BofA On Stock Market Valuations: Why Investors Shouldn't Panic

Table of Contents

BofA's Perspective on Current Stock Market Valuations

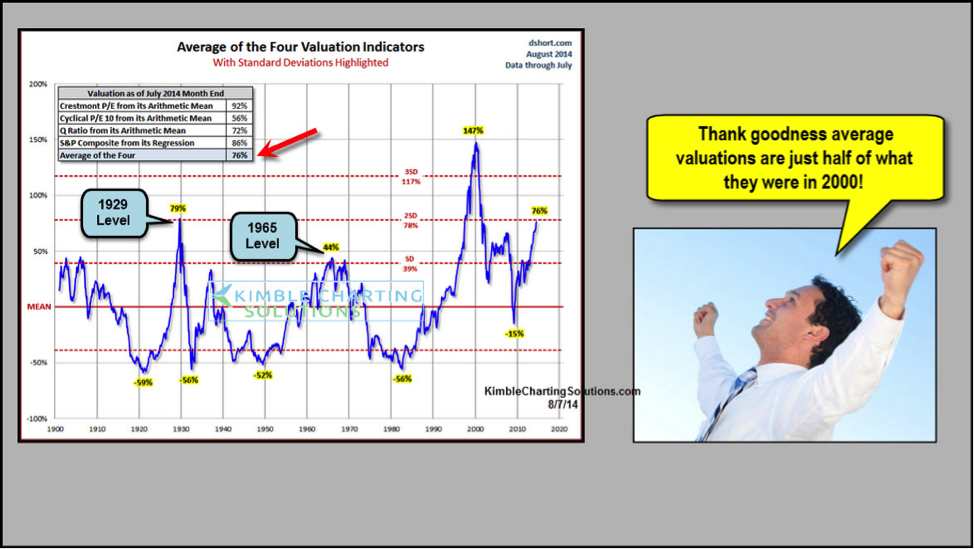

BofA's recent reports on market valuations provide a relatively balanced view, cautioning against knee-jerk reactions. While acknowledging some sectors are richly valued, they haven't issued a blanket warning of an impending crash. Their analysis often incorporates various metrics, including Price-to-Earnings (P/E) ratios, sector-specific growth projections, and macroeconomic factors.

- Key Findings: BofA's analysis often suggests that while certain sectors might be overvalued, the overall market isn't drastically overpriced. They might point to a specific P/E ratio that, while elevated compared to historical averages, is still within a reasonable range considering projected future earnings growth. Their reports seldom suggest a market crash is imminent.

- Sector Analysis: BofA typically provides detailed sector analysis, highlighting sectors deemed potentially undervalued (e.g., specific technology sub-sectors experiencing strong innovation) and those considered overvalued (e.g., certain consumer discretionary sectors potentially sensitive to interest rate hikes). This nuanced approach avoids sweeping generalizations.

- Methodology: BofA's methodology typically incorporates a combination of quantitative and qualitative factors. This includes analyzing historical data, evaluating current economic conditions, assessing corporate earnings reports, and considering future growth prospects. Their reports often emphasize the importance of considering long-term trends rather than reacting to short-term volatility.

Factors Supporting BofA's Optimistic Outlook

Despite market volatility, several factors contribute to BofA's relatively positive long-term outlook:

- Strong Corporate Earnings (or Potential): Many companies continue to report solid earnings, demonstrating resilience amidst economic uncertainty. BofA's analysis often points to specific sectors with consistent growth and strong profit margins. Future earnings projections also play a significant role in their valuation assessments.

- Low Interest Rates (or Projected Trajectory): While interest rates are rising, BofA might suggest that the projected trajectory remains relatively low compared to historical highs. This could continue to support borrowing and investment, stimulating economic growth.

- Government Stimulus Measures: Government policies and stimulus packages can significantly impact economic performance. BofA's analysis may incorporate the potential effects of such measures on overall market valuations and sector-specific growth.

- Technological Advancements: The continued advancement of technology often fuels innovation and growth in various sectors. BofA's reports often emphasize the potential of disruptive technologies to drive future market expansion.

Addressing Investor Concerns Regarding Market Volatility

It's understandable that investors are concerned by market fluctuations. However, it's crucial to remember that volatility is an inherent part of the market.

- Short-Term Volatility vs. Long-Term Growth: Short-term market dips are normal and shouldn't be interpreted as a definitive indicator of a long-term downturn. History shows that markets have always recovered from periods of uncertainty.

- Long-Term Investment Horizon: The key to navigating market volatility is maintaining a long-term investment strategy. Focusing on long-term growth allows investors to ride out short-term fluctuations without panic selling.

- Risk Management Strategies: Diversification is paramount. Spreading investments across different asset classes and sectors mitigates risk. Dollar-cost averaging, a strategy involving regular investments regardless of market conditions, can also help manage volatility.

Alternative Investment Strategies Based on BofA's Analysis

BofA's analysis can inform strategic investment decisions.

- Sector Selection: Based on BofA's insights, investors might consider shifting their portfolio toward sectors deemed undervalued or with strong growth potential. This requires careful consideration of individual risk tolerance.

- Focus on Long-Term Growth: The emphasis should always be on long-term growth potential, not short-term gains. This involves careful research and selection of companies with strong fundamentals and sustainable competitive advantages.

- Portfolio Diversification: Diversification remains crucial, irrespective of market conditions. A well-diversified portfolio cushions against sector-specific downturns.

Conclusion

BofA's analysis suggests that while market valuations warrant attention, they don't necessarily signal a reason for widespread panic. Their nuanced perspective highlights the importance of a long-term investment strategy, risk management, and considering both macroeconomic factors and sector-specific analyses. Don't let short-term stock market valuations dictate your long-term investment strategy. Use BofA's insights to inform your decisions and approach the stock market with a balanced, long-term perspective. Consider consulting a financial advisor for personalized guidance on your stock market investments and how to manage stock market valuations effectively. Learn more about BofA's market analysis and refine your approach to stock market valuations today!

Featured Posts

-

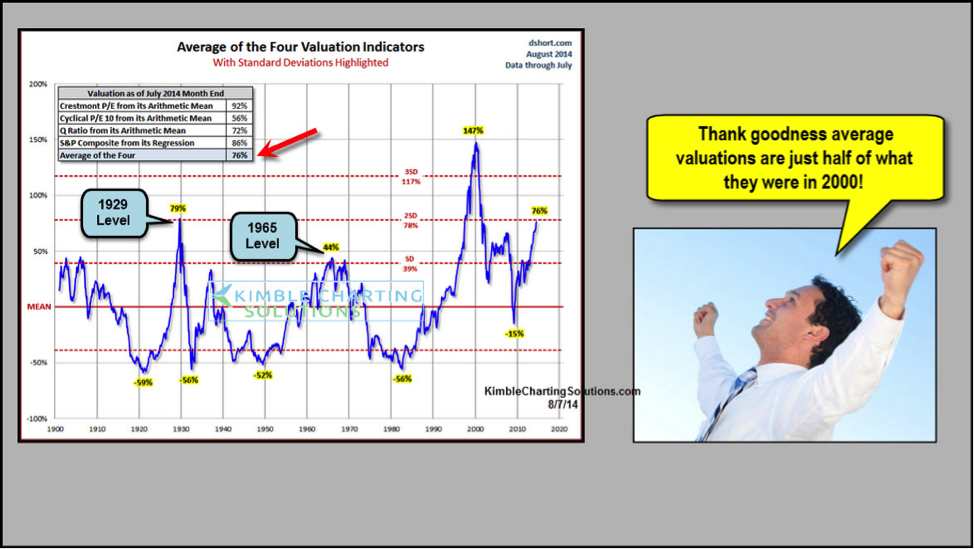

2025 Us Holiday Calendar Federal And Non Federal Holidays

Apr 23, 2025

2025 Us Holiday Calendar Federal And Non Federal Holidays

Apr 23, 2025 -

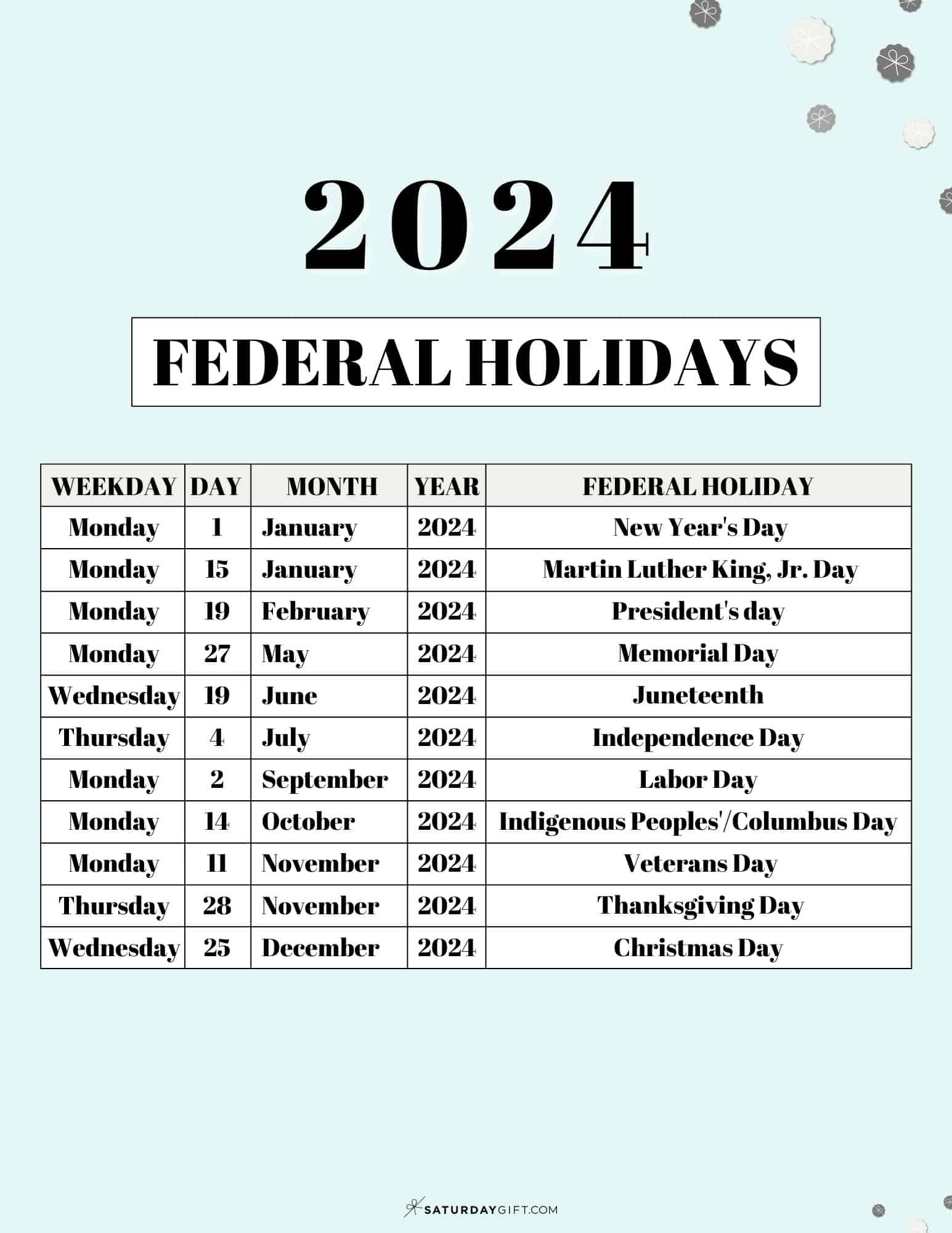

Giants Flores And Lee Power Win Against Brewers

Apr 23, 2025

Giants Flores And Lee Power Win Against Brewers

Apr 23, 2025 -

La Carte Blanche Decryptage De L Approche De Dominique Carlach

Apr 23, 2025

La Carte Blanche Decryptage De L Approche De Dominique Carlach

Apr 23, 2025 -

Prediksi Pernikahan Weton Senin Legi Dan Rabu Pon Panduan Primbon Jawa

Apr 23, 2025

Prediksi Pernikahan Weton Senin Legi Dan Rabu Pon Panduan Primbon Jawa

Apr 23, 2025 -

Supreme Court Weighs In Parental Rights Vs Lgbtq Inclusive Curriculum In Elementary Schools

Apr 23, 2025

Supreme Court Weighs In Parental Rights Vs Lgbtq Inclusive Curriculum In Elementary Schools

Apr 23, 2025