BofA's Take: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

The Impact of Low Interest Rates on Stock Valuations

The relationship between interest rates and stock valuations is fundamentally inverse. When interest rates are low, bonds become less attractive investments, pushing investors towards higher-yielding assets like stocks. This increased demand drives up stock prices, leading to higher valuations.

- Current Low-Interest Rate Environment: The current low-interest-rate environment, maintained by central banks globally, significantly impacts investor behavior. With the return on bonds depressed, investors seek opportunities for growth, thus fueling demand for equities.

- Effect on Discount Rates: Lower interest rates directly influence discount rates used in valuation models. A lower discount rate leads to higher present values of future cash flows, justifying higher stock prices, even with the same earnings outlook.

- BofA's Interest Rate Predictions: BofA's analysts frequently publish reports forecasting interest rates. Their predictions are crucial for investors trying to gauge the future trajectory of stock market valuations. While specific forecasts vary and are subject to change, their overall sentiment often reflects an expectation of low rates continuing for the foreseeable future, supporting their view on current stock valuations.

Strong Corporate Earnings and Revenue Growth Fueling the Market

Robust corporate earnings are a key pillar supporting current stock market valuations. Many companies are reporting strong revenue growth and exceeding profit expectations. This positive performance directly justifies higher stock prices, as investors are willing to pay a premium for companies demonstrating consistent growth and profitability.

- Role of Earnings in Justifying High Prices: Strong earnings translate directly into higher dividend payouts and increased shareholder value. This, in turn, contributes to a higher price-to-earnings ratio (P/E), a key metric in evaluating stock valuations.

- Sustainability of Earnings Growth: While some question the sustainability of current earnings growth, BofA analysts often point to factors like technological innovation, increased productivity, and global economic expansion as supporting continued corporate profitability.

- BofA Reports on Corporate Profitability: BofA regularly publishes in-depth sector reports and analyses on corporate profitability, offering insights into specific companies and industries that are driving market growth. These reports inform their overall positive outlook on the current market.

Long-Term Growth Potential Outweighs Short-Term Valuation Concerns

Focusing solely on short-term valuation metrics can be misleading. BofA emphasizes the importance of considering the long-term growth potential of the market and individual sectors. Technological advancements, global expansion into emerging markets, and ongoing innovation present significant opportunities for continued growth.

- Technological Advancements and Future Growth: Disruptive technologies continue to emerge, creating new markets and driving expansion in existing ones. This ongoing technological revolution supports the belief that future growth potential outweighs current valuation concerns.

- Emerging Markets Expansion: Many emerging markets show significant growth potential. Investments in these markets offer diversification and the opportunity to capitalize on long-term expansion.

- BofA's Long-Term Market Forecasts: BofA’s long-term market forecasts consistently highlight positive growth projections, especially when considering sectors ripe for technological disruption or benefiting from global expansion. These projections are critical in their perspective on high valuations.

Addressing Potential Risks and Mitigation Strategies

While BofA maintains a generally positive outlook, they acknowledge potential risks associated with high valuations. Market corrections and inflationary pressures are possibilities that need to be considered.

- BofA's Risk Mitigation Strategies: BofA's investment strategies emphasize diversification across asset classes and strategic asset allocation to mitigate risk. A well-diversified portfolio is less susceptible to significant losses during market corrections.

- Potential Scenarios and Impact on Valuations: BofA analyses various scenarios, including potential economic downturns, considering their likely impact on market valuations. This scenario planning informs their recommendations and risk management strategies.

- Risk Management Advice for Individual Investors: BofA advises investors to carefully consider their risk tolerance, diversify their investments, and work with a financial advisor to create a tailored portfolio aligned with their individual financial goals.

BofA's Take on Stock Market Valuations: A Balanced Perspective

In conclusion, while current stock market valuations may appear "stretched," BofA's analysis suggests that several factors support continued market growth. Low interest rates, strong corporate earnings, and significant long-term growth potential contribute to a balanced perspective. While acknowledging potential risks, BofA highlights the importance of diversification and strategic asset allocation in mitigating these risks. BofA's confidence in the market's long-term prospects is grounded in comprehensive analysis and a consideration of various economic factors. To learn more about BofA's investment strategies and how to navigate these market conditions, contact a BofA advisor to discuss your portfolio and how to best leverage their insights into these stretched stock market valuations.

Featured Posts

-

D Backs Walk Off Win Five Run Ninth Inning Delivers Victory Over Brewers

Apr 23, 2025

D Backs Walk Off Win Five Run Ninth Inning Delivers Victory Over Brewers

Apr 23, 2025 -

The Trump Presidency And Economic Performance A Data Driven Assessment

Apr 23, 2025

The Trump Presidency And Economic Performance A Data Driven Assessment

Apr 23, 2025 -

L Integrale Bfm Bourse Du Lundi 24 Fevrier Revue De Marche Complete

Apr 23, 2025

L Integrale Bfm Bourse Du Lundi 24 Fevrier Revue De Marche Complete

Apr 23, 2025 -

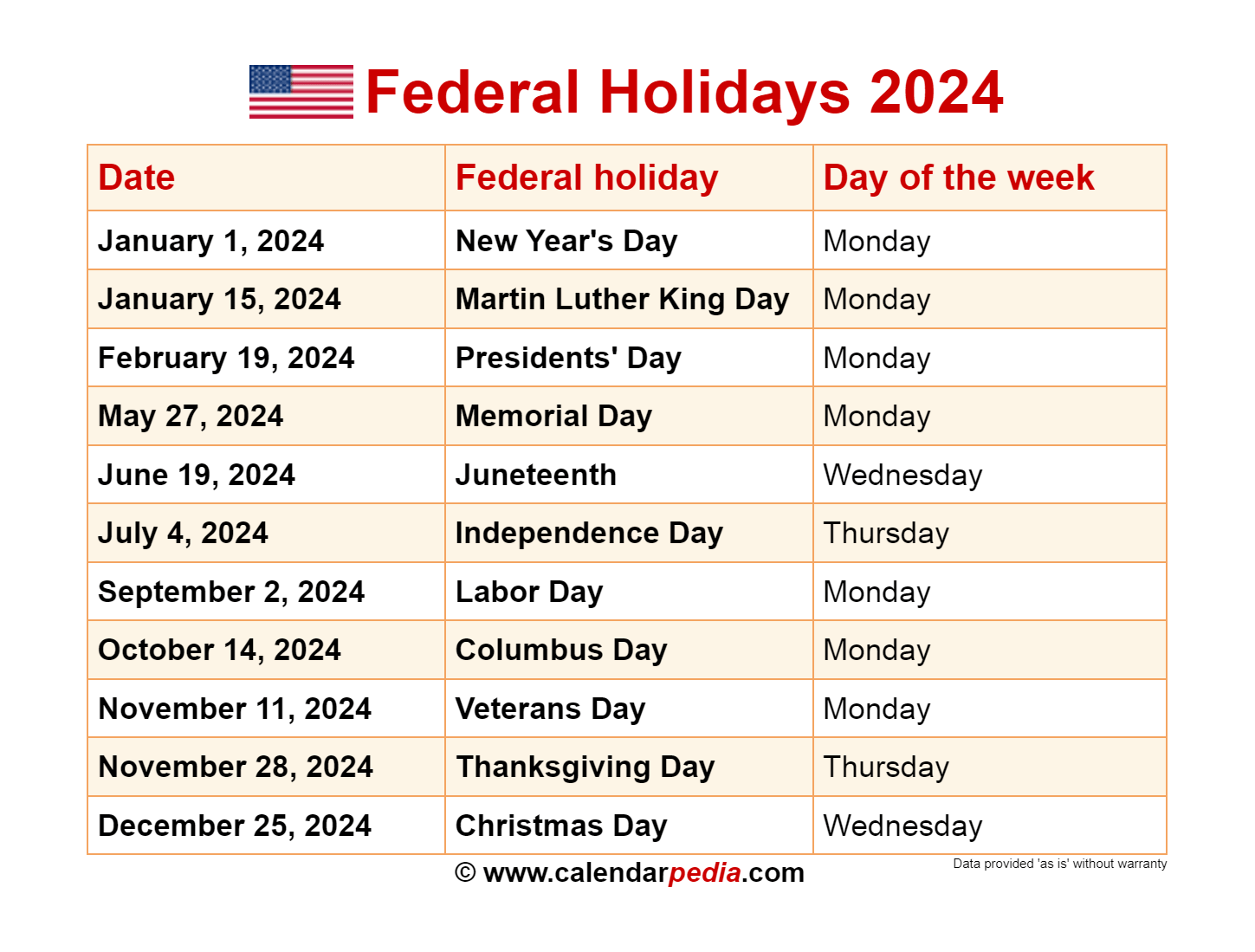

Us Holiday Calendar 2025 Complete Guide To Federal And Non Federal Holidays

Apr 23, 2025

Us Holiday Calendar 2025 Complete Guide To Federal And Non Federal Holidays

Apr 23, 2025 -

Woman Children Survive Terrifying Manhole Explosion

Apr 23, 2025

Woman Children Survive Terrifying Manhole Explosion

Apr 23, 2025