BofA's Take: Why High Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale: Understanding the Context of High Valuations

Several factors contribute to BofA's optimistic outlook, even amidst seemingly high stock market valuations. Understanding these nuances is crucial for navigating the current market environment.

Low Interest Rates and Their Impact

Historically low interest rates significantly influence stock valuations. These low rates impact the discount rate used in various valuation models, such as the discounted cash flow (DCF) analysis.

- Lower discount rates increase the present value of future earnings. This means that future profits are worth more today when interest rates are low, justifying higher current stock prices.

- Low interest rates make bonds less attractive relative to stocks. With bond yields remaining depressed, investors seek higher returns in the stock market, further driving up valuations.

- BofA's research consistently highlights the inverse relationship between interest rates and stock valuations, supporting the argument that current valuations are partly a consequence of the prevailing monetary policy.

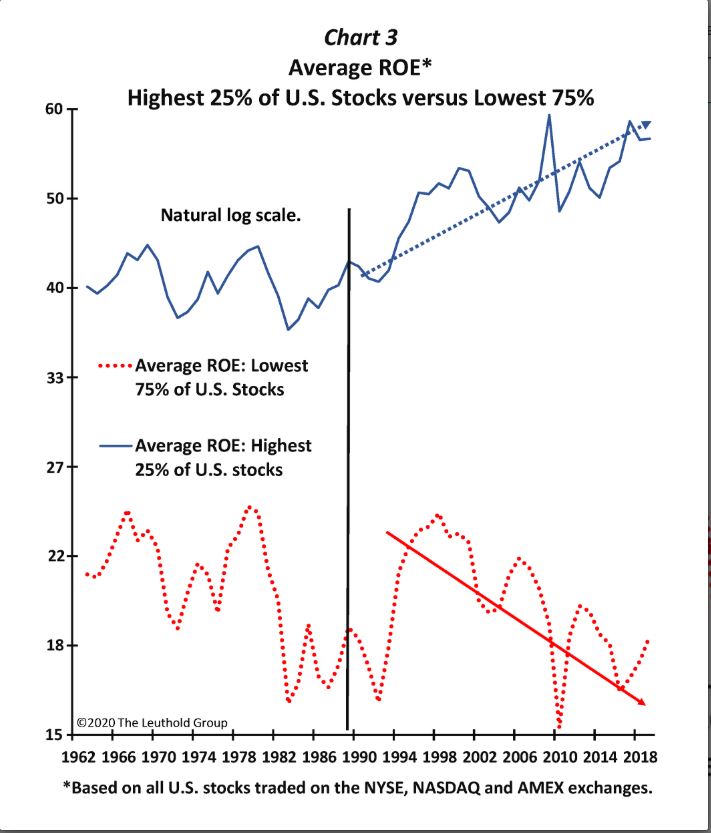

Strong Corporate Earnings and Growth Prospects

Robust corporate earnings and positive growth expectations play a vital role in supporting higher stock market valuations. Many sectors demonstrate impressive financial health, bolstering investor confidence.

- Technology, healthcare, and consumer staples are among the sectors exhibiting strong earnings growth and promising future prospects.

- BofA's economic forecasts suggest continued, albeit potentially moderated, earnings growth in the coming years. This positive outlook justifies, to some extent, the current valuation levels.

- Data points from BofA's earnings reports demonstrate that many companies are exceeding expectations, strengthening the case for higher valuations.

The Long-Term Perspective: Why Short-Term Fluctuations Shouldn't Dictate Decisions

The key to successfully navigating market volatility lies in adopting a long-term investment strategy. Short-term fluctuations are a normal part of the market cycle, and reacting to them emotionally can be detrimental to long-term returns.

- Historically, the stock market has delivered positive returns over the long term, despite experiencing numerous short-term corrections and even crashes.

- A buy-and-hold strategy, coupled with diversification, has consistently proven effective for long-term wealth creation.

- Your risk tolerance and carefully planned diversification are crucial components of a successful long-term investment plan.

Addressing Common Concerns About High Stock Market Valuations

Many investors harbor concerns about high stock market valuations, often fueled by misconceptions and fear. Let's address some common anxieties.

Mythbusting: High Valuations Don't Always Mean an Imminent Crash

High valuations don't automatically equate to an impending market crash. This is a critical point to understand.

- Absolute valuations (e.g., Price-to-Earnings ratio) should be considered alongside relative valuations (comparing valuations to historical averages and other asset classes).

- History shows numerous instances of sustained periods with high valuations that weren't followed by immediate market crashes. Context matters.

- Factors such as strong economic growth, low inflation, and accommodative monetary policy can mitigate the risks associated with high valuations.

The Importance of Sector-Specific Analysis

Rather than focusing solely on broad market indices, a sector-specific analysis is crucial. Some sectors may indeed be overvalued, while others present attractive investment opportunities.

- Identifying undervalued sectors requires in-depth research and analysis. Look beyond headline numbers.

- BofA's sector-specific reports offer valuable insights into individual sector valuations and growth prospects.

- A diversified portfolio across various sectors helps to mitigate the risk associated with any single sector's overvaluation.

Managing Risk Through Diversification and Strategic Asset Allocation

Investors can mitigate the risks associated with high stock market valuations through careful diversification and strategic asset allocation.

- Diversification across asset classes (stocks, bonds, real estate, etc.) is a cornerstone of effective risk management.

- A well-defined asset allocation plan, tailored to your risk tolerance and financial goals, is paramount.

- Consider seeking professional advice from a financial advisor to create a personalized investment strategy.

Conclusion

BofA's perspective on high stock market valuations suggests that long-term investors shouldn't be unduly concerned. Factors like low interest rates, robust corporate earnings, and the historical performance of the stock market all contribute to this viewpoint. However, a long-term perspective, coupled with strategic diversification and professional guidance, are crucial for mitigating risks. Don't let the fear of high stock market valuations derail your long-term investment goals. Consult with a financial advisor to build a diversified investment strategy suited to your needs and risk tolerance, even in a market with high stock market valuations. Explore BofA's resources for further insights into long-term investment strategies and managing risk in high-valuation environments. (Insert link to BofA resources here, if available).

Featured Posts

-

Mission Impossible Fallout The Truth Behind Henry Cavills Changing Beard

May 11, 2025

Mission Impossible Fallout The Truth Behind Henry Cavills Changing Beard

May 11, 2025 -

Exclusif Un Animateur De M6 Reagit A L Arrivee De Cyril Hanouna

May 11, 2025

Exclusif Un Animateur De M6 Reagit A L Arrivee De Cyril Hanouna

May 11, 2025 -

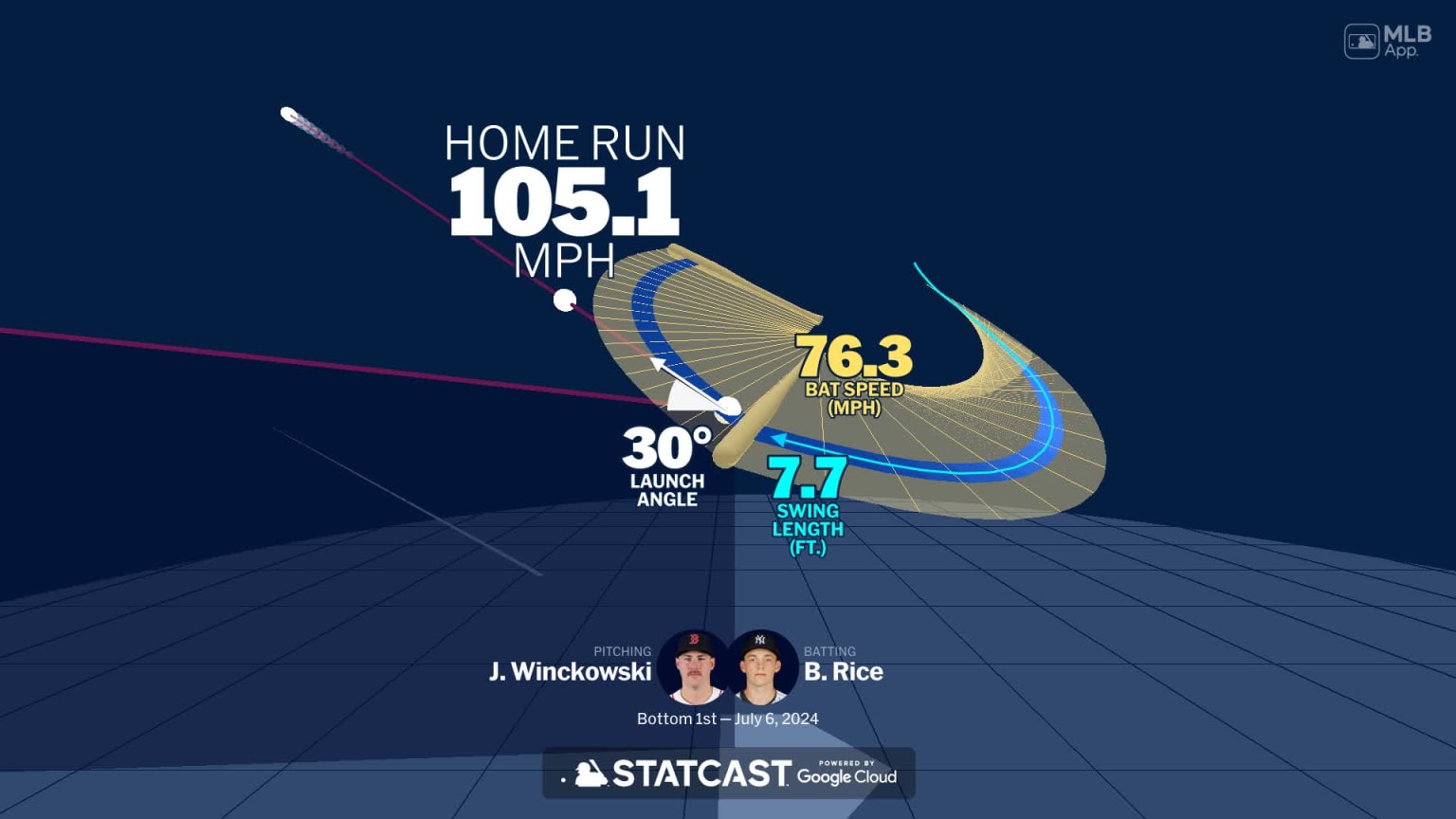

Yankees Rays Series May 2 4 A Look At The Injured Lists

May 11, 2025

Yankees Rays Series May 2 4 A Look At The Injured Lists

May 11, 2025 -

Tracking Injuries Yankees And Giants April 11 13 Series Preview

May 11, 2025

Tracking Injuries Yankees And Giants April 11 13 Series Preview

May 11, 2025 -

El Futuro Del Papado Posibles Sucesores De Francisco

May 11, 2025

El Futuro Del Papado Posibles Sucesores De Francisco

May 11, 2025