Bitcoin Price Prediction: Could Trump's 100-Day Speech Push BTC Past $100,000?

Table of Contents

Trump's Potential Influence on the Cryptocurrency Market

The cryptocurrency market, and Bitcoin in particular, is highly sensitive to political and regulatory changes. A hypothetical 100-day speech by a former president focusing on crypto or economic policy could significantly influence Bitcoin's price trajectory.

Economic Policies and Bitcoin

A hypothetical shift in economic policy could dramatically affect Bitcoin investment.

- Fiscal Stimulus: Increased government spending could lead to inflation, potentially driving investors towards Bitcoin as a hedge against inflation. This could increase demand and push the price higher.

- Tax Changes: Favorable tax policies towards cryptocurrency could boost investor confidence and encourage wider adoption, leading to increased demand and a higher Bitcoin price. Conversely, stricter tax regulations could dampen investor enthusiasm and negatively impact the price.

- Infrastructure Investments: Government investments in blockchain infrastructure could be a bullish sign for the crypto market, indicating government support and potentially boosting the Bitcoin price.

Experts like [insert expert name and link to their work] have noted the correlation between macroeconomic trends and Bitcoin's price. For instance, periods of high inflation often see increased Bitcoin adoption, potentially driving the price up. Conversely, periods of economic uncertainty can trigger sell-offs.

Regulatory Changes Under a Hypothetical Trump Administration

Regulatory clarity or uncertainty can significantly impact Bitcoin's price.

- Lenient Regulation: A more lenient regulatory approach, focusing on innovation and fostering a thriving cryptocurrency ecosystem, could attract institutional investors and boost Bitcoin adoption, potentially driving the price towards $100,000.

- Stricter Regulation: Conversely, stricter regulations, including increased scrutiny of exchanges or limitations on Bitcoin usage, could dampen investor enthusiasm and lead to a price correction. This could create uncertainty in the Bitcoin market.

News articles and analyses from reputable sources like [insert news source links] consistently highlight the importance of clear regulatory frameworks in fostering growth within the cryptocurrency market.

Analyzing Bitcoin's Current Market Conditions and Predictions

Understanding Bitcoin's current market standing is crucial for predicting its future price. This requires both technical and fundamental analysis.

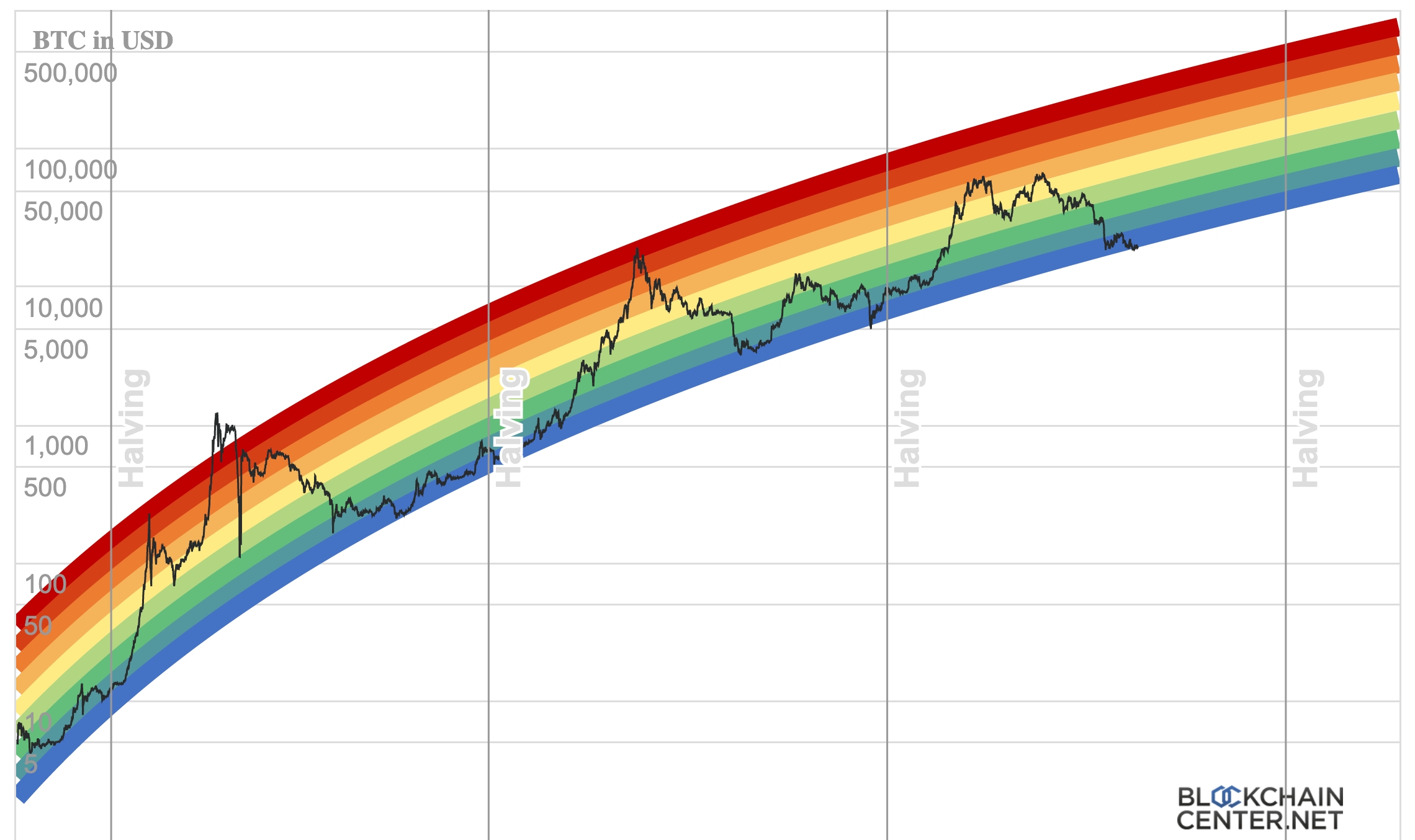

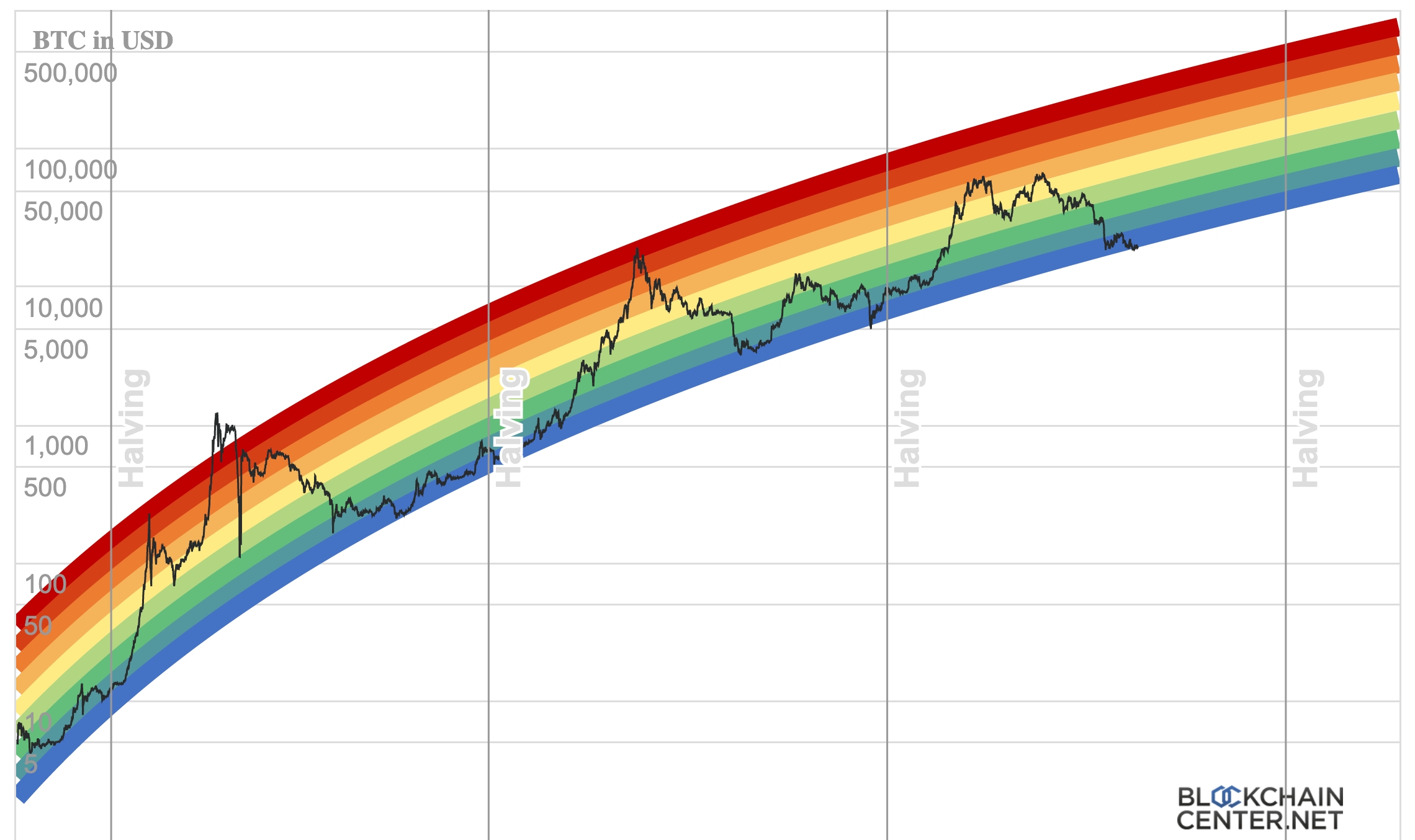

Technical Analysis of Bitcoin's Price

Technical analysis involves studying price charts and indicators to predict future price movements.

- Moving Averages: The 50-day and 200-day moving averages can signal potential trend reversals. A bullish crossover (50-day crossing above 200-day) could indicate an upcoming price increase.

- RSI (Relative Strength Index): An RSI above 70 suggests the market is overbought, indicating a potential price correction. Conversely, an RSI below 30 might signal a buying opportunity.

- MACD (Moving Average Convergence Divergence): MACD helps identify momentum shifts and potential trend changes.

[Insert a relevant Bitcoin price chart here]. Disclaimer: Technical analysis is not foolproof and should be used in conjunction with other forms of analysis.

Fundamental Analysis of Bitcoin

Fundamental analysis assesses the intrinsic value of Bitcoin based on factors affecting its long-term growth.

- Bitcoin Adoption: Widespread adoption by businesses and individuals strengthens Bitcoin's value proposition. Increased usage and transaction volume can contribute to price increases.

- Network Security: Bitcoin's robust and decentralized network is a major factor influencing its long-term value. Improved security features and upgrades further enhance investor confidence.

- Technological Developments: Ongoing development and improvements to Bitcoin's technology, such as the Lightning Network, enhance scalability and efficiency, potentially driving adoption and price growth.

Bitcoin's market capitalization and its position relative to other cryptocurrencies are also key fundamental indicators.

Scenarios and Probabilities: Bitcoin Reaching $100,000

Several scenarios could play out, influencing Bitcoin's price trajectory.

Best-Case Scenario

A best-case scenario would involve a combination of factors:

- A positive and supportive economic policy from the hypothetical administration.

- Favorable regulatory changes encouraging Bitcoin adoption.

- Strong market sentiment and continued institutional investment.

- Significant technological advancements improving scalability and usability.

This combination could potentially drive Bitcoin's price past $100,000.

Worst-Case Scenario

A worst-case scenario involves:

- Negative economic news and a downturn in the global economy.

- Stricter regulations hindering Bitcoin's growth.

- Negative market sentiment leading to significant sell-offs.

- Security breaches or technological setbacks impacting investor confidence.

This could significantly suppress Bitcoin's price, making $100,000 a distant target.

Most Likely Scenario

The most likely scenario is a moderate price increase, driven by a mix of positive and negative influences. Reaching $100,000 is possible but not guaranteed, depending on the interplay of various factors.

Conclusion: Bitcoin Price Prediction: The Verdict and Next Steps

The potential impact of a hypothetical Trump speech on Bitcoin's price is complex and depends on multiple intertwined factors. While a surge past $100,000 is possible under certain conditions, it's not a certainty. The scenarios outlined highlight the inherent uncertainty in Bitcoin price prediction. Reaching $100,000 Bitcoin requires a confluence of positive developments, while negative factors could significantly hinder its progress.

Stay informed about Bitcoin price predictions by following the Bitcoin market and conducting your own thorough research. Learn more about Bitcoin investments and understand the risks involved. To stay updated on market news and analysis, refer to resources like [insert links to relevant resources]. Remember, this is not financial advice, and investing in cryptocurrency carries significant risk.

Featured Posts

-

Strategie Ecologiste Pour Les Municipales A Dijon En 2026

May 09, 2025

Strategie Ecologiste Pour Les Municipales A Dijon En 2026

May 09, 2025 -

Snls Failed Harry Styles Impression His Honest Reaction

May 09, 2025

Snls Failed Harry Styles Impression His Honest Reaction

May 09, 2025 -

Is Jeanine Pirro Trumps Choice For Dcs Top Prosecutor A Fox News Perspective

May 09, 2025

Is Jeanine Pirro Trumps Choice For Dcs Top Prosecutor A Fox News Perspective

May 09, 2025 -

Analysis Attorney Generals Fake Fentanyl Presentation

May 09, 2025

Analysis Attorney Generals Fake Fentanyl Presentation

May 09, 2025 -

Tesla Stock Rally Propels Elon Musks Net Worth To New Heights

May 09, 2025

Tesla Stock Rally Propels Elon Musks Net Worth To New Heights

May 09, 2025