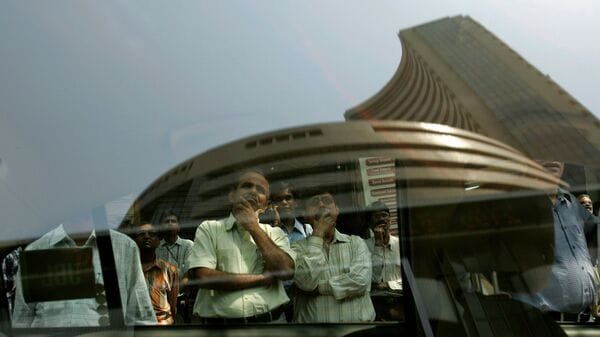

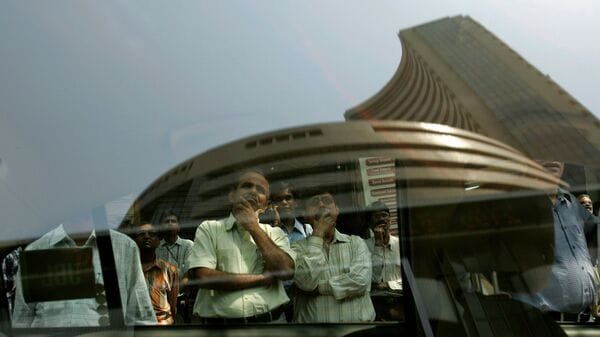

BofA: Understanding And Addressing Concerns About Stretched Stock Market Valuations

Table of Contents

BofA's Perspective on Current Market Valuations

BofA's market outlook frequently incorporates sophisticated valuation models to assess the overall health and potential risks within the stock market. Their analyses often utilize key valuation metrics such as the price-to-earnings ratio (P/E) and the price-to-sales ratio (P/S) to determine whether the market is fairly valued, undervalued, or, as is the current concern, overvalued. By examining these ratios across various sectors and comparing them to historical averages and projected earnings growth, BofA develops a comprehensive understanding of market valuation.

-

BofA's Overall Stance: While specific pronouncements change based on market conditions, BofA's recent reports often express a degree of caution regarding current valuations, highlighting potential risks associated with high valuations. Their exact stance should be referenced in their most recent public reports.

-

Potentially Overvalued Sectors: BofA's analysis may pinpoint specific sectors, such as technology or certain consumer discretionary segments, as potentially overvalued based on their valuation models and market forecasts. Closely following their reports helps investors identify potentially risky areas.

-

Influencing Economic Factors: BofA's valuation assessment is influenced by several key economic factors. Interest rate hikes, inflation levels, geopolitical uncertainties, and overall economic growth projections all play a significant role in their analyses and impact their assessment of the market's valuation. Understanding these factors is crucial for interpreting BofA's outlook.

Understanding the Risks of Stretched Valuations

Investing in a market with potentially stretched valuations presents several significant risks. High valuations often precede market corrections or even more substantial downturns. Understanding these risks is critical for informed investment decision-making.

-

Potential for Capital Losses: A market correction, driven by the unwinding of overvalued assets, can lead to significant capital losses. Investors holding highly valued stocks are particularly vulnerable during such events.

-

Increased Volatility: Markets with stretched valuations tend to experience heightened volatility. Price swings can be more dramatic, making it challenging to time the market effectively and increasing the potential for losses.

-

Importance of Risk Management and Diversification: Diversifying investments across different asset classes and sectors is a crucial risk management strategy in a potentially overvalued market. This reduces the impact of losses in any single sector.

Strategies for Navigating Stretched Valuations

Given BofA's analysis and the inherent risks, investors need to adopt strategic approaches to navigate the current market landscape. While BofA does not offer direct financial advice, their research can inform investment strategies.

-

Value Investing: Focusing on undervalued stocks or companies with strong fundamentals but relatively low valuations compared to their peers can be a suitable strategy. This approach aims to profit from companies whose potential isn't yet fully reflected in their market price.

-

Portfolio Diversification: Spreading investments across various asset classes (stocks, bonds, real estate, etc.) is essential to mitigate risk. This helps to balance out potential losses in one sector.

-

Regular Portfolio Review and Rebalancing: Regularly reviewing and rebalancing your portfolio helps ensure your asset allocation aligns with your risk tolerance and investment goals, adjusting to market changes highlighted by sources like BofA.

-

Seek Professional Advice: Consulting a financial advisor is highly recommended. They can help you develop a personalized investment strategy tailored to your specific circumstances and risk tolerance, considering insights from firms like BofA.

BofA's Recommendations (if available)

[This section should be populated with any publicly available specific recommendations from BofA. Clearly state that this is a summary of publicly available information and does not constitute financial advice. If BofA has not issued specific stock picks or recommendations, this section can be omitted or replaced with a statement to that effect.]

Conclusion

BofA's analysis highlights the potential risks associated with stretched stock market valuations. Understanding these risks and employing appropriate strategies, such as diversification and value investing, is crucial for navigating the current market conditions. While BofA's insights are valuable, remember that this information is for educational purposes only. Thorough research and consultation with a financial advisor are essential for developing a personalized investment strategy that addresses your specific concerns about stretched stock market valuations. Stay informed about BofA's ongoing market analysis for updates and insights on stock market valuation.

Featured Posts

-

Witt Jr And Garcia Lead Royals To Victory Over Guardians

May 01, 2025

Witt Jr And Garcia Lead Royals To Victory Over Guardians

May 01, 2025 -

Gillian Anderson And Chris Carters Thoughts On A Ryan Coogler X Files Series

May 01, 2025

Gillian Anderson And Chris Carters Thoughts On A Ryan Coogler X Files Series

May 01, 2025 -

Is Nothings Phone 2 The Future Of Modular Phones

May 01, 2025

Is Nothings Phone 2 The Future Of Modular Phones

May 01, 2025 -

Hamdi Yildirim Kadinlar Boks Sampiyonasi Samsun Daki Heyecan Dorukta

May 01, 2025

Hamdi Yildirim Kadinlar Boks Sampiyonasi Samsun Daki Heyecan Dorukta

May 01, 2025 -

Analyzing The Cleveland Cavaliers Week 16 Trade And Rest Impact

May 01, 2025

Analyzing The Cleveland Cavaliers Week 16 Trade And Rest Impact

May 01, 2025