Price Surge Reasons Behind This Weeks Rally

May 08, 2025

Dogecoin Shiba Inu And Sui Price Surge Reasons Behind This Weeks Rally

May 08, 2025 -

Saglik Bakanligi Ndan 37 Bin Kisiye Is Imkani Personel Alimi Basvuru Suereci Ve Detaylari

May 08, 2025

Saglik Bakanligi Ndan 37 Bin Kisiye Is Imkani Personel Alimi Basvuru Suereci Ve Detaylari

May 08, 2025 -

Brookfields Opportunistic Investments Navigating Market Volatility

May 08, 2025

Brookfields Opportunistic Investments Navigating Market Volatility

May 08, 2025 -

Uber Auto Service Adapting To The New Cash Payment System

May 08, 2025

Uber Auto Service Adapting To The New Cash Payment System

May 08, 2025