BOE Rate Cut Probabilities Diminish: Pound Gains Momentum Post-Inflation Announcement

Table of Contents

Inflation Data Surprises Markets

The latest inflation figures released have significantly deviated from market expectations, revealing a more robust UK economy than previously anticipated. This unexpected resilience in the face of global economic headwinds has sparked a reassessment of the BOE's likely course of action. The data points to a more persistent inflationary pressure than many economists predicted.

- CPI (Consumer Price Index): The CPI rose by X%, exceeding forecasts of Y%. This indicates continued pressure on consumer spending and highlights the ongoing challenge of controlling inflation.

- RPI (Retail Price Index): The RPI, another key inflation metric, showed a similar upward trend, registering a Z% increase. This further solidifies the picture of persistent inflation.

- Impact on BOE Policy: This persistent UK inflation significantly impacts BOE monetary policy decisions. The higher-than-expected figures reduce the probability of a near-term rate cut and may even increase the likelihood of future interest rate hikes. The BOE aims to maintain price stability, and these figures suggest that goal remains some way off.

Market Reaction and Pound Sterling's Strength

The immediate market reaction to the inflation announcement was a sharp appreciation of the Pound Sterling against major currencies. The reduced expectation of a BOE rate cut, indicating a stronger UK economy, fueled this positive movement.

- GBP/USD: The Pound rose significantly against the US dollar, reaching a level not seen in several months.

- GBP/EUR: Similar gains were observed against the Euro, reflecting increased confidence in the UK economy.

- Reasons Beyond Inflation: The Pound's strength isn't solely attributable to the inflation data. Factors such as improving global economic sentiment and a perceived increase in political stability within the UK have also contributed to its rise. This positive combination of domestic and global factors boosted the GBP exchange rate.

Shifting BOE Rate Expectations and Future Outlook

The unexpected inflation figures have dramatically altered the landscape of BOE rate expectations. The probability of a BOE rate cut has diminished significantly, while the possibility of future interest rate hikes has increased.

- Future Interest Rate Hikes: Analysts now predict a higher probability of the BOE raising interest rates in the coming months to combat persistent inflation. The market is pricing in a more hawkish stance from the central bank.

- BOE Statements: While official statements from the BOE Governor and other officials remain to be seen, market speculation leans towards a more cautious and potentially restrictive monetary policy approach.

- Uncertainties and Risks: Geopolitical events and global economic fluctuations remain significant risks and could influence the BOE's decisions. The UK's economic outlook remains subject to several unpredictable variables.

Impact on Investors and Businesses

The shift in BOE rate cut probabilities has significant implications for investors and businesses alike.

- Investors: The reduced likelihood of a rate cut has impacted bond yields and stock market volatility. Investors are reassessing their portfolios to accommodate the changing economic environment. Higher interest rates generally lead to lower bond prices.

- Businesses: Higher interest rates translate into increased borrowing costs for UK businesses, potentially affecting investment decisions and impacting economic growth. Businesses will need to adjust their financial planning in light of the new expectations.

BOE Rate Cut Probabilities Diminish: A Positive Outlook for the Pound?

The unexpected inflation data has significantly reduced the likelihood of a BOE rate cut, leading to a strengthening of the Pound Sterling. This positive shift reflects market confidence in the UK economy's resilience. The implications for investors are substantial, requiring careful portfolio adjustments. Businesses need to prepare for potentially higher borrowing costs. Understanding BOE rate cut probabilities is crucial for navigating the current economic landscape. Stay tuned for further updates on BOE policy and how changes in BOE rate cut probabilities might affect your financial planning. Understanding BOE rate cut probabilities is crucial for making informed investment decisions.

Featured Posts

-

Promena Imena Vanje Mijatovic Reakcije Javnosti

May 23, 2025

Promena Imena Vanje Mijatovic Reakcije Javnosti

May 23, 2025 -

Todays Happy News Dylan Dreyer And Brian Fichera Share Family Joy

May 23, 2025

Todays Happy News Dylan Dreyer And Brian Fichera Share Family Joy

May 23, 2025 -

Dallas Chef Tiffany Derrys Master Chef Judging Return

May 23, 2025

Dallas Chef Tiffany Derrys Master Chef Judging Return

May 23, 2025 -

Antonys Almost Transfer To Manchester Uniteds Biggest Rivals

May 23, 2025

Antonys Almost Transfer To Manchester Uniteds Biggest Rivals

May 23, 2025 -

Exploring The Netflix Cobra Kai Karate Kid Link A Showrunner Interview

May 23, 2025

Exploring The Netflix Cobra Kai Karate Kid Link A Showrunner Interview

May 23, 2025

Latest Posts

-

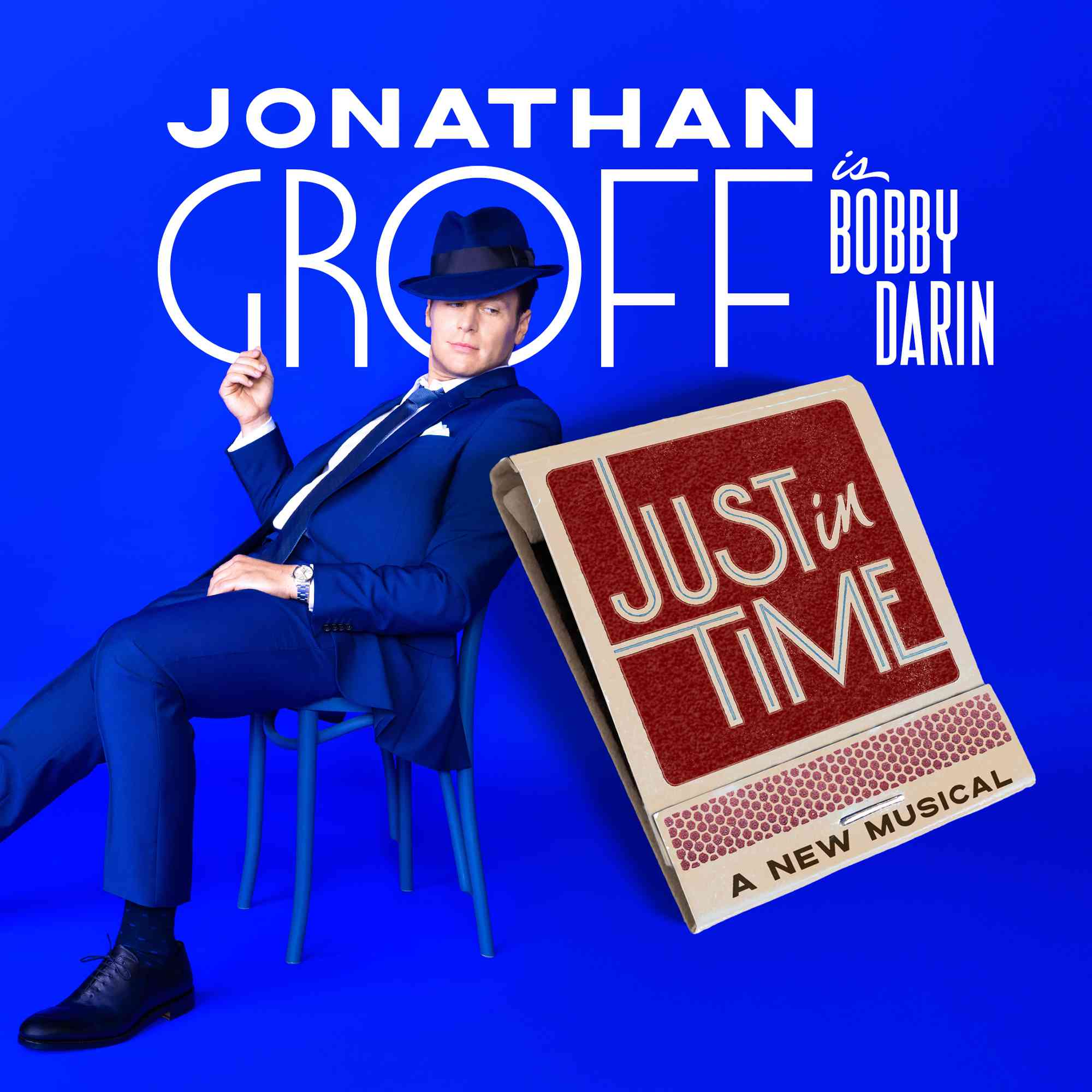

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025 -

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025 -

Jonathan Groff Discusses His Experiences With Asexuality

May 23, 2025

Jonathan Groff Discusses His Experiences With Asexuality

May 23, 2025 -

Jonathan Groffs Bobby Darin Transformation Just In Time And The Power Of Performance

May 23, 2025

Jonathan Groffs Bobby Darin Transformation Just In Time And The Power Of Performance

May 23, 2025 -

Broadway Buzz Jonathan Groffs Just In Time And The Raw Energy Of Bobby Darin

May 23, 2025

Broadway Buzz Jonathan Groffs Just In Time And The Raw Energy Of Bobby Darin

May 23, 2025