BofA's View: Why Stretched Stock Market Valuations Aren't A Cause For Alarm

Table of Contents

Investor concerns are mounting regarding stretched stock market valuations. Many are questioning whether the current market represents a bubble ripe for bursting. However, Bank of America (BofA) offers a different perspective, arguing that these seemingly high valuations aren't necessarily a cause for alarm. Let's explore their rationale.

BofA's Rationale: Understanding the Current Market Context

BofA's positive outlook stems from a comprehensive assessment of the current economic landscape. Their analysis points to several key factors supporting continued growth and justifying current valuations, despite their apparent "stretch." This positive market outlook is underpinned by several key economic indicators.

-

Strong Corporate Earnings Growth: BofA projects robust corporate earnings growth, fueled by a combination of economic recovery and technological innovation. This expectation of future profits contributes significantly to justifying higher price-to-earnings ratios. Analysts predict continued growth across various sectors, leading to increased profitability and supporting higher stock prices.

-

Sustained Low Inflation: The current low inflation environment reduces pressure on interest rates, supporting higher valuations. Low inflation means companies' future earnings aren't eroded as quickly by rising prices, making future profits more valuable in today's money. This stability allows investors to confidently project future returns.

-

Positive Consumer Spending: Continued strong consumer spending indicates a healthy economy, further underpinning positive projections for corporate earnings. Consumer confidence remains relatively high, indicating sustained demand for goods and services. This translates directly into higher revenues for companies.

-

Government Support (If Applicable): Any ongoing government stimulus measures (such as infrastructure spending or tax cuts) also contribute to the overall economic strength and positive market outlook. These measures can inject capital into the economy, stimulating growth and further supporting higher valuations.

The Role of Low Interest Rates in Justifying High Valuations

Historically low interest rates play a crucial role in shaping market valuations. Lower interest rates lead to lower discount rates used to calculate the present value of future earnings. This means that future earnings are discounted less heavily, resulting in higher present values and seemingly higher valuations. Understanding this relationship is key to interpreting current market conditions.

-

Discount Rates and Valuations: The discount rate is inversely related to stock valuations. Lower rates mean higher valuations, all else being equal. A lower discount rate increases the present value of future cash flows, making investments appear more attractive and justifying higher prices.

-

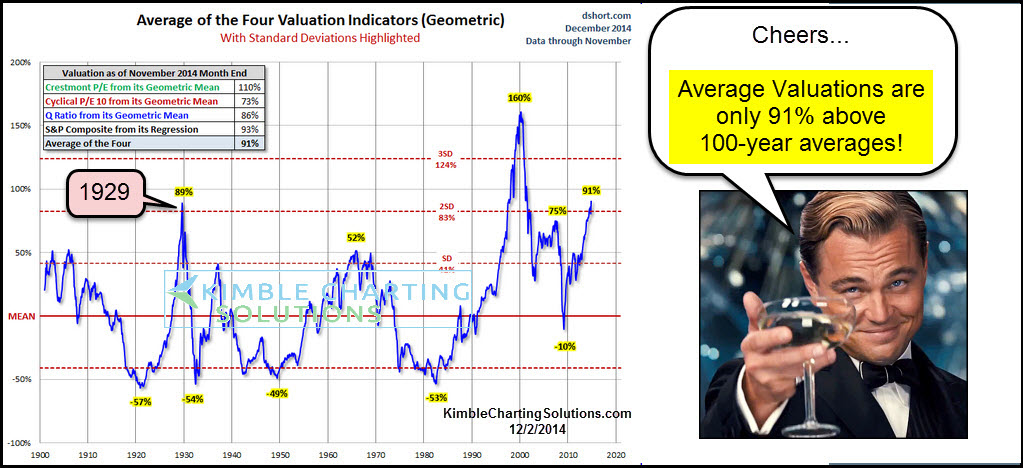

Historical Precedents: We've seen similar low-interest-rate environments historically, where valuations also appeared elevated but didn't necessarily lead to immediate market crashes. Examining past market cycles can provide valuable context for understanding current valuations.

-

Future Interest Rate Scenarios: While interest rates are expected to rise eventually, BofA anticipates a gradual increase, mitigating the risk of a sudden market correction triggered by rapid rate hikes. A slow and predictable increase in interest rates allows the market to adjust gradually, reducing the likelihood of a sharp downturn.

Technological Innovation and Growth Potential

Disruptive technologies are driving significant growth in specific sectors, further supporting the argument that current valuations are justified, at least in part. Innovation is a key driver of long-term economic growth and market performance.

-

High-Growth Sectors: Companies leading in areas like artificial intelligence, biotechnology, and renewable energy are projected to experience substantial future growth, outpacing the overall market. These sectors represent significant opportunities for long-term investment.

-

Long-Term Investment Potential: These innovative sectors offer considerable long-term growth potential, justifying higher valuations based on future earnings expectations. Investors are willing to pay a premium for companies with high growth potential.

-

Future Market Disruption: While disruptive technologies themselves pose risks, they also present significant opportunities for long-term growth, potentially offsetting the risks associated with higher valuations. The potential for future innovation continues to support positive market sentiment.

Addressing the Risk of a Market Correction

While BofA acknowledges the risks associated with high valuations, they emphasize that these risks are not necessarily imminent or insurmountable. Prudent risk management is crucial in any investment strategy.

-

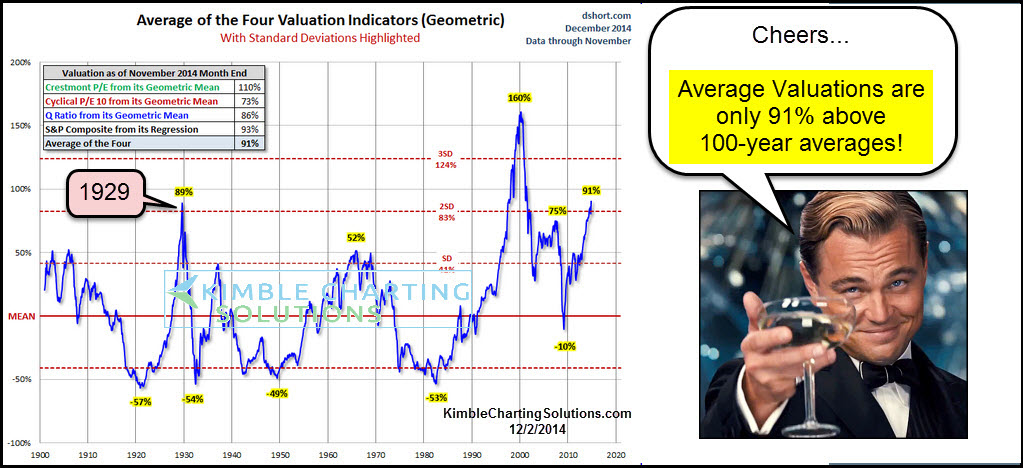

Potential Catalysts: Events like a sharp increase in interest rates, unexpected geopolitical events, or a significant economic slowdown could trigger a market correction. These are external factors that can significantly impact market performance.

-

Risk Mitigation Strategies: BofA emphasizes diversification as a key element of risk management, suggesting that a well-diversified portfolio can help mitigate the impact of potential market downturns. Diversification reduces the impact of any single investment performing poorly.

-

Strategic Planning: BofA advises a long-term perspective and carefully managed risk tolerance. A long-term investment horizon allows investors to ride out short-term market fluctuations.

Conclusion:

BofA's assessment suggests that while stock market valuations appear stretched, they aren't necessarily a reason for immediate alarm. Factors such as low interest rates, strong corporate earnings growth, and the potential of technological innovation contribute to their optimistic outlook. However, it's crucial to acknowledge the inherent risks in any market. To make informed investment decisions, consider BofA's perspective and consult with a financial advisor to build a strategy that aligns with your financial goals and risk tolerance. Understanding stock market valuations and their associated risks is key to successful long-term investing.

Featured Posts

-

Today I M Not Ok The Plight Of A Transgender Soldier Facing Discharge

May 16, 2025

Today I M Not Ok The Plight Of A Transgender Soldier Facing Discharge

May 16, 2025 -

Heat Loss Dwyane Wade On Jimmy Butlers Departure

May 16, 2025

Heat Loss Dwyane Wade On Jimmy Butlers Departure

May 16, 2025 -

Cassie Venturas Account Of Relationship With Sean Diddy Combs In Sex Trafficking Case

May 16, 2025

Cassie Venturas Account Of Relationship With Sean Diddy Combs In Sex Trafficking Case

May 16, 2025 -

Analyzing The Padres Cubs Matchup Who Will Win

May 16, 2025

Analyzing The Padres Cubs Matchup Who Will Win

May 16, 2025 -

The Economic Fallout Trumps Tariffs And Californias 16 Billion Revenue Cut

May 16, 2025

The Economic Fallout Trumps Tariffs And Californias 16 Billion Revenue Cut

May 16, 2025

Latest Posts

-

Analyzing The Earthquakes Defeat Steffens Performance And Team Strategy

May 16, 2025

Analyzing The Earthquakes Defeat Steffens Performance And Team Strategy

May 16, 2025 -

Lafc Vs San Jose All Eyes On The Mls

May 16, 2025

Lafc Vs San Jose All Eyes On The Mls

May 16, 2025 -

Earthquakes Vs Rapids A Post Match Analysis Of Steffens Performance

May 16, 2025

Earthquakes Vs Rapids A Post Match Analysis Of Steffens Performance

May 16, 2025 -

Reviewing The Earthquakes Loss Zach Steffens Performance And The Road Ahead

May 16, 2025

Reviewing The Earthquakes Loss Zach Steffens Performance And The Road Ahead

May 16, 2025 -

San Jose Earthquakes Visit Lafc Mls Showdown

May 16, 2025

San Jose Earthquakes Visit Lafc Mls Showdown

May 16, 2025