BofA's Take On High Stock Market Valuations: A Reason For Investor Optimism

Table of Contents

BofA's Current Market Outlook and Rationale

BofA maintains a cautiously optimistic stance on the current market. While acknowledging the elevated valuations, they aren't predicting an immediate crash. Their rationale hinges on a combination of factors, including strong corporate earnings and the expectation of continued, albeit slower, economic growth.

- Key Arguments: BofA emphasizes the resilience of corporate profits, suggesting that many companies are successfully navigating inflationary pressures and maintaining healthy margins. They also point to robust consumer spending in certain sectors as a positive indicator.

- Economic Indicators: BofA's analysis cites positive employment data and continued investment in infrastructure projects as supporting their view. They also closely monitor inflation figures and their impact on consumer behavior.

- Relevant Reports: To gain a deeper understanding of their perspective, investors should refer to BofA's regularly published market commentaries and research reports, often available on their website.

Addressing Concerns about High Stock Market Valuations

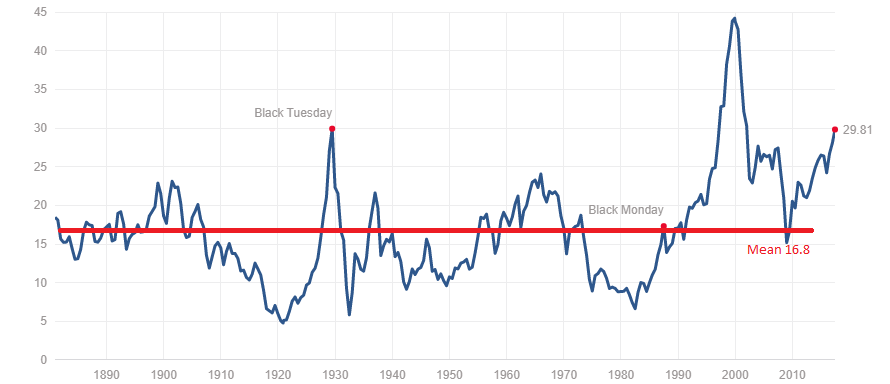

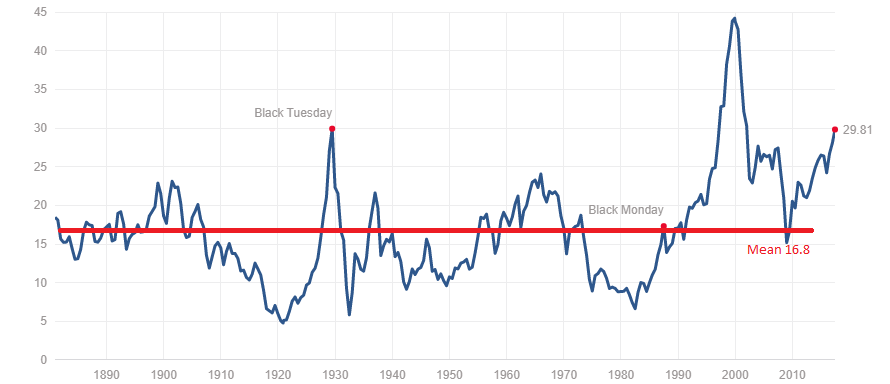

The primary concern for many investors is whether current high stock market valuations are justified. Some believe they are unsustainable and predict a significant market correction. BofA, however, offers counterarguments.

- Counterarguments: BofA argues that while valuations are high relative to historical averages, they are not necessarily excessive when considering the low interest rate environment and strong corporate earnings. They suggest that traditional valuation metrics, like P/E ratios, may not fully capture the current economic landscape.

- Mitigating Factors: The persistently low interest rate environment, though potentially changing, continues to support borrowing and investment, providing a tailwind for corporate growth. Strong corporate earnings, particularly in certain sectors, also contribute to justifying higher valuations in BofA's analysis.

- Alternative Metrics: BofA likely employs a variety of valuation metrics beyond simple P/E ratios, including discounted cash flow analysis and other forward-looking models to provide a more holistic view of asset valuations.

BofA's Recommendations for Investors

Given the current environment of high stock market valuations, BofA's recommendations are geared towards a balanced approach. They advocate for careful stock selection and diversification.

- Recommended Sectors: While specific sector recommendations vary across BofA's research, they often highlight sectors exhibiting strong fundamentals and consistent growth potential, even amidst economic uncertainty. This might include technology companies with disruptive innovations or companies in the healthcare and consumer staples sectors.

- Investment Strategies: BofA likely encourages a blend of value and growth investing, focusing on companies with strong balance sheets and future earnings potential. Diversification across different asset classes, including bonds and alternative investments, remains a cornerstone of their advice.

- Risk Management: In a market characterized by high valuations, BofA emphasizes the importance of prudent risk management. This includes setting realistic investment goals, diversifying portfolios, and carefully monitoring market conditions to adjust strategies as needed.

The Role of Interest Rates in BofA's Analysis

Interest rates play a crucial role in BofA's analysis of high stock market valuations. Higher interest rates tend to decrease valuations by increasing borrowing costs for companies and making bonds a more attractive alternative to stocks.

- Interest Rate Expectations: BofA's outlook is intricately linked to their expectations for future interest rate movements. Changes in central bank policies significantly impact the attractiveness of equities relative to fixed-income assets.

- Potential Rate Hikes/Cuts: The potential for future rate hikes or cuts will significantly influence BofA's investment recommendations. A series of rate hikes could negatively impact stock valuations, whereas cuts might provide support.

- Interest Rate Forecasts: BofA regularly publishes interest rate forecasts, which should be consulted for a comprehensive understanding of their overall market outlook and investment strategy.

Long-Term Growth Prospects and Their Influence on Valuations

BofA's assessment of long-term economic growth is fundamental to their justification of current, seemingly high, stock market valuations.

- Long-Term Growth Predictions: BofA's long-term economic growth forecasts influence their evaluation of whether current valuations are justified. Positive forecasts for long-term growth would support higher valuations as future earnings potential is expected to be higher.

- Valuation Assessment: Their predictions about long-term growth directly impact their valuation assessment. If they foresee sustained economic expansion, current valuations might appear less concerning.

- High-Growth Sectors: BofA likely identifies specific industries and sectors poised for strong long-term growth, which could justify higher valuations within those specific segments of the market.

Conclusion: Navigating High Stock Market Valuations with BofA's Insights

In summary, while high stock market valuations present legitimate concerns, BofA's analysis offers a perspective of cautious optimism. Their assessment considers factors such as strong corporate earnings, low interest rates (though this is dynamic), and predictions of continued long-term economic growth. While acknowledging the risks, BofA’s approach highlights the importance of careful stock selection, diversification, and robust risk management strategies. To effectively navigate this market, understand BofA's take on high stock market valuations, explore BofA's investment recommendations, and learn more about managing your portfolio in a high-valuation market by consulting their research and reports.

Featured Posts

-

Xrps Potential A Deep Dive Into Etf Prospects Sec Legal Battles And Future Price Predictions

May 08, 2025

Xrps Potential A Deep Dive Into Etf Prospects Sec Legal Battles And Future Price Predictions

May 08, 2025 -

Former Okc Thunder Rare Double Performance Records

May 08, 2025

Former Okc Thunder Rare Double Performance Records

May 08, 2025 -

Fanatics Your One Stop Shop For Boston Celtics Gear During The Nba Finals

May 08, 2025

Fanatics Your One Stop Shop For Boston Celtics Gear During The Nba Finals

May 08, 2025 -

Stephen Kings 2025 Will The Monkey Adaptation Be A Hit Or Miss

May 08, 2025

Stephen Kings 2025 Will The Monkey Adaptation Be A Hit Or Miss

May 08, 2025 -

The Night Counting Crows Changed Their Trajectory On Saturday Night Live

May 08, 2025

The Night Counting Crows Changed Their Trajectory On Saturday Night Live

May 08, 2025