Bitcoin's Golden Cross: Analyzing The Implications For Price

Table of Contents

Understanding Bitcoin's Golden Cross

The Golden Cross is a bullish technical indicator formed when a shorter-term moving average crosses above a longer-term moving average. In the context of Bitcoin, this typically involves the 50-day moving average crossing above the 200-day moving average.

! (Replace with an actual chart)

This crossover is significant because it suggests a potential shift from a bearish to a bullish trend. Historically, the Golden Cross in various markets, including Bitcoin, has often been associated with upward price movements.

- Moving Averages Explained: Moving averages smooth out price fluctuations, providing a clearer picture of the overall trend. The 50-day moving average reflects shorter-term price action, while the 200-day moving average represents the long-term trend.

- Bullish Signal: When the 50-day MA crosses above the 200-day MA, it suggests that buying pressure is overcoming selling pressure, potentially signaling a sustained price increase.

- Death Cross vs. Golden Cross: The opposite scenario, where the 50-day MA crosses below the 200-day MA, is known as a Death Cross and is generally considered a bearish signal.

Historical Performance of Bitcoin's Golden Cross

Analyzing past instances of Bitcoin's Golden Cross reveals a mixed bag. While many occurrences have preceded periods of price appreciation, it's not a guaranteed predictor.

- Past Instances and Price Movements: For example, a Golden Cross in [Insert Date] was followed by a [percentage]% increase in Bitcoin's price over [timeframe]. Conversely, the Golden Cross in [Insert Date] resulted in a more modest price increase, highlighting the indicator's limitations.

- Duration and Magnitude of Price Increases: The duration and magnitude of price increases following a Golden Cross vary significantly. Some have led to prolonged bull runs, while others have resulted in only temporary price rallies.

- Exceptions and Inaccuracies: It's crucial to acknowledge that the Golden Cross is not infallible. There have been instances where a Golden Cross was followed by a continuation of the bearish trend or only a minor price bump.

Factors Influencing the Predictive Power of Bitcoin's Golden Cross

The accuracy of the Golden Cross as a predictive tool is significantly impacted by various factors. Ignoring these can lead to inaccurate interpretations and poor investment decisions.

- Market Sentiment: A strongly bearish market sentiment can negate the positive signal of a Golden Cross, as overall investor negativity might outweigh the technical indicator. Conversely, a bullish sentiment can amplify the impact of the Golden Cross.

- Macroeconomic Factors: Global economic conditions, such as inflation rates, regulatory changes, and geopolitical events, significantly influence Bitcoin's price, often overriding technical signals like the Golden Cross.

- Bitcoin Adoption Rate: Increased adoption and institutional investment can fuel price increases, regardless of the Golden Cross signal, while decreased adoption might dampen any potential rally.

- News Events and Regulatory Changes: Significant news events, regulatory announcements, and even social media trends can drastically affect Bitcoin's price, potentially overriding the predictive power of the Golden Cross. Whale activity and institutional investment also play a crucial role.

Interpreting Bitcoin's Golden Cross: Cautions and Considerations

While the Bitcoin Golden Cross can be a useful tool, it is essential to approach it with caution. It should never be the sole basis for investment decisions.

- Not a Guaranteed Predictor: The Golden Cross is not a crystal ball. It's a statistical observation, not a guarantee of future price movements. Past performance does not predict future results.

- Risk Management Strategies: Employing sound risk management techniques, such as setting stop-loss orders and diversifying your portfolio, is crucial to mitigate potential losses.

- Importance of Diversification: Don't put all your eggs in one basket. Diversify your investment portfolio across different asset classes to reduce risk.

- Thorough Research and Due Diligence: Always conduct comprehensive research and consider consulting with a financial advisor before making investment decisions.

Conclusion

Bitcoin's Golden Cross is a valuable technical indicator, but it's crucial to understand its limitations. While historically associated with bullish trends, its accuracy can be influenced by various market factors. Therefore, relying solely on the Golden Cross for investment decisions is risky. Successful Bitcoin investing requires a holistic approach, combining technical analysis with fundamental analysis, risk management, and a deep understanding of market dynamics. Don't solely rely on the Bitcoin Golden Cross; instead, use it as one piece of information in your broader investment strategy. Conduct thorough research and consult with a financial advisor before making any investment decisions related to Bitcoin's Golden Cross or any cryptocurrency.

Featured Posts

-

Prelista De Brasil Incluye A Neymar Posible Regreso Contra Argentina

May 08, 2025

Prelista De Brasil Incluye A Neymar Posible Regreso Contra Argentina

May 08, 2025 -

Filipe Luis Consigue Otro Titulo

May 08, 2025

Filipe Luis Consigue Otro Titulo

May 08, 2025 -

La Accion De Pulgar Que Llego Al Corazon De Los Hinchas Del Flamengo

May 08, 2025

La Accion De Pulgar Que Llego Al Corazon De Los Hinchas Del Flamengo

May 08, 2025 -

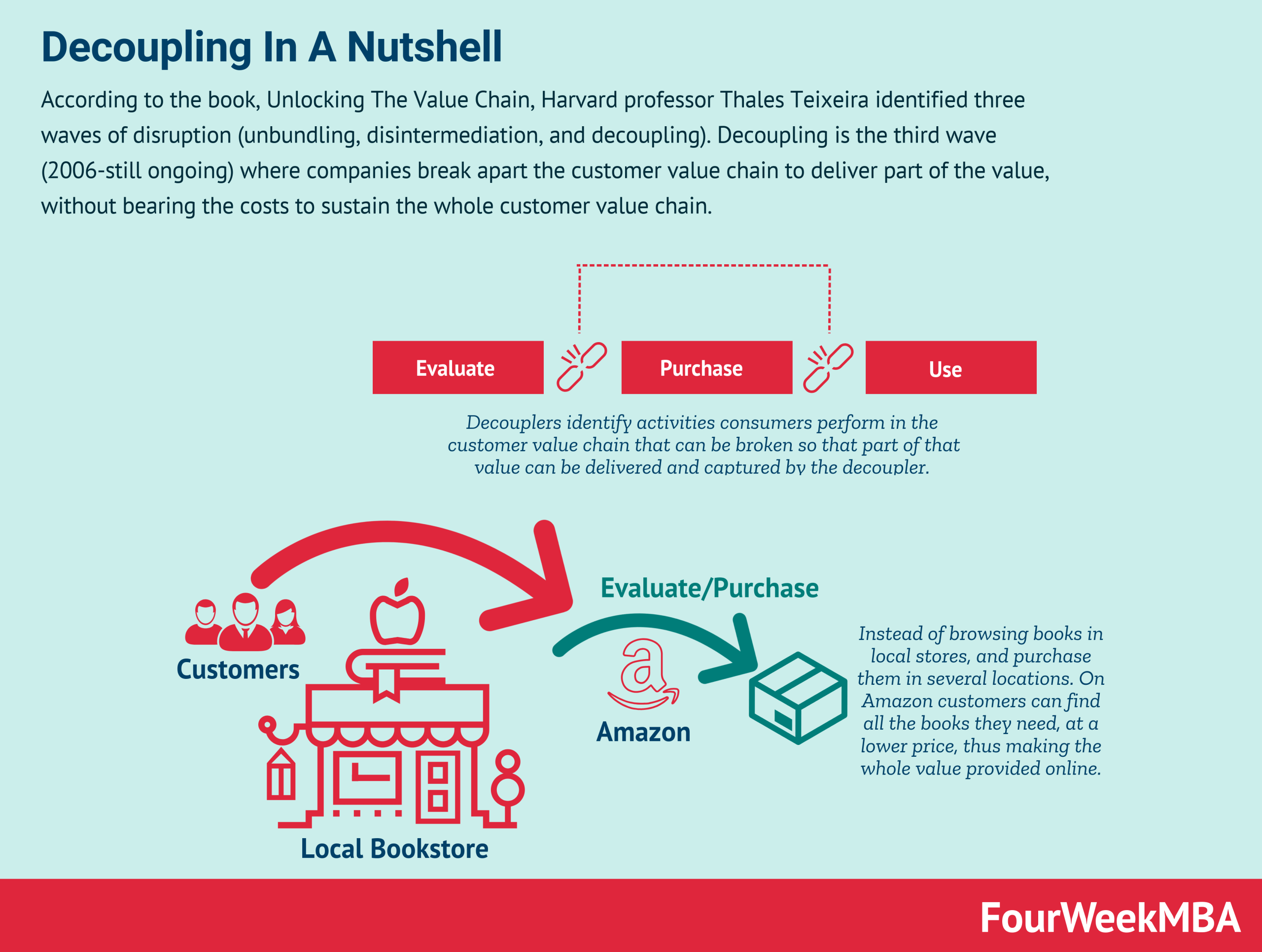

Is The Great Decoupling Inevitable Exploring The Evidence

May 08, 2025

Is The Great Decoupling Inevitable Exploring The Evidence

May 08, 2025 -

Jayson Tatum On Grooming Confidence And His Transformative Coaching Relationship

May 08, 2025

Jayson Tatum On Grooming Confidence And His Transformative Coaching Relationship

May 08, 2025