BofA's View: Why Current Stock Market Valuations Shouldn't Deter Investors

Table of Contents

BofA's Positive Outlook on Long-Term Growth

BofA's optimistic stance is rooted in a strong belief in long-term economic growth. Their analysts predict sustained expansion driven by several key factors:

- Strong Corporate Earnings Growth Projections: BofA forecasts robust corporate earnings growth over the next several years, fueled by ongoing technological advancements and increasing consumer spending. Their analysts point to a sustained period of above-average profit margins, indicating healthy corporate fundamentals.

- Positive Global Economic Indicators: While acknowledging regional challenges, BofA highlights positive global economic indicators in key sectors. Emerging markets are showing signs of recovery, and sectors like technology and healthcare continue to exhibit strong growth. These trends contribute to their positive long-term outlook.

- Technological Innovation Driving Future Growth: BofA's research emphasizes the transformative potential of technological innovation, particularly in areas like artificial intelligence, cloud computing, and renewable energy. This innovation is projected to drive productivity gains and create new growth opportunities across various sectors.

- Expert Analysis: Reports from BofA Global Research, including those by leading analysts like [Insert Name of Relevant BofA Analyst if available], strongly support these positive projections, providing a robust foundation for their optimistic viewpoint.

Addressing Concerns About High Stock Market Valuations

The concern about high stock market valuations, reflected in elevated Price-to-Earnings (P/E) ratios and other valuation metrics, is undeniably valid. However, BofA counters these concerns with several key arguments:

- Low Interest Rates Justifying Higher Valuations: BofA points out that historically low interest rates justify higher P/E ratios. When borrowing costs are low, the present value of future earnings is higher, supporting valuations that might seem expensive at first glance.

- Strong Future Earnings Growth Offsetting Current Valuations: BofA's projections for strong future earnings growth suggest that current valuations are not necessarily excessive when considering the expected future returns. Their models indicate a significant upside potential, mitigating the perceived risk of high valuations.

- Historical Context: Comparing current valuations to historical averages, BofA highlights that while valuations are elevated, they are not unprecedented. The current environment, characterized by low interest rates and strong technological disruption, differs significantly from historical periods, necessitating a nuanced perspective.

The Role of Interest Rates in Valuation

Interest rates play a crucial role in determining stock valuations. Lower interest rates reduce the discount rate used to calculate the present value of future earnings, leading to higher valuations. BofA's interest rate forecasts, [mention specific forecast if available], suggest that interest rates are likely to remain low for the foreseeable future, continuing to support higher valuations.

Identifying Undervalued Sectors and Opportunities

Despite the overall elevated market valuations, BofA identifies specific sectors and industries that they believe are currently undervalued, offering attractive investment opportunities.

- Specific Examples: [Insert Specific examples of undervalued sectors or stocks according to BofA's research. For example: "The energy sector, particularly renewable energy companies, is identified as undervalued due to [Reason]. BofA analysts highlight [Stock ticker] as a particularly compelling investment within this sector."] Support these claims with data and analysis from BofA reports.

Managing Risk in the Current Market

Even with a positive outlook, BofA emphasizes the importance of risk management in the current market environment. Their recommendations include:

- Diversification Strategies: Diversifying investments across various sectors, asset classes, and geographies is crucial to mitigate risk.

- Long-Term Investment Horizons: Maintaining a long-term investment horizon helps weather short-term market fluctuations and realize the potential for long-term growth.

- Consideration of Different Asset Classes: Incorporating different asset classes, such as bonds and real estate, into the portfolio can further diversify risk and enhance overall portfolio performance.

BofA's View: Why Current Stock Market Valuations Shouldn't Deter You

BofA's positive outlook is based on strong projected long-term growth, countered arguments against high valuations, and the identification of undervalued investment opportunities. By considering their analysis and adopting prudent risk management strategies, investors can navigate the current market effectively. Don't let current stock market valuations deter you from exploring the potential for long-term growth. Consider BofA's insights for informed investment decisions. Learn more about BofA's market outlook and investment strategies by visiting [Link to relevant BofA research or investment resources].

Featured Posts

-

Ripple Settlement Talks Sec May Classify Xrp As A Commodity

May 01, 2025

Ripple Settlement Talks Sec May Classify Xrp As A Commodity

May 01, 2025 -

Cong Nhan Dien Luc Mien Nam Hanh Trinh Chinh Phuc Du An 500k V Mach 3

May 01, 2025

Cong Nhan Dien Luc Mien Nam Hanh Trinh Chinh Phuc Du An 500k V Mach 3

May 01, 2025 -

Inadequate Police Accountability Review Campaigners Demand Action

May 01, 2025

Inadequate Police Accountability Review Campaigners Demand Action

May 01, 2025 -

10 Tran Dau Dang Chu Y Tai Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

May 01, 2025

10 Tran Dau Dang Chu Y Tai Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025

May 01, 2025 -

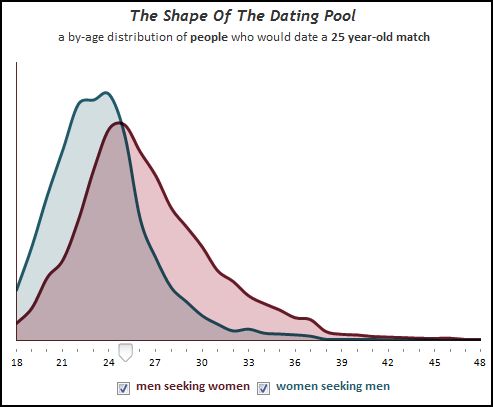

Is Age Just A Number Exploring The Social And Biological Realities Of Aging

May 01, 2025

Is Age Just A Number Exploring The Social And Biological Realities Of Aging

May 01, 2025