BofA's Reassurance: Are Stretched Stock Market Valuations A Concern?

Table of Contents

BofA's Stance on Current Market Valuations

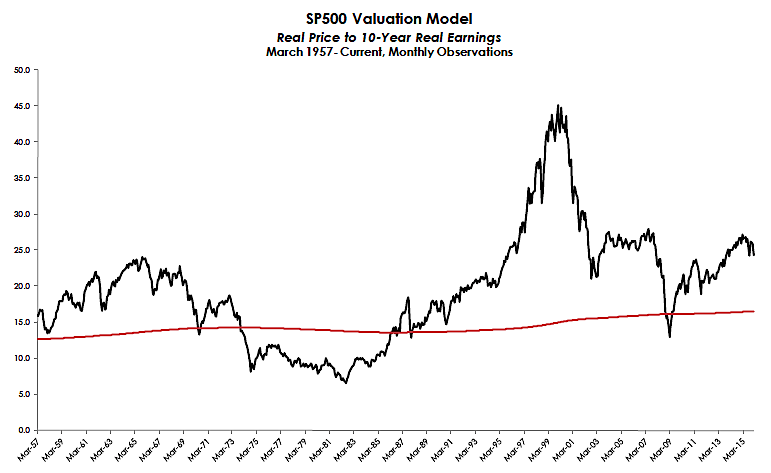

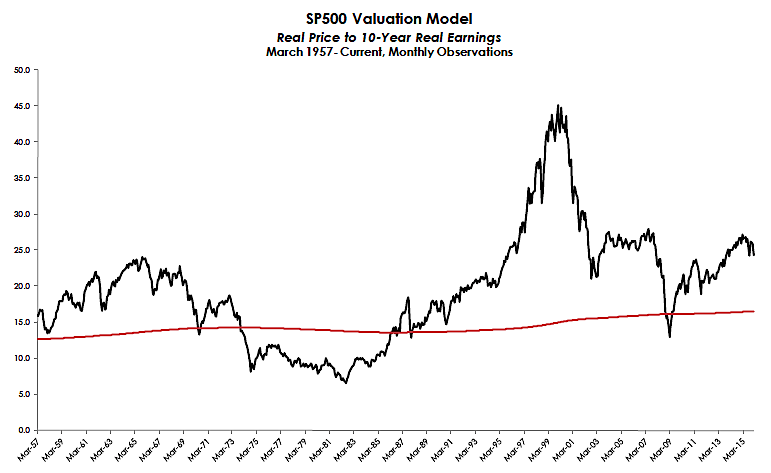

BofA's official stance on current market valuations is nuanced. While acknowledging that valuations appear elevated by historical standards, their analysis suggests a more cautious, rather than overtly pessimistic, outlook. Their assessment relies on a variety of valuation metrics, including the widely used price-to-earnings ratio (P/E ratio) and the cyclically adjusted price-to-earnings ratio (Shiller P/E), which adjusts for inflation and economic cycles. They also consider factors like market capitalization and earnings growth forecasts.

-

Summary of BofA's key findings regarding valuations: BofA's recent reports haven't declared a definitive "overvalued" market, but they emphasize the need for careful consideration given the current elevated levels. Their analyses often point to specific sectors showing higher valuations than others.

-

Mention specific valuation metrics used in BofA's analysis: BofA typically uses a range of metrics, including P/E ratios, Shiller P/E ratios, and various growth-adjusted valuation models to arrive at a comprehensive picture. These metrics provide different perspectives, allowing for a more nuanced understanding of market valuations.

-

Highlight any caveats or qualifications BofA includes in their assessment: BofA consistently emphasizes that its analysis is not a prediction of future market movements. Their assessments acknowledge the influence of factors such as low interest rates and strong corporate earnings on valuations. They typically caution against making investment decisions based solely on valuation metrics.

Factors Contributing to Stretched Valuations

Several interconnected factors have contributed to the current environment of seemingly stretched stock market valuations. These include:

-

Impact of low interest rates on stock valuations: Historically low interest rates make bonds less attractive, pushing investors towards higher-yielding assets like stocks, thereby increasing demand and prices. This is a key factor driving up valuations.

-

Effect of quantitative easing (QE) on market liquidity and prices: The massive injection of liquidity into the market through QE programs by central banks has increased market liquidity, supporting asset prices, including stocks. This increased liquidity fuels speculation and can lead to inflated valuations.

-

Influence of inflation expectations on stock prices: Expectations of future inflation can influence stock prices. If investors anticipate higher inflation, they may bid up stock prices in anticipation of future earnings growth.

-

Contribution of robust corporate earnings to high valuations: Strong corporate earnings, or the expectation thereof, can justify higher valuations. However, it's crucial to evaluate whether these earnings are sustainable in the long term and are accurately reflected in the current market prices.

-

Role of investor confidence and speculation: High investor confidence and speculative trading can drive stock prices higher, even in the face of seemingly high valuations. This is a particularly important factor to consider during periods of exuberant market sentiment.

Potential Risks Associated with High Valuations

Investing in a market with stretched valuations comes with inherent risks:

-

Risk of a market correction or downturn: High valuations leave less room for error. Any negative economic news or shift in investor sentiment could trigger a significant market correction or even a bear market.

-

Potential for increased volatility in the short-term: Markets with high valuations tend to exhibit increased volatility, leading to potentially sharp price swings in the short term.

-

Importance of diversification to mitigate risk: Diversification is critical in a high-valuation environment. Spreading investments across different asset classes and sectors helps reduce the impact of a potential downturn in any single sector.

-

Strategies for managing risk in a high-valuation environment: Investors might consider strategies like hedging, reducing overall equity exposure, or focusing on undervalued assets to mitigate the risks associated with potentially stretched market valuations.

BofA's Recommendations and Investment Strategies

BofA's recommendations usually emphasize a cautious yet balanced approach. They don't typically advocate for a complete market exit, but rather a strategic approach based on risk tolerance and investment horizons.

-

Summary of BofA's investment recommendations: BofA's recommendations often involve a selective approach, favoring companies with strong fundamentals and sustainable earnings growth over highly speculative investments.

-

Suggested asset allocation strategies: They typically suggest adjusting asset allocation based on an investor’s risk profile, potentially reducing exposure to higher-valuation sectors and increasing allocation to defensive assets during periods of perceived market overvaluation.

-

Advice on managing risk based on individual investor profiles: The bank typically underscores the importance of aligning investment strategies with individual risk tolerances and long-term financial goals.

-

Emphasis on long-term investment horizons: BofA consistently emphasizes the importance of maintaining a long-term perspective, suggesting that investors with a longer time horizon may be better positioned to weather short-term market volatility.

Conclusion

BofA's assessment of stretched stock market valuations reflects a balanced perspective, acknowledging the elevated levels while emphasizing the need for careful consideration rather than immediate panic. Factors such as low interest rates, QE, and strong corporate earnings have contributed significantly to the current situation. However, the potential for market corrections and increased volatility remains a key risk. BofA's recommendations typically center on a diversified portfolio, a strategic approach to asset allocation, and a long-term investment horizon. Make informed decisions about your portfolio by carefully considering BofA's assessment of stretched stock market valuations and adapting your investment strategy accordingly. Remember to conduct thorough research and consult with a financial advisor before making any significant investment decisions.

Featured Posts

-

May 2025 New York Daily News Accessing Past Issues

May 17, 2025

May 2025 New York Daily News Accessing Past Issues

May 17, 2025 -

Singapore Airlines Staff To Receive Over 7 Months Bonus St Report

May 17, 2025

Singapore Airlines Staff To Receive Over 7 Months Bonus St Report

May 17, 2025 -

Josh Cavallo Breaking Barriers After Coming Out

May 17, 2025

Josh Cavallo Breaking Barriers After Coming Out

May 17, 2025 -

Market Chaos The Ultra Wealthy Find Stability In Luxury Real Estate

May 17, 2025

Market Chaos The Ultra Wealthy Find Stability In Luxury Real Estate

May 17, 2025 -

Deudas Estudiantiles El Departamento De Educacion Y Las Consecuencias Del Impago

May 17, 2025

Deudas Estudiantiles El Departamento De Educacion Y Las Consecuencias Del Impago

May 17, 2025

Latest Posts

-

Srbi U Inostranstvu Investiranje U Nekretnine I Popularna Podrucja

May 17, 2025

Srbi U Inostranstvu Investiranje U Nekretnine I Popularna Podrucja

May 17, 2025 -

Razvitie Biznesa V Usloviyakh Vysokoy Konkurentsii Industrialnykh Parkov Rukovodstvo

May 17, 2025

Razvitie Biznesa V Usloviyakh Vysokoy Konkurentsii Industrialnykh Parkov Rukovodstvo

May 17, 2025 -

Srbi Kupuju Stanove Preko Granice Popularne Lokacije I Trendovi

May 17, 2025

Srbi Kupuju Stanove Preko Granice Popularne Lokacije I Trendovi

May 17, 2025 -

Analiz Rynka I Strategii Dlya Industrialnykh Parkov S Vysokoy Plotnostyu Predpriyatiy

May 17, 2025

Analiz Rynka I Strategii Dlya Industrialnykh Parkov S Vysokoy Plotnostyu Predpriyatiy

May 17, 2025 -

Kak Vyzhit I Protsvetat V Usloviyakh Vysokoy Konkurentsii Industrialnykh Parkov

May 17, 2025

Kak Vyzhit I Protsvetat V Usloviyakh Vysokoy Konkurentsii Industrialnykh Parkov

May 17, 2025