Bitcoin Price Prediction: Evaluating The Potential Of A Trump-Driven Bull Run

Table of Contents

Trump's Economic Policies and Their Impact on Bitcoin

Trump's economic philosophy, characterized by deregulation and a focus on fiscal stimulus, could significantly impact Bitcoin's trajectory.

Deregulation and its effect on cryptocurrency adoption

- Easing of Regulations: A Trump administration might favor less stringent regulations on cryptocurrency trading. This could lead to increased institutional investment and broader cryptocurrency adoption, potentially driving up Bitcoin's price. Relaxed SEC regulations on crypto exchanges, for example, could unlock significant capital inflows.

- Increased Institutional Investment: Reduced regulatory hurdles could encourage institutional investors – hedge funds, pension funds, and other large players – to allocate more capital to Bitcoin, further increasing demand and price.

- Boosted Crypto Adoption: A more favorable regulatory environment would likely increase mainstream adoption of Bitcoin, attracting more individual investors and expanding the overall market.

Fiscal policy and inflation's influence on Bitcoin as a hedge

- Inflationary Pressures: Trump's fiscal policies might lead to increased government spending and potential inflationary pressures. Historically, Bitcoin has shown a tendency to act as a hedge against inflation, attracting investors seeking to protect their purchasing power.

- Store of Value: In an inflationary environment, Bitcoin's limited supply could make it an increasingly attractive store of value, driving up demand and price.

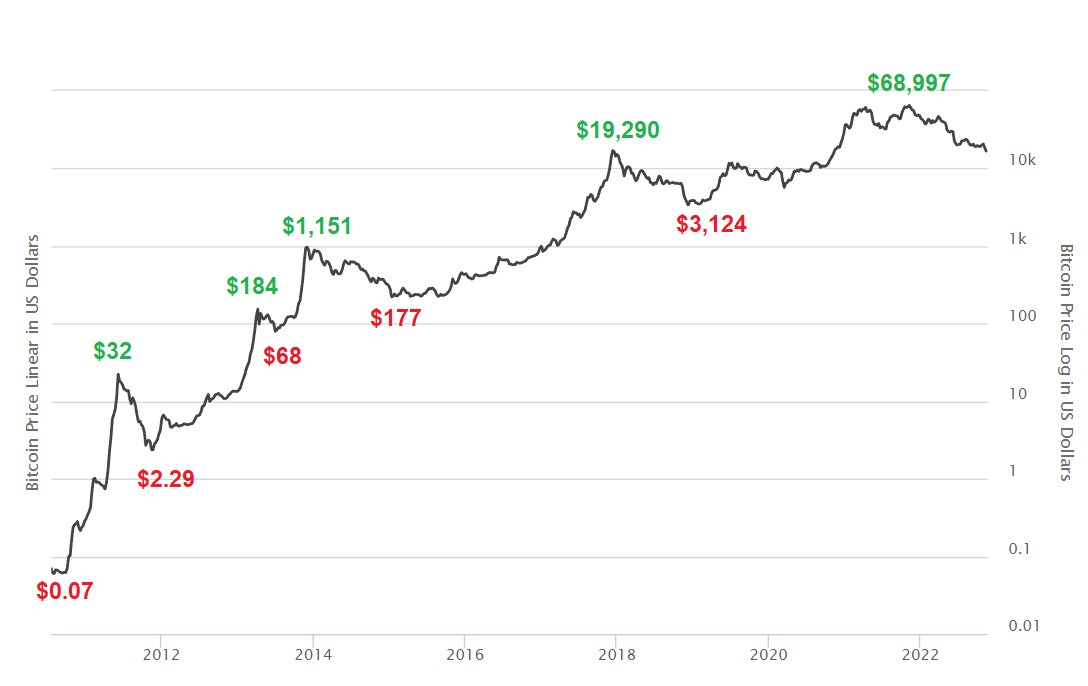

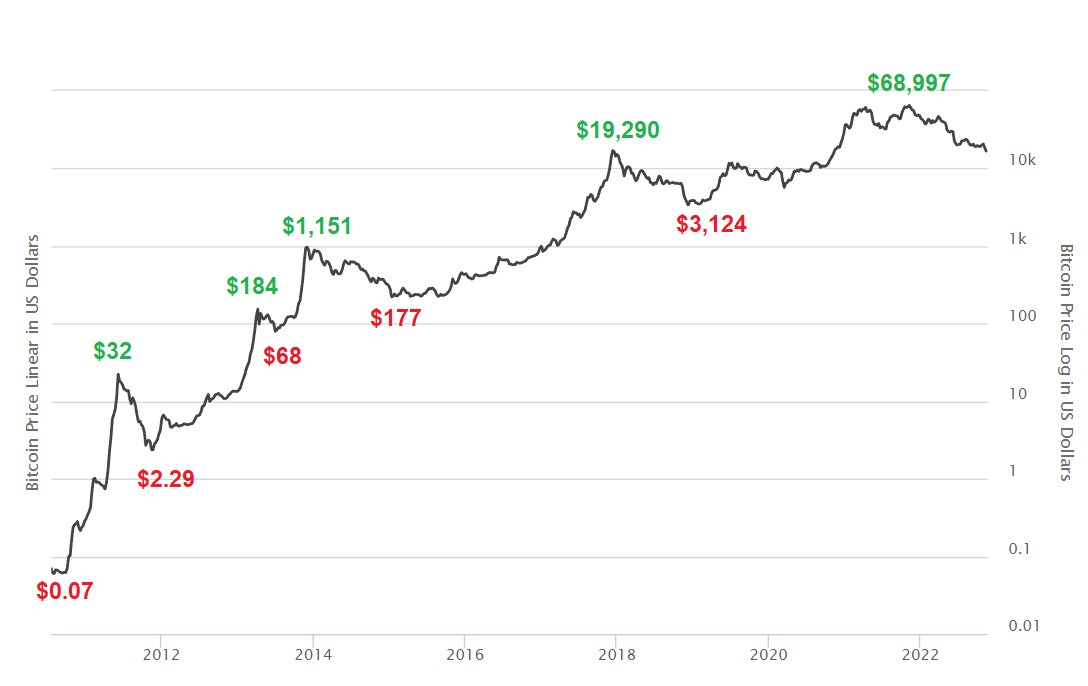

- Historical Correlation: Analyzing historical data reveals a correlation between periods of high inflation and significant Bitcoin price increases, although this correlation isn't absolute and other factors play a role.

"America First" and its implications for global Bitcoin adoption

- International Trade Impacts: A protectionist "America First" approach could impact international trade and potentially affect Bitcoin's global appeal. However, the effect is uncertain.

- Potential for Increased Adoption: Ironically, economic isolationism could paradoxically boost Bitcoin adoption in countries seeking alternatives to the US dollar.

- Stifled Growth?: Conversely, trade wars or protectionist measures could negatively impact global economic growth, potentially hurting Bitcoin's price alongside other assets.

Sentiment Analysis and Market Speculation Surrounding a Trump Presidency

Market sentiment plays a crucial role in Bitcoin's price. A Trump presidency (or the expectation of one) will influence this sentiment in several ways.

Examining social media trends and news coverage

- Social Media Sentiment: Tools like sentiment analysis software can track social media conversations about Bitcoin and Trump, providing insights into prevailing market sentiment. Positive sentiment generally correlates with higher prices.

- News Media Influence: Mainstream news coverage significantly impacts investor perception. Positive news about Bitcoin and a generally favorable portrayal of Trump's policies could boost the cryptocurrency's price.

- Correlation, Not Causation: It's important to remember that correlation between social media sentiment and Bitcoin price doesn't imply causation; other factors are also at play.

The role of institutional investors and whale activity

- Institutional Investor Sentiment: Large institutional investors' decisions heavily influence Bitcoin's price. Their reaction to a Trump presidency will impact market dynamics.

- Whale Activity: "Whales," or individuals and entities holding significant Bitcoin amounts, can manipulate the market through large buy or sell orders. Their actions in response to political events are crucial to watch.

- Price Volatility: The combined actions of institutional investors and whales can lead to significant price volatility, creating both opportunities and risks for investors.

Alternative Scenarios and Risk Assessment

While a Trump-driven bull run is possible, it's crucial to acknowledge potential downsides.

Potential downside risks and factors that could negate a bull run

- Increased Regulatory Scrutiny: A Trump administration, despite its potential for deregulation, could also increase regulatory scrutiny of cryptocurrencies in response to concerns about market manipulation or illicit activities.

- Economic Downturn: A general economic downturn, regardless of Trump's policies, could negatively impact the entire crypto market, dragging Bitcoin's price down.

- Unforeseen Events: Geopolitical events completely unrelated to the Trump administration could significantly impact Bitcoin's price.

Considering other geopolitical factors influencing Bitcoin price

- Geopolitical Risk: Global events such as wars, political instability, or economic crises can influence investor sentiment and Bitcoin's price irrespective of US domestic policy.

- Bitcoin Price Drivers: Multiple factors beyond a Trump presidency – technological innovation, adoption rates, and regulatory changes in other countries – significantly influence Bitcoin's price.

Conclusion: Bitcoin Price Prediction: Summarizing the Potential of a Trump-Driven Bull Run

A Trump presidency or Trump-influenced political environment presents both opportunities and risks for Bitcoin. While deregulation and potential inflationary pressures could drive a bull run, increased regulatory scrutiny or a general economic downturn could negate this. Predicting the precise impact is impossible due to the inherent volatility of the cryptocurrency market and the multitude of interacting factors. While a cautiously optimistic scenario is possible, we must acknowledge the considerable uncertainty involved. To make informed investment decisions, continuous monitoring of "Bitcoin price prediction" analyses, social media sentiment, and geopolitical events is essential. Stay informed and conduct your own thorough research before making any investment decisions related to Bitcoin.

Featured Posts

-

Liga Chempionov 2024 2025 Predvaritelniy Obzor Matchey Arsenal Ps Zh I Barselona Inter

May 08, 2025

Liga Chempionov 2024 2025 Predvaritelniy Obzor Matchey Arsenal Ps Zh I Barselona Inter

May 08, 2025 -

Choosing The Right Surface Pro 12 Inch Model Deep Dive

May 08, 2025

Choosing The Right Surface Pro 12 Inch Model Deep Dive

May 08, 2025 -

Nuggets Vs Bulls De Andre Jordans Historic Night

May 08, 2025

Nuggets Vs Bulls De Andre Jordans Historic Night

May 08, 2025 -

Latest Arsenal News Dembele Injury Casts Doubt On Summer Plans

May 08, 2025

Latest Arsenal News Dembele Injury Casts Doubt On Summer Plans

May 08, 2025 -

Review Your Universal Credit Hardship Payments Potential Refunds

May 08, 2025

Review Your Universal Credit Hardship Payments Potential Refunds

May 08, 2025