Bond Market Reaction: Powell's Comments Temper Rate Cut Expectations

Table of Contents

Powell's Hawkish Stance and its Impact on Bond Yields

Powell's recent pronouncements struck a decidedly hawkish tone, emphasizing concerns about persistent inflation and the Federal Reserve's commitment to price stability. This marked a significant shift from previous market sentiment, which had anticipated imminent interest rate cuts. The expectation of continued monetary policy tightening, directly influenced by Powell's statements, led to a reassessment of future interest rate trajectories.

- Specific quotes from Powell's statements emphasizing persistent inflation: [Insert specific quotes here, citing the source]. These comments signaled the Fed's unwavering dedication to bringing inflation down to its 2% target.

- Analysis of the Fed's commitment to price stability: Powell's emphasis on price stability underscores the Fed's willingness to maintain a restrictive monetary policy for an extended period, even at the risk of slowing economic growth.

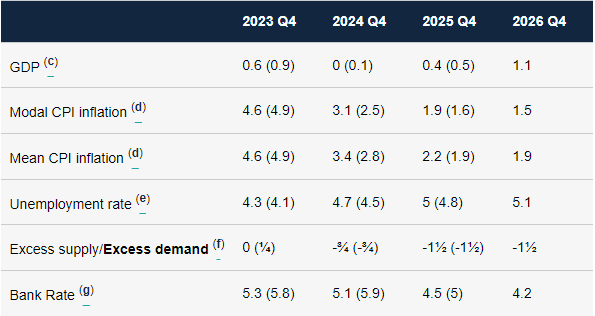

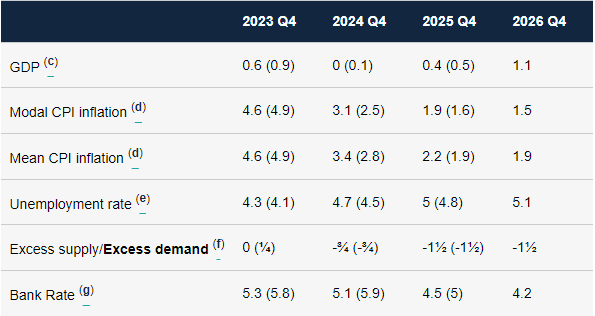

- Impact on long-term and short-term bond yields: The hawkish stance resulted in a rise in both short-term and long-term bond yields. The 10-year Treasury yield, for example, experienced a noticeable increase [Insert percentage and timeframe]. This reflects investors' anticipation of higher interest rates in the future.

- Mention specific bond yield movements (e.g., increase in 10-year Treasury yield): The 10-year Treasury yield increased by X% in the days following Powell's speech, signaling a shift in investor expectations.

The Bond Market's Immediate Response

The bond market's immediate response to Powell's comments was a clear indication of the altered expectations. We observed significant changes in bond prices, trading volume, and overall investor behavior. The market reacted swiftly, reflecting the weight of Powell's words on future monetary policy decisions.

- Changes in bond prices (e.g., decrease in bond prices due to higher yields): As bond yields rose, bond prices fell, reflecting the inverse relationship between these two variables. This decrease was particularly noticeable in longer-term bonds.

- Increased trading volume indicating market uncertainty: Trading volume surged, reflecting heightened uncertainty and volatility in the market as investors adjusted their positions.

- Analysis of flight-to-safety trends (or lack thereof): [Analyze whether investors sought safe haven assets like government bonds or moved away from them].

- Mention specific bond indices and their movements: [Mention specific indices like the Barclays Aggregate Bond Index and describe their movements following Powell's comments].

Analyzing the Implications for Investors

Powell's comments have significant implications for various types of investors. Bondholders, in particular, face potential challenges as higher yields impact the value of their existing holdings. Stock investors also need to consider the consequences of a more restrictive monetary policy environment.

- Impact on fixed-income portfolios: Investors with significant fixed-income holdings may experience reduced returns, depending on the duration of their bonds.

- Implications for bond fund performance: Bond fund managers will need to adapt their strategies to navigate the changing yield curve and potential capital losses.

- Potential adjustments to investment strategies: Investors might consider adjusting their portfolios by diversifying into assets less sensitive to interest rate changes or exploring hedging strategies.

- Discussion on hedging strategies to mitigate risks: Investors may consider employing hedging techniques like interest rate swaps or options to mitigate risks associated with rising interest rates.

Long-Term Outlook and Uncertainty

Uncertainty remains a defining characteristic of the current bond market environment. While Powell's comments offer some clarity regarding the Fed's near-term intentions, the longer-term outlook remains clouded by several factors.

- Discussion of lingering uncertainties regarding future interest rate decisions and their potential impact on the bond market: The path of future interest rates will depend on a complex interplay of economic indicators, inflation data, and geopolitical developments.

- Analyze the factors that could influence future Fed decisions (e.g., inflation data, economic growth): Data releases on inflation, employment, and economic growth will be closely scrutinized for clues about the future direction of monetary policy.

- Highlight the need for investors to remain vigilant and adapt their strategies based on new information: Investors need to monitor incoming economic data and adjust their strategies accordingly.

Conclusion: Understanding the Bond Market Reaction and Future Outlook

In conclusion, Jerome Powell's recent comments have significantly altered the bond market landscape. His hawkish stance tempered expectations for imminent rate cuts, resulting in a tangible shift in bond market sentiment and yields. This bond market reaction highlights the crucial role of central bank communication in shaping investor expectations and market volatility. It is paramount for investors to remain vigilant and actively monitor developments related to monetary policy and inflation.

To make informed investment decisions in this dynamic environment, stay informed about future Fed announcements and adapt your strategies based on new information. Conduct thorough research on interest rate cuts and monetary policy to understand their impact on the bond market. Remember to consult with a qualified financial advisor before making any significant investment decisions related to the bond market.

Featured Posts

-

Doze D Economie Un Budget A Revoir

May 12, 2025

Doze D Economie Un Budget A Revoir

May 12, 2025 -

Calls Grow For Action Parliament Addresses Surge In Undocumented Labor Migration

May 12, 2025

Calls Grow For Action Parliament Addresses Surge In Undocumented Labor Migration

May 12, 2025 -

Aldos Return To Featherweight A New Chapter In Ufc History

May 12, 2025

Aldos Return To Featherweight A New Chapter In Ufc History

May 12, 2025 -

The Tom Cruise Tom Hanks 1 Debt A Hollywood Oddity

May 12, 2025

The Tom Cruise Tom Hanks 1 Debt A Hollywood Oddity

May 12, 2025 -

Absence De Chantal Ladesou Les Coulisses De Qui Rit Sort

May 12, 2025

Absence De Chantal Ladesou Les Coulisses De Qui Rit Sort

May 12, 2025

Latest Posts

-

Update Search For Missing Woman 79 In Portola Valley Preserve

May 13, 2025

Update Search For Missing Woman 79 In Portola Valley Preserve

May 13, 2025 -

Town City Name Obituaries Saying Goodbye To Our Neighbors

May 13, 2025

Town City Name Obituaries Saying Goodbye To Our Neighbors

May 13, 2025 -

79 Year Old Missing In Portola Valley Ongoing Search And Rescue Efforts

May 13, 2025

79 Year Old Missing In Portola Valley Ongoing Search And Rescue Efforts

May 13, 2025 -

Obituaries A Listing Of Recent Deaths In Town City Name

May 13, 2025

Obituaries A Listing Of Recent Deaths In Town City Name

May 13, 2025 -

Community Leader Sue Crane Of Portola Valley Passes Away

May 13, 2025

Community Leader Sue Crane Of Portola Valley Passes Away

May 13, 2025