BofA's Reassurance: Are High Stock Market Valuations A Cause For Concern?

Table of Contents

BofA's Stance on High Stock Market Valuations

BofA's official position on current stock market valuations isn't a blanket statement of alarm. While acknowledging the elevated levels, their analysis suggests a more nuanced perspective. Instead of outright panic, their reports emphasize the need for careful consideration and a strategic approach. BofA's analysts cite a combination of factors supporting their outlook, suggesting that while valuations are high, they aren't necessarily unsustainable in the short to medium term.

- Key arguments from BofA's report: BofA's analysts point to strong corporate earnings, accommodative monetary policy, and continued investor confidence as key factors supporting current valuations. They also highlight the resilience of the US economy as a factor to consider.

- Specific sectors: While BofA generally maintains a cautiously optimistic view, their reports may highlight specific sectors, like technology or certain consumer discretionary stocks, as potentially overvalued. Conversely, other sectors might be identified as relatively undervalued, offering potential investment opportunities. This sector-specific analysis is crucial for developing a tailored investment strategy.

- Economic indicators: BofA likely uses a range of key economic indicators in their analysis, including inflation rates, interest rate forecasts, and GDP growth projections. These indicators help to contextualize the valuation levels and forecast future market performance.

Analyzing the Factors Contributing to High Valuations

Several interconnected factors contribute to the current high stock market valuations. Understanding these elements is crucial for assessing the long-term outlook.

Low Interest Rates

Low interest rates significantly impact stock valuations. When interest rates are low, the return on safer investments like bonds decreases, making stocks a relatively more attractive option for investors seeking higher yields. This increased demand pushes stock prices upward, contributing to higher valuations.

- Example: The prolonged period of near-zero interest rates following the 2008 financial crisis significantly contributed to the bull market that followed.

- Data: Historical data clearly shows a strong inverse correlation between interest rates and stock market valuations.

Strong Corporate Earnings

Robust corporate earnings are another significant driver of high stock prices. Strong profitability boosts investor confidence, leading to increased demand for company shares. This increased demand, in turn, elevates market valuations.

- Example: The tech sector's consistently strong earnings have played a significant role in boosting overall market valuations.

- Data: Analysis of S&P 500 earnings growth over the past few years reveals a strong upward trend.

Inflation and Monetary Policy

Inflation and central bank monetary policy exert considerable influence on stock market valuations. Inflation erodes the purchasing power of money, impacting investor sentiment and potentially leading to increased stock prices as investors seek to protect their assets. Central bank actions, such as interest rate adjustments, also play a significant role in shaping market behavior and valuations.

- Example: The Federal Reserve's response to the COVID-19 pandemic, including significant interest rate cuts and quantitative easing, fueled a surge in stock prices.

- Data: Tracking inflation rates and central bank policy announcements provides valuable insights into their impact on market valuations.

Potential Risks Associated with High Valuations

While BofA might present a relatively optimistic outlook, it's crucial to acknowledge the inherent risks associated with investing in a market characterized by high valuations.

- Market corrections or crashes: High valuations often precede market corrections or even crashes. When investor sentiment shifts, or unexpected economic events occur, a sharp decline in prices can occur.

- Increased risk of losses: Investing in a highly valued market inherently carries a higher risk of losses. The potential for a significant downturn is greater when valuations are already elevated.

- Importance of diversification and risk management: Diversification across various asset classes and the implementation of robust risk management strategies are paramount in mitigating the potential negative impact of high valuations.

BofA's Investment Recommendations & Strategies

BofA's investment recommendations will likely advocate for a cautious yet opportunistic approach. They might not advise against investing altogether but rather suggest strategic adjustments to navigate the current environment.

- Recommended asset allocation: BofA's recommendations likely include a diversified portfolio, perhaps with a slightly more conservative allocation than during periods of lower valuations.

- Specific sectors or investment vehicles: They might recommend specific sectors or investment vehicles that they deem less susceptible to the risks associated with high valuations, possibly focusing on value stocks or defensive sectors.

- Risk mitigation strategies: Strategies such as hedging, using stop-loss orders, and carefully managing position sizing are crucial elements of risk mitigation that BofA will likely emphasize.

Conclusion

BofA's stance on high stock market valuations is not one of outright fear, but rather cautious optimism. While acknowledging the elevated levels, their analysis highlights supporting factors like strong corporate earnings and accommodative monetary policy. However, the inherent risks associated with high valuations, such as the potential for market corrections and increased risk of losses, cannot be ignored. Therefore, BofA's likely investment recommendations would emphasize diversification, risk management, and a strategic approach to portfolio construction. Understand BofA's insights on high stock market valuations and make informed investment decisions. Don't ignore BofA's assessment of high stock market valuations – take control of your financial future. Remember to conduct thorough research and consult with a qualified financial advisor before making any investment decisions.

Featured Posts

-

One Dead Multiple Injured In Clearwater Ferry Collision

Apr 29, 2025

One Dead Multiple Injured In Clearwater Ferry Collision

Apr 29, 2025 -

The Unexpected Rise Of Macario Martinez From Street Sweeper To National Fame

Apr 29, 2025

The Unexpected Rise Of Macario Martinez From Street Sweeper To National Fame

Apr 29, 2025 -

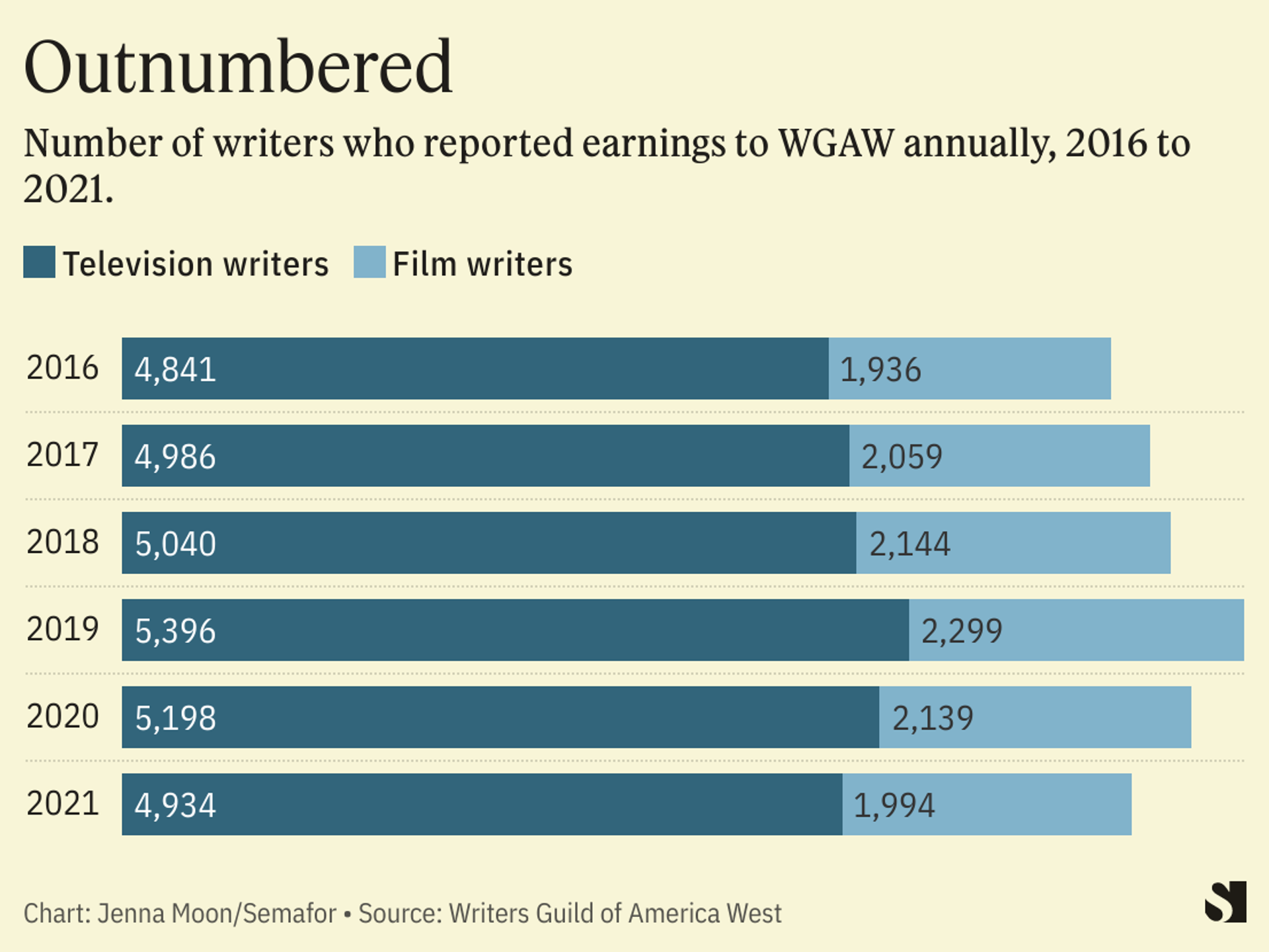

Double Strike Cripples Hollywood Actors And Writers Demand Fair Treatment

Apr 29, 2025

Double Strike Cripples Hollywood Actors And Writers Demand Fair Treatment

Apr 29, 2025 -

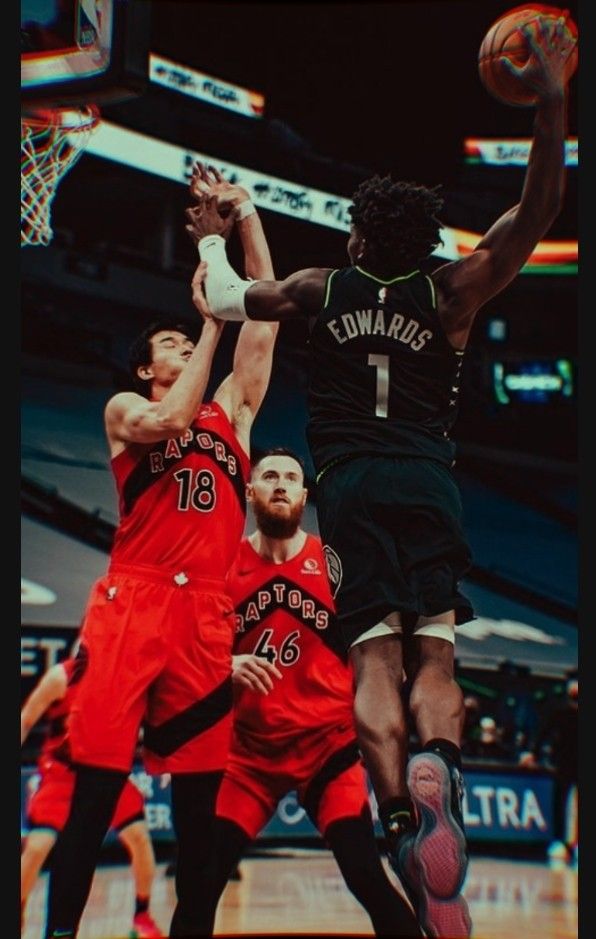

Anthony Edwards Fined 50 K By Nba Over Fan Interaction

Apr 29, 2025

Anthony Edwards Fined 50 K By Nba Over Fan Interaction

Apr 29, 2025 -

Attorney Generals Transgender Sports Ban Legal Showdown With Minnesota

Apr 29, 2025

Attorney Generals Transgender Sports Ban Legal Showdown With Minnesota

Apr 29, 2025

Latest Posts

-

Solving The Nyt Spelling Bee Hints And Answers For February 26th Puzzle 360

Apr 29, 2025

Solving The Nyt Spelling Bee Hints And Answers For February 26th Puzzle 360

Apr 29, 2025 -

Nyt Spelling Bee February 12 2025 Clues Answers And Pangram

Apr 29, 2025

Nyt Spelling Bee February 12 2025 Clues Answers And Pangram

Apr 29, 2025 -

Nyt Spelling Bee February 10 2025 Find The Pangram And All Answers

Apr 29, 2025

Nyt Spelling Bee February 10 2025 Find The Pangram And All Answers

Apr 29, 2025 -

Nyt Spelling Bee Answers February 12 2025 Complete Guide

Apr 29, 2025

Nyt Spelling Bee Answers February 12 2025 Complete Guide

Apr 29, 2025 -

Solve The Nyt Spelling Bee February 10 2025 Answers And Strategies

Apr 29, 2025

Solve The Nyt Spelling Bee February 10 2025 Answers And Strategies

Apr 29, 2025