Bitcoin's Potential For Explosive Growth: A 1,500% Scenario

Table of Contents

Factors Fueling Potential Bitcoin Explosive Growth

Several converging factors suggest a potential for explosive Bitcoin growth, even exceeding the ambitious 1,500% mark. Let's explore some key drivers:

Increasing Institutional Adoption

The tide is turning. Once a niche asset for tech enthusiasts, Bitcoin is gaining significant traction among institutional investors. Large corporations, investment firms, and hedge funds are increasingly recognizing Bitcoin's potential as a store of value and a diversification tool within their portfolios. This institutional Bitcoin adoption signifies a shift towards mainstream acceptance and lends significant credibility to the asset.

- Grayscale Investments: This leading digital currency asset manager holds a substantial amount of Bitcoin, demonstrating institutional confidence.

- MicroStrategy's Bitcoin Holdings: MicroStrategy, a publicly traded business intelligence company, has made a bold commitment to Bitcoin, holding a significant portion of its treasury reserves in BTC.

- Tesla's Bitcoin Purchase: Tesla's investment in Bitcoin further solidified the cryptocurrency's legitimacy in the eyes of mainstream investors, causing a ripple effect across the market.

This growing interest in corporate Bitcoin holdings and the rise of Bitcoin investment funds are powerful catalysts for future price appreciation.

Growing Global Adoption and Decentralized Finance (DeFi)

Beyond institutional investors, global adoption of Bitcoin as a store of value and medium of exchange is accelerating. Countries like El Salvador have already embraced Bitcoin as legal tender, and the growth of Bitcoin ATMs worldwide reflects increasing accessibility. Furthermore, the burgeoning Decentralized Finance (DeFi) ecosystem is creating innovative use cases for Bitcoin, further fueling demand.

- Bitcoin adoption in El Salvador: This landmark decision has shown that Bitcoin can be integrated into national economies, potentially leading to wider adoption elsewhere.

- Growth of Bitcoin ATMs: The increasing availability of Bitcoin ATMs simplifies the process of buying and selling Bitcoin, making it more accessible to a broader population.

- DeFi applications using Bitcoin: The integration of Bitcoin into DeFi protocols expands its utility beyond simply holding it as a store of value, unlocking new possibilities for investors and users.

This expanding Bitcoin global adoption, coupled with the innovative applications made possible by DeFi, creates a powerful synergy pushing Bitcoin’s price upwards.

Scarcity and Limited Supply

Perhaps the most compelling argument for Bitcoin's future price appreciation is its inherent scarcity. Unlike fiat currencies that can be printed endlessly, Bitcoin has a fixed supply of 21 million coins. This deflationary nature ensures that as demand increases, the price must inevitably rise to maintain equilibrium.

- Bitcoin halving events: The halving events, which reduce the rate of new Bitcoin creation, further contribute to the scarcity and potential for price increases.

- Comparison with fiat currencies: The inflationary nature of most fiat currencies contrasts sharply with Bitcoin's deflationary characteristics, making Bitcoin a potentially attractive hedge against inflation.

- Increasing scarcity: As more Bitcoins are lost or held long-term, the circulating supply decreases, further enhancing scarcity.

This limited supply cryptocurrency characteristic of Bitcoin is a fundamental driver of its long-term value proposition.

Potential Risks and Challenges

While the bullish case for Bitcoin is strong, it's crucial to acknowledge the potential risks and challenges:

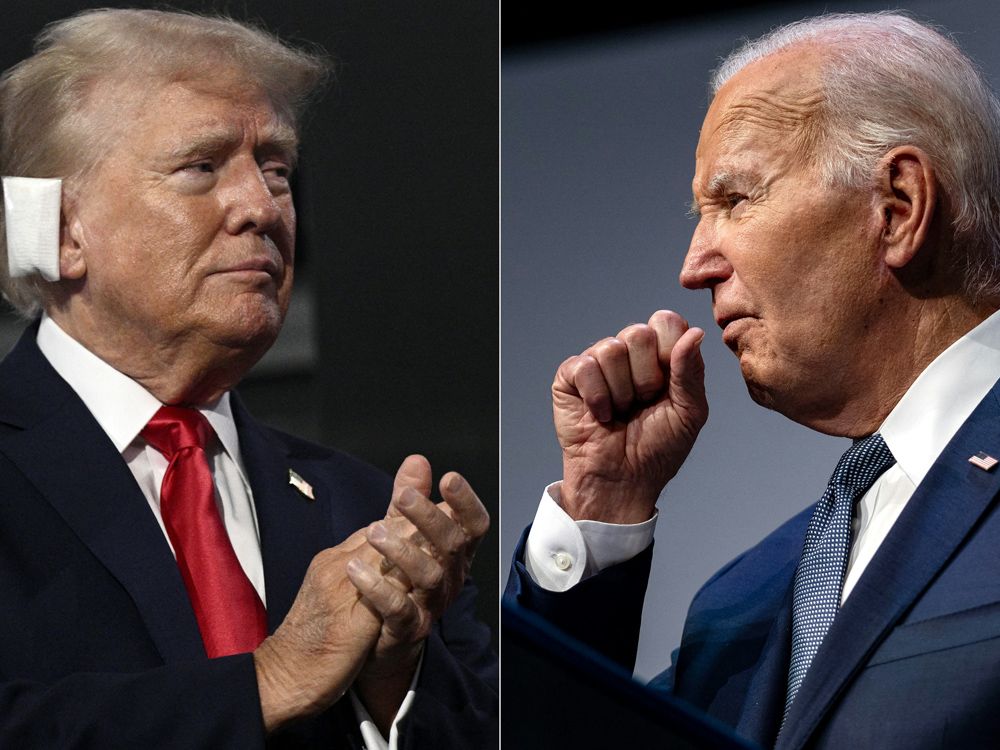

Regulatory Uncertainty and Government Intervention

Government regulations surrounding Bitcoin remain a significant source of uncertainty. Different countries have adopted varying approaches, creating a complex and often unpredictable regulatory landscape. Stringent regulations or outright bans could negatively impact Bitcoin's price.

- Bitcoin regulation in the US: The evolving regulatory framework in the US could influence Bitcoin's price trajectory.

- China's Bitcoin mining ban: China's ban on Bitcoin mining demonstrated the potential impact of government intervention.

- Regulatory hurdles: Navigating the complex web of regulations across different jurisdictions presents challenges for investors and businesses involved with Bitcoin.

This Bitcoin regulation uncertainty necessitates careful consideration of the regulatory risks involved.

Market Volatility and Price Corrections

The cryptocurrency market is inherently volatile, and Bitcoin is no exception. Sharp price corrections are a recurring feature of the market, posing a significant risk to investors.

- Historical Bitcoin price fluctuations: Examining past Bitcoin price fluctuations highlights the substantial volatility inherent in the asset.

- Market cycles: Understanding the cyclical nature of the cryptocurrency market can help investors manage their risk.

- Risk mitigation strategies: Employing various risk mitigation strategies is crucial for navigating the market's volatility.

Managing Bitcoin volatility requires a sophisticated understanding of market dynamics and risk management techniques.

Technological Risks and Security Concerns

Bitcoin's technology is not without its limitations. Potential technological vulnerabilities and security concerns could impact the price.

- 51% attacks: While unlikely, a 51% attack on the Bitcoin network could compromise its security and disrupt its functioning.

- Scaling issues: Addressing Bitcoin's scalability challenges is crucial for maintaining its efficiency and user experience.

- Security breaches: Security breaches at exchanges or wallets could lead to losses for investors, impacting market sentiment.

Understanding these Bitcoin security risks is paramount for investors and developers alike.

Conclusion: Is a 1,500% Bitcoin Growth Scenario Realistic?

The potential for Bitcoin's explosive growth is fueled by several key factors: increasing institutional adoption, growing global adoption driven by DeFi applications, and the inherent scarcity of its limited supply. However, significant risks and challenges remain, including regulatory uncertainty, market volatility, and technological vulnerabilities. While a 1,500% increase is a substantial and ambitious target, it's not entirely outside the realm of possibility given the right confluence of these factors. A balanced perspective is crucial; while the potential is immense, responsible investment strategies must account for the inherent risks. Learn more about Bitcoin's potential for explosive growth and start building your informed investment strategy today!

Featured Posts

-

Psg Ve Nantes Berabere Kaldi Mac Oezeti Ve Analizi

May 08, 2025

Psg Ve Nantes Berabere Kaldi Mac Oezeti Ve Analizi

May 08, 2025 -

Cusma Trump Declares It Beneficial Yet Reserves Right To Withdraw

May 08, 2025

Cusma Trump Declares It Beneficial Yet Reserves Right To Withdraw

May 08, 2025 -

Situacion Financiera De Central Cordoba Instituto De Cordoba Ofrece Perspectiva Positiva Desde El Gigante De Arroyito

May 08, 2025

Situacion Financiera De Central Cordoba Instituto De Cordoba Ofrece Perspectiva Positiva Desde El Gigante De Arroyito

May 08, 2025 -

Positive Signals From Washington On Canada Us Trade

May 08, 2025

Positive Signals From Washington On Canada Us Trade

May 08, 2025 -

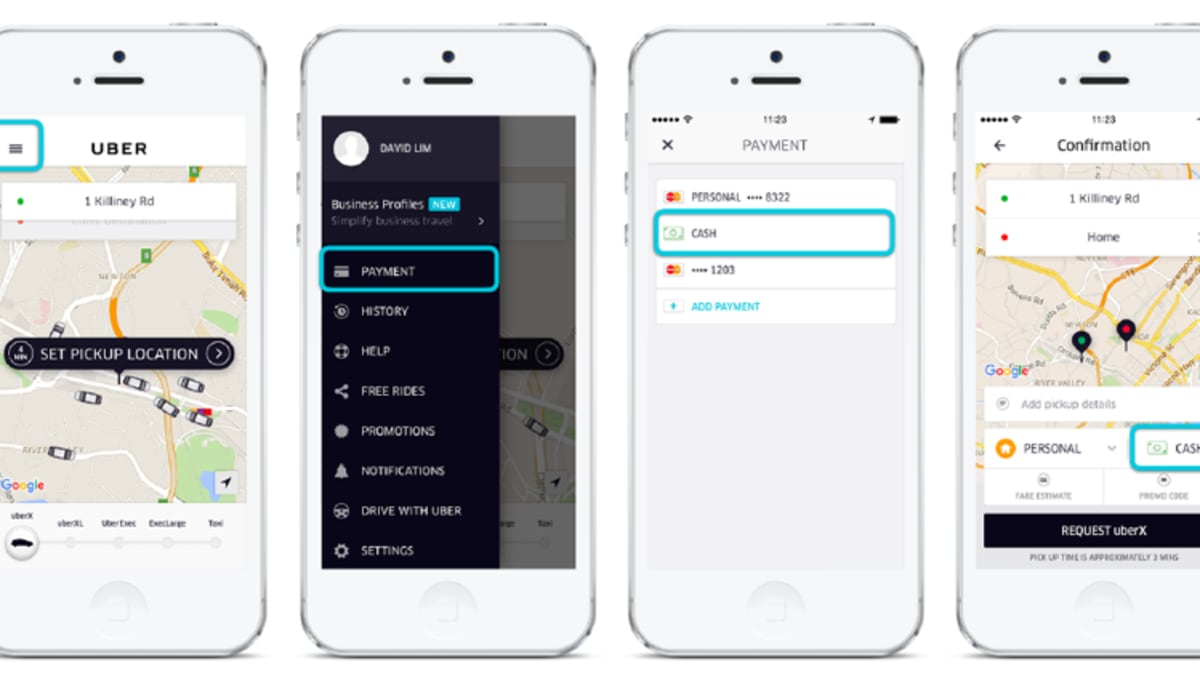

No More Cash On Uber Auto Upi Payments Explained

May 08, 2025

No More Cash On Uber Auto Upi Payments Explained

May 08, 2025