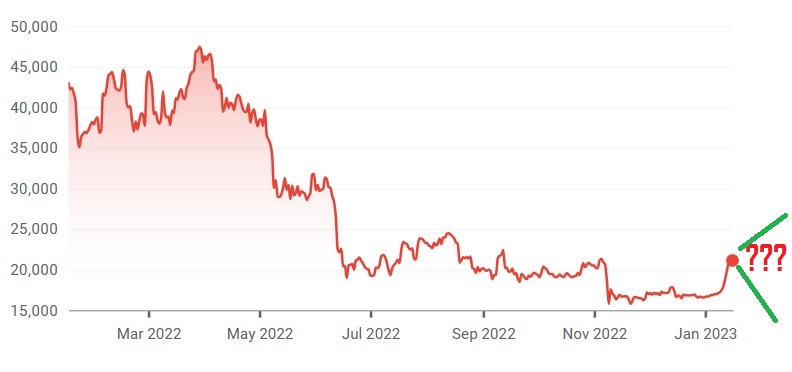

Bitcoin Rebound: Understanding The Market Dynamics And Future Outlook

Table of Contents

Analyzing the Drivers of a Bitcoin Rebound

Several factors could be contributing to a potential Bitcoin rebound. Let's explore some key drivers:

Macroeconomic Factors

Macroeconomic conditions significantly influence Bitcoin's price. High inflation, increasing interest rates, and recessionary fears often drive investors towards alternative assets, including Bitcoin. Bitcoin is increasingly viewed as a hedge against inflation, as its supply is capped at 21 million coins. This scarcity, unlike fiat currencies prone to inflationary pressures, makes it an attractive store of value for some.

- Example 1: The high inflation rates witnessed in 2022 led to increased Bitcoin adoption by investors seeking to protect their purchasing power.

- Example 2: Concerns about a potential recession can push investors towards Bitcoin's perceived safe-haven status.

- Example 3: Changes in central bank monetary policies directly impact the value of traditional assets and influence the flow of capital into cryptocurrencies like Bitcoin.

Regulatory Developments

Regulatory clarity, or the lack thereof, profoundly impacts Bitcoin's price. Positive regulatory announcements from major jurisdictions often lead to increased investor confidence and higher prices. Conversely, negative news or stringent regulations can trigger sell-offs.

- Example 1: Clear regulatory frameworks in certain countries have boosted Bitcoin adoption and trading volumes.

- Example 2: Negative regulatory pronouncements from governments can create uncertainty and lead to price drops.

- Example 3: The ongoing debate surrounding Bitcoin regulation globally creates volatility in the market.

Institutional Adoption and Investment

The growing interest from institutional investors, such as hedge funds and corporations, is a significant factor supporting a potential Bitcoin rebound. Large-scale purchases by these institutional players inject liquidity into the market and signal growing confidence in Bitcoin's long-term potential.

- Example 1: MicroStrategy's significant Bitcoin acquisitions have demonstrated institutional confidence in the cryptocurrency.

- Example 2: The increasing number of publicly traded companies holding Bitcoin on their balance sheets indicates growing acceptance.

- Example 3: The entrance of institutional investors brings significant capital into the Bitcoin market, affecting price stability and growth.

Technological Advancements

Technological advancements within the Bitcoin ecosystem play a crucial role in enhancing its scalability, efficiency, and overall appeal. The Lightning Network, for instance, is addressing transaction speed and fees, making Bitcoin more practical for everyday transactions.

- Example 1: The Lightning Network's improvement in transaction speeds and reduced fees increases Bitcoin's utility.

- Example 2: Upgrades to the Bitcoin protocol enhance security and efficiency.

- Example 3: The ongoing development of new technologies within the Bitcoin ecosystem fosters innovation and attracts further investment.

Assessing the Risks and Challenges

Despite the positive indicators, several risks and challenges remain associated with Bitcoin:

Volatility and Price Corrections

Bitcoin's price is inherently volatile. Sharp price drops, or corrections, are a common feature of the cryptocurrency market. Understanding historical patterns and potential triggers for these corrections is vital for informed investment decisions.

- Example 1: The Bitcoin price crash of 2021 highlights the risk of significant price fluctuations.

- Example 2: Market manipulation and speculative bubbles can cause sharp and sudden price movements.

- Example 3: Unexpected news events can trigger significant volatility in the Bitcoin market.

Security Concerns and Hacks

Security breaches and hacks targeting cryptocurrency exchanges and wallets remain a significant concern. While security measures are constantly evolving, the risk of theft or loss of funds persists.

- Example 1: High-profile exchange hacks have led to significant losses for Bitcoin holders in the past.

- Example 2: Phishing scams and malware pose continuous threats to Bitcoin users.

- Example 3: Using secure wallets and practicing good security hygiene are crucial to mitigate security risks.

Environmental Concerns

The energy consumption associated with Bitcoin mining is a widely debated topic. However, initiatives are underway to reduce the environmental footprint of Bitcoin mining through the adoption of renewable energy sources.

- Example 1: The shift towards renewable energy sources for Bitcoin mining is reducing its carbon footprint.

- Example 2: Improved mining efficiency is reducing the energy consumption per transaction.

- Example 3: Ongoing discussions about the environmental impact of Bitcoin are leading to innovative solutions.

Predicting the Future Outlook for Bitcoin

Predicting Bitcoin's future price is inherently challenging due to its volatility and the interplay of numerous factors. However, we can offer a cautious outlook:

Short-Term Price Predictions

Short-term price predictions are speculative and should be approached with caution. Current market analysis suggests potential upward movement, but sharp corrections remain possible. It's crucial to remember that the cryptocurrency market is highly unpredictable.

Long-Term Potential

Despite the volatility, Bitcoin's long-term potential as a store of value and decentralized medium of exchange remains significant. Increased adoption by institutions and governments, along with technological advancements, could drive long-term price growth.

- Example 1: Widespread adoption of Bitcoin as a payment method could significantly boost its value.

- Example 2: Growing recognition of Bitcoin as a safe-haven asset could drive long-term demand.

- Example 3: Continued technological improvements will enhance Bitcoin's scalability and efficiency.

Conclusion

This article explored the factors driving a potential Bitcoin rebound, including macroeconomic conditions, regulatory developments, institutional adoption, and technological advancements. While the inherent volatility of Bitcoin presents challenges, the long-term potential remains significant. Understanding the dynamics of a Bitcoin rebound requires continuous monitoring of market trends and thorough research. Stay informed about the latest developments in the Bitcoin market to make informed decisions about your Bitcoin investments. Learn more about Bitcoin price predictions and strategies for navigating the volatile cryptocurrency landscape.

Featured Posts

-

Understanding The Dwps 3 Month Warning 355 000 Benefits Affected

May 08, 2025

Understanding The Dwps 3 Month Warning 355 000 Benefits Affected

May 08, 2025 -

The Complete Guide To Ethereum Price Prediction

May 08, 2025

The Complete Guide To Ethereum Price Prediction

May 08, 2025 -

Tyn Khwatyn Smyt Jely Dstawyzat Awr Gdagry Ke Alzam Myn Grftary

May 08, 2025

Tyn Khwatyn Smyt Jely Dstawyzat Awr Gdagry Ke Alzam Myn Grftary

May 08, 2025 -

Superior To Saving Private Ryan Military Historians Rate The Best Realistic Wwii Movies

May 08, 2025

Superior To Saving Private Ryan Military Historians Rate The Best Realistic Wwii Movies

May 08, 2025 -

The Best War Movie Saving Private Ryan Dethroned

May 08, 2025

The Best War Movie Saving Private Ryan Dethroned

May 08, 2025