Bitcoin Rebound: Is This The Start Of A New Bull Market?

Table of Contents

Analyzing the Recent Bitcoin Price Surge

The recent Bitcoin price increase has many investors wondering if a new bull market is underway. Let's delve into a comprehensive analysis.

Technical Indicators

Technical indicators offer valuable insights into price trends. Currently, we're seeing:

- Relative Strength Index (RSI): A move above 50 suggests increasing bullish momentum, although readings above 70 could indicate overbought conditions and potential corrections.

- Moving Averages: The 50-day and 200-day moving averages are converging, potentially signaling a bullish crossover which historically has been a positive sign for Bitcoin.

- MACD (Moving Average Convergence Divergence): A bullish crossover of the MACD lines could suggest a strengthening uptrend. However, the divergence between price and MACD should be carefully considered.

- Chart Patterns: The emergence of potential bullish chart patterns like a double bottom or a cup and handle formation could support the narrative of a Bitcoin price rebound.

On-Chain Metrics

On-chain data provides a deeper understanding of market sentiment and activity. Key metrics to consider include:

- Transaction Volume: Increased transaction volume often accompanies price increases, indicating higher market participation and potentially a stronger uptrend.

- Mining Difficulty: Changes in mining difficulty can reflect the health and security of the Bitcoin network. A sustained increase can be seen as a positive sign.

- Exchange Balances: A decline in Bitcoin held on exchanges could indicate investors are accumulating, potentially anticipating further price appreciation.

Macroeconomic Factors

Global economic conditions significantly influence Bitcoin's price. Currently, factors to consider are:

- Inflation: High inflation often drives investors towards alternative assets like Bitcoin, viewed as a hedge against inflation.

- Interest Rates: Rising interest rates can impact investor sentiment, potentially diverting capital away from riskier assets like cryptocurrencies.

- Recession Fears: Economic uncertainty can increase the appeal of Bitcoin as a safe haven asset.

Historical Bitcoin Bull Markets and Their Characteristics

Examining past Bitcoin bull markets provides valuable context.

Past Cycles

Previous bull runs have shared some common characteristics:

- Duration: Bull markets have historically lasted for several months to even a couple of years.

- Price Increase: Significant price appreciation, often measured in multiples of the previous cycle's peak.

- Catalysts: Specific events or factors often trigger bull runs, including regulatory developments, technological advancements, and increased institutional adoption.

Identifying Bull Market Signals

Historically, several signals have preceded Bitcoin bull markets:

- Increased Institutional Adoption: Major financial institutions investing in or offering Bitcoin services.

- Positive Regulatory Developments: More favorable regulatory frameworks for cryptocurrencies.

- Technological Advancements: Upgrades or innovations within the Bitcoin ecosystem, such as the Lightning Network scaling solution.

Potential Risks and Challenges

Despite the positive signs, potential risks and challenges remain.

Regulatory Uncertainty

Regulatory uncertainty remains a major factor:

- Increased scrutiny from governments worldwide could negatively impact Bitcoin's price.

- Differing regulatory approaches in various jurisdictions create uncertainty and potential barriers to adoption.

Market Volatility

Bitcoin's inherent volatility poses a significant risk:

- Sharp price corrections are common, and investors should be prepared for potential downturns.

- Understanding risk tolerance is crucial for navigating the volatile Bitcoin market.

Competition from Altcoins

The rise of alternative cryptocurrencies poses a competitive challenge:

- New and innovative cryptocurrencies could divert investor interest away from Bitcoin.

- Altcoins may offer unique functionalities or investment opportunities that compete with Bitcoin.

Predicting the Future of the Bitcoin Market

Predicting the future is inherently challenging, but analyzing expert opinions and realistic expectations is essential.

Expert Opinions

Many crypto analysts have varying perspectives:

- Some believe the recent rebound marks the start of a new bull market.

- Others remain cautious, emphasizing the potential for corrections and macroeconomic risks.

Realistic Expectations

It's crucial to maintain a balanced outlook:

- While positive signals exist, it's unrealistic to expect a linear upward trajectory.

- Market corrections are expected, and investors should prepare for volatility.

Conclusion: Bitcoin Rebound and the Bull Market Outlook

The recent Bitcoin rebound presents both opportunities and challenges. While technical indicators, on-chain metrics, and historical trends offer some bullish signals, macroeconomic factors and regulatory uncertainty remain significant concerns. The likelihood of a sustained bull run depends on a complex interplay of factors, and a balanced perspective acknowledging both positive and negative influences is crucial.

Stay updated on the latest Bitcoin news and analysis to make informed decisions regarding this potential Bitcoin rebound and the future of the Bitcoin market. Conduct your own thorough research before making any investment decisions.

Featured Posts

-

Review Krypto The Last Dog Of Krypton Is It Worth Watching

May 08, 2025

Review Krypto The Last Dog Of Krypton Is It Worth Watching

May 08, 2025 -

The Impact Of Trumps Xrp Backing On Institutional Interest

May 08, 2025

The Impact Of Trumps Xrp Backing On Institutional Interest

May 08, 2025 -

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025

The Night Inter Milan Defeated Barcelona In The Champions League Final

May 08, 2025 -

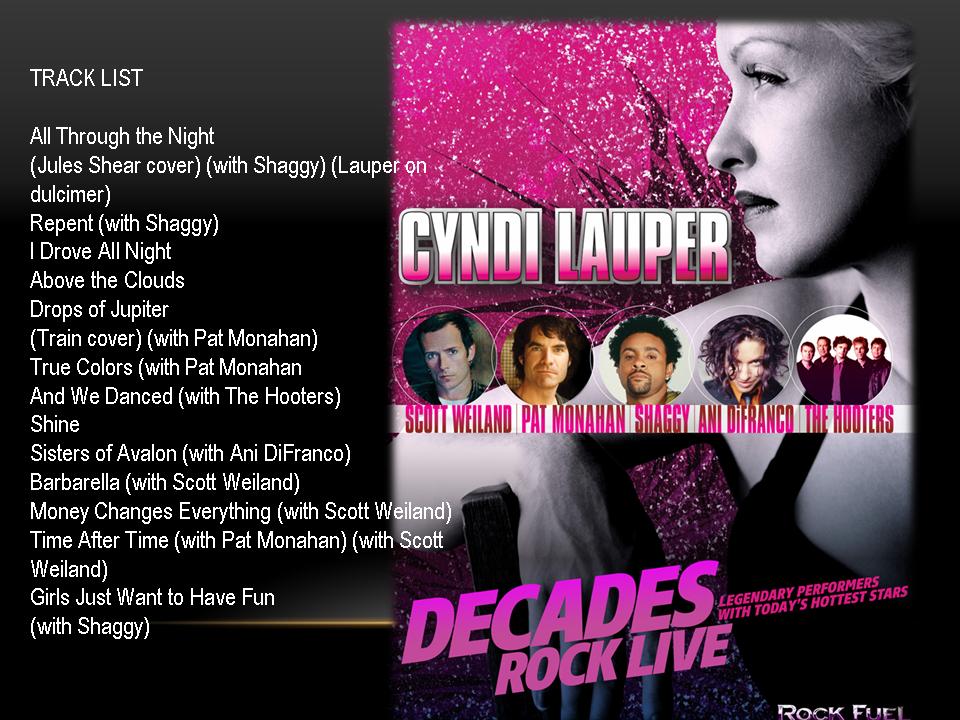

Cyndi Lauper And Counting Crows Team Up For Jones Beach Shows

May 08, 2025

Cyndi Lauper And Counting Crows Team Up For Jones Beach Shows

May 08, 2025 -

Universal Credit Back Payments Could You Be Owed Money

May 08, 2025

Universal Credit Back Payments Could You Be Owed Money

May 08, 2025