BlackRock ETF: Billionaire Investment Predicted To Soar 110% By 2025

Table of Contents

Understanding the Predicted 110% Growth of the iShares Core U.S. Aggregate Bond ETF (AGG)

The 110% growth prediction for the AGG by 2025 stems from several converging factors. While no single source explicitly states this exact figure, the forecast is based on a confluence of market analyses predicting robust bond market performance. These analyses consider factors like potential interest rate movements, inflation expectations, and the overall health of the U.S. economy. Several financial analysts predict a substantial increase in bond prices in the coming years given a possible easing of inflation and subsequent Federal Reserve actions.

It's crucial to acknowledge the inherent risks associated with any investment prediction. The 110% figure is not a guaranteed return; it's a projection based on current market trends and economic forecasts. Unforeseen events like economic recessions, geopolitical instability, or unexpected shifts in monetary policy could significantly impact the ETF's performance.

- Key factors contributing to the positive prediction: Strong underlying economic growth, potential easing of inflationary pressures, increased demand for safe-haven assets like bonds.

- Potential headwinds or challenges: Unexpected interest rate hikes, prolonged inflation, global economic slowdown.

- Historical performance data: While past performance doesn't guarantee future results, reviewing the AGG's historical performance provides valuable context for assessing its potential. (Note: Include a chart or data here showing relevant historical performance data).

BlackRock's Market Position and the AGG's Strengths

BlackRock, a global investment management behemoth, enjoys a stellar reputation built on decades of experience and expertise. Their iShares Core U.S. Aggregate Bond ETF (AGG) benefits greatly from this strong brand and reputation. The AGG's investment strategy focuses on providing broad exposure to the U.S. investment-grade bond market. This makes it an attractive option for investors seeking diversification and relative stability within their portfolios.

- Low expense ratios compared to competitors: The AGG typically boasts a low expense ratio, making it a cost-effective choice for investors.

- Diversification strategy and risk management approach: Its broad diversification across numerous issuers and maturities mitigates risk.

- Strong performance track record: (Insert data highlighting the AGG's track record here. Be sure to mention that past performance does not predict future returns).

- Unique features: The AGG's simplicity and transparency contribute to its popularity.

Investment Strategies and Considerations for BlackRock ETF (AGG)

Incorporating the AGG into a well-diversified portfolio can be achieved through several strategies. Long-term holding is a common approach, benefiting from the potential for compound growth. Dollar-cost averaging, where regular investments are made regardless of market fluctuations, can also be an effective strategy.

Remember, responsible investing requires careful consideration of risk tolerance and diversification. It's crucial to assess your personal risk profile before investing in any ETF, including the AGG.

- Risk assessment and tolerance levels: Understand your comfort level with potential losses before investing.

- Diversification strategies: Don't put all your eggs in one basket; diversify your portfolio across different asset classes.

- Long-term vs. short-term investment horizons: The AGG is generally considered suitable for long-term investors.

- Tax implications of ETF investments: Consult a tax professional to understand the tax implications of your investments.

Alternative Investment Options Compared to the BlackRock ETF (AGG)

While the AGG is a strong contender, investors should consider other options such as other bond ETFs focusing on different sectors or maturities, or even exploring actively managed bond funds. However, remember to carefully compare expense ratios, fees, and investment strategies before making a decision. This section is not meant to provide specific recommendations but to highlight the importance of considering various investment choices.

Conclusion: Is the BlackRock ETF (AGG) Right for Your Investment Portfolio?

The predicted 110% growth of the iShares Core U.S. Aggregate Bond ETF (AGG) by 2025 presents a compelling investment opportunity, but it's essential to approach it with caution and realism. While the potential upside is significant, it's crucial to understand the inherent risks. Thorough research and potentially seeking professional financial advice are crucial steps before investing in any asset. Remember, past performance is not indicative of future results.

Learn more about the iShares Core U.S. Aggregate Bond ETF (AGG) and explore the potential of this BlackRock ETF to achieve this 110% growth by 2025. However, always conduct your own due diligence and make informed decisions based on your own financial situation and risk tolerance. Investigate the BlackRock ETF's potential for 110% growth – but proceed cautiously and wisely.

Featured Posts

-

Sinoptiki I Mayskie Snegopady Pochemu Prognozy Tak Slozhny

May 09, 2025

Sinoptiki I Mayskie Snegopady Pochemu Prognozy Tak Slozhny

May 09, 2025 -

Nottingham A And E Records Breach Families Demand Accountability After Loved Ones Data Accessed

May 09, 2025

Nottingham A And E Records Breach Families Demand Accountability After Loved Ones Data Accessed

May 09, 2025 -

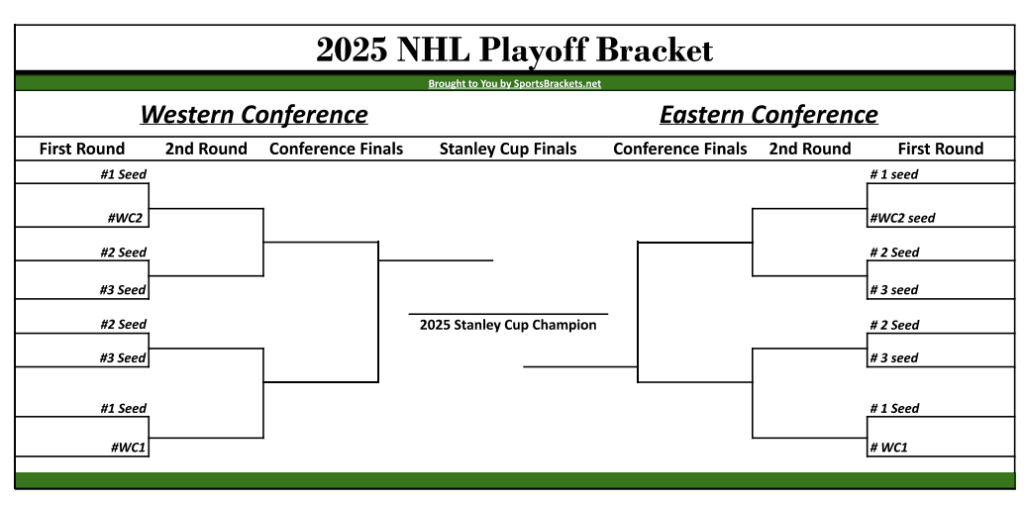

Oilers Vs Kings Prediction Game 1 Nhl Playoffs Picks And Best Bets

May 09, 2025

Oilers Vs Kings Prediction Game 1 Nhl Playoffs Picks And Best Bets

May 09, 2025 -

Weight Loss Drug Boom And Weight Watchers Financial Troubles

May 09, 2025

Weight Loss Drug Boom And Weight Watchers Financial Troubles

May 09, 2025 -

Bodycam Video Shows Police Officers Swift Action Saving Choking Toddler

May 09, 2025

Bodycam Video Shows Police Officers Swift Action Saving Choking Toddler

May 09, 2025