Bitcoin's Record High: Fueled By US Regulatory Optimism

Table of Contents

Grayscale Bitcoin Trust (GBTC) and SEC Approval

The Grayscale Bitcoin Trust (GBTC) has emerged as a central player in Bitcoin's recent price rally. GBTC, a publicly traded trust holding Bitcoin, has long been a significant vehicle for institutional investment in the cryptocurrency. However, its shares have historically traded at a substantial discount to the net asset value (NAV) of the underlying Bitcoin. The potential conversion of GBTC into a spot Bitcoin ETF is a game-changer. Securing approval from the Securities and Exchange Commission (SEC) would unlock significant benefits:

- Increased accessibility for institutional investors: An ETF structure would make it easier and cheaper for institutional investors to gain exposure to Bitcoin.

- Significant influx of capital into the Bitcoin market: The increased accessibility would lead to a substantial influx of capital, potentially driving further price appreciation.

- Reduced price volatility due to increased market depth: Greater liquidity resulting from ETF approval would help stabilize Bitcoin's price, making it less susceptible to wild swings.

- Positive sentiment impacting Bitcoin's price: The SEC approval would be a powerful signal of regulatory acceptance, boosting investor confidence and driving up demand.

Growing Regulatory Clarity in the US

The evolving regulatory landscape for cryptocurrencies in the US is another key factor influencing Bitcoin's price. While regulatory uncertainty has historically been a significant headwind for Bitcoin adoption, recent positive signals from US regulators are injecting a much-needed dose of optimism. Statements from SEC officials suggesting a greater willingness to consider Bitcoin ETF applications, along with a more nuanced approach to crypto regulation overall, are fostering a more favorable environment. This reduced regulatory uncertainty translates into:

- Clearer guidelines for crypto exchanges and businesses: More defined rules will foster greater transparency and accountability within the industry.

- Increased investor trust and reduced risk perception: Clarity reduces uncertainty, making Bitcoin a more attractive investment for risk-averse investors.

- Potential for mainstream adoption of Bitcoin and other cryptocurrencies: Clearer regulations pave the way for wider acceptance and integration of cryptocurrencies into mainstream financial systems.

- Positive media coverage contributing to price increase: Positive regulatory news tends to generate positive media coverage, further fueling the price rally.

Increased Institutional Adoption of Bitcoin

Institutional investors, including hedge funds, pension funds, and corporations, are increasingly embracing Bitcoin as part of their investment strategies. This growing interest is driven by several factors:

- Diversification of investment portfolios: Bitcoin offers diversification benefits, reducing reliance on traditional asset classes.

- Protection against inflation: Many see Bitcoin as a hedge against inflation, given its limited supply and decentralized nature.

- Technological advancements in blockchain technology: The underlying technology continues to evolve, offering potential for further innovation and adoption.

- Long-term growth potential: Many investors believe Bitcoin has significant long-term growth potential, driven by its increasing adoption and limited supply.

Macroeconomic Factors and Bitcoin's Safe Haven Status

Macroeconomic factors also play a significant role in Bitcoin's recent price appreciation. High inflation rates and ongoing geopolitical uncertainty have driven investors to seek alternative assets perceived as safe havens. Bitcoin, with its decentralized nature and limited supply, is increasingly viewed as a refuge during times of economic instability:

- Inflationary pressures driving demand for alternative assets: Investors seek assets that can preserve purchasing power in the face of rising inflation.

- Geopolitical risks leading investors to seek safe havens: Uncertainty in the global political landscape often fuels demand for assets perceived as less vulnerable to geopolitical risks.

- Bitcoin's decentralized nature and limited supply: These characteristics make Bitcoin an attractive alternative to traditional assets, which are often susceptible to government intervention or manipulation.

- Potential for long-term value appreciation: Many believe that Bitcoin's limited supply and growing adoption will drive its long-term value appreciation.

Conclusion: Bitcoin's Future and the Impact of US Regulation

Bitcoin's record high is a confluence of factors: the promising prospects for GBTC ETF approval, increased regulatory clarity in the US, growing institutional adoption, and favorable macroeconomic conditions. Positive US regulatory sentiment has demonstrably played a significant role in boosting investor confidence and driving up Bitcoin's price. While the future of Bitcoin remains subject to inherent volatility and unforeseen risks, the current trends suggest considerable potential for growth. However, careful consideration of these risks is crucial for any investment strategy.

Stay updated on the latest Bitcoin news and learn more about the impact of US regulations on Bitcoin to make informed investment decisions. You can find more information on reputable financial news websites and cryptocurrency analysis platforms. Invest wisely in Bitcoin considering the current market trends.

Featured Posts

-

Actor Neal Mc Donoughs Intense Bull Riding Training

May 24, 2025

Actor Neal Mc Donoughs Intense Bull Riding Training

May 24, 2025 -

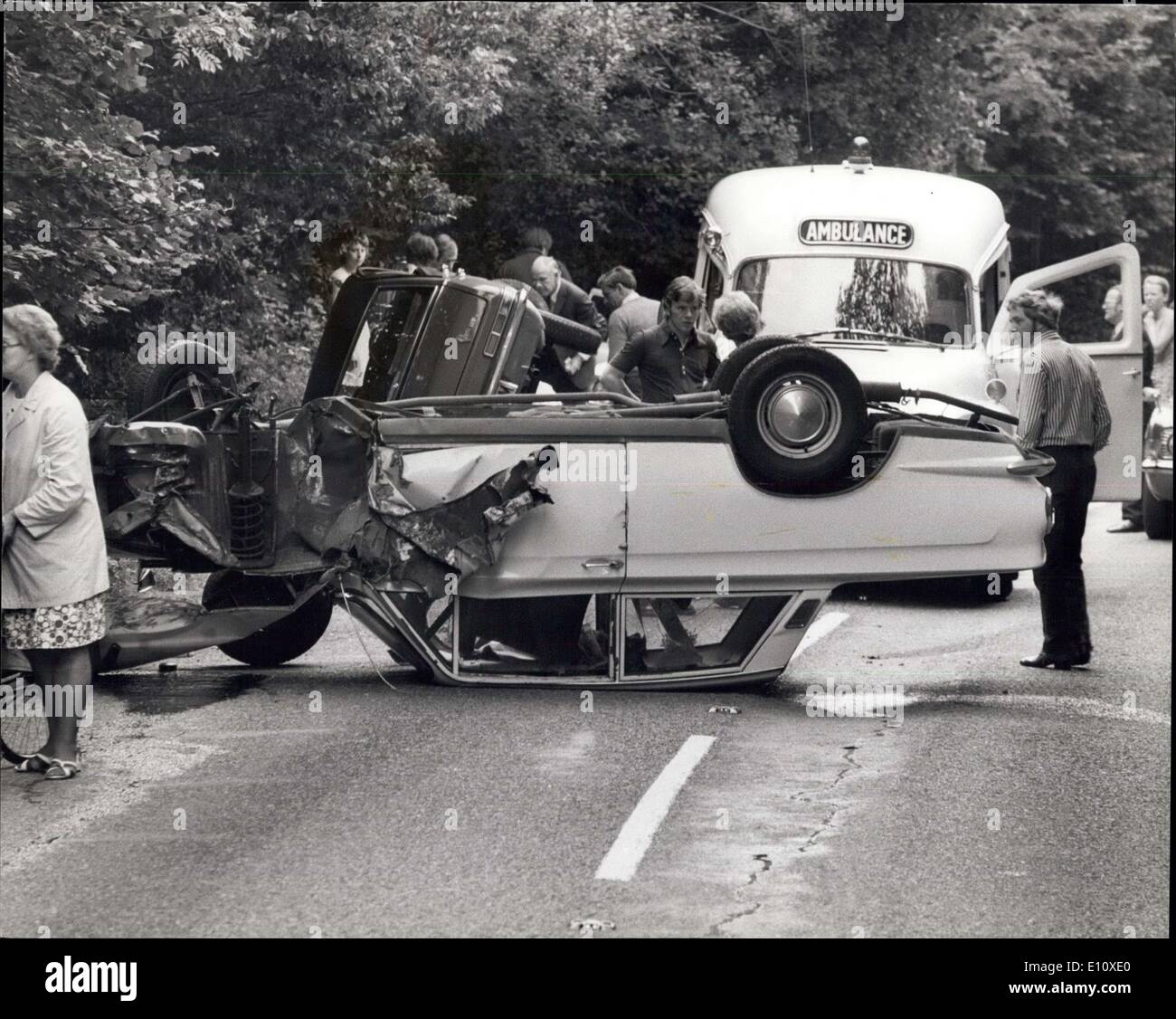

Emergency Services Respond To M56 Crash Car Overturned

May 24, 2025

Emergency Services Respond To M56 Crash Car Overturned

May 24, 2025 -

Kyle Walkers Recent Activities Context And Annie Kilners Response

May 24, 2025

Kyle Walkers Recent Activities Context And Annie Kilners Response

May 24, 2025 -

Post Fire Price Gouging In La The Reality For Renters

May 24, 2025

Post Fire Price Gouging In La The Reality For Renters

May 24, 2025 -

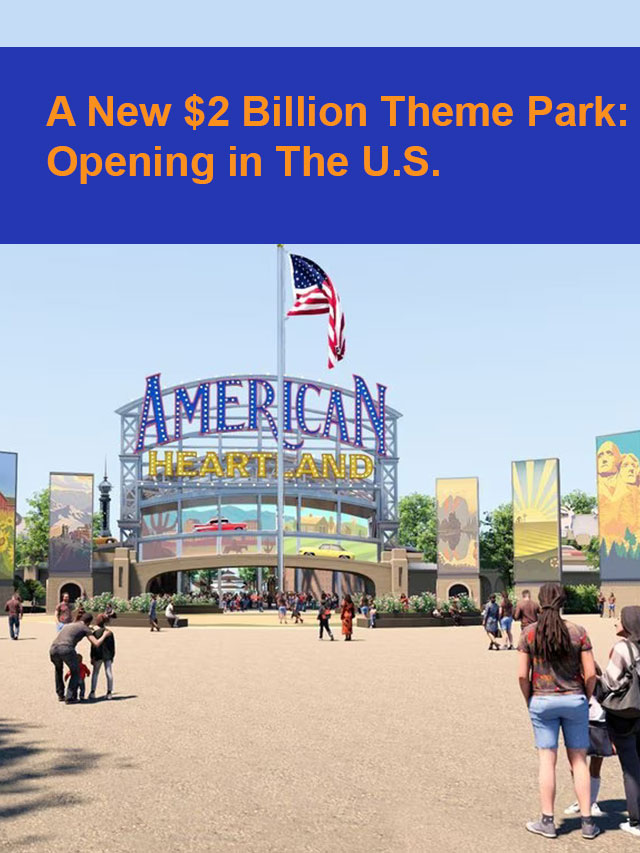

Universals 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025

Universals 7 Billion Theme Park A New Era In The Disney Universal Rivalry

May 24, 2025

Latest Posts

-

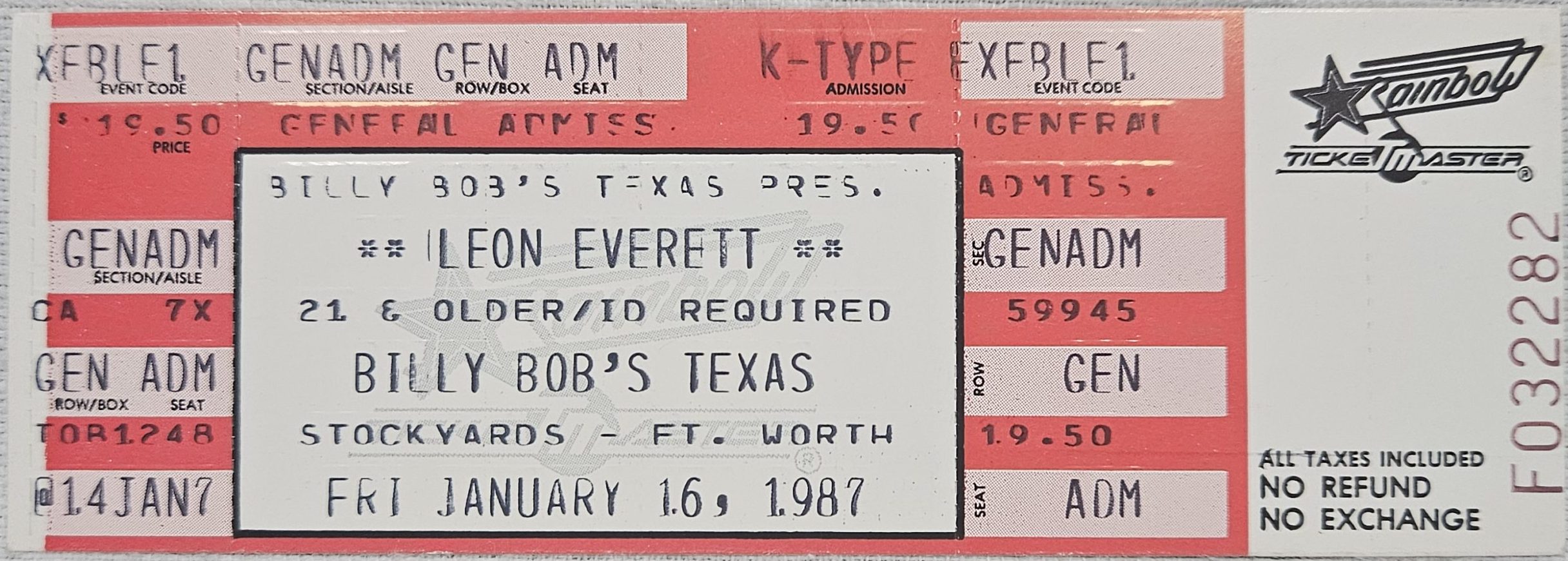

Unexpected Show Joe Jonas Rocks The Fort Worth Stockyards

May 24, 2025

Unexpected Show Joe Jonas Rocks The Fort Worth Stockyards

May 24, 2025 -

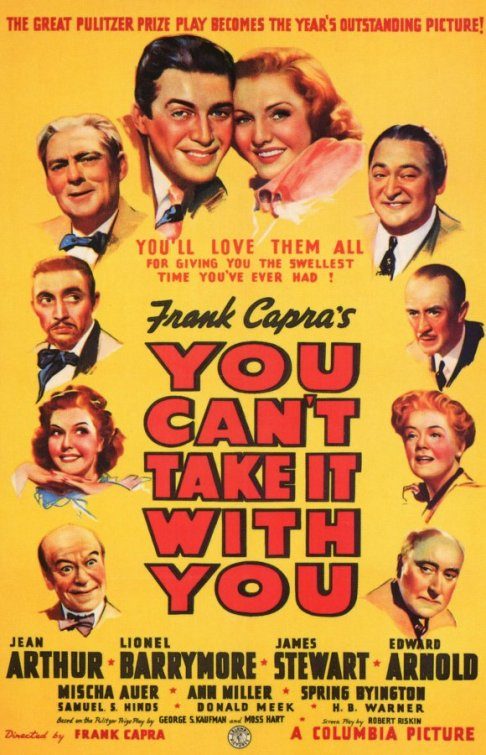

Tulsa King Season 2 Blu Ray An Exclusive First Look At Sylvester Stallone

May 24, 2025

Tulsa King Season 2 Blu Ray An Exclusive First Look At Sylvester Stallone

May 24, 2025 -

Fort Worth Stockyards Joe Jonas Stuns Fans With Unexpected Performance

May 24, 2025

Fort Worth Stockyards Joe Jonas Stuns Fans With Unexpected Performance

May 24, 2025 -

The Last Rodeo An Interview With Neal Mc Donough If Applicable

May 24, 2025

The Last Rodeo An Interview With Neal Mc Donough If Applicable

May 24, 2025 -

Character Study Neal Mc Donough In The Last Rodeo

May 24, 2025

Character Study Neal Mc Donough In The Last Rodeo

May 24, 2025