Bitcoin Price Surge: Trade Tensions Boost Crypto Market

Table of Contents

Trade Wars and Safe-Haven Demand

Increased global trade uncertainty, particularly between major economic powers, has driven investors towards alternative assets perceived as less susceptible to geopolitical risk. Bitcoin, with its decentralized nature and limited supply (21 million coins), is increasingly viewed as a Bitcoin safe haven. The inherent volatility of traditional markets, coupled with concerns about government intervention and inflation, is pushing investors to seek refuge in assets outside of traditional financial systems.

- Increased volatility in traditional markets: Fluctuations in stock markets and other traditional investment vehicles are driving capital into cryptocurrencies like Bitcoin, seen as a hedge against these uncertainties.

- Bitcoin's decentralized nature: Unlike fiat currencies controlled by central banks, Bitcoin operates on a decentralized blockchain, making it resistant to government manipulation or freezing of assets. This characteristic is a key appeal for investors seeking protection from geopolitical risks.

- Growing institutional interest: The entry of major institutional investors further fuels the Bitcoin price surge. This signifies a growing acceptance of Bitcoin as a legitimate asset class within mainstream finance.

- Correlation analysis: Studies show a demonstrable correlation between escalating trade tensions and upward movements in the Bitcoin price. As uncertainty increases, investors flock to Bitcoin, pushing the price higher.

Increased Institutional Investment in Bitcoin

A growing number of institutional investors, including hedge funds, investment firms, and even publicly traded companies, are allocating a portion of their portfolios to Bitcoin. This signifies a pivotal shift in the perception of cryptocurrencies, solidifying their status as a legitimate asset class. This institutional Bitcoin investment is a major catalyst for the recent price surge.

- Recent major institutional investments: Several high-profile investments by major financial institutions have significantly impacted Bitcoin's price. Public announcements of these investments create a ripple effect, attracting further investment.

- Impact of institutional buying on Bitcoin price: Large-scale purchases by institutional investors have a considerable influence on market liquidity and price discovery. This is particularly true given the relatively smaller market capitalization of Bitcoin compared to traditional markets.

- Reasons behind increased institutional interest: Diversification strategies, a hedge against inflation, and the potential for high returns are all driving factors behind the increasing institutional interest in Bitcoin.

Regulatory Developments and Their Impact

While regulatory uncertainty remains a global concern, some positive developments in certain jurisdictions are contributing to a more favorable climate for Bitcoin adoption. Clearer Bitcoin regulation often leads to increased investor confidence and participation. However, a lack of consistent global regulation remains a challenge.

- Recent regulatory announcements: Several countries have either clarified their stance on Bitcoin or are actively exploring regulatory frameworks, impacting investor sentiment and market confidence.

- Influence of positive regulatory developments: Clearer regulatory guidelines reduce uncertainty, encouraging more institutional and retail investment, which subsequently impacts Bitcoin’s price.

- Differing regulatory approaches: The varying approaches to Bitcoin regulation across different nations create both opportunities and challenges for the market. Some jurisdictions' more progressive stances attract investment, while others' restrictive measures can hinder growth.

Technical Analysis of the Bitcoin Price Surge

Analyzing the technical aspects of the recent Bitcoin price surge provides further insights into the market dynamics. Technical indicators offer a valuable perspective beyond fundamental factors.

- Key support and resistance levels: Identifying these levels is crucial for understanding potential price movements. Breakouts above resistance levels often signal further upward momentum.

- Relevant technical indicators: Moving averages, Relative Strength Index (RSI), and other technical indicators help assess the strength and sustainability of the upward trend. These tools offer signals that can be interpreted by traders and investors.

- Prediction of future price movements (Disclaimer): Predicting future price movements is inherently speculative. Technical analysis can provide insights, but it's not a guarantee of future performance. Any analysis should be considered alongside fundamental factors and market sentiment.

Conclusion

The recent Bitcoin price surge is a complex phenomenon driven by a confluence of factors: escalating trade tensions, increased institutional investment, and evolving regulatory landscapes. The perception of Bitcoin as a safe-haven asset during times of economic uncertainty is a significant driver of this upward trend. Understanding the interplay of these factors is crucial for navigating the crypto market.

Call to Action: Understanding the forces behind this Bitcoin price surge is crucial for both seasoned investors and those new to the crypto market. Stay informed about the latest developments in global economics, regulatory changes, and technical indicators to make informed decisions regarding your Bitcoin investment strategy. Learn more about navigating the volatile world of Bitcoin price fluctuations and capitalizing on opportunities presented by future Bitcoin price surges.

Featured Posts

-

Urgent Dwp Issues 3 Month Warning On Benefit Stoppage For 355 000 Claimants

May 08, 2025

Urgent Dwp Issues 3 Month Warning On Benefit Stoppage For 355 000 Claimants

May 08, 2025 -

Pakstan Aym Aym Ealm Ky 12 Wyn Brsy Ke Mwqe Pr Khswsy Prwgram

May 08, 2025

Pakstan Aym Aym Ealm Ky 12 Wyn Brsy Ke Mwqe Pr Khswsy Prwgram

May 08, 2025 -

Bitcoin Madenciliginin Azalan Karliligi Neden Ve Ne Yapmali

May 08, 2025

Bitcoin Madenciliginin Azalan Karliligi Neden Ve Ne Yapmali

May 08, 2025 -

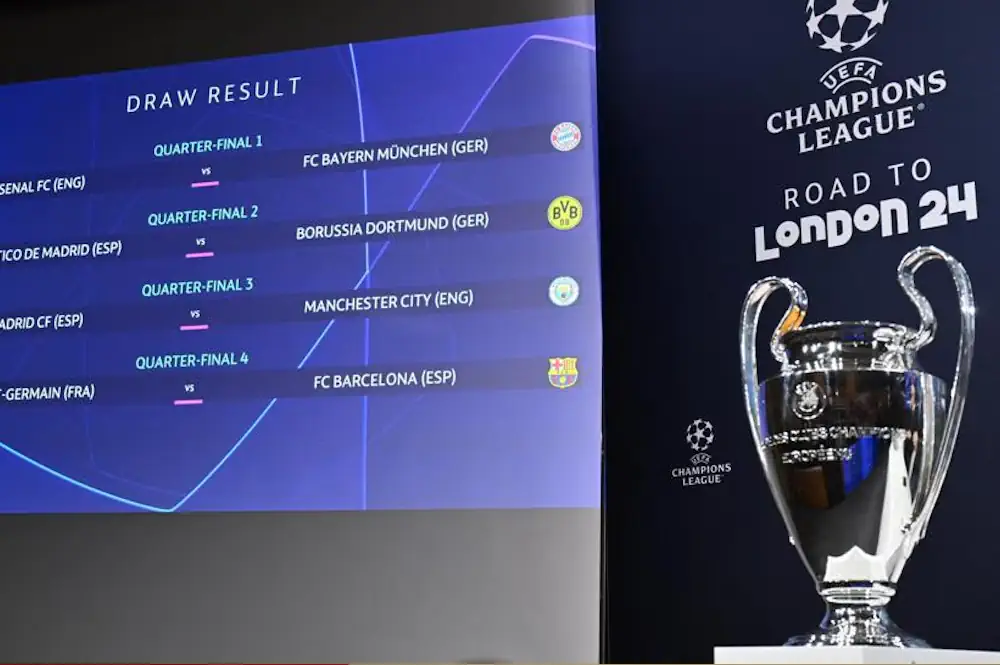

Arsenal Ps Zh Barselona Inter Anons Matchey 1 2 Finala Ligi Chempionov 2024 2025

May 08, 2025

Arsenal Ps Zh Barselona Inter Anons Matchey 1 2 Finala Ligi Chempionov 2024 2025

May 08, 2025 -

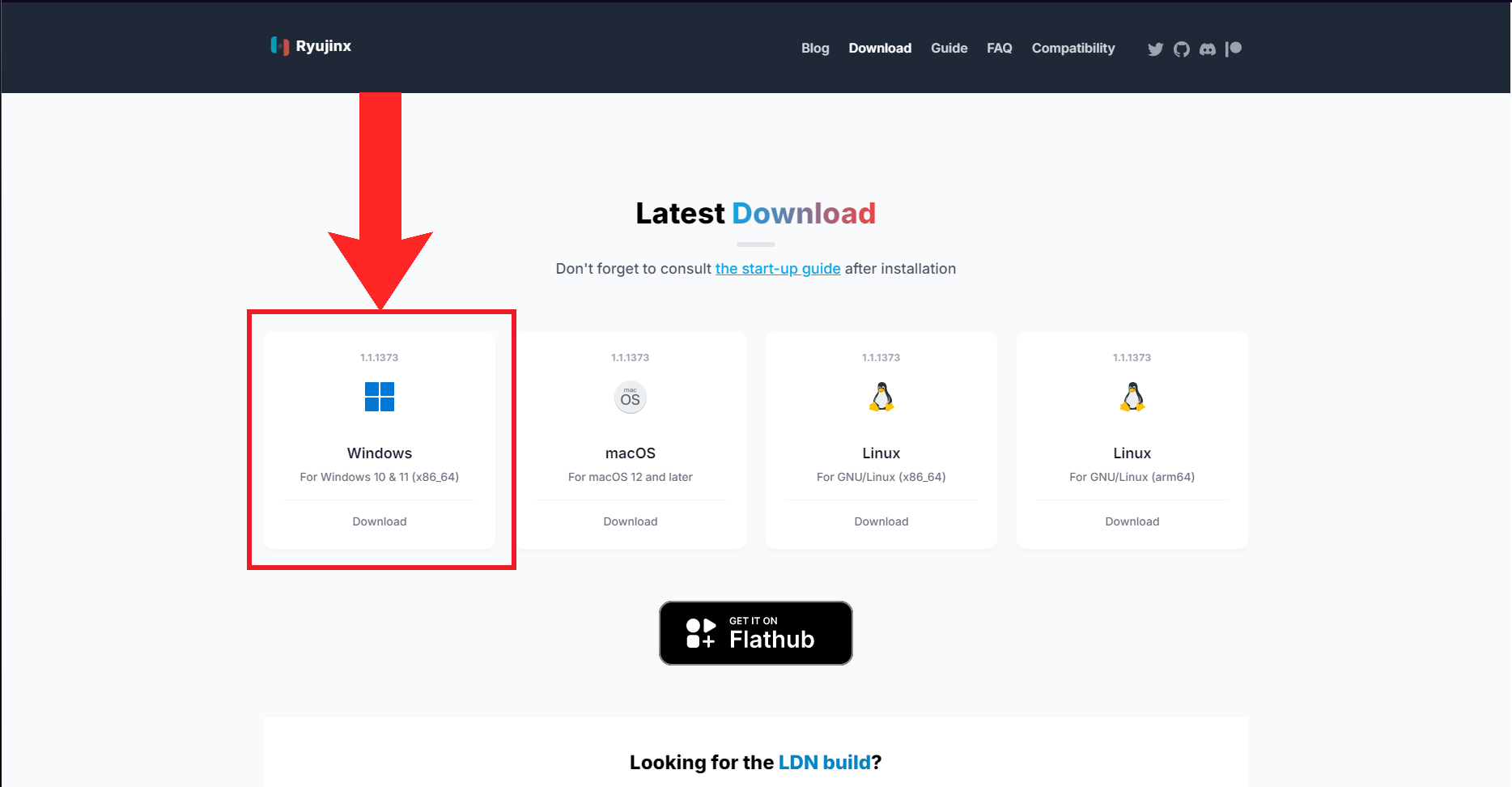

Ryujinx Emulator Project Closure A Response To Nintendo

May 08, 2025

Ryujinx Emulator Project Closure A Response To Nintendo

May 08, 2025