Bitcoin Price Prediction: Could Trump's 100-Day Speech Send BTC To $100,000?

Table of Contents

Trump's Economic Policies and Their Potential Effect on Bitcoin

The economic policies championed by certain political figures can have a profound and multifaceted effect on Bitcoin's price. Let's examine key areas:

Fiscal Policy and Inflation: A Bitcoin Hedge?

- Inflation's Impact: High inflation erodes the purchasing power of fiat currencies. Bitcoin, with a fixed supply of 21 million coins, is often seen as a hedge against inflation. Increased government spending or significant tax cuts, if not carefully managed, could lead to higher inflation, potentially driving investors towards Bitcoin as a store of value.

- Scenario 1: High Inflation: If inflation rises substantially, the demand for Bitcoin as a safe haven asset could skyrocket, potentially pushing its price upwards.

- Historical Data: While not directly comparable, periods of high inflation in various countries have historically shown increased interest in alternative assets, including cryptocurrencies.

Regulatory Uncertainty and Bitcoin's Price: A Double-Edged Sword

- Stricter Regulations: A more stringent regulatory environment for cryptocurrencies could stifle innovation and adoption, potentially leading to a decrease in Bitcoin's price. Increased regulatory scrutiny could also impact investor confidence.

- Relaxed Regulations: Conversely, a more lenient regulatory approach could foster greater adoption and investment, potentially driving the price up. Clearer regulatory frameworks can increase institutional investment, a key factor in price appreciation.

- Past Regulatory Impacts: Past instances of regulatory uncertainty have shown a direct correlation with Bitcoin's price volatility. Periods of clarity have often been followed by periods of price stabilization or even growth.

The US Dollar and Bitcoin's Inverse Relationship: A Delicate Balance

- Inverse Correlation: Bitcoin and the US dollar often show an inverse relationship. When the dollar weakens, Bitcoin's price may strengthen, as investors seek alternative assets. Conversely, a strong dollar may negatively impact Bitcoin's price.

- Examples: Historical data reveals several instances where a weakening dollar corresponded with Bitcoin price increases, and vice versa. This relationship is not absolute, but it's a crucial factor to consider.

Market Sentiment and Speculation Surrounding Trump's Announcements

Market psychology plays a crucial role in Bitcoin's price fluctuations, especially in reaction to significant political events.

The Psychology of the Bitcoin Market: Fear, Hope, and Greed

- FOMO (Fear of Missing Out): Major announcements can trigger FOMO, leading to rapid price increases as investors rush to buy before prices rise further.

- Market Manipulation: Large players can manipulate the market by creating artificial demand or fear, impacting the price significantly.

- Herd Behavior: Investors often follow the trends set by others, creating a herd effect that can amplify price movements.

Media Influence and Bitcoin Price Volatility: The Power of Perception

- News Outlets: Major news outlets and financial publications significantly impact public perception of Bitcoin. Positive coverage can drive investment, while negative coverage can trigger sell-offs.

- Social Media: Social media platforms play a considerable role in shaping public opinion and driving market sentiment, influencing Bitcoin price volatility.

- Past Examples: Numerous examples demonstrate the impact of both positive and negative media coverage on Bitcoin's price. A single tweet from an influential figure can trigger significant price swings.

Technical Analysis of Bitcoin's Price Chart and Potential for $100,000

Reaching $100,000 Bitcoin requires a confluence of factors, including favorable technical indicators.

Support and Resistance Levels: Breaking Through Barriers

- Key Levels: Identifying crucial support and resistance levels on Bitcoin's price chart is essential for predicting potential price movements. Breaking through significant resistance levels is often a precursor to a major price increase.

- Chart Analysis: Technical analysis using various indicators (e.g., moving averages, RSI, MACD) can help identify these levels and predict potential price trends. (Note: Inclusion of relevant charts would enhance this section)

Trading Volume and Market Capitalization: Gauging Market Strength

- Trading Volume: High trading volume indicates strong market interest and can support significant price movements.

- Market Capitalization: Market capitalization reflects the overall value of Bitcoin. A sustained increase in market cap is a positive signal for future price growth.

Conclusion: Bitcoin Price Prediction and the Road to $100,000

This article explored the potential impact of hypothetical policy announcements on Bitcoin's price, examining macroeconomic factors, market sentiment, and technical indicators. While reaching $100,000 Bitcoin is entirely possible, it depends on many interacting factors, including the overall economic climate, regulatory developments, and investor sentiment. The path to $100,000 is fraught with uncertainty, and a balanced perspective is crucial.

Therefore, conducting your own thorough research, staying informed about political developments and their potential ripple effects on the cryptocurrency market, and closely following the Bitcoin price prediction are essential. The potential for $100,000 Bitcoin remains, but careful monitoring of the situation is vital. Remember, this is not financial advice.

Featured Posts

-

What Did Kyle Kuzma Say About Jayson Tatums Viral Instagram

May 08, 2025

What Did Kyle Kuzma Say About Jayson Tatums Viral Instagram

May 08, 2025 -

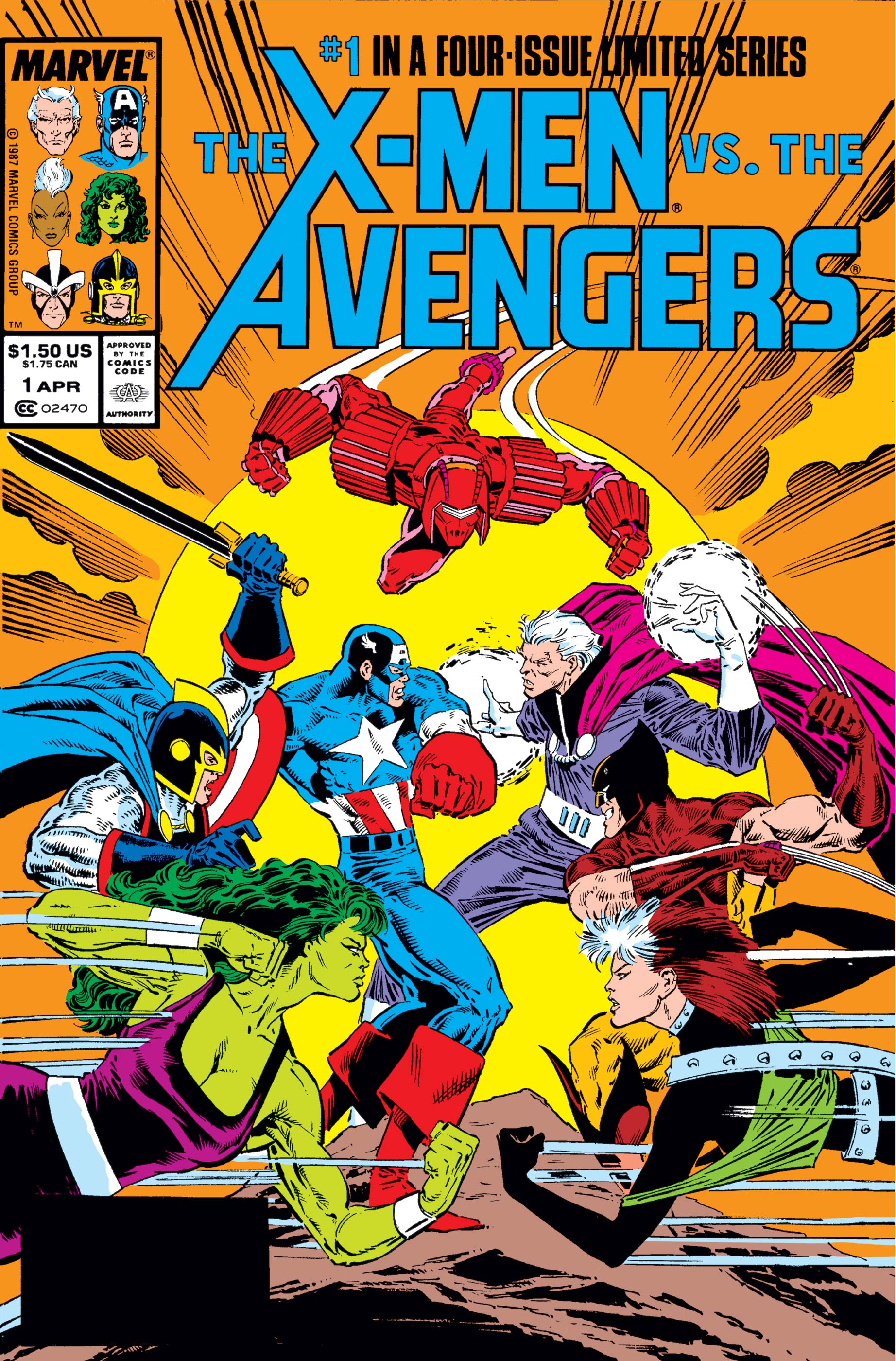

Rethinking Rogues Place Avengers Vs X Men

May 08, 2025

Rethinking Rogues Place Avengers Vs X Men

May 08, 2025 -

Xrp Ripple Investment A Potential Path To Financial Independence

May 08, 2025

Xrp Ripple Investment A Potential Path To Financial Independence

May 08, 2025 -

Incidente Grave Jugadores De Flamengo Y Botafogo Protagonizan Pelea En El Campo

May 08, 2025

Incidente Grave Jugadores De Flamengo Y Botafogo Protagonizan Pelea En El Campo

May 08, 2025 -

Dissecting The Thunder Bulls Offseason Trade Fact Vs Fiction

May 08, 2025

Dissecting The Thunder Bulls Offseason Trade Fact Vs Fiction

May 08, 2025