BMW And Porsche In China: Market Headwinds And Strategic Adjustments

Table of Contents

Headwinds Facing BMW and Porsche in the Chinese Market

The Chinese automotive market, while lucrative, presents formidable challenges for established luxury players like BMW and Porsche.

Increased Domestic Competition

The rise of powerful domestic Chinese brands like Nio, Xpeng, and BYD is dramatically reshaping the Chinese luxury car market. These companies are not only offering competitive pricing but also leveraging cutting-edge technology and sophisticated marketing strategies to attract younger, tech-savvy consumers.

- Model Comparisons: BYD's Han EV directly competes with the BMW 5 Series, while Nio's ET7 rivals the Porsche Taycan in terms of performance and luxury features. This direct competition is impacting market share significantly.

- Market Share Data: While precise figures fluctuate, the increasing market share of domestic electric vehicle (EV) brands is undeniable and poses a growing threat to the established luxury carmakers' dominance in the Chinese luxury car market.

- The emergence of these domestic automakers in China has forced BMW and Porsche to re-evaluate their strategies and offerings.

Economic Slowdown and Shifting Consumer Preferences

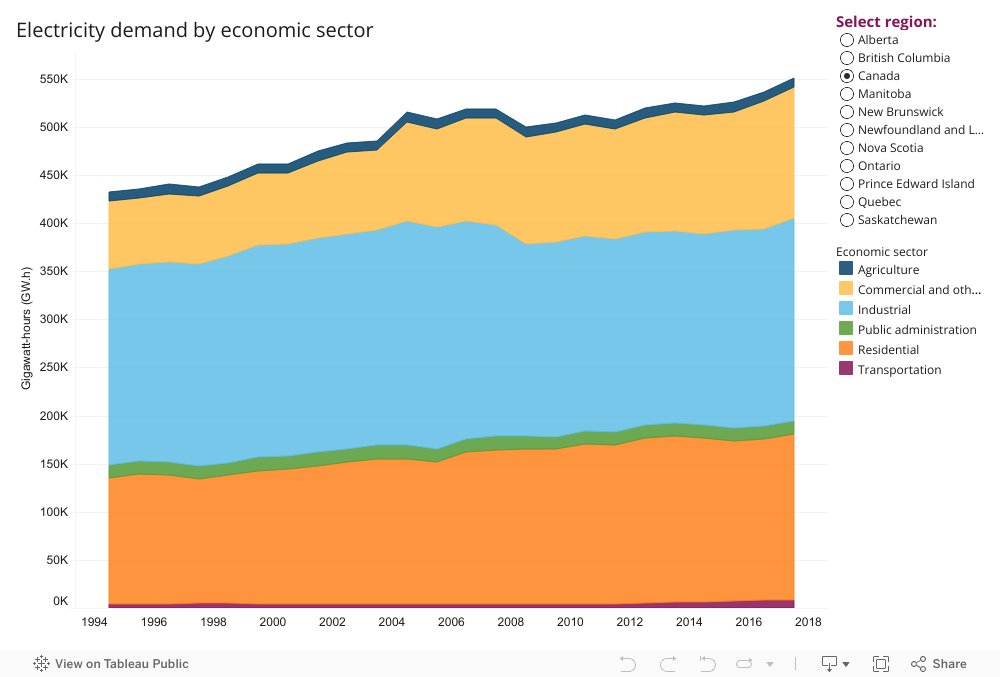

China's economic growth, once a consistent driver of luxury car sales, has shown signs of slowing down. This, coupled with evolving consumer preferences, poses a double challenge. Consumers are increasingly prioritizing electric vehicles (EVs) and advanced driver-assistance systems (ADAS).

- Statistics: Data from the National Bureau of Statistics of China reveals fluctuating consumer spending patterns, impacting discretionary purchases like luxury vehicles. The shift towards EVs is equally significant, with sales figures consistently demonstrating rapid growth in this segment.

- EV Preference: The demand for electric vehicles in China is booming, fuelled by government incentives and growing environmental awareness. Features like autonomous driving technology are also becoming key selling points for Chinese consumers.

- This shift towards EVs and technological advancements forces BMW and Porsche to invest heavily in their own electric vehicle offerings and related technologies to remain competitive in the EV market share in China.

Supply Chain Disruptions and Geopolitical Factors

Global supply chain disruptions, exacerbated by geopolitical tensions, impact the availability and pricing of imported vehicles. Trade policies and tariffs further complicate the situation for foreign automakers.

- Supply Chain Examples: The semiconductor chip shortage and disruptions to logistics networks have directly impacted production and delivery timelines for BMW and Porsche in China.

- Trade Policies: Trade policies and import restrictions, while not always directly targeting luxury vehicles, add layers of complexity and increase costs for these brands.

- The overall geopolitical risk and instability create uncertainty for long-term investment planning in the Chinese market for BMW and Porsche.

Strategic Adjustments by BMW and Porsche

To navigate these headwinds, BMW and Porsche are undertaking significant strategic adjustments.

Localization Strategies

Both brands are actively pursuing localization strategies to better resonate with Chinese consumers.

- Localized Production: BMW and Porsche are increasing local production to reduce reliance on imports and minimize logistical challenges.

- Features: They are tailoring vehicle features and specifications to meet local preferences, including offering unique trim levels and functionalities.

- Marketing Campaigns: Marketing campaigns are being localized to better engage with Chinese cultural nuances and digital platforms. Joint ventures and partnerships with Chinese companies are also being explored to further enhance market penetration. This strategy of product localization is crucial for success in this competitive market.

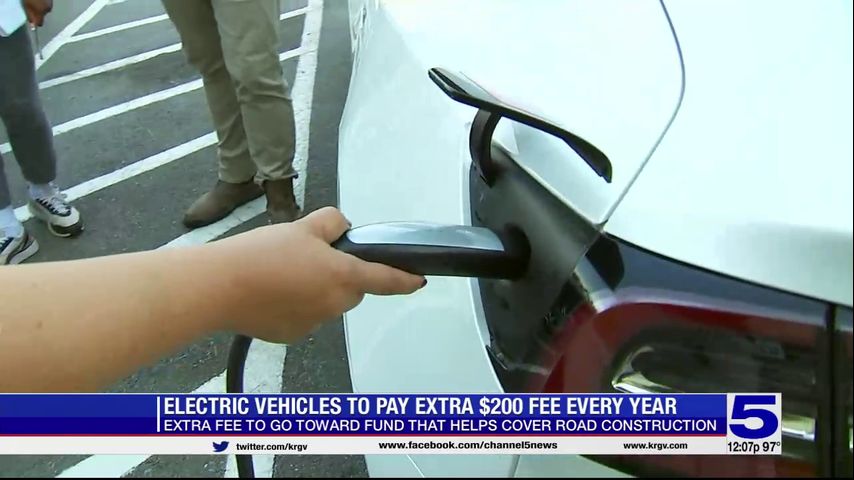

Electric Vehicle Push

Investment in electric vehicles is paramount for both brands.

- EV Models: BMW is aggressively expanding its i-series lineup in China, while Porsche is focusing on the Taycan and exploring other EV models suited to the Chinese market.

- Charging Infrastructure: Partnerships are being forged to enhance charging infrastructure, addressing range anxiety concerns amongst potential buyers. This strategic investment in electric vehicles in China is essential for future competitiveness.

- This concerted push into the electric vehicle market is a direct response to the rapidly growing demand for EVs in China.

Digital Marketing and Customer Engagement

Digital marketing is playing a crucial role in reaching Chinese consumers.

- Social Media: Leveraging platforms like WeChat and Weibo for targeted advertising and customer engagement is paramount.

- Online Campaigns: Successful digital marketing campaigns often involve influencer collaborations and interactive online experiences tailored to Chinese audiences.

- The use of digital marketing China and social media marketing China is vital for reaching the tech-savvy consumers in this market.

Charting a Course for Success: BMW and Porsche's Future in China

The Chinese automotive market presents both significant challenges and immense opportunities for BMW and Porsche. The headwinds discussed – intensified domestic competition, economic fluctuations, and supply chain disruptions – demand agile and adaptive strategies. Localization, a robust EV push, and sophisticated digital marketing are key to navigating this dynamic landscape. The long-term prospects for BMW and Porsche in China hinge on their ability to continually adapt to the evolving preferences of Chinese consumers and the complexities of the market. The future success of BMW and Porsche in China will depend on their continued commitment to localization and innovation.

What are your thoughts on the future of BMW and Porsche in China? Share your insights and predictions in the comments below. The ongoing evolution of this crucial market demands continued analysis and discussion.

Featured Posts

-

Enforcement Action Pfc Stops Eo W Transfer Based On Gensols False Documents

Apr 27, 2025

Enforcement Action Pfc Stops Eo W Transfer Based On Gensols False Documents

Apr 27, 2025 -

Robert Pattinson And The Horror Movie That Kept Him Awake

Apr 27, 2025

Robert Pattinson And The Horror Movie That Kept Him Awake

Apr 27, 2025 -

Ariana Grandes New Look A Deep Dive Into The Professional Help She Received

Apr 27, 2025

Ariana Grandes New Look A Deep Dive Into The Professional Help She Received

Apr 27, 2025 -

Pne Ag Ad Hoc Mitteilung Gemaess Wp Hg 40 Abs 1

Apr 27, 2025

Pne Ag Ad Hoc Mitteilung Gemaess Wp Hg 40 Abs 1

Apr 27, 2025 -

Motherhood And Triumph Belinda Bencics Return To Wta Winning Ways

Apr 27, 2025

Motherhood And Triumph Belinda Bencics Return To Wta Winning Ways

Apr 27, 2025

Latest Posts

-

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025

Broadcoms V Mware Acquisition At And T Highlights Extreme Price Increase Concerns

Apr 28, 2025 -

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025

1 050 Price Hike At And T Challenges Broadcoms V Mware Acquisition Proposal

Apr 28, 2025 -

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025

Assessing The Us Economy The Immediate Effects Of A Canadian Travel Boycott

Apr 28, 2025 -

Canadian Travel Boycott A Fed Snapshot Reveals Economic Repercussions

Apr 28, 2025

Canadian Travel Boycott A Fed Snapshot Reveals Economic Repercussions

Apr 28, 2025 -

Car Dealerships Renew Pushback Against Electric Vehicle Regulations

Apr 28, 2025

Car Dealerships Renew Pushback Against Electric Vehicle Regulations

Apr 28, 2025