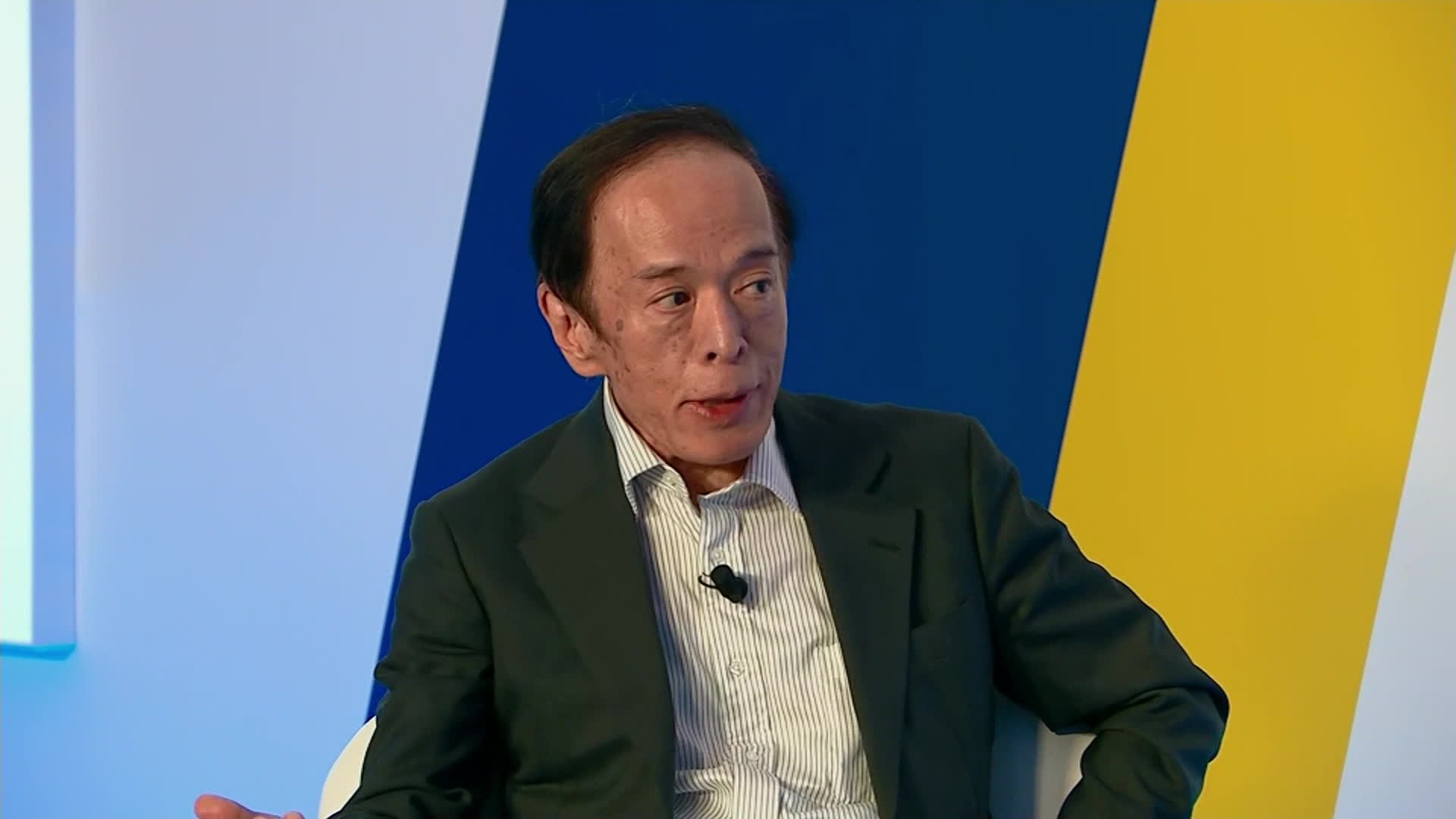

BOJ's Ueda On Long-Term Yield Risks And Potential Economic Fallout

Table of Contents

Ueda's Concerns Regarding Long-Term Yield Risks

The BOJ's current monetary policy hinges on yield curve control (YCC), a strategy aimed at maintaining low long-term interest rates to stimulate economic activity. However, this policy faces significant challenges in the current environment of rising global inflation and interest rates. Governor Ueda has voiced concerns about the sustainability of YCC, highlighting several key risks:

- Increased borrowing costs: Maintaining artificially low long-term yields while global rates rise increases the risk of widening the gap, leading to potentially unsustainable borrowing costs for Japanese businesses and consumers. This could stifle investment and consumption, impacting economic growth.

- Market destabilization: The widening gap between domestic and international interest rates creates the potential for significant market fluctuations. Speculative trading against the YCC policy could lead to unpredictable and potentially destabilizing movements in bond yields and the Japanese Yen.

- Yen exchange rate volatility: The divergence between Japanese and global interest rates puts downward pressure on the Japanese yen, impacting import costs and potentially fueling inflation. A weaker yen can also negatively affect Japan's trade balance.

- Risks to financial stability: Maintaining artificially low yields could distort market signals, potentially leading to excessive risk-taking and vulnerabilities within the financial system. This could increase the systemic risks within Japan's financial sector.

Keywords: yield curve control, YCC, interest rate risks, inflation risks, financial stability, Japanese Yen, exchange rate.

Potential Economic Fallout from Unmanaged Yield Rises

Uncontrolled increases in long-term yields could have severe consequences for the Japanese economy. The potential economic fallout includes:

- Slower economic growth: Higher borrowing costs will dampen investment and consumption, leading to a slowdown in economic growth. This could even push Japan into a recession, particularly given its already fragile economic recovery.

- Increased bankruptcies: Companies with high levels of debt could struggle to meet their obligations, resulting in a surge in bankruptcies across various sectors. This is particularly true for smaller businesses and companies with high levels of variable-rate debt.

- Reduced consumer spending: Higher interest rates on mortgages and consumer loans reduce disposable income, leading to reduced consumer spending and further dampening economic activity. Consumer confidence could plummet, exacerbating the slowdown.

- Impact on government debt: Japan carries a substantial level of government debt. Higher interest rates will increase the cost of servicing this debt, putting further strain on public finances.

Keywords: economic slowdown, recession risks, bankruptcies, consumer confidence, government debt, economic impact, sector-specific analysis.

BOJ's Policy Options and Their Implications

The BOJ faces difficult choices in addressing these risks. Potential policy responses include:

- Modifying or abandoning YCC: Adjusting the YCC target or abandoning it altogether would allow market forces to determine long-term interest rates. This could lead to higher borrowing costs but might also reduce market distortions and increase transparency.

- Adjusting the pace of monetary easing: The BOJ could slow down or halt its quantitative easing (QE) program, gradually allowing interest rates to rise. This could be a more gradual approach than abandoning YCC entirely.

- Improved communication: Clearer communication with markets about the BOJ's intentions and potential future policy adjustments could help manage expectations and reduce market volatility.

- International cooperation: Coordinated action with other central banks could help manage global interest rate movements and mitigate the risks associated with diverging monetary policies.

Keywords: monetary policy options, quantitative easing, interest rate adjustments, communication strategy, central bank cooperation.

Market Reactions and Investor Sentiment

Governor Ueda's statements and the BOJ's policy decisions have significant implications for market sentiment and investor behavior.

- Bond yields: Any indication of a shift in the BOJ's YCC policy or a faster-than-expected normalization of monetary policy is likely to cause significant fluctuations in Japanese government bond yields.

- Japanese Yen: The Yen's exchange rate remains highly sensitive to changes in BOJ policy, with expectations of tighter monetary policy generally leading to Yen appreciation.

- Equity markets: Uncertainty surrounding the BOJ's policy direction could negatively impact investor confidence and lead to volatility in Japanese equity markets.

- Investor confidence: Overall, investor confidence in the Japanese economy and the stability of its financial system is directly tied to the clarity and effectiveness of the BOJ's policy response.

Keywords: market volatility, investor sentiment, bond market, equity market, currency fluctuations, risk assessment.

Conclusion: Understanding BOJ's Ueda and Long-Term Yield Risks

Governor Ueda's concerns regarding long-term yield risks underscore the significant challenges facing the BOJ in balancing economic stimulus with the need to manage inflation and financial stability. The potential economic fallout from uncontrolled yield increases could be substantial, impacting various sectors of the Japanese economy. The BOJ's policy choices will be crucial in determining the trajectory of the Japanese economy and its influence on global financial markets. To stay informed about these critical developments, monitor BOJ policy updates, analyze Japanese economic forecasts, and stay abreast of long-term yield predictions. Developing robust risk management strategies in light of these evolving dynamics is essential for investors and businesses operating in the Japanese market. Further reading on related topics can provide a deeper understanding of the nuances of BOJ policy and its broader implications.

Featured Posts

-

Wie Wordt De Nieuwe Ajax Trainer Van Hanegem Geeft Advies

May 29, 2025

Wie Wordt De Nieuwe Ajax Trainer Van Hanegem Geeft Advies

May 29, 2025 -

Alastqlal Alerby Rmz Alkramt Walhryt

May 29, 2025

Alastqlal Alerby Rmz Alkramt Walhryt

May 29, 2025 -

Yamahas Le Mans Advantage A Challenge For Hondas Rising Star

May 29, 2025

Yamahas Le Mans Advantage A Challenge For Hondas Rising Star

May 29, 2025 -

Murder Charges Filed In Seattles Baker Park Shooting Death

May 29, 2025

Murder Charges Filed In Seattles Baker Park Shooting Death

May 29, 2025 -

Brazils Lula To Pressure Putin For Istanbul Talks With Zelenskyy

May 29, 2025

Brazils Lula To Pressure Putin For Istanbul Talks With Zelenskyy

May 29, 2025

Latest Posts

-

Gorillaz 25th Anniversary House Of Kong Exhibition And Exclusive London Gigs

May 30, 2025

Gorillaz 25th Anniversary House Of Kong Exhibition And Exclusive London Gigs

May 30, 2025 -

Gorillazs 25th Anniversary House Of Kong Exhibition And Exclusive London Shows

May 30, 2025

Gorillazs 25th Anniversary House Of Kong Exhibition And Exclusive London Shows

May 30, 2025 -

House Of Kong Gorillaz Mark 25 Years With New Exhibition And London Performances

May 30, 2025

House Of Kong Gorillaz Mark 25 Years With New Exhibition And London Performances

May 30, 2025 -

House Of Kong Gorillazs 25th Anniversary Exhibition And London Concerts

May 30, 2025

House Of Kong Gorillazs 25th Anniversary Exhibition And London Concerts

May 30, 2025 -

Gorillaz Celebrate 25 Years With House Of Kong Exhibition And Special London Concerts

May 30, 2025

Gorillaz Celebrate 25 Years With House Of Kong Exhibition And Special London Concerts

May 30, 2025