Bitcoin Price Rally: Analysis Of The Recent 10-Week High And Potential For $100,000

Table of Contents

Factors Contributing to the Recent Bitcoin Price Rally

Several interconnected factors have fueled Bitcoin's recent price rally. Understanding these dynamics is crucial for assessing its future trajectory and the potential for a $100,000 Bitcoin.

Institutional Investment and Adoption

Institutional interest in Bitcoin has exploded in recent years, transforming it from a niche asset to a legitimate investment option for large corporations and financial institutions. This growing acceptance is a key driver of the current rally.

- Increased institutional interest: Many large companies are now allocating a portion of their treasury reserves to Bitcoin, viewing it as a hedge against inflation and a potential long-term store of value.

- Growing acceptance as an asset class: Mainstream financial institutions are increasingly offering Bitcoin-related products and services, making it more accessible to a wider range of investors.

- Examples of institutional investments: MicroStrategy's significant Bitcoin holdings, coupled with similar investments from companies like Tesla, have demonstrated the growing confidence of major corporations in Bitcoin's potential. Other examples include Square and Galaxy Digital.

- Keywords: Institutional Bitcoin adoption, Bitcoin ETF, corporate Bitcoin treasury, Bitcoin investment trust.

Macroeconomic Factors and Inflation

Global macroeconomic conditions are significantly impacting Bitcoin's price. High inflation and economic uncertainty are driving investors towards alternative assets perceived as inflation hedges.

- Bitcoin as an inflation hedge: Many investors see Bitcoin as a safeguard against inflation, as its supply is capped at 21 million coins. This scarcity is viewed as a key differentiating factor compared to fiat currencies.

- Bitcoin's performance during inflationary periods: Historical data suggests a positive correlation between periods of high inflation and Bitcoin's price appreciation. This strengthens the narrative of Bitcoin as a safe haven asset.

- Current macroeconomic conditions: The ongoing economic uncertainty and persistent inflation in many countries have contributed to the increased demand for Bitcoin as a hedge.

- Keywords: Bitcoin inflation hedge, macroeconomic factors Bitcoin, safe haven asset, Bitcoin vs inflation.

Regulatory Developments and Global Adoption

Regulatory clarity and global adoption are playing a significant role in shaping investor sentiment and Bitcoin's price.

- Positive regulatory developments: While regulation varies significantly across jurisdictions, some countries are adopting more favorable stances towards cryptocurrencies, boosting investor confidence. El Salvador's adoption of Bitcoin as legal tender is a prime example.

- Growing adoption in emerging markets: Many emerging economies are experiencing increased Bitcoin adoption, driven by factors like unstable local currencies and limited access to traditional financial services.

- Impact of regulatory clarity: Clearer regulatory frameworks can attract more institutional investors who often require regulatory certainty before committing significant capital.

- Keywords: Bitcoin regulation, global Bitcoin adoption, cryptocurrency regulation, Bitcoin legal tender.

Technological Advancements and Network Upgrades

Ongoing technological advancements and network upgrades are continuously improving Bitcoin's scalability and efficiency, enhancing investor confidence.

- Bitcoin network upgrades: Improvements to the Bitcoin network's transaction speed and efficiency are crucial for widespread adoption and price appreciation.

- Scalability solutions: Solutions like the Lightning Network aim to address Bitcoin's scalability challenges by enabling faster and cheaper transactions off-chain.

- Keywords: Bitcoin scaling solutions, Lightning Network, Bitcoin upgrades, Bitcoin transaction speed.

Assessing the Potential for Bitcoin to Reach $100,000

The question of whether Bitcoin will reach $100,000 is complex, requiring a balanced assessment of bullish and bearish arguments.

Bullish Arguments and Price Predictions

Several factors point towards the possibility of Bitcoin reaching $100,000 in the future:

- Continued institutional adoption: As more institutional investors enter the market, demand is likely to increase, pushing prices higher.

- Mainstream acceptance: Widespread adoption by individuals and businesses would significantly increase Bitcoin's value.

- Scarcity: The limited supply of Bitcoin compared to ever-increasing demand is a strong bullish factor.

- Keywords: Bitcoin price prediction, Bitcoin future price, $100,000 Bitcoin, Bitcoin price target.

Bearish Arguments and Potential Risks

Despite the bullish arguments, several factors could hinder Bitcoin's price rise:

- Regulatory uncertainty: Unfavorable regulations in major jurisdictions could dampen investor enthusiasm and limit price growth.

- Market volatility: Bitcoin's price is notoriously volatile, subject to significant fluctuations.

- Security breaches: Security concerns and potential hacks could negatively impact investor confidence.

- Keywords: Bitcoin risks, Bitcoin volatility, cryptocurrency risks, Bitcoin security.

Technical Analysis and Chart Patterns

While not a foolproof predictor, technical analysis can offer insights into potential price movements. Analyzing chart patterns, indicators like moving averages, and relative strength index (RSI) can help identify potential support and resistance levels. However, it's crucial to remember that technical analysis is not a guaranteed method for predicting future price action.

- Keywords: Bitcoin technical analysis, Bitcoin chart patterns, Bitcoin trading, Bitcoin technical indicators.

Conclusion

The recent Bitcoin price rally to a 10-week high, fueled by institutional investment, macroeconomic factors, and positive regulatory developments, has reignited the debate about its potential to reach $100,000. While bullish arguments suggest a strong possibility, it's crucial to acknowledge potential risks. Thorough research and understanding of both the bullish and bearish factors are vital before making any investment decisions. Stay informed about the latest developments in the Bitcoin market to make informed choices regarding your Bitcoin investments. Continue to track the Bitcoin price and its potential for growth. Remember to conduct your own thorough research before investing in Bitcoin or any other cryptocurrency.

Featured Posts

-

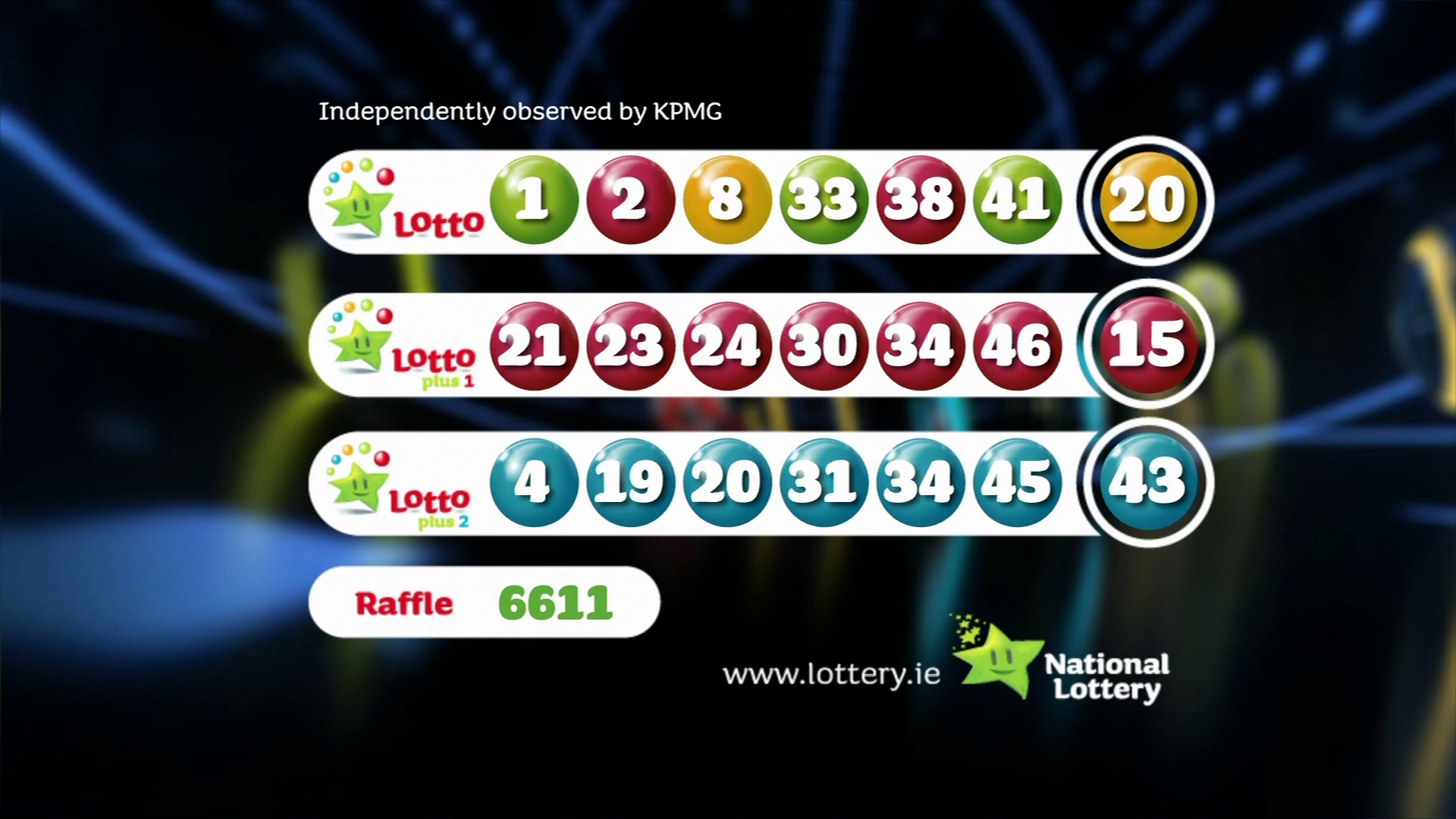

Saturday Lotto Results April 12th Check The Jackpot Numbers

May 07, 2025

Saturday Lotto Results April 12th Check The Jackpot Numbers

May 07, 2025 -

Anthony Edwards Injury Impact On Timberwolves Lakers Game

May 07, 2025

Anthony Edwards Injury Impact On Timberwolves Lakers Game

May 07, 2025 -

Minnesota Timberwolves The Crucial Role Of Coach Chris Finchs Decision Making

May 07, 2025

Minnesota Timberwolves The Crucial Role Of Coach Chris Finchs Decision Making

May 07, 2025 -

De Echte Soldaat Van Oranje Het Leven Van Spion Peter Tazelaar

May 07, 2025

De Echte Soldaat Van Oranje Het Leven Van Spion Peter Tazelaar

May 07, 2025 -

Rihanna And A Ap Rocky Relationship Speculation Heats Up

May 07, 2025

Rihanna And A Ap Rocky Relationship Speculation Heats Up

May 07, 2025

Latest Posts

-

Anthony Edwards Questions Barack Obama On His Legacy

May 07, 2025

Anthony Edwards Questions Barack Obama On His Legacy

May 07, 2025 -

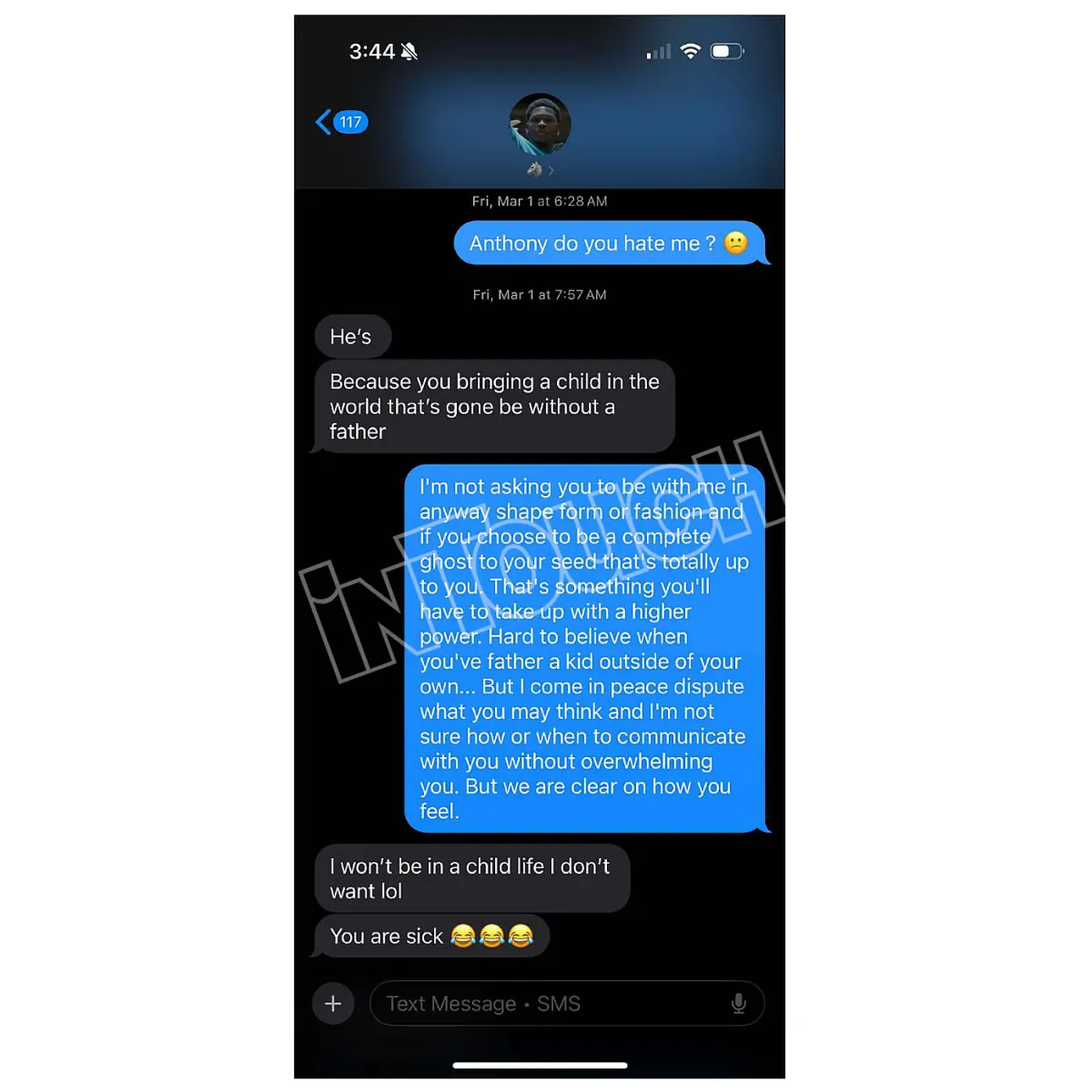

Nba Player Anthony Edwards Facing Backlash Over Alleged Abortion Texts To Ayesha Howard

May 07, 2025

Nba Player Anthony Edwards Facing Backlash Over Alleged Abortion Texts To Ayesha Howard

May 07, 2025 -

Anthony Edwards Alleged Texts To Ayesha Howard About Pregnancy

May 07, 2025

Anthony Edwards Alleged Texts To Ayesha Howard About Pregnancy

May 07, 2025 -

Paternity Dispute Resolved Ayesha Howard Awarded Custody

May 07, 2025

Paternity Dispute Resolved Ayesha Howard Awarded Custody

May 07, 2025 -

Latest News On Anthony Edwards Injury Timberwolves Vs Lakers

May 07, 2025

Latest News On Anthony Edwards Injury Timberwolves Vs Lakers

May 07, 2025