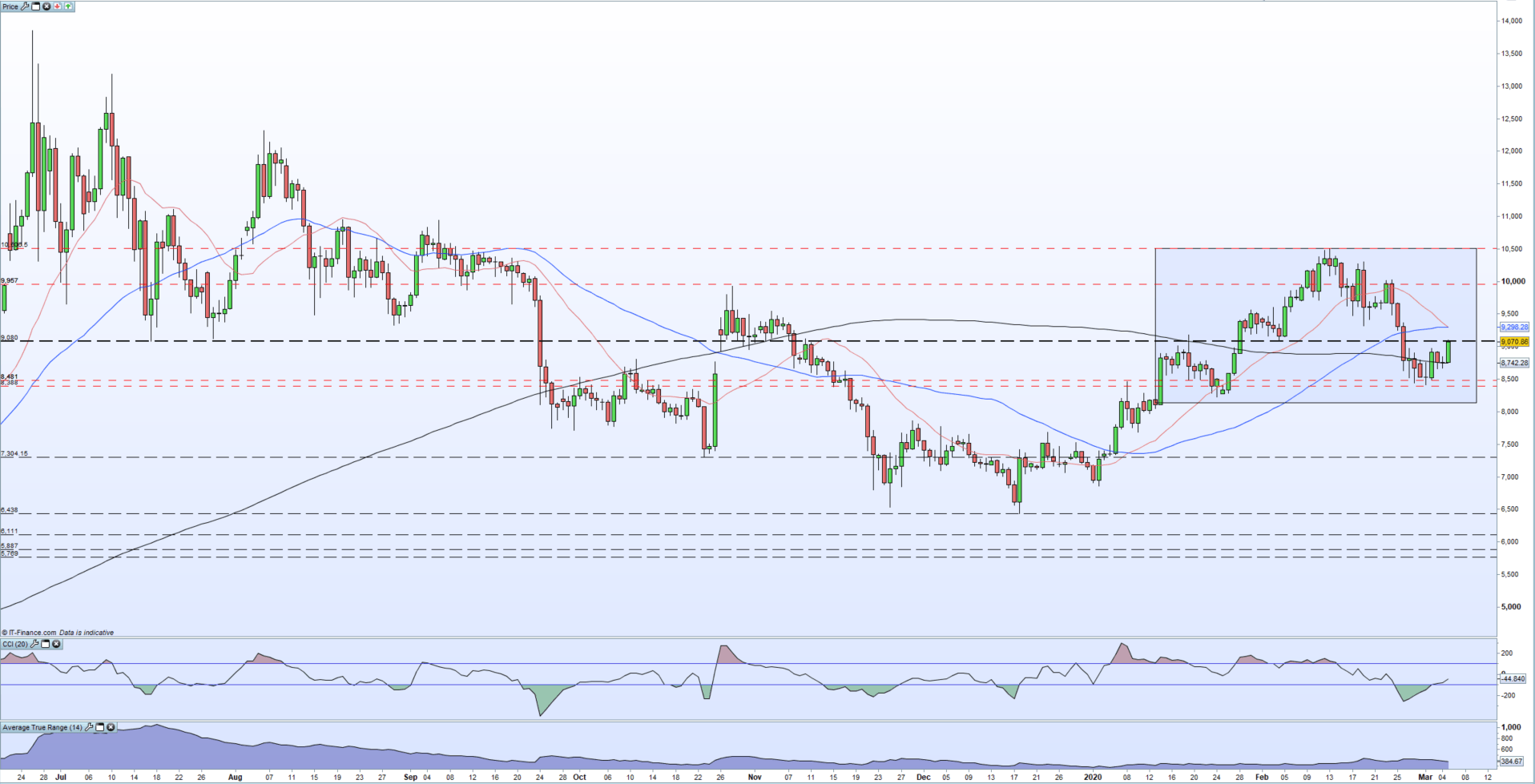

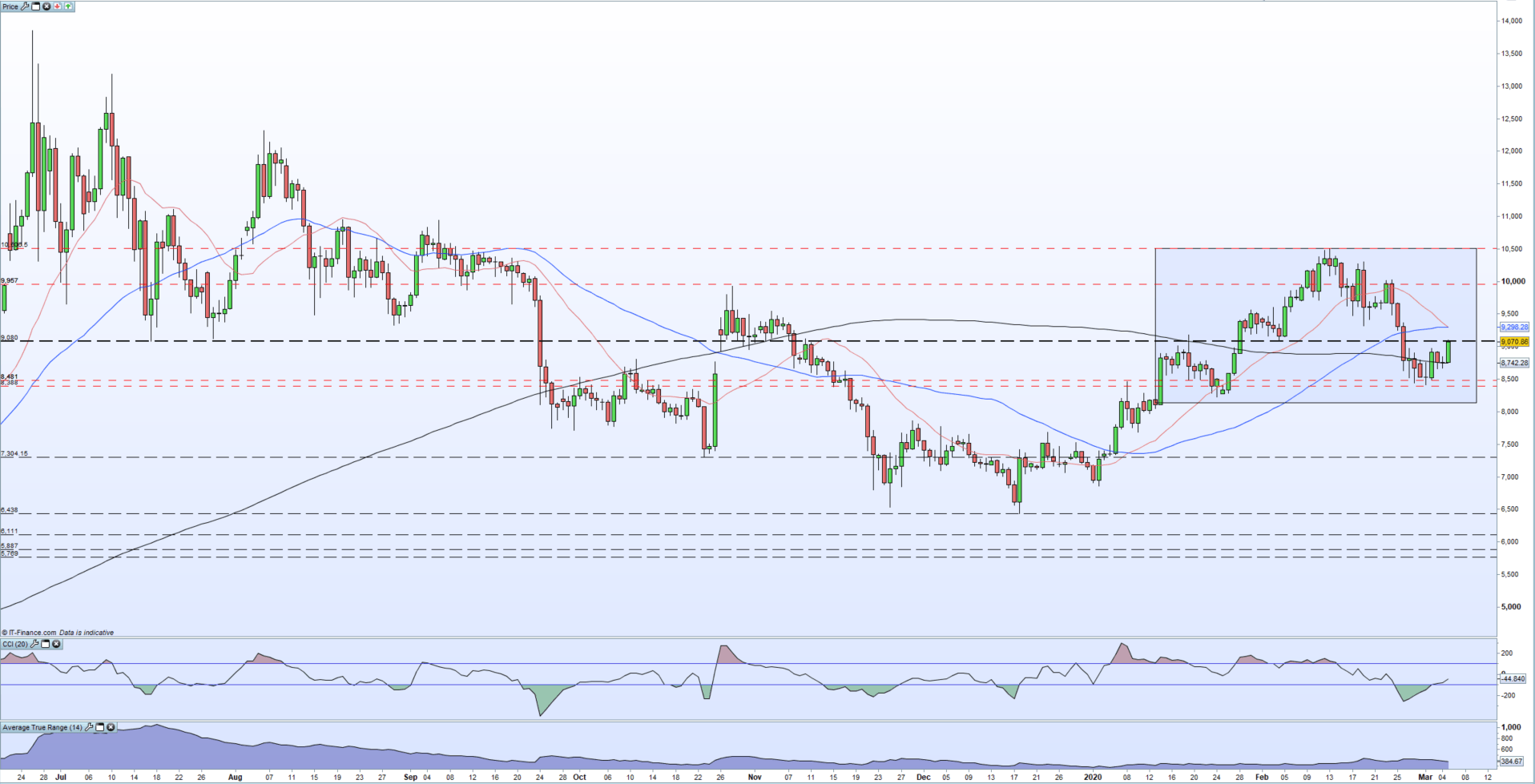

Bitcoin Price Rebound: A Look At Potential Future Growth

Table of Contents

Macroeconomic Factors Influencing Bitcoin's Rebound

Macroeconomic conditions significantly influence Bitcoin's price. Understanding these factors is key to predicting potential future price movements.

Inflation and Safe-Haven Assets

Inflation, the persistent increase in the general price level of goods and services, plays a crucial role in driving Bitcoin investment. As traditional fiat currencies lose purchasing power, investors seek alternative assets to preserve their wealth.

- Increased inflation pushes investors towards alternative assets like Bitcoin, gold, and other precious metals.

- Bitcoin's limited supply of 21 million coins makes it an attractive hedge against inflation. Unlike fiat currencies, which can be printed indefinitely, Bitcoin's scarcity ensures its value is less susceptible to inflationary pressures.

- Historically, Bitcoin's performance during inflationary periods has shown some correlation with gold, though it's important to note that this correlation isn't always consistent. Further research is needed to establish a definitive relationship.

Interest Rate Hikes and Their Impact

Central bank interest rate hikes impact the cryptocurrency market, including Bitcoin. Higher interest rates can make holding assets like Bitcoin, which don't generate interest, less attractive.

- Higher interest rates can reduce investment in riskier assets like Bitcoin, as investors may prefer higher returns from interest-bearing accounts.

- Conversely, strategic long-term investors may view Bitcoin's price dip as a buying opportunity, believing in its long-term potential regardless of short-term interest rate fluctuations.

- Analyzing historical Bitcoin price data alongside interest rate movements reveals some correlation, but the relationship isn't always straightforward. Other factors often play a more significant role.

Technological Advancements and Bitcoin Adoption

Technological advancements and increased adoption are crucial factors driving Bitcoin's price. Improved scalability and institutional acceptance are vital for long-term growth.

The Lightning Network and Scalability

The Lightning Network is a layer-2 scaling solution that significantly improves Bitcoin's transaction speed and reduces fees. This enhanced scalability is a key driver of wider adoption.

- Faster transaction speeds, facilitated by the Lightning Network, attract more users and businesses, increasing demand for Bitcoin.

- Reduced transaction fees make Bitcoin more accessible for everyday transactions, fostering greater adoption among individuals and businesses.

- The adoption rate of the Lightning Network is steadily increasing, and this increased usage positively correlates with Bitcoin price movements, although the relationship isn't perfectly linear.

Institutional Investment and Regulatory Clarity

Institutional investors, such as hedge funds and corporations, are increasingly investing in Bitcoin. Regulatory clarity in different jurisdictions further fuels this adoption.

- Growing institutional investment signals increased confidence in Bitcoin's long-term viability as an asset class.

- Regulatory clarity, or the lack thereof, significantly impacts institutional acceptance of Bitcoin. Clearer regulatory frameworks reduce risk and encourage investment.

- The correlation between Bitcoin's price performance and increasing institutional investment is demonstrably positive, showcasing the significant impact of large-scale buy-ins.

Sentiment Analysis and Market Speculation

Market sentiment, driven by social media, news coverage, and the actions of large holders, significantly impacts Bitcoin's price.

Social Media Sentiment and News Coverage

Social media trends and news reports heavily influence Bitcoin's price. Positive news tends to fuel price increases, while negative news or "Fear, Uncertainty, and Doubt" (FUD) can cause significant price drops.

- Positive news coverage, such as regulatory approvals or major partnerships, often leads to price surges.

- Negative news or FUD, such as hacking incidents or regulatory crackdowns, can cause significant price declines.

- Analyzing social media sentiment using tools that track mentions and sentiment scores can provide valuable insights into market trends, although it's crucial to interpret this data cautiously.

Whale Activity and Market Manipulation

Large Bitcoin holders, known as "whales," can influence price volatility through their trading activities. The potential for market manipulation is a concern, although difficult to definitively prove.

- Large transactions by whales can create significant price swings, sometimes independent of broader market trends.

- While market manipulation is a persistent concern, definitively proving such manipulation is challenging due to the decentralized nature of the Bitcoin network.

- Studying historical examples of whale activity helps to understand their potential impact on price, but caution is necessary in drawing definitive conclusions.

Conclusion

This analysis of Bitcoin's price rebound highlights the complex interplay of macroeconomic factors, technological advancements, and market sentiment. While predicting future Bitcoin prices with certainty is impossible, several key indicators suggest potential for further growth. Continued institutional adoption, improved scalability solutions, and a more positive regulatory environment could all contribute to a sustained Bitcoin price rebound. Stay informed about these developments and continue monitoring the Bitcoin market to capitalize on future opportunities. Learn more about navigating the exciting world of Bitcoin price fluctuations and potential growth. Understanding the factors driving Bitcoin's price is key to making informed investment decisions.

Featured Posts

-

Partly Cloudy Skies Your Guide To Dressing For The Day

May 08, 2025

Partly Cloudy Skies Your Guide To Dressing For The Day

May 08, 2025 -

76 2 0

May 08, 2025

76 2 0

May 08, 2025 -

Gha Opposes Jhl Privatisation Plan Key Concerns And Potential Impacts

May 08, 2025

Gha Opposes Jhl Privatisation Plan Key Concerns And Potential Impacts

May 08, 2025 -

Black Rock Etf A Billionaire Investment Strategy For 2025s Market

May 08, 2025

Black Rock Etf A Billionaire Investment Strategy For 2025s Market

May 08, 2025 -

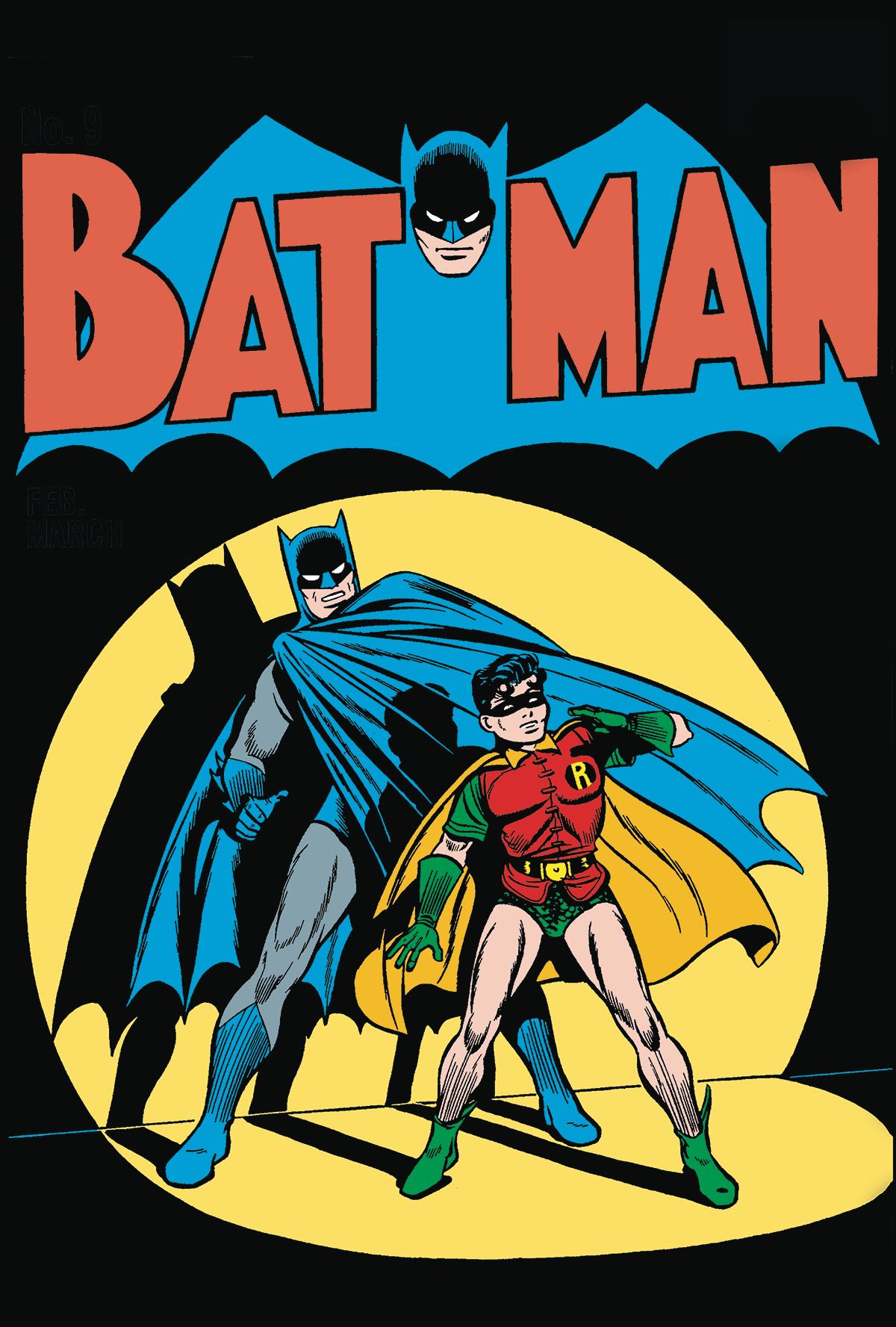

Dc Comics Batman A Fresh Start With New 1 And Costume

May 08, 2025

Dc Comics Batman A Fresh Start With New 1 And Costume

May 08, 2025