Bitcoin Vs MicroStrategy Stock: Which To Invest In For 2025?

Table of Contents

Bitcoin: A Decentralized Digital Asset

Bitcoin's Value Proposition:

Bitcoin's core value proposition lies in its decentralized nature and limited supply. Unlike fiat currencies controlled by central banks, Bitcoin operates on a blockchain, a distributed ledger ensuring transparency and security. Its fixed supply of 21 million coins creates inherent scarcity, potentially driving long-term growth as adoption increases. Several factors influence Bitcoin's price:

- Increasing Adoption: Growing acceptance by institutional investors, corporations, and governments fuels demand.

- Regulatory Changes: Government regulations and legal frameworks significantly impact Bitcoin's price and accessibility.

- Market Sentiment: Investor confidence and overall market conditions play a crucial role. Positive news often drives price increases, while negative news can lead to significant drops.

Keywords: Bitcoin price prediction, Bitcoin adoption, cryptocurrency market cap, decentralized finance.

Risks Associated with Bitcoin:

While Bitcoin offers significant potential, it also carries substantial risks:

- Extreme Volatility: Bitcoin's price is notoriously volatile, experiencing sharp price swings in short periods.

- Regulatory Uncertainty: The regulatory landscape for cryptocurrencies remains unclear in many jurisdictions, posing a significant risk. Governments could impose restrictions or outright bans.

- Security Risks: Holding Bitcoin involves security risks, including exchange hacks, scams, and the loss of private keys.

Keywords: Bitcoin volatility, cryptocurrency regulation, Bitcoin security.

Bitcoin Investment Strategies:

Successful Bitcoin investment requires a well-defined strategy:

- Buy and Hold: A long-term strategy involving purchasing Bitcoin and holding it for an extended period, regardless of short-term price fluctuations.

- Dollar-Cost Averaging (DCA): Investing a fixed amount of money at regular intervals, regardless of price, to mitigate risk.

Successful Bitcoin investment also emphasizes risk tolerance and diversification within a broader investment portfolio.

Keywords: Bitcoin trading strategies, Bitcoin investment portfolio, risk management.

MicroStrategy: A Bitcoin-Focused Business Intelligence Company

MicroStrategy's Bitcoin Holdings:

MicroStrategy has made a bold strategic move by accumulating a significant amount of Bitcoin. This corporate strategy directly links its stock price to the performance of Bitcoin. As Bitcoin's value rises, so too does the value of MicroStrategy's holdings, positively impacting its stock price. Conversely, a Bitcoin price drop negatively affects MicroStrategy's balance sheet and share value.

Keywords: MicroStrategy Bitcoin holdings, MSTR stock price, corporate Bitcoin adoption.

MicroStrategy's Business Operations:

Beyond its Bitcoin holdings, MicroStrategy is a business intelligence company providing software and services to analyze data. Its financial performance and growth prospects independent of Bitcoin are crucial factors for investors. Analyzing its core business profitability and competitive landscape is essential for a holistic assessment.

Keywords: MicroStrategy financials, business intelligence software, MSTR stock analysis.

Risks Associated with MicroStrategy Stock:

Investing in MicroStrategy carries inherent risks:

- Bitcoin Price Dependence: MicroStrategy's stock is heavily correlated with Bitcoin's price, making it vulnerable to its volatility.

- Market Risk: The business intelligence market is competitive, and MicroStrategy faces risks associated with competition and technological disruption.

Keywords: MSTR stock risk, investment risk, business intelligence market.

Bitcoin vs. MicroStrategy: A Comparative Analysis

Direct Comparison:

| Feature | Bitcoin (BTC) | MicroStrategy (MSTR) |

|---|---|---|

| Volatility | Extremely High | High (correlated with Bitcoin) |

| Risk | High (regulatory, security) | High (Bitcoin price dependence) |

| Potential Returns | Potentially very high | Potentially high (linked to BTC) |

| Accessibility | Relatively easy (exchanges) | Easy (stock market) |

Investment Horizons:

Bitcoin is better suited for long-term investors with a high-risk tolerance. MicroStrategy stock might appeal to investors seeking exposure to Bitcoin but within a more traditional stock market context. Short-term trading in either is highly risky.

Investor Profiles:

Bitcoin is suitable for risk-tolerant investors who understand the volatility and potential for significant losses. MicroStrategy stock might appeal to investors seeking some exposure to Bitcoin's potential but with slightly less volatility compared to direct Bitcoin ownership. However, it still carries considerable risk.

Conclusion: Making the Right Choice for 2025

Investing in either Bitcoin or MicroStrategy stock requires careful consideration of individual risk tolerance, investment goals, and a thorough understanding of the market. While both offer the potential for substantial returns, they also carry significant risks. Bitcoin's decentralized nature and limited supply offer long-term growth potential, but its volatility is undeniable. MicroStrategy provides a more traditional investment vehicle with exposure to Bitcoin, but its performance is directly tied to Bitcoin's price.

Carefully consider your investment goals before deciding between Bitcoin investment and MicroStrategy stock for 2025. Conduct thorough research and consult a financial advisor before making any investment decisions. Remember that diversification is crucial for mitigating risk in any investment portfolio.

Featured Posts

-

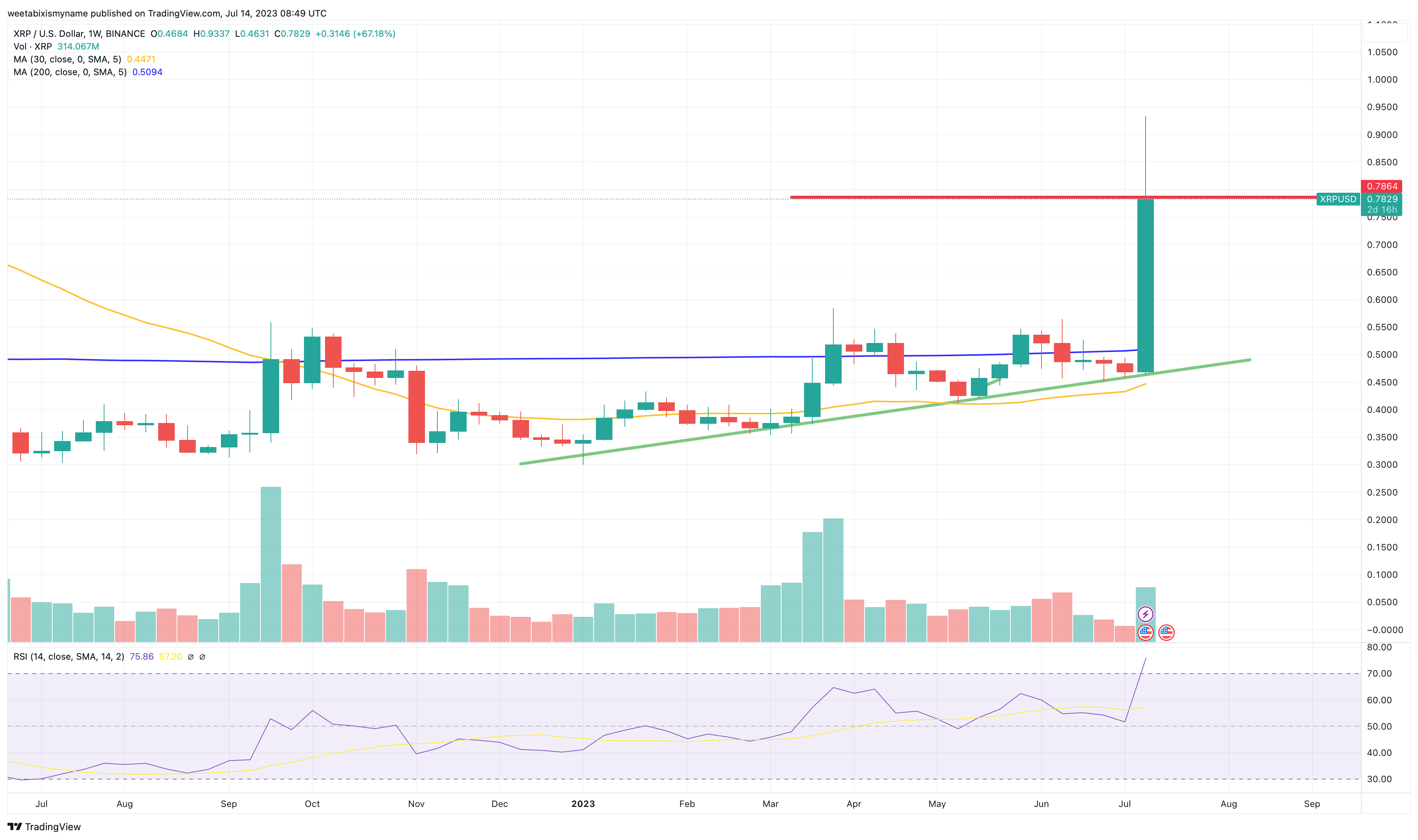

Xrp Price Prediction Exploring The Path To 5 In 2025

May 08, 2025

Xrp Price Prediction Exploring The Path To 5 In 2025

May 08, 2025 -

Neymar Te Psg Historia E Plote E Transferimit 222 Milione Eurosh

May 08, 2025

Neymar Te Psg Historia E Plote E Transferimit 222 Milione Eurosh

May 08, 2025 -

Counting Crows Downtown Indianapolis Show Venue Date And Ticket Information

May 08, 2025

Counting Crows Downtown Indianapolis Show Venue Date And Ticket Information

May 08, 2025 -

Uber Stock Can Robotaxi Plans Fuel A Comeback

May 08, 2025

Uber Stock Can Robotaxi Plans Fuel A Comeback

May 08, 2025 -

Filipe Luis Consigue Otro Titulo

May 08, 2025

Filipe Luis Consigue Otro Titulo

May 08, 2025