Bitcoin's Future: A Look At Important Price Levels

Table of Contents

H2: Identifying Key Bitcoin Support Levels

Support levels in Bitcoin, like in any market, represent price points where buying pressure is strong enough to prevent a further price decline. Think of them as potential price floors. Identifying these levels is vital for investors seeking buying opportunities and gauging market sentiment.

- Historical support levels: Bitcoin has shown consistent support around $20,000 throughout 2023, suggesting a significant psychological and technical support zone. Previous periods of consolidation around $10,000 in 2020 also illustrate how historical price actions can indicate future support. Analyzing past Bitcoin price charts to identify these areas is crucial for future price prediction.

- Technical indicators suggesting strong support: Moving averages, such as the 200-day moving average, often act as strong support levels. The Relative Strength Index (RSI) can also signal oversold conditions, suggesting a potential bounce from a support level. A low RSI reading coupled with price action near a historical support level strengthens the potential for a price rebound.

- Psychological support levels: Round numbers like $20,000, $30,000, and $40,000 often act as significant psychological support levels. These levels represent price points where many investors are likely to buy, providing a strong base of support. Monitoring these Bitcoin support levels is essential for any serious Bitcoin price analysis.

Monitoring these levels helps identify potential buying opportunities. A break below a key support level, however, could signal further downward pressure and a negative shift in market sentiment.

H2: Analyzing Crucial Bitcoin Resistance Levels

Resistance levels represent price points where selling pressure is strong enough to prevent further price increases. These act as potential price ceilings. Identifying these is crucial for anticipating potential price corrections and managing risk.

- Historical resistance levels: The $60,000 to $69,000 range acted as significant resistance for Bitcoin in late 2021. Understanding why these levels proved challenging for Bitcoin's price to surpass provides valuable insight. Analyzing past Bitcoin price charts is key to recognizing these areas of resistance.

- Technical indicators suggesting strong resistance: Moving averages, particularly the 50-day and 200-day moving averages, often act as resistance levels. An overbought RSI reading suggests potential selling pressure and a likely price correction from a resistance level. This type of Bitcoin price analysis allows for more informed decisions.

- Psychological resistance levels: Round numbers such as $40,000, $50,000, and $100,000 represent significant psychological resistance levels for many investors. A break above these levels often signals strong bullish momentum.

The significance of resistance levels lies in their potential to predict selling pressure and subsequent price corrections. A failure to break above a key resistance level could indicate a temporary ceiling for Bitcoin's price.

H2: The Role of Macroeconomic Factors in Bitcoin Price Levels

Bitcoin's price is not immune to global economic events. Macroeconomic factors significantly impact its value and future price levels.

- Impact of inflation on Bitcoin's value as a hedge against inflation: Many investors view Bitcoin as a hedge against inflation, believing its limited supply will protect its value during periods of high inflation. This factor significantly impacts its potential for future price increases.

- Effect of interest rate hikes on cryptocurrency markets: Increased interest rates generally lead to a decrease in riskier assets, including cryptocurrencies, impacting potential Bitcoin future price predictions.

- Influence of regulatory changes on Bitcoin's price: Regulatory clarity or uncertainty regarding Bitcoin can significantly impact its price. Positive regulatory developments tend to boost investor confidence, while uncertainty or negative regulations can lead to price declines.

Considering these macroeconomic factors is crucial when analyzing Bitcoin's potential for future price movements. A Bitcoin price prediction must therefore take these into account.

H2: Predicting Future Bitcoin Price Levels: A Cautious Approach

Predicting Bitcoin's future price with certainty is impossible. While analyzing support and resistance levels and macroeconomic factors provides valuable insights, several limitations exist.

- Importance of fundamental analysis: Focus on Bitcoin's underlying technology, adoption rate, and network effects alongside price analysis for a more comprehensive understanding.

- The role of social sentiment and media hype: Social media sentiment and media coverage can significantly influence short-term price fluctuations, making accurate long-term predictions challenging.

- Risks associated with relying solely on price predictions: Avoid basing investment decisions solely on price predictions. Diversification and risk management are vital.

Remember, even the most sophisticated Bitcoin price analysis techniques cannot guarantee accurate predictions.

3. Conclusion

Successfully navigating the Bitcoin market requires a thorough understanding of key support and resistance levels, coupled with an awareness of macroeconomic factors and market sentiment. While predicting the future Bitcoin price with certainty is impossible, analyzing these factors can provide valuable insights. Stay informed about important Bitcoin price levels and their implications for your investment strategy. Continue your research and learn more about Bitcoin price analysis to make informed decisions in this dynamic market. Understanding these key Bitcoin price levels is your first step towards successful Bitcoin investment.

Featured Posts

-

The Impact Of Trumps Xrp Backing On Institutional Interest

May 08, 2025

The Impact Of Trumps Xrp Backing On Institutional Interest

May 08, 2025 -

Grand Theft Auto Vi Second Trailer Deep Dive Bonnie And Clyde Theme Analysis

May 08, 2025

Grand Theft Auto Vi Second Trailer Deep Dive Bonnie And Clyde Theme Analysis

May 08, 2025 -

Uber Stock Forecast Will Self Driving Technology Drive Growth

May 08, 2025

Uber Stock Forecast Will Self Driving Technology Drive Growth

May 08, 2025 -

Instituto De Cordoba Salud Financiera Del Club Central Cordoba En El Gigante De Arroyito

May 08, 2025

Instituto De Cordoba Salud Financiera Del Club Central Cordoba En El Gigante De Arroyito

May 08, 2025 -

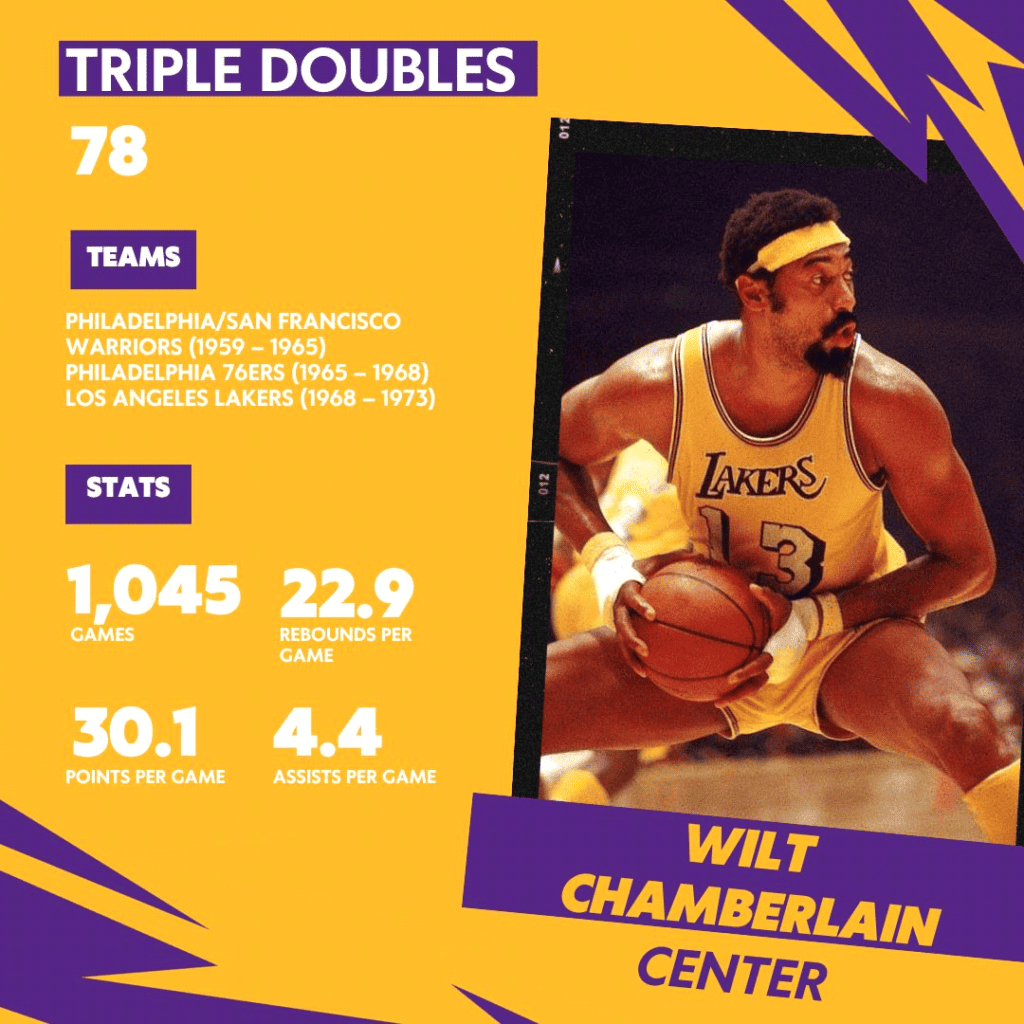

How Well Do You Know Nba Playoffs Triple Doubles Leaders

May 08, 2025

How Well Do You Know Nba Playoffs Triple Doubles Leaders

May 08, 2025